Alabama Sample Letter for Agreement to Compromise Debt

Description

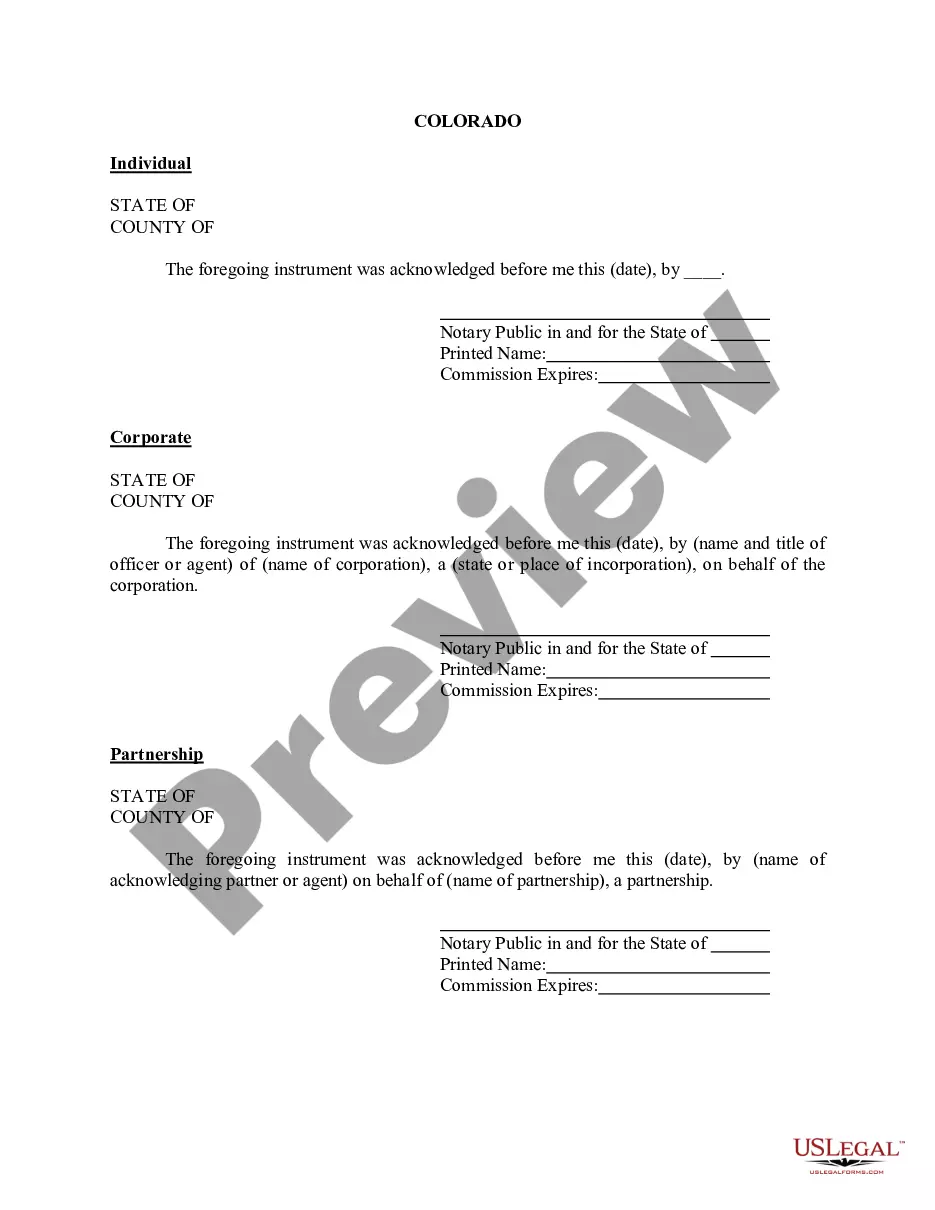

How to fill out Sample Letter For Agreement To Compromise Debt?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad variety of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the latest versions of forms such as the Alabama Sample Letter for Agreement to Compromise Debt in just minutes.

If you have a subscription, Log In and obtain the Alabama Sample Letter for Agreement to Compromise Debt from the US Legal Forms catalog. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Choose the format and download the form to your device.

Make edits. Complete, modify, and print the downloaded Alabama Sample Letter for Agreement to Compromise Debt.

- Verify that you have selected the appropriate form for your city/state. Click the Review button to examine the form's details.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you want and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

To write a good settlement offer, start by clearly stating your intention to settle the debt. Include specific details about the debt, such as the amount owed and your proposed payment terms. It's helpful to refer to an 'Alabama Sample Letter for Agreement to Compromise Debt,' as this provides a framework to structure your offer. Ensuring clarity and professionalism in your letter can significantly enhance your chances of reaching a favorable agreement.

The 777 rule for debt collectors serves as a guideline for managing communications and ensuring you have rights as a debtor. After a collector's persistent contact over seven days, you can request verification of the debt or finalize an agreement to settle it. This promotes accountability and transparency in debt collection practices. Utilize an Alabama Sample Letter for Agreement to Compromise Debt to formally engage in negotiations and clarify your terms.

The 11-word phrase you can use to halt debt collectors is, 'I do not wish to communicate with you any further.' This clear statement effectively communicates your desire to cease all contact. It's crucial to document such communications for your records. Remember, sending an Alabama Sample Letter for Agreement to Compromise Debt can further strengthen your position in negotiations.

The 777 rule refers to a strategy to manage interactions with debt collectors. It suggests that after seven days of attempting to collect a debt, a collector must stop contacting you unless they provide verification of the debt. Knowing this rule can empower consumers when dealing with aggressive collection practices. Using an Alabama Sample Letter for Agreement to Compromise Debt can help formalize your response to collectors.

Sending a debt validation letter is typically a wise decision for anyone facing debt collection. It allows you to confirm the legitimacy of the debt and your rights in the situation. Moreover, using an Alabama Sample Letter for Agreement to Compromise Debt can enhance your approach, helping you negotiate effectively with creditors and potentially resolving issues amicably.

An example of debt validation occurs when a debtor receives a letter from a collector, asking for proof that the debt is legitimate. This could include documents like the original signed agreement or account statements showing payment history. If you need help crafting a request, an Alabama Sample Letter for Agreement to Compromise Debt can serve as an effective template to streamline the process.

Filling out a debt validation letter involves several key steps. First, write down your personal information and the date. Then, formally address the letter to the debt collector and mention the specific debt in question. Finally, request documentation that proves the validity of the debt, and consider using an Alabama Sample Letter for Agreement to Compromise Debt for guidance on formatting and content.

To fill out a debt validation letter, start by including your name and address at the top. Next, clearly state that you are requesting validation of the debt, including the debt collector's name and the account in question. You should also express your right under the Fair Debt Collection Practices Act to dispute the debt. Using a well-structured Alabama Sample Letter for Agreement to Compromise Debt can help ensure you include all necessary information.

When writing a letter requesting proof of debt, start by including your account details and any previous communications regarding the debt. Clearly state the purpose of your request and the specific information you seek. It’s important to keep the tone professional and courteous. Using the Alabama Sample Letter for Agreement to Compromise Debt can provide you with a solid starting point for your letter.

To ask for verification of debt, write a formal letter requesting that the creditor provide proof of the debt's validity. Be clear about the specifics, including the amount and the original creditor's name. Mention your rights under the Fair Debt Collection Practices Act. You can refer to the Alabama Sample Letter for Agreement to Compromise Debt for an example of how to format your request.