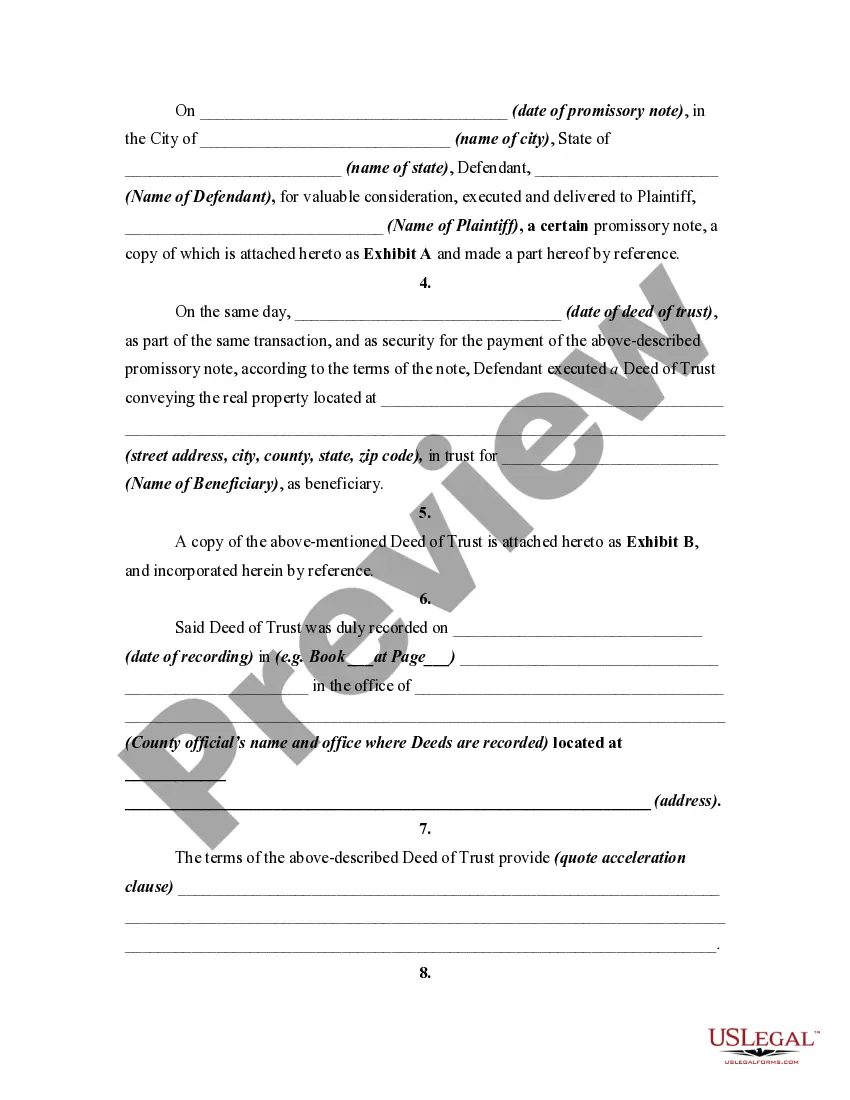

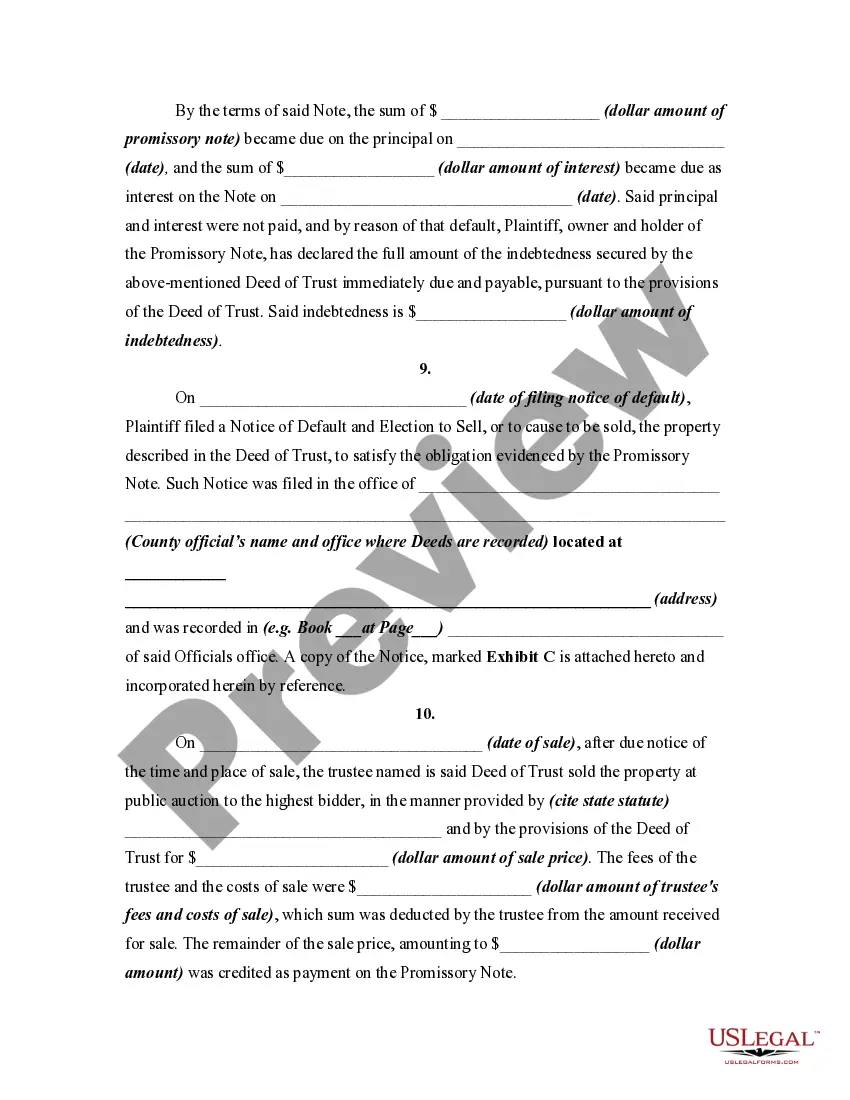

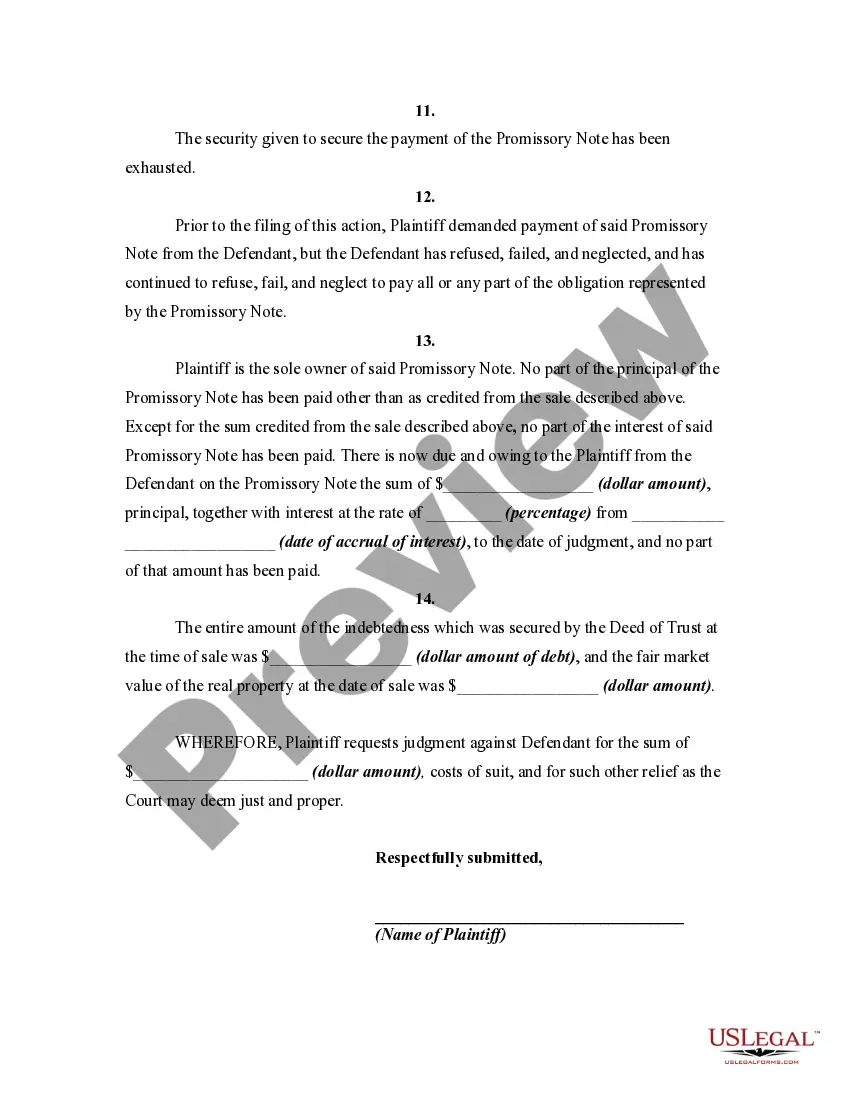

Have you been within a position in which you need paperwork for sometimes enterprise or person uses virtually every day? There are plenty of legitimate record templates available on the Internet, but getting kinds you can rely on isn`t effortless. US Legal Forms provides 1000s of develop templates, much like the Alabama Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust, which are composed to satisfy state and federal requirements.

Should you be already informed about US Legal Forms web site and get an account, simply log in. After that, you may obtain the Alabama Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust template.

Unless you come with an bank account and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for your correct metropolis/region.

- Make use of the Preview option to check the form.

- See the information to ensure that you have selected the appropriate develop.

- When the develop isn`t what you`re looking for, make use of the Look for field to discover the develop that meets your needs and requirements.

- When you find the correct develop, simply click Purchase now.

- Opt for the rates program you would like, complete the specified information and facts to generate your money, and buy the order using your PayPal or bank card.

- Pick a convenient document structure and obtain your duplicate.

Find all of the record templates you have purchased in the My Forms menus. You can aquire a further duplicate of Alabama Complaint or Petition to Recover Deficiency after Sale under Trust Deed or Deed of Trust any time, if possible. Just click the necessary develop to obtain or printing the record template.

Use US Legal Forms, by far the most substantial assortment of legitimate varieties, to save efforts and avoid mistakes. The support provides professionally produced legitimate record templates that can be used for an array of uses. Make an account on US Legal Forms and initiate generating your life easier.