Alabama Sample Letter regarding Completion of Corporate Annual Report

Description

How to fill out Sample Letter Regarding Completion Of Corporate Annual Report?

Are you in a situation where you frequently need to have documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of template forms, such as the Alabama Sample Letter regarding Completion of Corporate Annual Report, which are designed to meet federal and state requirements.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Alabama Sample Letter regarding Completion of Corporate Annual Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

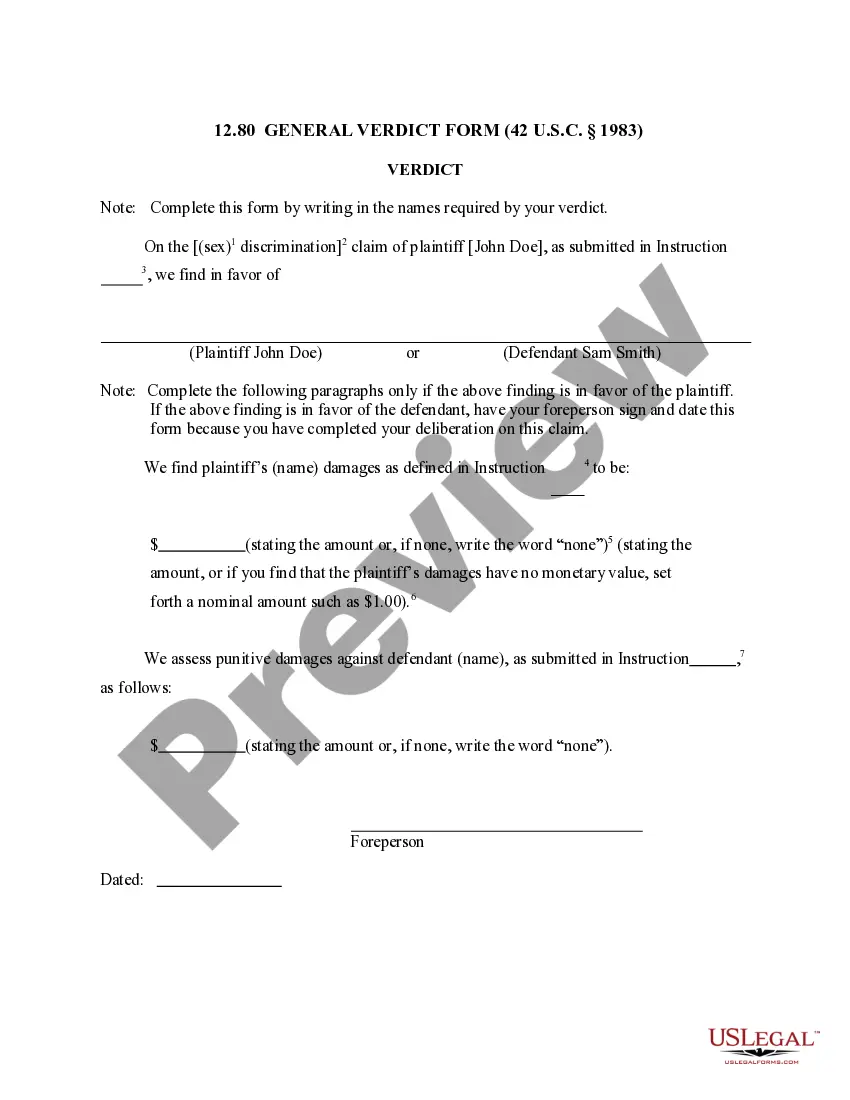

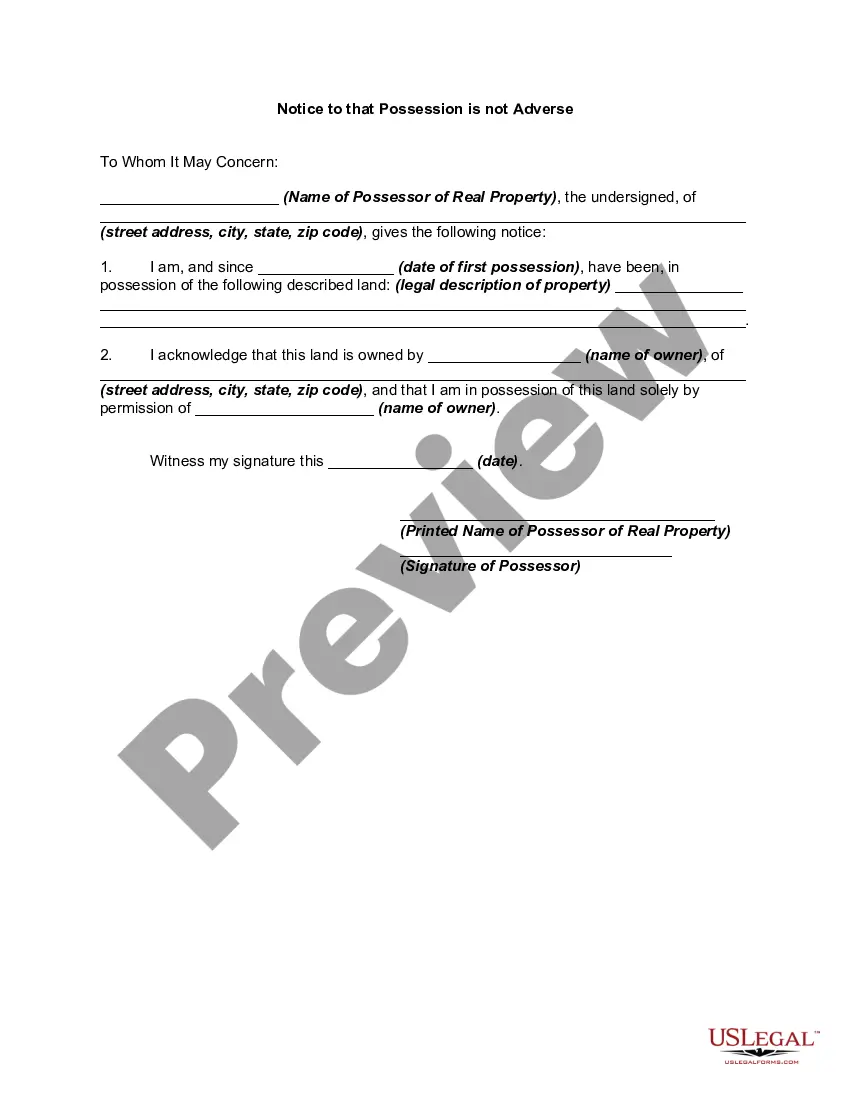

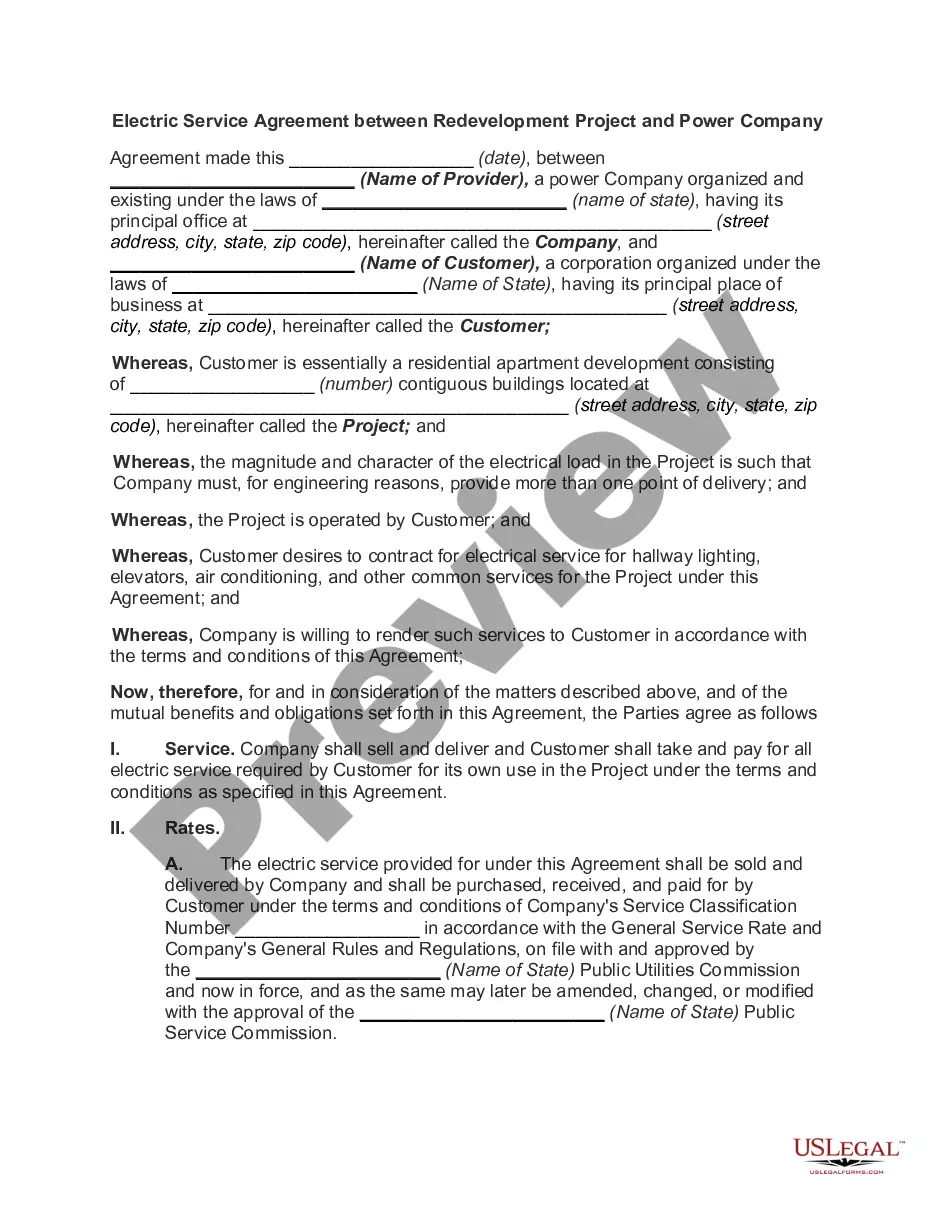

- Utilize the Review button to examine the document.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you have obtained the correct form, click on Buy now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and purchase the order with your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Alabama Sample Letter regarding Completion of Corporate Annual Report at any time, if needed. Just click the desired form to download or print the document template.

- Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Key Things to Know About Annual Reports Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state.

Who Prepares the Annual Report? Companies may have their own in-house writing and design team, or they may choose to hire an outside firm to prepare their report. Teams usually include accounting, writing, and graphic design professionals.

Annual reports are required filings to maintain a business entity's good standing with the secretary of state. With a few exceptions, annual reports are not complex. They generally contain basic information about a company such as its principal address, registered agent, and officers and directors.

Alabama requires LLCs to file a Business Privilege Tax Return and Annual Report with the Department of Revenue on or before three and one-half months after the beginning of the LLC's taxable year. Taxes. For complete details on state taxes for Alabama LLCs, visit Business Owner's Toolkit or the State of Alabama .

You must include an income report, a balance sheet, and a cash flow statement, as well as a written summary of any big financial changes. Accountant Perspective: In some cases, you may also be asked to include an auditor's report.

Annual Reports are filed with the Alabama Secretary of State - Business Services Division. To view your entity registration and confirm your due date, use the corporation filing authority's business search feature and search for your entity.

An annual report filing is a process of updating your company records with Alabama state authorities on a yearly basis. Business entities such as corporations, LLCs, and partnerships must submit an annual report in every state that they are registered to do business.

Alabama Annual Business Report Filing Only corporations, LLPs, and LLCs are required to file annual reports in Alabama, but all entities operating a business in the state must pay Alabama Business Privilege Tax in order to stay compliant with the state's regulations.