Alabama Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Agreement To Repay Cash Advance On Credit Card?

Are you presently in the circumstance where you require documents for potential business or personal purposes almost all the time.

There are numerous authentic file templates accessible online, but locating versions you can trust isn't straightforward.

US Legal Forms provides a wide array of form templates, such as the Alabama Agreement to Repay Cash Advance on Credit Card, which is designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the file templates you have purchased in the My documents section. You can obtain an additional copy of the Alabama Agreement to Repay Cash Advance on Credit Card anytime, if necessary. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive selection of authentic forms, to save time and prevent errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Alabama Agreement to Repay Cash Advance on Credit Card template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

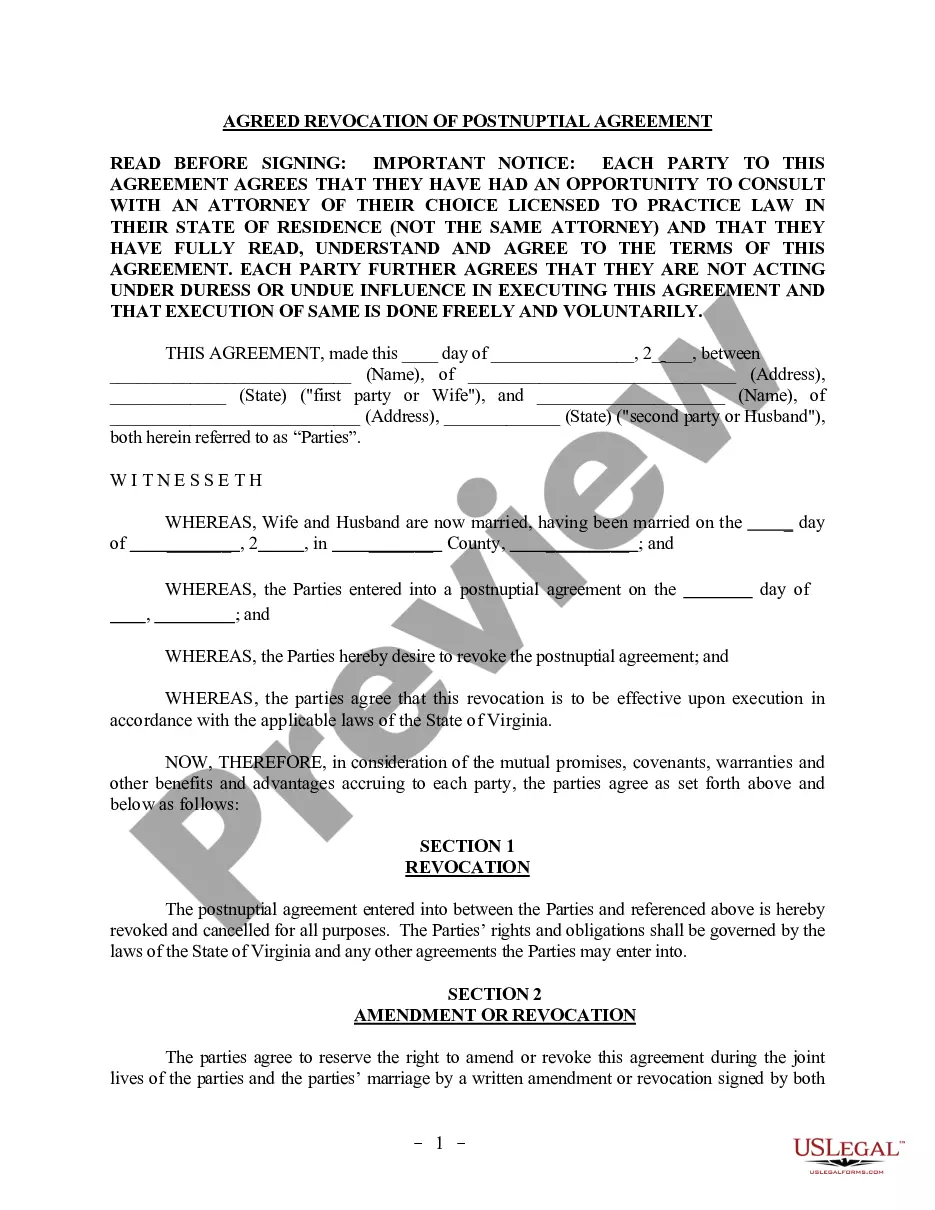

- Use the Preview button to review the document.

- Check the description to ensure you have chosen the right form.

- If the form isn't what you are looking for, use the Search box to locate the form that suits your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

You can also avoid cash advances and get cash from a credit card using prepaid cards. You can take a few approaches, but the most direct and immediate one is buying a Mastercard gift card with a sufficient amount of cash on it using your credit card and withdrawing that cash from an ATM.

The only way to avoid a cash advance fee is by avoiding cash advances and cash equivalent transactions on your credit card. If you can't avoid the transaction completely, you can minimize the cash advance fee you pay by reducing the amount of cash you withdraw on your credit card.

3 And you will pay interest on your cash advance even if you pay it off in full and had a zero balance for that billing cycle. You also have the option of paying off the cash advance over time, just as you can with a purchase, as long as you make minimum monthly payments.

Cash advances don't impact your credit score differently than regular credit card purchases. However, the additional fees and interest that cash advances are subject to sometimes catch card holders off-guard and lead to situations of credit card delinquency, which negatively affect credit score.

How to use a credit card at an ATM to withdraw moneyInsert your credit card into an ATM.Enter your credit card PIN.Select the cash withdrawal or cash advance option.Select the credit option, if necessary (you may be asked to choose between checking, debit or credit)Enter the amount of cash you'd like to withdraw.More items...?

Card issuers typically charge a fee if you use your credit card for a cash advance. This can either be a flat fee per cash advance or a percentage of the loan amount. Depending on the lender, this transaction fee can be as high as 5% of the advance or $10, whichever is greater.

Since your advance begins accruing interest the same day you get your cash, start repaying the amount you borrow as soon as possible. If you take out a $200 cash advance, aim to pay that amount in fullor as much as possibleon top of your minimum payment. Make it a goal to repay the amount in days instead of weeks.

That means you will be charged interest starting from the date you withdraw a cash advance. That's different from when you make a purchase with you card, and the issuer offers a grace period of at least 21 days where you won't incur interest if your balance is paid in full by the due date.

A cash advance allows you to use your credit card to get a short-term cash loan at a bank or ATM. Unlike a cash withdrawal from a bank account, a cash advance has to be paid back just like anything else you put on your credit card. Think of it as using your credit card to "buy" cash rather than goods or services.

Cardholders can use a credit card at nearly any ATM and withdraw cash as they would when using a debit card, but instead of drawing from a bank account, the cash withdrawal shows up as a charge on a credit card.