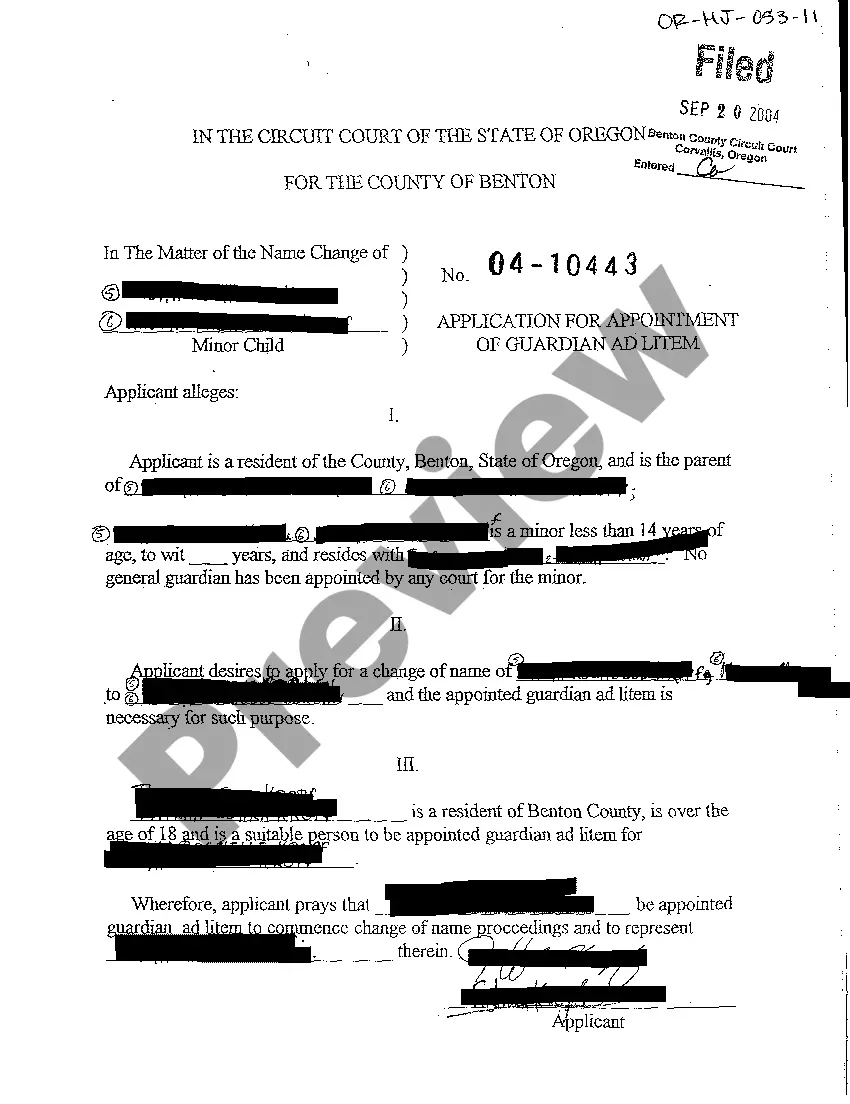

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Verification of an Account for Services and Supplies to a Public Entity

Description

How to fill out Verification Of An Account For Services And Supplies To A Public Entity?

Choosing the best lawful record template can be a have difficulties. Of course, there are plenty of layouts available on the Internet, but how do you get the lawful type you need? Make use of the US Legal Forms web site. The support offers a large number of layouts, for example the Alabama Verification of an Account for Services and Supplies to a Public Entity, that can be used for company and personal requirements. Every one of the varieties are inspected by professionals and satisfy federal and state requirements.

If you are presently listed, log in in your account and click the Obtain button to get the Alabama Verification of an Account for Services and Supplies to a Public Entity. Utilize your account to check from the lawful varieties you may have bought earlier. Go to the My Forms tab of the account and obtain an additional copy of the record you need.

If you are a whole new end user of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- Very first, be sure you have selected the proper type for the metropolis/region. It is possible to look through the shape utilizing the Review button and look at the shape description to make sure it is the right one for you.

- In case the type does not satisfy your requirements, make use of the Seach discipline to find the appropriate type.

- When you are sure that the shape would work, click the Purchase now button to get the type.

- Select the costs program you want and enter the needed information and facts. Create your account and pay for the transaction with your PayPal account or Visa or Mastercard.

- Choose the submit formatting and obtain the lawful record template in your product.

- Comprehensive, change and produce and indicator the attained Alabama Verification of an Account for Services and Supplies to a Public Entity.

US Legal Forms will be the greatest local library of lawful varieties where you can find various record layouts. Make use of the company to obtain appropriately-manufactured documents that adhere to status requirements.

Form popularity

FAQ

178. Section 810-6-1-. 178 - Transportation Charges (1) Where a seller delivers tangible personal property in his own equipment or in equipment leased by him, the transportation charges shall be considered a part of the selling price subject to sales or use tax.

09. Section 810-6-5-. 09 - Leasing and Rental of Tangible Personal Property (1) The term "rental tax" as used in this rule shall mean the privilege or license tax levied in Section 40-12-222, Code of Ala.

The veterinarian shall collect sales tax from the customer on those items purchased tax-free from veterinarian supply houses and resold by the veterinarian.

02 - State Sales And Use Tax Certificate Of Exemption (Form STE-1) - Issued For Wholesalers, Manufacturers And Other Product Based Exemptions. (1) The term "Department" as used in this regulation shall mean the Department of Revenue of the State of Alabama.

(9) Wholesale sale or sale at wholesale. Any one of the following: a. A sale of tangible personal property by wholesalers to licensed retail merchants, jobbers, dealers, or other wholesalers for resale and does not include a sale by wholesalers to users or consumers, not for resale.

84. Section 810-6-1-. 84 - Labor Or Service Charges (1) The term "new or different" as used in this rule shall mean new or different insofar as the ultimate purchaser is concerned.

Section 810-6-1-. 37 - Computer Hardware And Software (1) Computers and related equipment, also known as computer hardware, consist of components and accessories that make up the physical computer assembly. The retail sale of computer hardware is subject to Sales Tax or Use Tax.

Any person or company that fails to obtain or renew a certificate of exemption prior to its expiration may not make tax exempt purchases or rent tax exempt accommodations after the expiration.

90.03 - Requirements For Certain Out-Of-State Sellers Making Significant Sales Into Alabama. (1) An out-of-state seller who is making retail sales of tangible personal property into the state is required to register with the Department and to collect and remit tax pursuant to Section 40-23-67, Code of Ala.