Alabama Revocable Living Trust for Minors

Description

How to fill out Revocable Living Trust For Minors?

If you require to complete, attain, or create approved document templates, utilize US Legal Forms, the largest compilation of legal forms accessible online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Alabama Revocable Living Trust for Minors in only a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you obtained in your account. Visit the My documents section and select a form to print or download again.

Complete and obtain, and print the Alabama Revocable Living Trust for Minors with US Legal Forms. There are many specialized and state-specific forms you can use for your business or personal requirements.

- If you are currently a US Legal Forms member, sign in to your account and click the Download button to obtain the Alabama Revocable Living Trust for Minors.

- You can also access forms you've previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

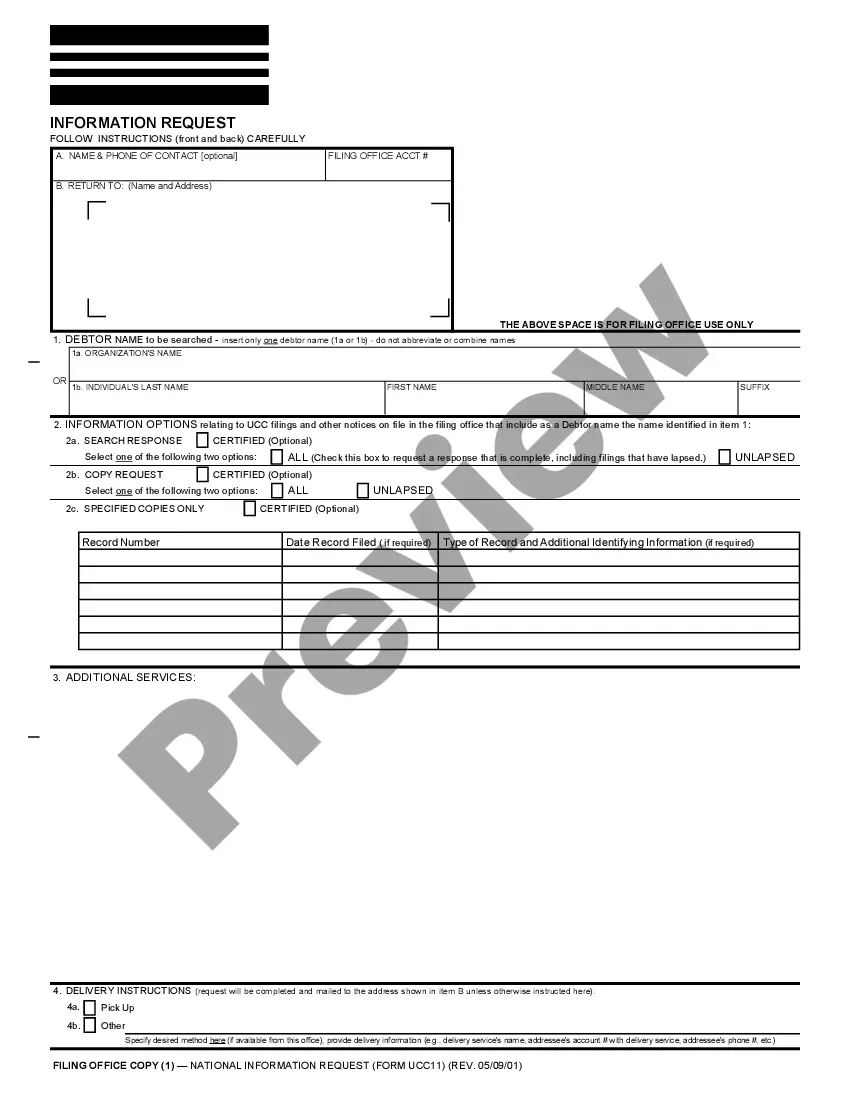

- Step 2. Use the Review option to examine the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it onto your system.

- Step 7. Complete, edit, and print or sign the Alabama Revocable Living Trust for Minors.

Form popularity

FAQ

Yes, an Alabama Revocable Living Trust for Minors can help you avoid probate. By placing your assets in this trust, you ensure a smoother and quicker transfer to your beneficiaries after your death. This bypasses the lengthy probate process, saving time and reducing stress for your family. As a result, your loved ones can access their inheritance without unnecessary delays.

Creating an Alabama Revocable Living Trust for Minors can be a wise decision. This trust allows you to manage your assets while ensuring that your minor children receive their inheritance without complications. It provides flexibility for making changes as your circumstances change. Additionally, it offers peace of mind, knowing that your children will be taken care of in the event of your passing.

While an Alabama Revocable Living Trust for Minors offers many benefits, there are some downsides to consider. Setting up the trust may require time and resources, and ongoing management can be complex. Additionally, a revocable living trust does not cover all aspects of estate planning, such as avoiding probate for certain assets. It is important to weigh these factors and consult a professional if needed.

An Alabama Revocable Living Trust for Minors is often the best choice for managing assets for your children. This type of trust allows for flexible management and protection of assets until your children reach a specified age. It also ensures that their inheritance is distributed according to your wishes. Using tools like USLegalForms can help you tailor the trust to specifically meet your children's needs.

Trusts in Alabama, including the Alabama Revocable Living Trust for Minors, must adhere to state-specific regulations. Generally, the person creating the trust must be of legal age and sound mind. Additionally, the trust must have a defined purpose and designated beneficiaries. Familiarizing yourself with these rules can help you create a compliant trust that meets your family's needs, and resources like USLegalForms can be a helpful starting point.

A minor trust is a specific category of trust tailored to benefit underage individuals, like an Alabama Revocable Living Trust for Minors. This trust type allows you to allocate funds for education, health, and other essential needs without relinquishing control. By setting up this trust, you can provide a structured financial safety net for your child, ensuring their well-being both now and in the future. Determine your objectives clearly to optimize the trust's benefits.

Trust accounts for minors, such as an Alabama Revocable Living Trust for Minors, are financial tools designed to manage assets for children. These accounts allow you to hold and safeguard funds until your child reaches adulthood. Establishing a trust ensures that your child receives the financial support they need, along with guidance on how to manage their inheritance responsibly. This proactive approach promotes financial literacy and security.

When considering an Alabama Revocable Living Trust for Minors, it is essential to think about your specific goals. A revocable trust allows you to maintain control over your assets while planning for your child's future. This option can provide flexibility, as you can modify its terms whenever necessary. Consulting with a legal expert can ensure you select the best trust type for your family.

Opening a trust account for a minor involves selecting a financial institution that offers trust accounts. You will need to provide the minor's identification and the trust documents. Having an Alabama Revocable Living Trust for Minors makes this process smoother, as it clearly outlines asset management and allows for effective oversight.

The best trust for minors often depends on your specific circumstances. An Alabama Revocable Living Trust for Minors offers flexibility and the ability to change terms as needs evolve. However, understanding your goals and consulting with a financial advisor can help you choose the right trust for your child's future.