Alabama Affidavit of Mailing

Description

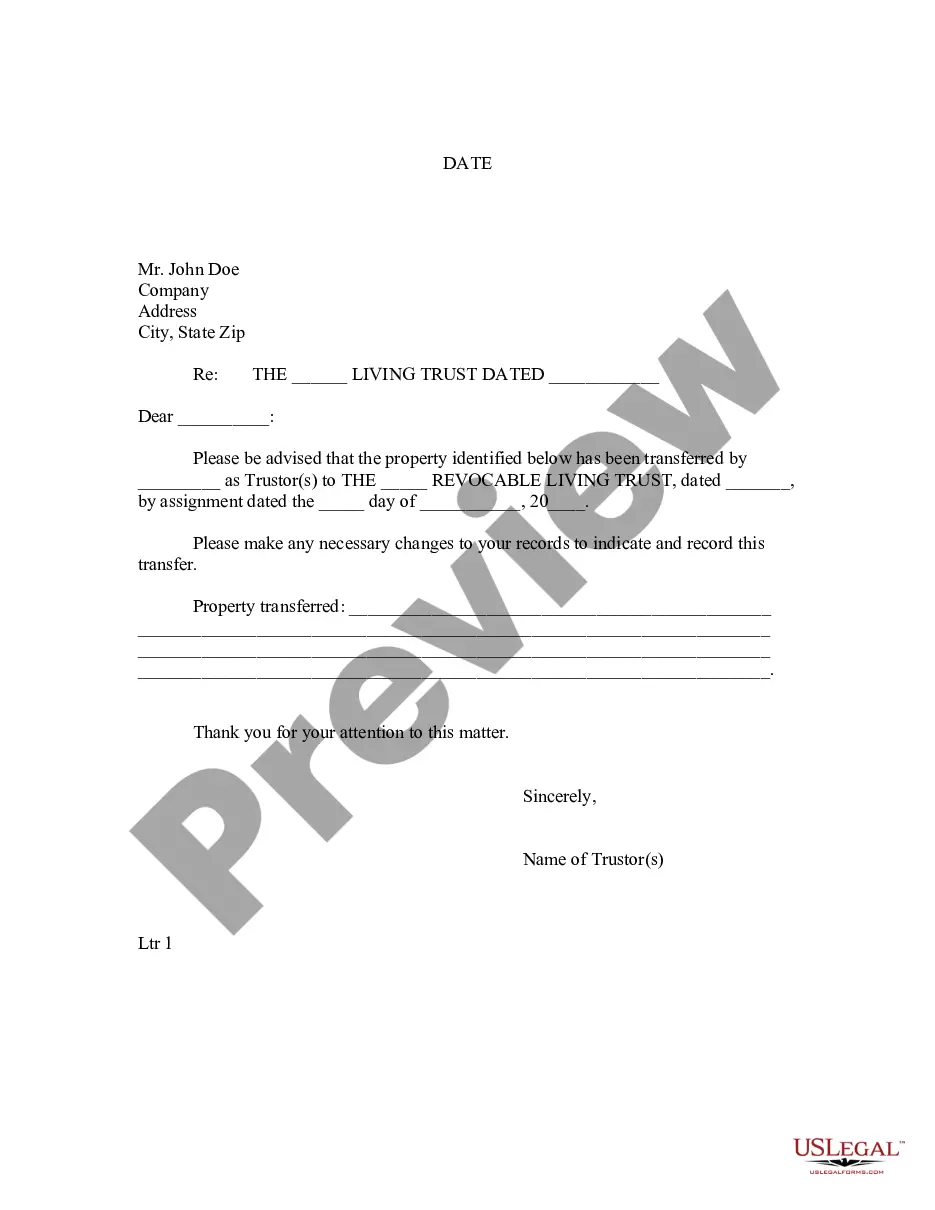

How to fill out Affidavit Of Mailing?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Alabama Affidavit of Mailing in mere seconds.

Read the form summary to ensure you have chosen the appropriate form.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you possess a registration, Log In and download the Alabama Affidavit of Mailing from your US Legal Forms library.

- The Download button will be visible on each form you examine.

- You have access to all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to assist you in getting started.

- Ensure you have selected the correct form for your area/state.

- Click the Review button to inspect the form's content.

Form popularity

FAQ

No, you should not attach your federal tax return to your Alabama state tax return. Each tax return is independent and submitted separately. Ensure you maintain a copy of both for your records, as this will be helpful for future reference or audits. To stay organized, you may want to consider the Alabama Affidavit of Mailing.

You can file your federal tax return electronically or mail it to the designated address based on your location in Alabama. The IRS provides specific mailing addresses that can vary by state and whether you are paying taxes or seeking a refund. It is advisable to check the latest IRS guidelines to ensure accurate filing. Don't forget to keep your confirmation, which can be secured through the Alabama Affidavit of Mailing.

Any business entity operating in Alabama that is taxable under the state's business license law must file an Alabama PPT. This generally includes corporations and partnerships that meet defined criteria. It is essential to stay updated on filing requirements to ensure compliance. Resources like the Alabama Affidavit of Mailing can assist in managing your business's tax documents effectively.

You do not need to attach your federal return to your Alabama return when filing. Each return is treated as a separate entity. However, keep a copy of your federal return for your records. To guarantee your documents are received, consider the Alabama Affidavit of Mailing.

When filing your Alabama return, attach all necessary documentation as outlined in the instructions for Form 40. This typically includes W-2 forms and any other income verification. Make sure to review the requirements carefully to avoid any penalties. Using the Alabama Affidavit of Mailing can help ensure that all documents are properly submitted.

You should mail your Alabama Form 40 to the address specified in the instructions provided with the form. This may vary depending on whether you are expecting a refund or owe taxes. Always double-check the current mailing address, as it may change year to year. Utilizing the Alabama Affidavit of Mailing can also help confirm your submission.

No, you do not need to send a copy of your Alabama state return with your federal return. Each tax return is processed separately. However, ensure you keep copies for your records. For clarity on submissions, consider using the Alabama Affidavit of Mailing.

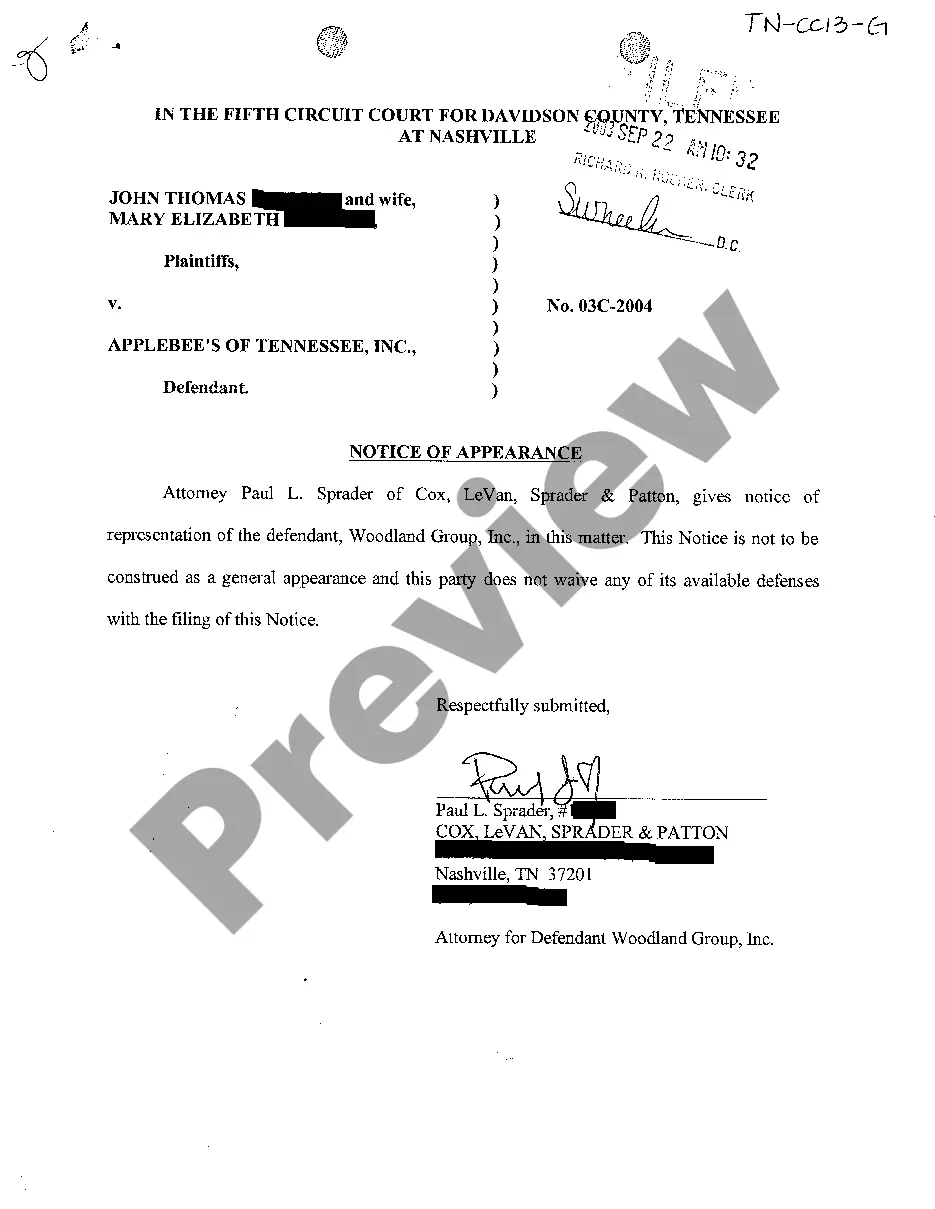

To file a small estate affidavit in Alabama, begin by gathering all necessary documents, including the Alabama Affidavit of Mailing. After completing the affidavit, you must file it with the probate court in your county. Be sure to check local regulations, as each court may have specific requirements. Utilizing resources like US Legal Forms can help simplify this process and ensure you have the right forms.

Filling out an affidavit of service by mail requires you to provide details about the sender, recipient, and method of mailing. Begin by clearly stating the names, addresses, and the date of mailing in the Alabama Affidavit of Mailing format. Ensure you sign the affidavit to certify that it is accurate. USLegalForms offers templates and support to help you complete this process efficiently.

To mail the Alabama form 40V, you should send it to the appropriate address provided by the Alabama Department of Revenue. Ensure you use the correct mailing location based on your residency and filing requirements. The Alabama Affidavit of Mailing is crucial for confirming you submitted your form on time. You can make this process easier by using USLegalForms, which guides you through the proper steps.