Alabama Revocable Living Trust for Real Estate

Description

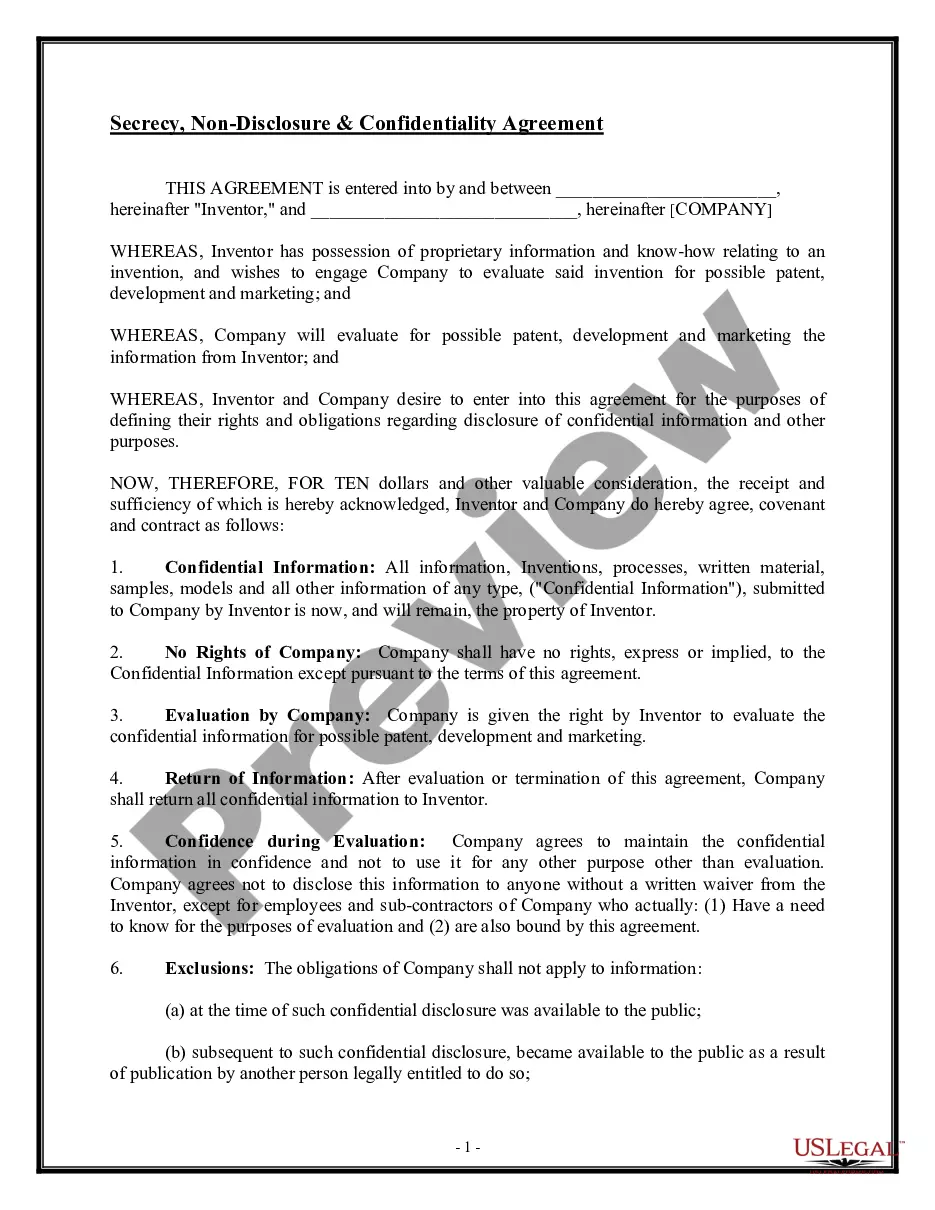

How to fill out Revocable Living Trust For Real Estate?

If you require to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the top assortment of legal forms, available online.

Leverage the site's straightforward and convenient search feature to locate the documents you need.

A variety of templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your information to create an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Alabama Revocable Living Trust for Real Estate. Each legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again. Complete and download, and print the Alabama Revocable Living Trust for Real Estate with US Legal Forms. There are millions of professional and state-specific forms available for your personal business or individual needs.

- Use US Legal Forms to acquire the Alabama Revocable Living Trust for Real Estate with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Alabama Revocable Living Trust for Real Estate.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

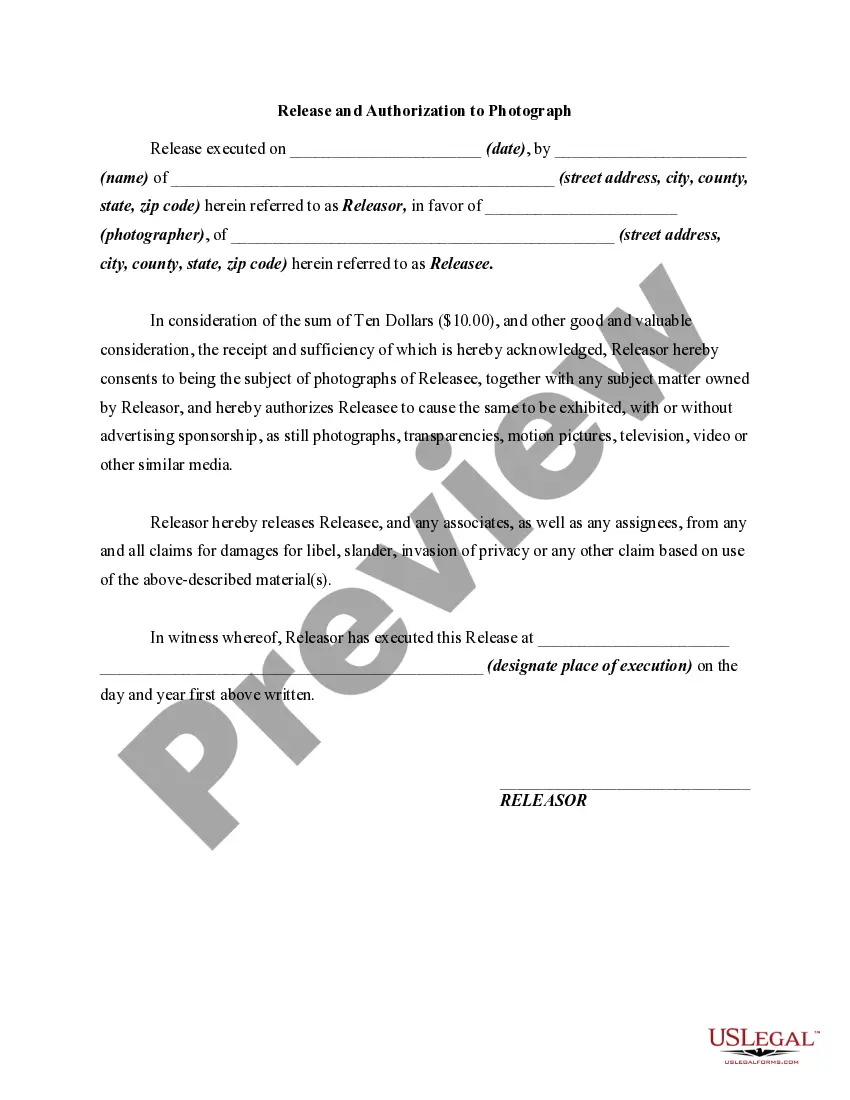

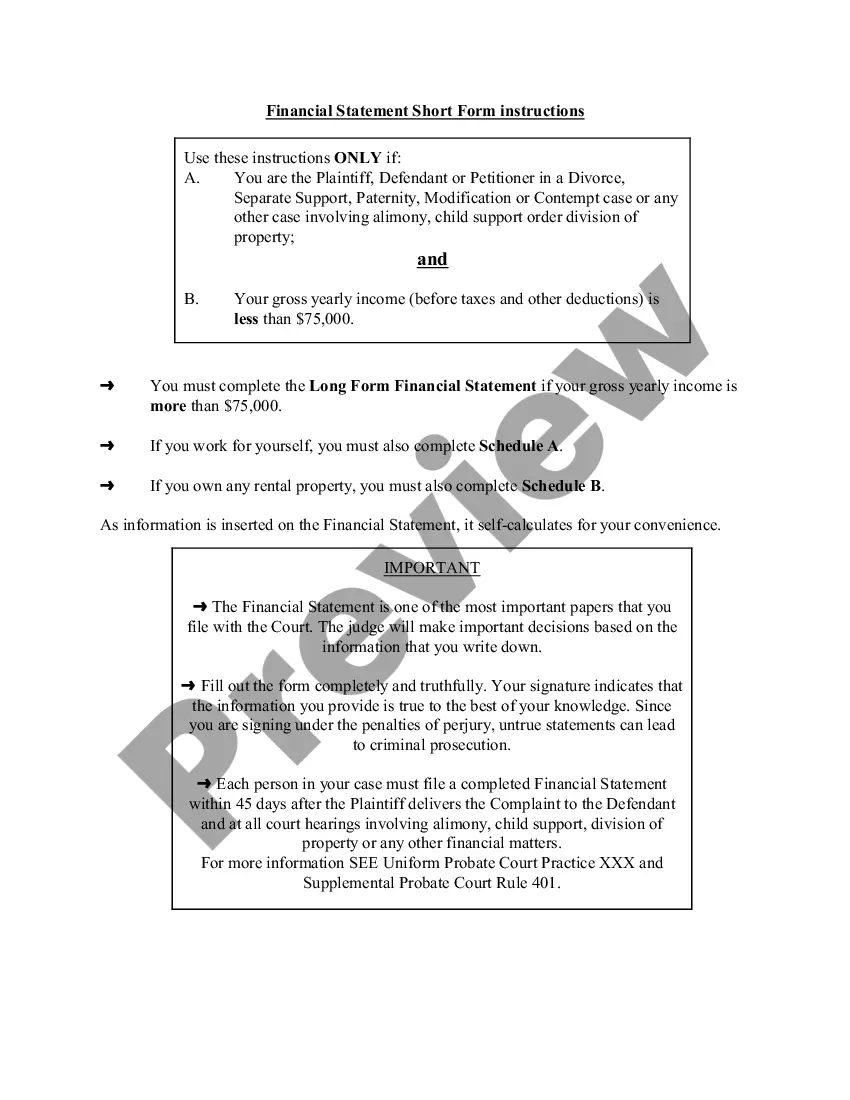

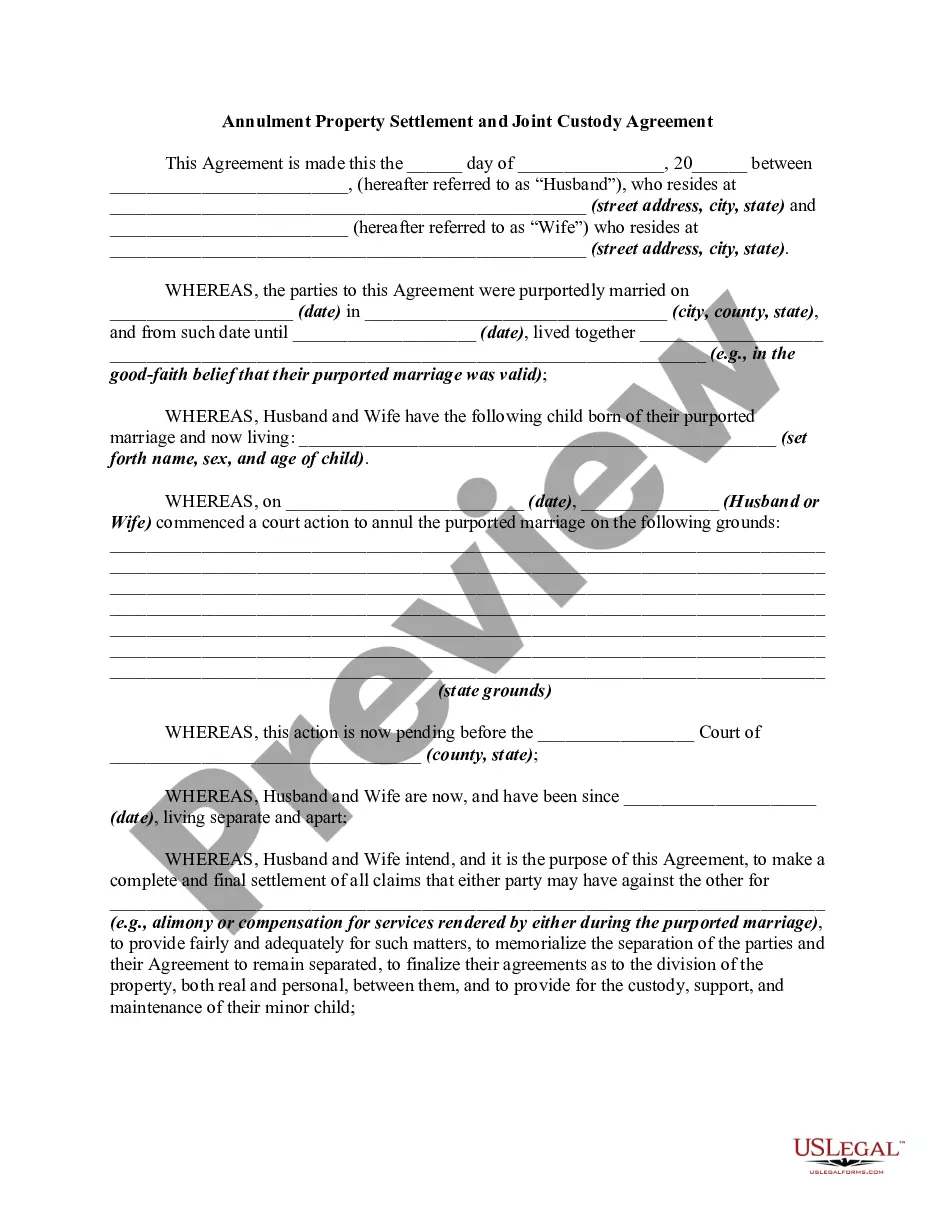

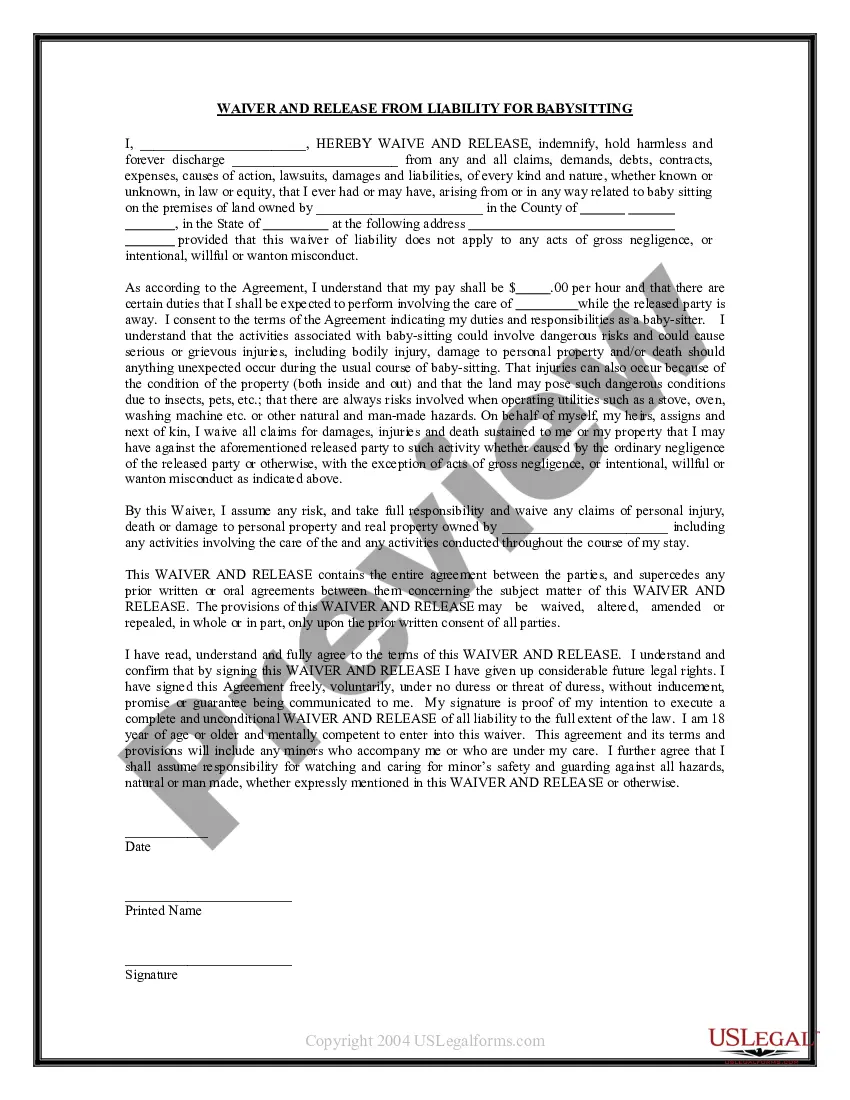

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative variations of the legal document template.

Form popularity

FAQ

Determining whether your parents should place their assets in an Alabama Revocable Living Trust for Real Estate depends on their financial situation and estate planning goals. Such a trust can simplify the transfer of real estate and help them avoid probate issues. However, it is crucial for them to consult with a legal expert to evaluate their specific needs and make an informed decision that ensures their wishes are honored.

While revocable living trusts have their advantages, they also come with disadvantages. For instance, they do not provide asset protection from creditors, which could be a concern for some. Additionally, any income generated by properties in the trust is still subject to taxation. It is vital to weigh these factors when considering an Alabama Revocable Living Trust for Real Estate.

A significant disadvantage of an Alabama Revocable Living Trust for Real Estate is the initial setup and maintenance costs. Establishing a trust involves legal fees and administrative tasks that might deter some individuals. Furthermore, transferring property into the trust requires careful paperwork. However, many find that the long-term benefits outweigh these initial investments.

Trust funds, including the Alabama Revocable Living Trust for Real Estate, can present certain risks. One main concern is the potential for mismanagement by trustees, which can lead to financial loss. Additionally, lack of clarity in terms can cause disputes among beneficiaries. It is essential to select a reliable trustee and ensure all terms are clearly documented to mitigate these dangers.

Using an Alabama Revocable Living Trust for Real Estate offers several advantages. It allows you to manage your property during your lifetime while maintaining flexibility to make changes as needed. Moreover, this trust can facilitate a smoother transfer of assets after your passing, avoiding the lengthy and costly probate process. Overall, it provides both control and peace of mind for your real estate investments.

To transfer your house into an Alabama Revocable Living Trust for Real Estate, start by drafting the trust document. After creating it, execute a new deed that conveys the property from your name to the trust’s name. Lastly, record the new deed with your county's probate court to solidify the transfer legally. For a straightforward process, uslegalforms provides templates and resources tailored for Alabama residents.

Filling out an Alabama Revocable Living Trust for Real Estate involves several key steps. Begin by gathering personal information, asset details, and desired beneficiaries. Once you have all necessary data, use clear language to define how each asset will be handled under the trust. Consider utilizing uslegalforms to access guided templates and ensure accuracy in your trust documentation.

Besides retirement accounts and life insurance policies, avoid putting any assets with specific tax implications in your Alabama Revocable Living Trust for Real Estate. These may include qualified plans or certain business interests. Each of these assets has unique provisions that could complicate the trust’s purpose. Carefully consider which items align with your estate planning goals.

Some assets should typically remain outside your Alabama Revocable Living Trust for Real Estate. For example, retirement accounts like 401(k)s and IRAs may have designated beneficiaries that override trust instructions. Also, life insurance policies should maintain their separate contracts. It’s essential to consult an attorney to ensure you manage asset allocation effectively.

When creating an Alabama Revocable Living Trust for Real Estate, consider including your home, rental properties, bank accounts, and investments. These assets benefit from the trust’s ability to bypass probate, ensuring a smoother transition to your heirs. Additionally, including vehicles and personal property can further enhance asset protection. Ultimately, evaluate each asset's importance to streamline your estate planning.