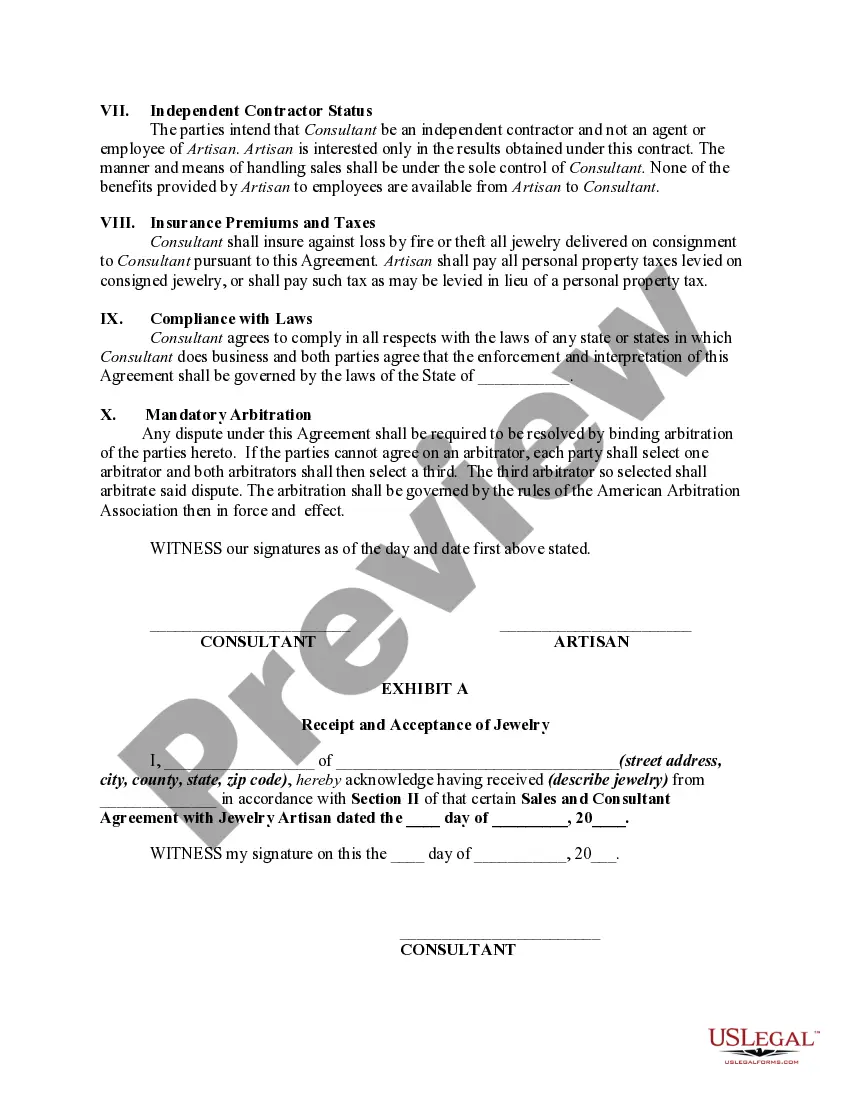

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

If you require to obtain, acquire, or generate legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the website's user-friendly search to find the documents you need.

Many templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase Now button. Select the payment plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions in the legal form format.

Form popularity

FAQ

To obtain a seller's permit in Alabama, you must register your business with the Alabama Department of Revenue. This process usually requires submitting specific documents and completing forms. Once you have your seller permit, you can engage in an Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans confidently.

In Alabama, most professional services are not subject to sales tax. However, specific service categories could be taxable under certain circumstances. For businesses drafting the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans, clarity on tax obligations for services ensures smooth transactions.

In Alabama, certain items are exempt from sales tax, including non-profit purchases and agricultural products. Understanding these exemptions is vital, especially for businesses involved in the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans. This knowledge can help you manage costs and improve profitability in your operations.

Section 40 23 2 of the Alabama Code defines what constitutes a retail sale. This section is essential for businesses in assessing their sales tax obligations when entering into agreements like the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans. Compliance with these regulations can help prevent unexpected tax liabilities.

Section 68 of the Alabama Constitution addresses the authority of the state to levy taxes. This section is crucial for understanding how taxes apply to businesses, including those involved in the Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans. Profound knowledge of this section can lead to better tax management.

Title 40 of the Alabama Code deals with taxation. It encompasses various tax laws, including provisions for sales and use tax, corporate income tax, and property tax. For professionals drafting an Alabama Sales and Marketing Consultant Agreement with Jewelry Artisans, being familiar with Title 40 can streamline financial planning.

Section 40 23 68 of the Alabama Code outlines the requirements and regulations concerning sales and use tax. This section is particularly relevant for businesses entering Alabama Sales and Marketing Consultant Agreements with Jewelry Artisans. Understanding these regulations helps ensure compliance and optimize tax strategies for your business.

Certain types of income are not taxable under Alabama state law, including gifts, inheritances, and certain types of insurance proceeds. Additionally, income from state bonds is generally exempt. When considering your financial arrangements surrounding an Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan, understanding these exemptions can help you manage your tax implications effectively. Explore resources at uslegalforms for complete guidance.

In Alabama, service contracts are generally subject to sales tax unless they meet specific criteria for exemption. This means that if you enter into an Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan that includes various service elements, it’s crucial to determine tax applicability. For clarity on your obligations, consulting uslegalforms can provide essential insights tailored to your contract specifics.

Alabama Code 22 21 333 addresses regulations related to the licensing and operation of certain professional services. It may include provisions about ensuring compliance with health, safety, and operational standards. When entering into an Alabama Sales and Marketing Consultant Agreement with Jewelry Artisan, understanding relevant state codes can guide your business practices effectively. Utilize resources like uslegalforms for interpretations and applications of such codes.