Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

Alabama Receipt for Payment of Salary or Wages

Description

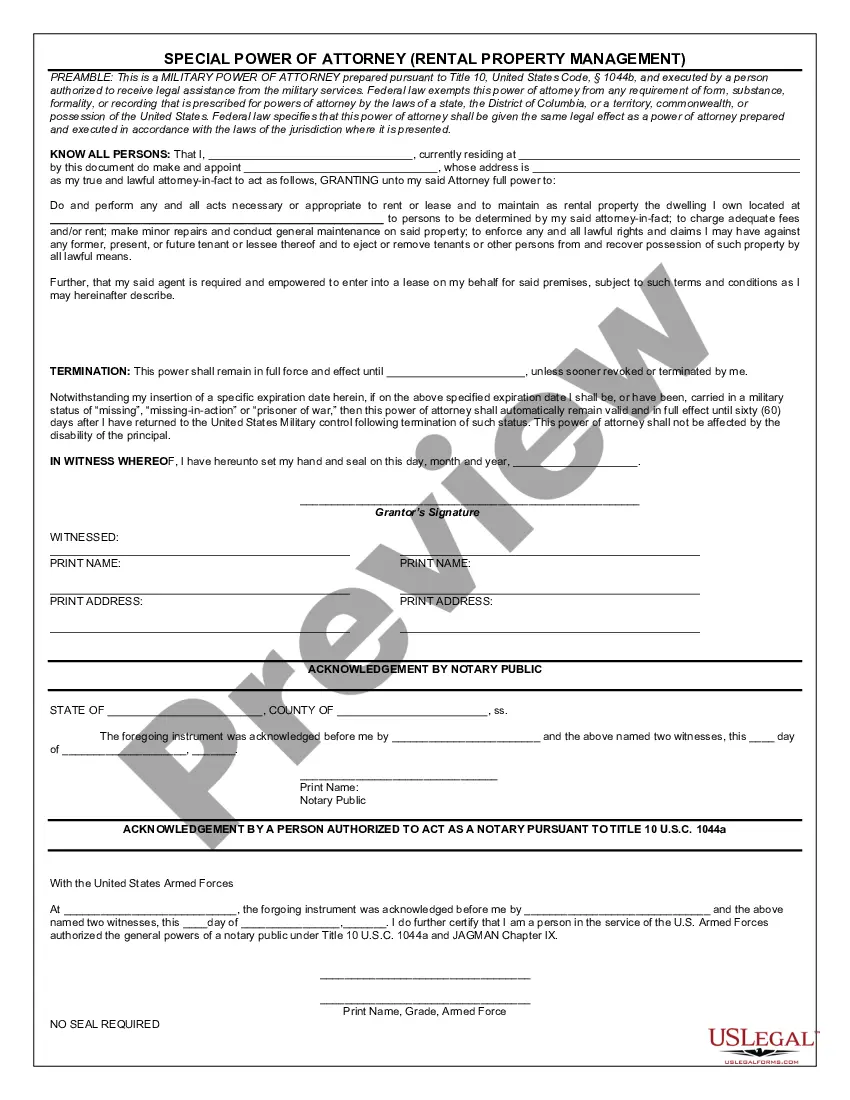

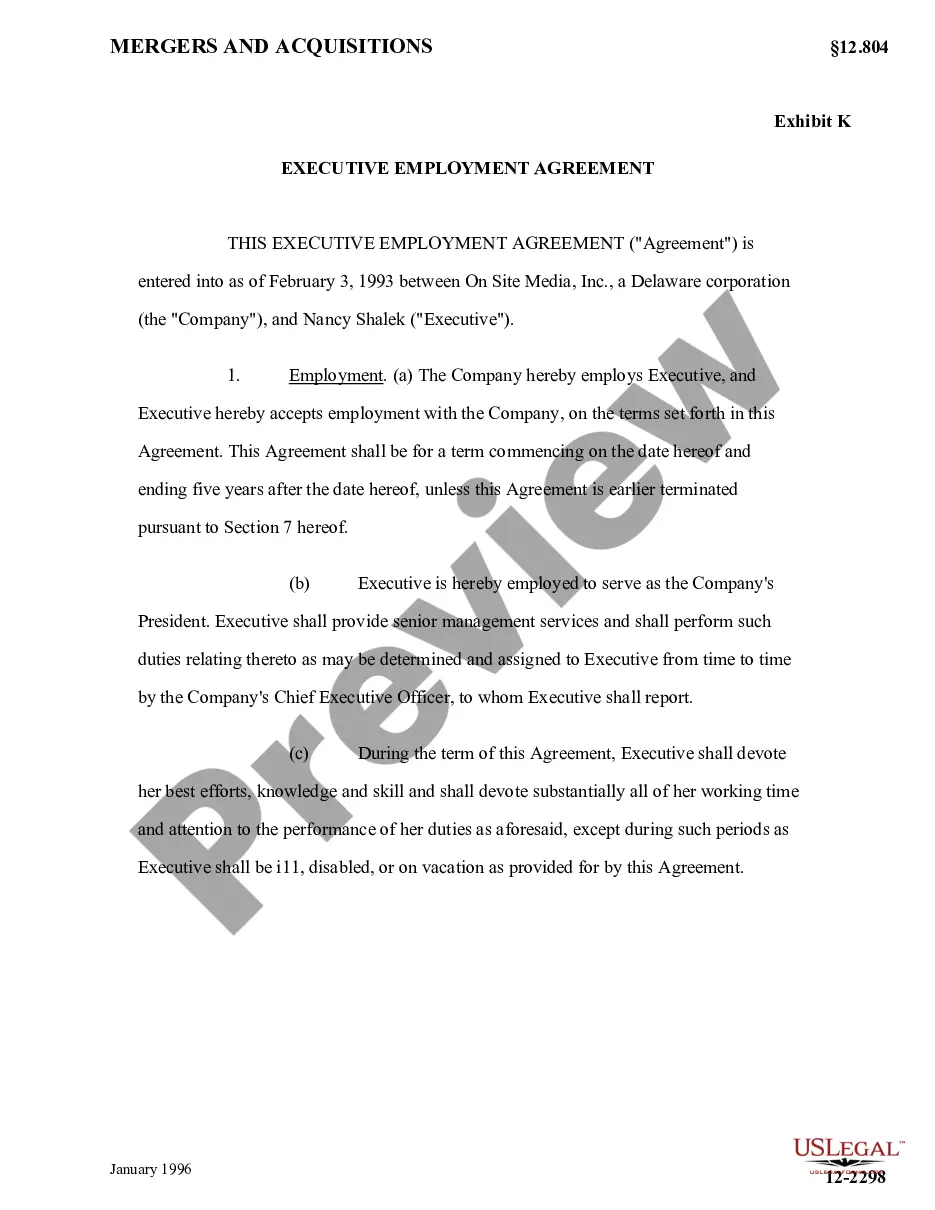

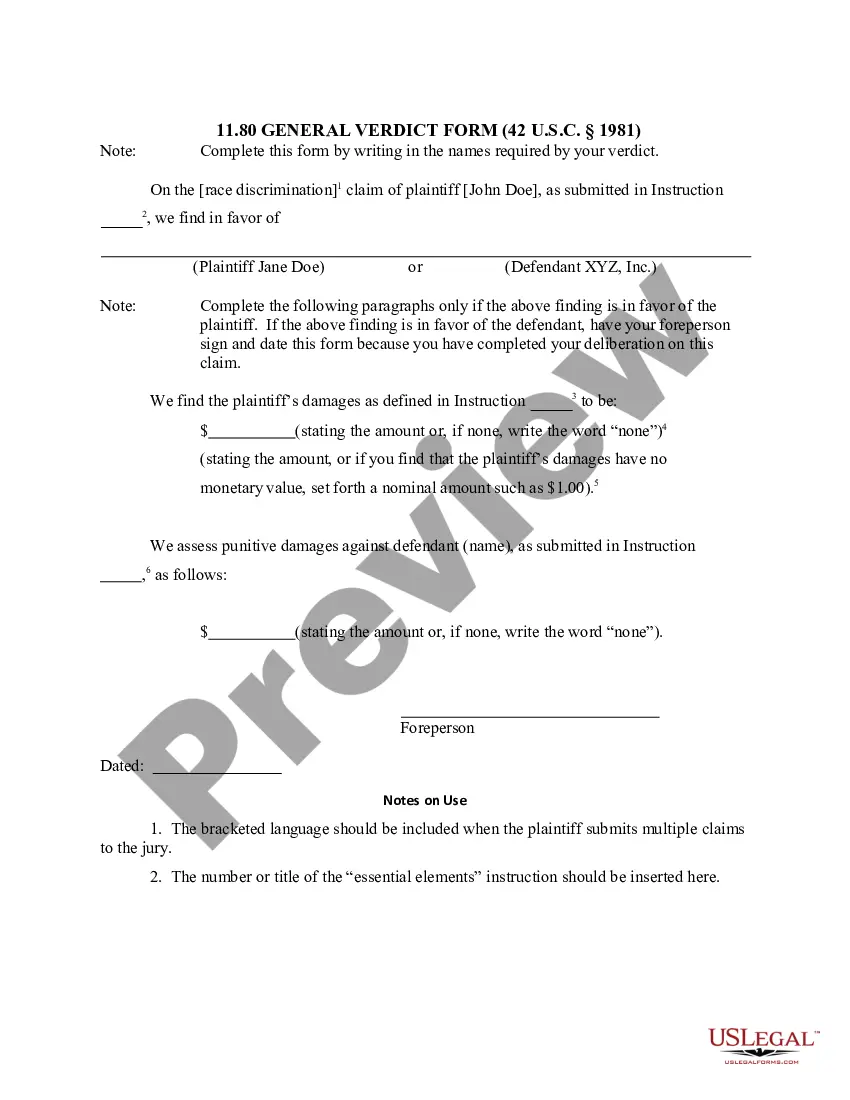

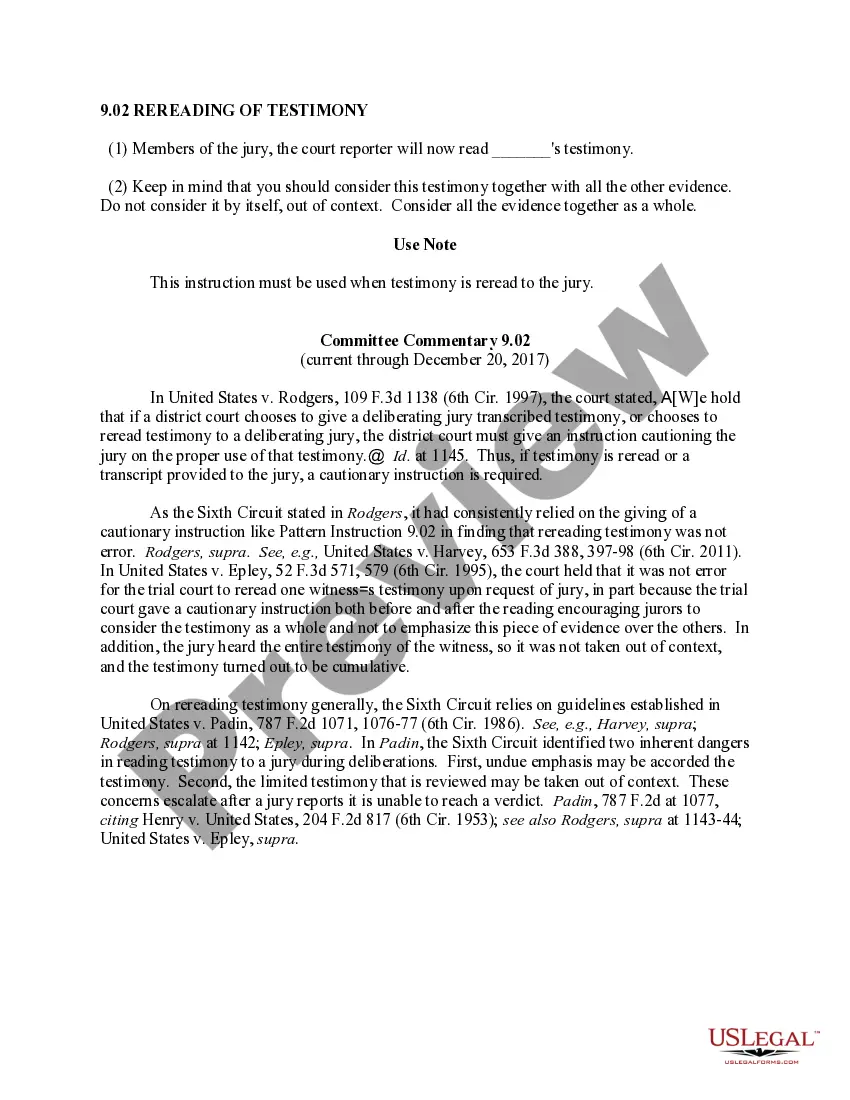

How to fill out Receipt For Payment Of Salary Or Wages?

You can spend numerous hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can download or print the Alabama Receipt for Payment of Salary or Wages through their service.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Alabama Receipt for Payment of Salary or Wages.

- Each legal document template you purchase is yours permanently.

- To get an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to verify that you have chosen the right one.

Form popularity

FAQ

Receiving a deposit from the State of Alabama EOM typically indicates a refund or adjustment related to previous payments made. This could be linked to overpayment or other corrections in your tax withholdings. If you're unsure about the details, utilizing resources on Alabama receipt for payment of salary or wages may provide clarity and guidance.

Alabama EOM stands for 'End of Month,' often used to indicate reports or payments due at the close of a month. Businesses must recognize the significance of EOM processes, particularly when managing payroll and ensuring compliance with wage regulations. Incorporating Alabama receipt for payment of salary or wages can streamline this process.

The Alabama Administrative Procedure Act establishes the process by which state agencies create and enforce regulations. It ensures transparency and public participation in the administrative rule-making process. It's essential to understand this act when dealing with wage and hour laws, especially regarding Alabama receipt for payment of salary or wages.

Alabama net operating loss refers to the situation when a business's allowable tax deductions exceed its income. This means the business can carry over its losses to future tax years, reducing taxable income in those years. Understanding how to report and claim these losses is crucial for maximizing your tax benefits, especially when considering forms related to Alabama receipt for payment of salary or wages.

Payroll withholding in Alabama refers to the amount automatically deducted from an employee's paycheck for state and federal taxes. Employers follow specific guidelines set by the Alabama Department of Revenue for these deductions. You can always check your Alabama Receipt for Payment of Salary or Wages to see how much is being withheld.

The amount of tax withheld from your paycheck in Alabama depends on your income and filing status. Typically, state taxes can range from 2% to 5%. For an accurate understanding of your withholdings, refer to your Alabama Receipt for Payment of Salary or Wages.

For Alabama income tax, the standard deduction for single filers is $2,500, while for married couples filing jointly, it is $7,500. This deduction can significantly reduce your taxable income. Make sure to document your earnings with your Alabama Receipt for Payment of Salary or Wages.

Alabama has a progressive income tax rate ranging from 2% to 5%. The specific rate depends on your income level. Understanding how these rates apply to your situation can be aided by reviewing your Alabama Receipt for Payment of Salary or Wages.

In Alabama, wage deductions include various items such as federal income tax, state income tax, Social Security, and Medicare. The exact amount will vary based on individual circumstances. Keeping your Alabama Receipt for Payment of Salary or Wages helps you track these deductions accurately.

To mail your Alabama tax return with payment, send it to the appropriate address indicated on the form. This typically includes the Alabama Department of Revenue in Montgomery. Don't forget to include your Alabama Receipt for Payment of Salary or Wages with your payment to avoid any delays.