Alabama Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation

Description

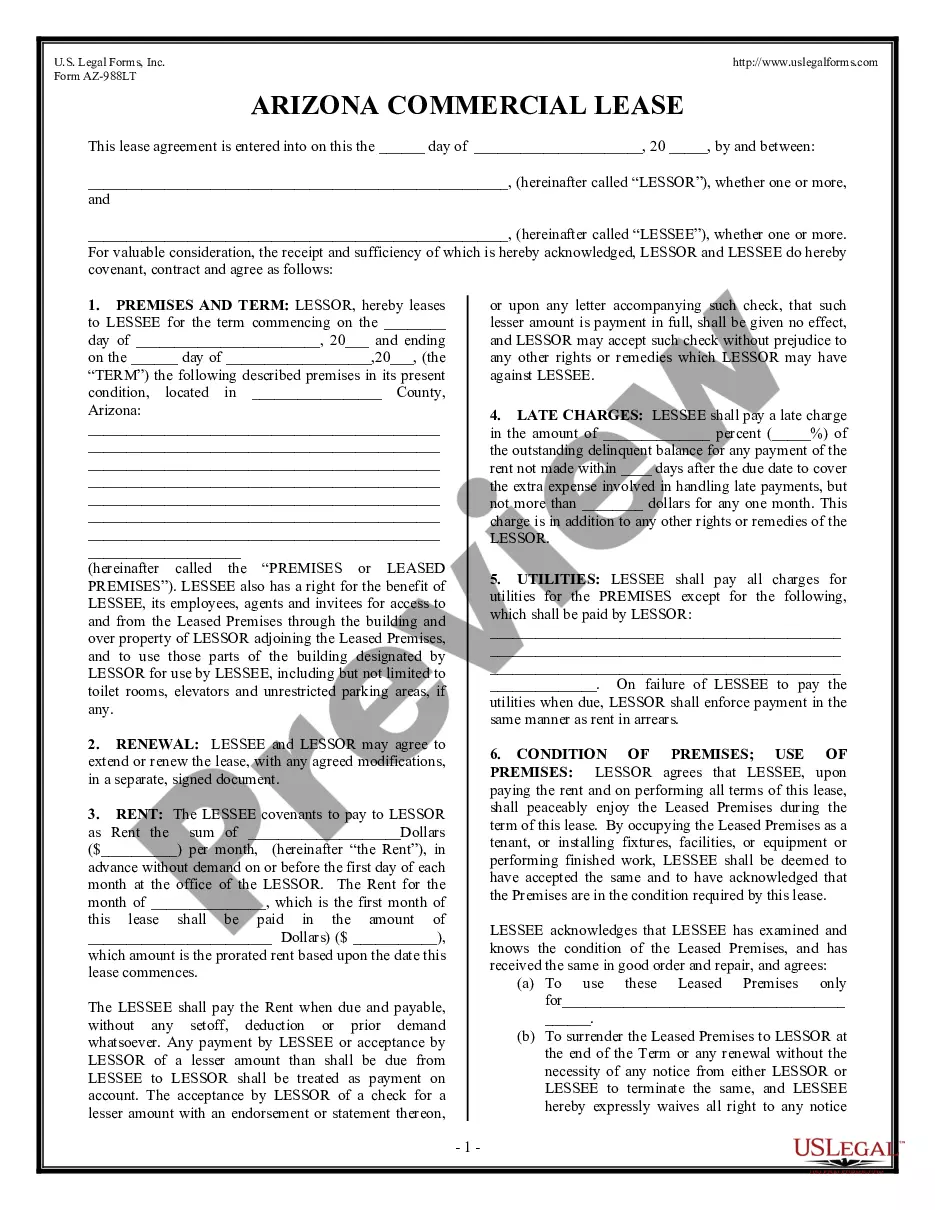

How to fill out Sample Letter Regarding Notification Of Official Notice Of Intent To Administratively Dissolve Or Revoke Corporation?

You can spend hours online searching for the legal template that meets the state and federal standards you require.

US Legal Forms provides thousands of legal documents that are reviewed by professionals.

You can easily download or print the Alabama Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation from the service.

If available, use the Preview button to review the template as well. If you wish to find another version of your form, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you want, click Acquire now to proceed. Choose the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make changes to your document if possible. You can fill out, modify, sign, and print the Alabama Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation. Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Use expert and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Alabama Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation.

- Every legal template you obtain is yours permanently.

- To acquire another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct template for the region/city that you select.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Steps to dissolving a corporation or obtaining a corporate dissolution Call a board meeting. ... File a certificate of dissolution with the Secretary of State. ... Notify the Internal Revenue Service (IRS) ... Close accounts and credit lines, cancel licenses, etc.

PURPOSE: In order to dissolve a Limited Liability Company (LLC) under Section 10A-5A-7.02(b) of the Code of Alabama 1975, these Articles of Dissolution and the appropriate filing fees must be filed with the Secretary of State's office. The information required in this form is required by Title 10A.

Administrative dissolution is the taking away of the rights, powers, and authority of a domestic corporation, LLC, or other statutory business entity by the state administrator overseeing business entities, due to the entity's failure to comply with certain obligations of the business entity statute.

Complete Articles of Dissolutions Form based on the entity type. Follow the instructions on the form pertaining to the type of entity you are dissolving. Provide any missing returns and payments as determined by ADOR staff, if found not to be in compliance to ADOR. Receive Certificate of Compliance from ADOR.

To dissolve your Alabama corporation, you must provide the completed original and two copies of the Domestic Business Corporation Articles of Dissolution form, to the Judge of Probate in the county where the original Certificate of Formation was recorded, by mail or in person. An original signature is required.

To close a business tax account administered by the Sales & Use Tax Division, complete and mail the Business Closing Form. To close your withholding tax account, select the box on Line 1 of Form A-1 or A-6. You will be instructed to complete Form A-7.

To dissolve your LLC or corporation in Alabama, the Secretary of State filing fee of $100 is required. You will need to contact the Judge of Probate Office to verify their recording fees, but it is a minimum $50. Two separate checks are required.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.