An action to recover on an open account is one usually based on an implied or oral contract. Ordinarily, it is not necessary to specify all the individual items that make up the account balance due. Some jurisdictions authorize a short form of pleading that allows a copy of the written statement to be attached, specifying only that a certain sum is due the plaintiff from the defendant. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

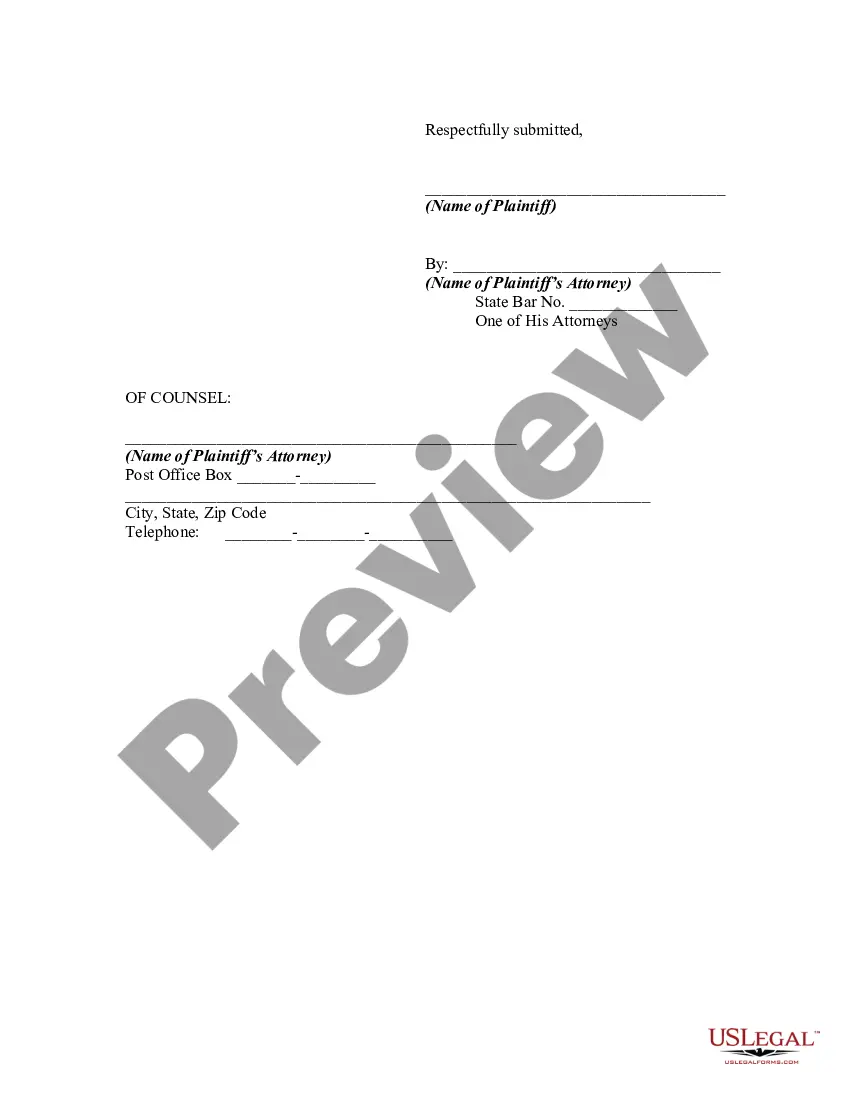

Alabama Complaint for Amount Due for Goods Sold and Delivered Pursuant to an Open Account

Description

How to fill out Complaint For Amount Due For Goods Sold And Delivered Pursuant To An Open Account?

If you wish to comprehensive, down load, or print out authorized file templates, use US Legal Forms, the most important collection of authorized varieties, which can be found on the Internet. Make use of the site`s basic and convenient research to obtain the documents you will need. Different templates for enterprise and personal reasons are sorted by types and suggests, or key phrases. Use US Legal Forms to obtain the Alabama Complaint for Amount Due for Goods Sold and Delivered Pursuant to an Open Account in just a number of clicks.

When you are currently a US Legal Forms buyer, log in for your bank account and then click the Acquire button to have the Alabama Complaint for Amount Due for Goods Sold and Delivered Pursuant to an Open Account. You can also gain access to varieties you earlier acquired inside the My Forms tab of your bank account.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape to the right metropolis/country.

- Step 2. Use the Preview solution to check out the form`s content. Never overlook to learn the explanation.

- Step 3. When you are not satisfied with all the kind, make use of the Research discipline at the top of the monitor to find other types from the authorized kind design.

- Step 4. Upon having discovered the shape you will need, select the Acquire now button. Select the costs program you like and add your credentials to register for an bank account.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Pick the formatting from the authorized kind and down load it on the product.

- Step 7. Comprehensive, revise and print out or indication the Alabama Complaint for Amount Due for Goods Sold and Delivered Pursuant to an Open Account.

Each and every authorized file design you acquire is the one you have for a long time. You possess acces to each kind you acquired within your acccount. Click the My Forms area and decide on a kind to print out or down load again.

Compete and down load, and print out the Alabama Complaint for Amount Due for Goods Sold and Delivered Pursuant to an Open Account with US Legal Forms. There are many professional and express-particular varieties you can use to your enterprise or personal requirements.

Form popularity

FAQ

Three years. The statute of limitations for an open account is three years from the date of last item of the account, or from the time when, by contract or usage, the account is due. Ala.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

A debt collector may not engage in any conduct the natural consequence of which is to harass, oppress, or abuse any person in connection with the collection of a debt.

Alabama state law (AL Code § 6-2-37) says that debt collectors have 3 years to file a debt collection lawsuit on an open account, such as a credit card account. The clock starts ticking 3 years from the date of the last action on the account in question.

A collector cannot use threats of violence or harm, repeatedly call to annoy you, or lie or mislead you. Lies or misleading behavior include the suggestion that you have committed a crime, overstating the amount of your debt, or threatening to garnish your wages unless they already have a judgment against you.

If you owe state tax debt, the statute of limitation is 10 years. If you owe credit card or auto loan debt, the statute is 3-4 years. Medical debt and mortgage debt don't run out until 6 years later.

If you do not take steps to file for lien avoidance, the creditor can still take the property or force its sale by the Sheriff. If the property with a judgment lien is a house or car and the creditor does nothing, the lien remains on the property until it expires.