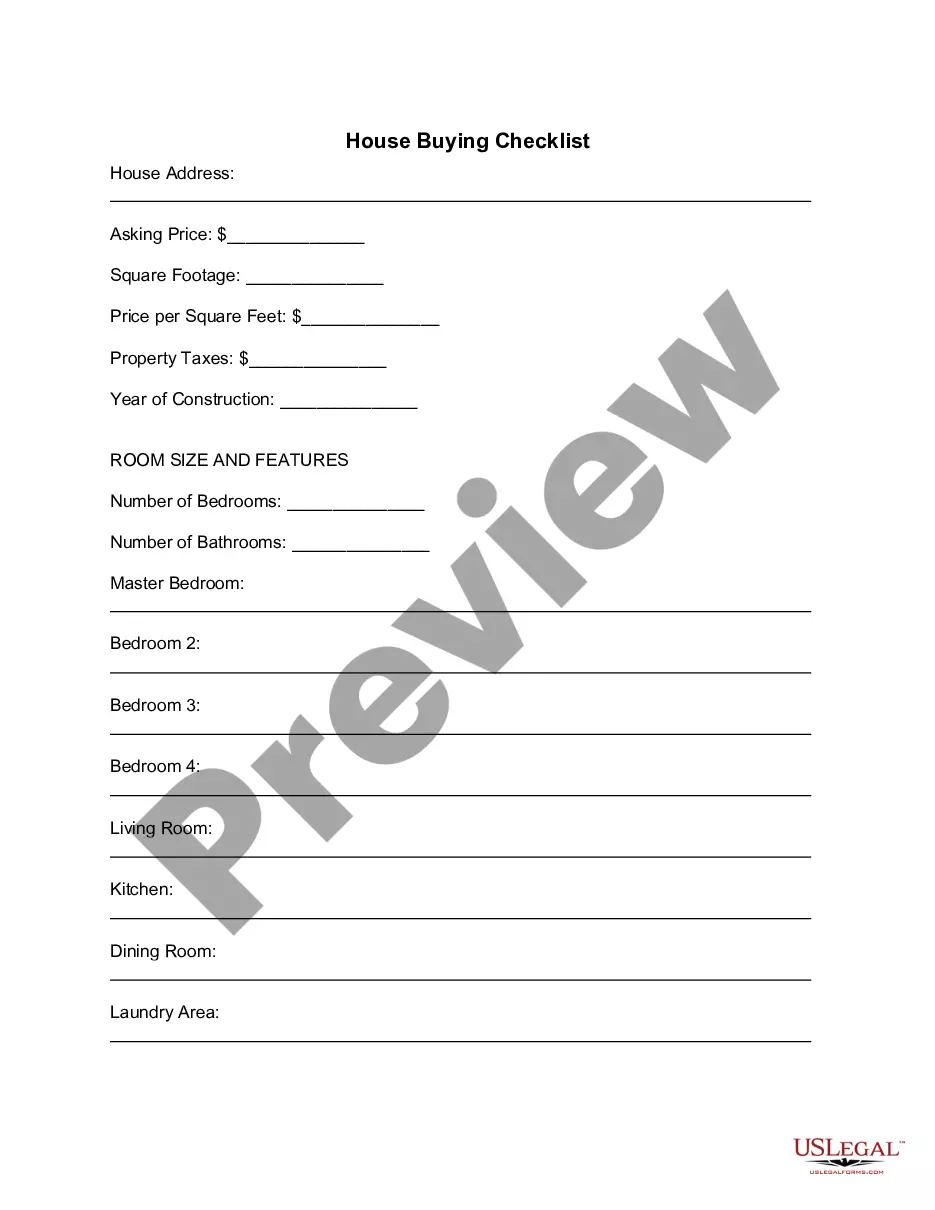

Alabama Property Information Check List - Residential

Description

How to fill out Property Information Check List - Residential?

You might spend hours online attempting to discover the official document template that meets the federal and state standards you require.

US Legal Forms offers a multitude of legal forms that can be reviewed by experts.

It is easy to download or create the Alabama Property Information Check List - Residential through the service.

To find another version of the form, use the Search section to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Alabama Property Information Check List - Residential.

- Every legal document template you acquire is your personal property indefinitely.

- To obtain another copy of a downloaded form, navigate to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the right document template for your chosen county/region.

- Review the document description to confirm you have selected the correct form.

Form popularity

FAQ

To look up property records in Alabama, you can visit the local county tax assessor's website or office. Most counties provide online databases where you can access information on ownership, property boundaries, and assessment details. Utilizing the Alabama Property Information Check List - Residential will guide you through this process, providing step-by-step assistance for finding the data you need with ease. This approach empowers you to stay informed about your residential property.

In Alabama, property assessment involves determining the market value of residential properties. The local tax assessor evaluates the property based on its size, location, and improvements, ensuring fair taxation. For homeowners, using the Alabama Property Information Check List - Residential can simplify the process, helping you understand potential assessment values. This tool is beneficial for realizing your home's worth and making informed decisions.

Eligibility for homestead exemption in Alabama typically includes homeowners who occupy their property as their primary residence. This includes individuals, married couples, and certain qualifying groups like seniors or disabled veterans. To ensure you meet the requirements, consult the Alabama Property Information Check List - Residential, which outlines the necessary qualifications and benefits you may receive.

Yes, many senior citizens in Alabama qualify for property tax exemptions. In particular, those aged 65 and older can apply for the State of Alabama's Homestead Exemption for Senior Citizens. This can significantly reduce their property tax burden. To understand the specific criteria, refer to the Alabama Property Information Check List - Residential for detailed information on eligibility and the application process.

To file for a homestead exemption in Alabama, you should prepare several important documents. Typically, you will need proof of residency, a valid driver's license, and property deed information. Additionally, it helps to have your Social Security number and any relevant tax documents. Using the Alabama Property Information Check List - Residential can simplify the process, ensuring you have everything needed to complete your application.

In Alabama, seniors aged 65 and older may be eligible for an exemption that stops property taxes on their primary residence. However, qualifying factors, such as income and property value limits, may apply. For further assistance and details, you can explore the Alabama Property Information Check List - Residential, which provides comprehensive information regarding senior property tax exemptions.

In Georgia, the assessed value is determined by taking the fair market value and applying a set assessment ratio, which is generally 40% for residential properties. Although this information pertains to Georgia, understanding property assessment principles can be beneficial. For Alabama residents, the Alabama Property Information Check List - Residential focuses specifically on your state's guidelines for assessments.

Finding the assessed value of a property often involves checking your local tax assessor's records, which can include various online search tools. You can also consult property tax statements, which typically list the assessed values clearly. The Alabama Property Information Check List - Residential is a valuable resource to assist you in this endeavor.

To calculate Alabama property tax, you need the assessed value of your property and the local tax rate, which is usually expressed in mills. Multiply the assessed value by the tax rate, then divide by 1,000 for the total tax due. Utilizing the Alabama Property Information Check List - Residential can provide clarity on tax calculations and information specific to your property.

You can find the assessed value of a property by visiting your local county tax assessor’s website or office. They maintain records that include property assessments, which are often accessible through an online database. For a thorough understanding, consider using the Alabama Property Information Check List - Residential to streamline this process.