The following Lease or Rental Agreement is meant to be used by one individual dealing with another individual rather than a dealership situation. It therefore does not contain disclosures required by the Federal Consumer Leasing Act.

Alabama Lease or Personal Rental Agreement of Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own

Description

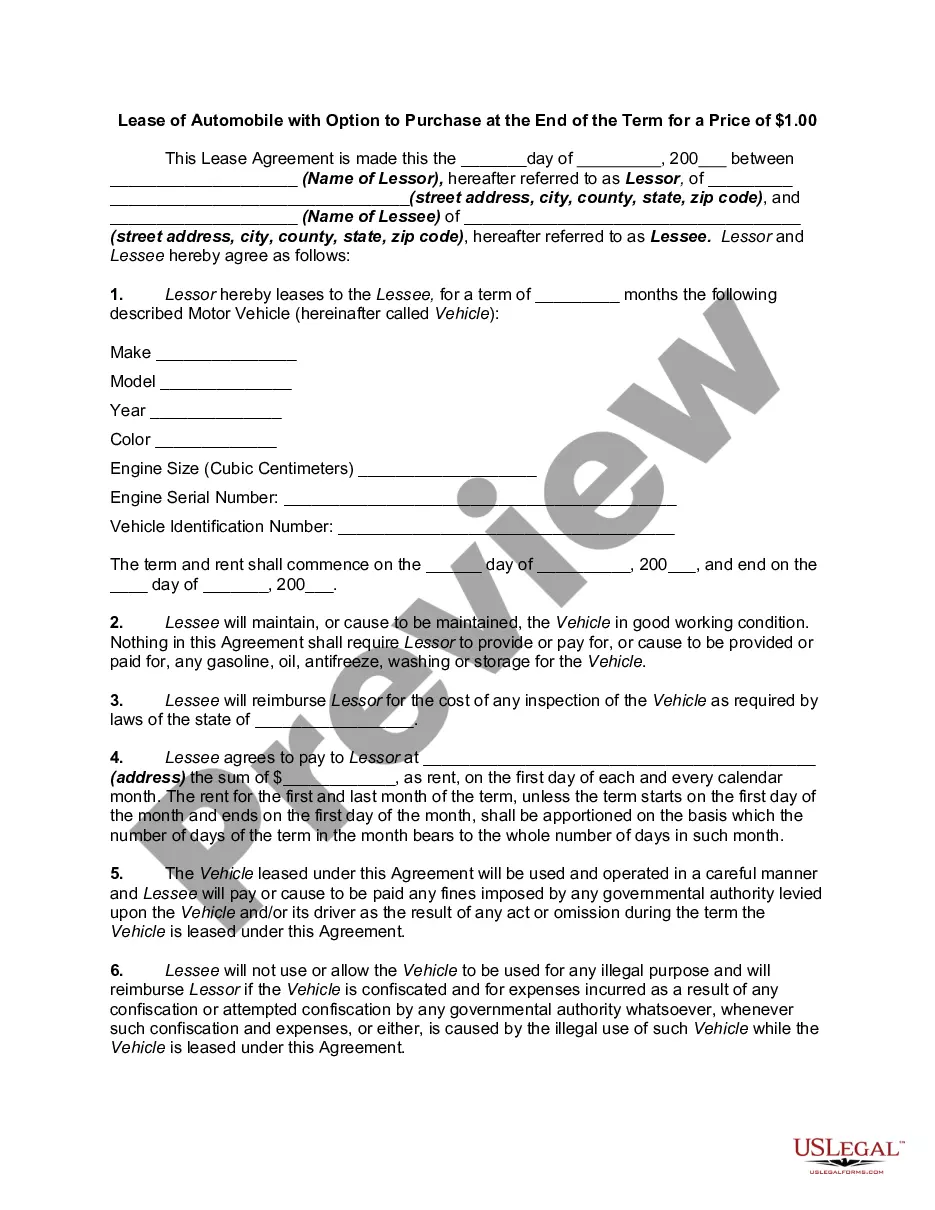

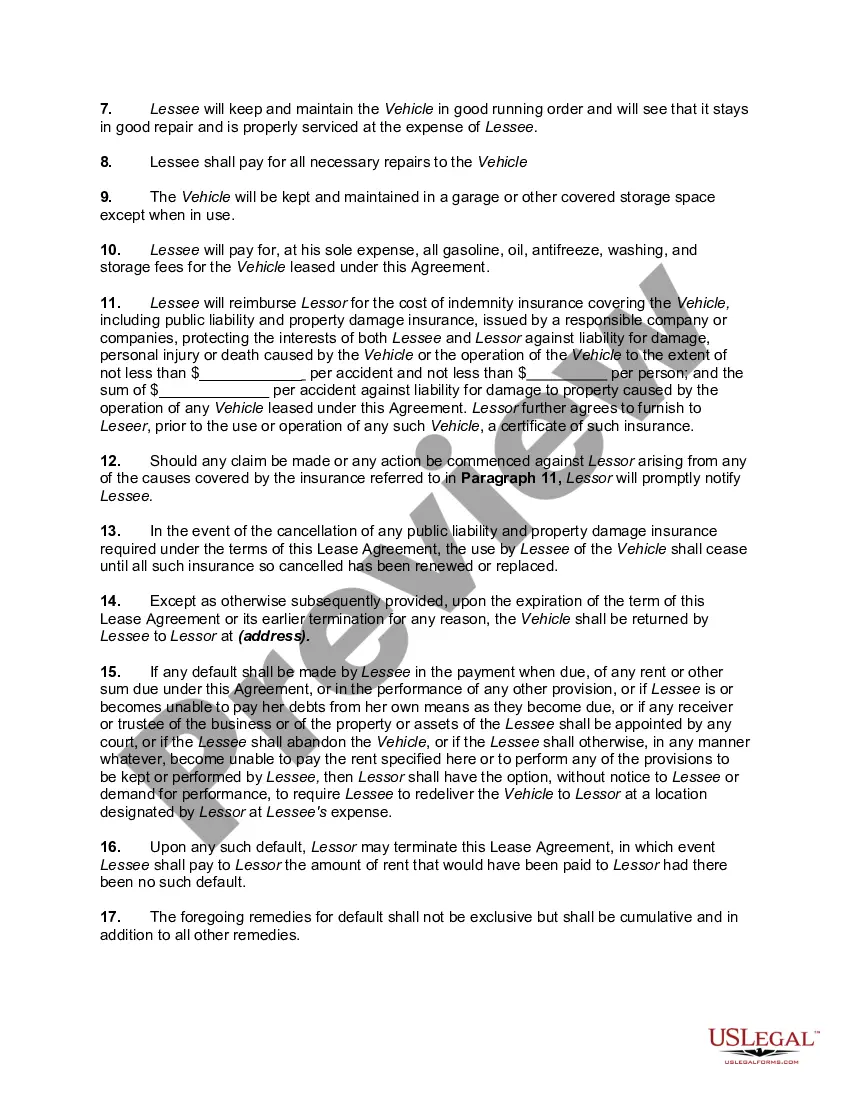

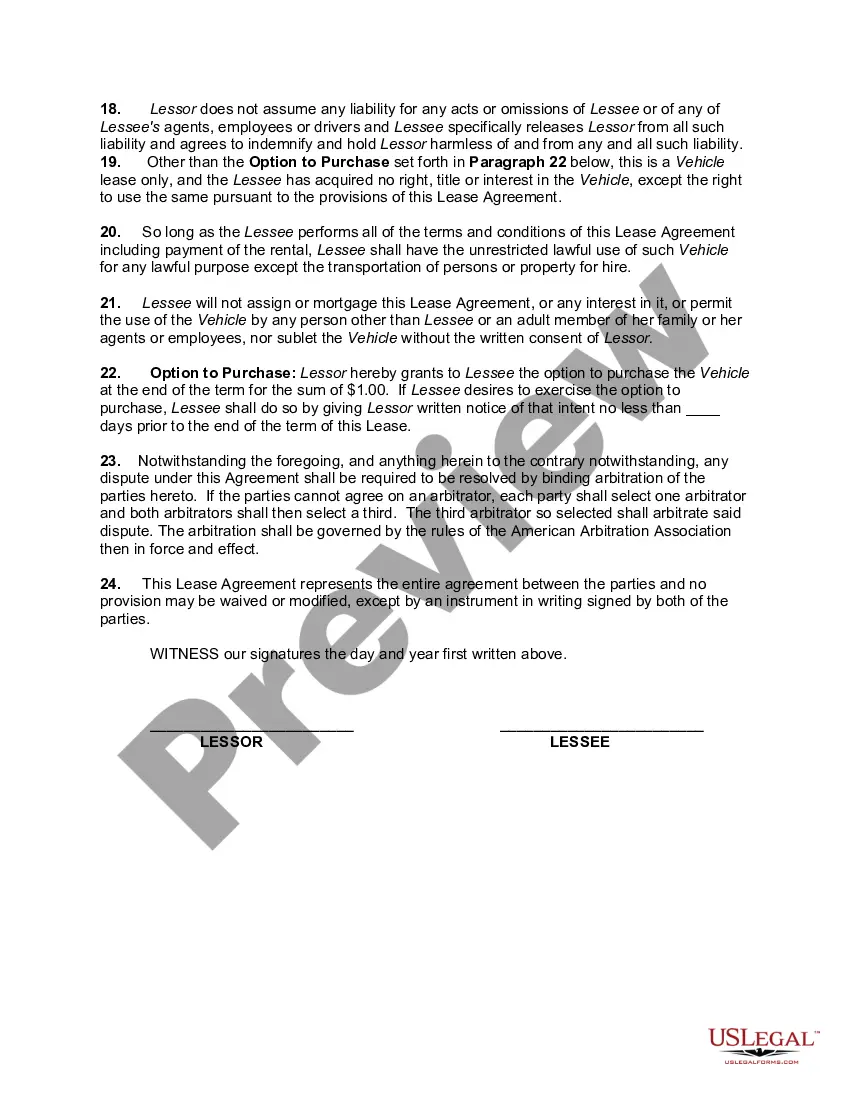

How to fill out Lease Or Personal Rental Agreement Of Automobile With Option To Purchase And Own At The End Of The Term For A Price Of $1.00 - Selling Car - Rent To Own?

US Legal Forms - one of the largest collections of legal forms in the USA - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest versions of forms such as the Alabama Lease or Personal Rental Agreement for Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own in moments.

Read the form description to confirm that you have selected the right form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In to download the Alabama Lease or Personal Rental Agreement for Automobile with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Selling Car - Rent to Own from your US Legal Forms account.

- The Acquire button will be available on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To get started with US Legal Forms for the first time, here are some simple steps.

- Ensure you have selected the correct form for your location/county.

- Click the Preview button to review the form's details.

Form popularity

FAQ

Over time, owning a car can be more cost-effectivebut you'll also have to pay for repairs and upkeep. A lease may come with lower monthly payments than an auto loan, but you'll only be able to keep your car for a few yearsand you'll typically also face mileage restrictions.

In general, leasing payments are lower than finance payments. When you lease, you're not paying for the entire vehicle but rather the value you use up for the time you're driving it. In the short term, based solely on monthly payments, it's typically cheaper to lease than to finance.

The idea of rent-to-own financing is that you can rent a vehicle for a set period of time, after which it becomes yours. Generally, buyers put down a deposit and then make payments on a weekly or monthly basis. While they're in possession of the vehicle, they are responsible for the maintenance and running costs.

The major drawback of leasing is that you don't acquire any equity in the vehicle. It's a bit like renting an apartment. You make monthly payments but have no ownership claim to the property once the lease expires. In this case, it means you can't sell the car or trade it in to reduce the cost of your next vehicle.

Leasing a car with the opportunity to buy it later can be a good way to get a new car for a low up-front investment and lower initial monthly payments. When you lease, you're getting a brand new car, with affordable payments and warranty coverage, with the option to buy it out at the end.

The major drawback of leasing is that you don't acquire any equity in the vehicle. It's a bit like renting an apartment. You make monthly payments but have no ownership claim to the property once the lease expires. In this case, it means you can't sell the car or trade it in to reduce the cost of your next vehicle.

Leasing allows you to keep your car payment in check. Also, as mentioned earlier, leasing is a good way for automakers to package incentives and rebates into an attractive monthly payment. These incentives may be more generous than the discounts or low-interest rate offers given to traditional cash buyers.

In general, leasing payments are lower than finance payments. When you lease, you're not paying for the entire vehicle but rather the value you use up for the time you're driving it. In the short term, based solely on monthly payments, it's typically cheaper to lease than to finance.

If you can acquire the automobile for less than its current market value and you like the car, buying it from the leasing company probably makes financial sense. But even if it looks like you'd be overpaying slightly at first glance, buying the car can still be a good idea.