Alabama Demand Bond

Description

How to fill out Demand Bond?

If you need to gather, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly search tool to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Alabama Demand Bond in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Alabama Demand Bond with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Alabama Demand Bond.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/state.

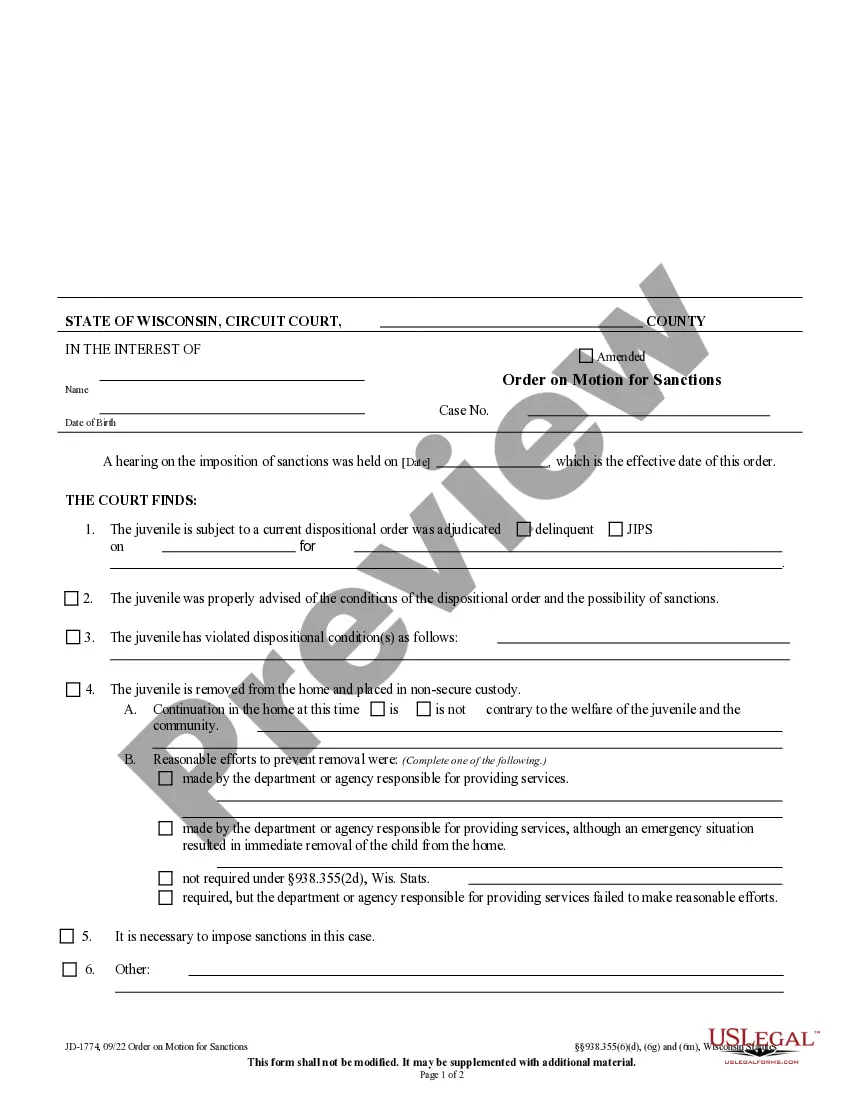

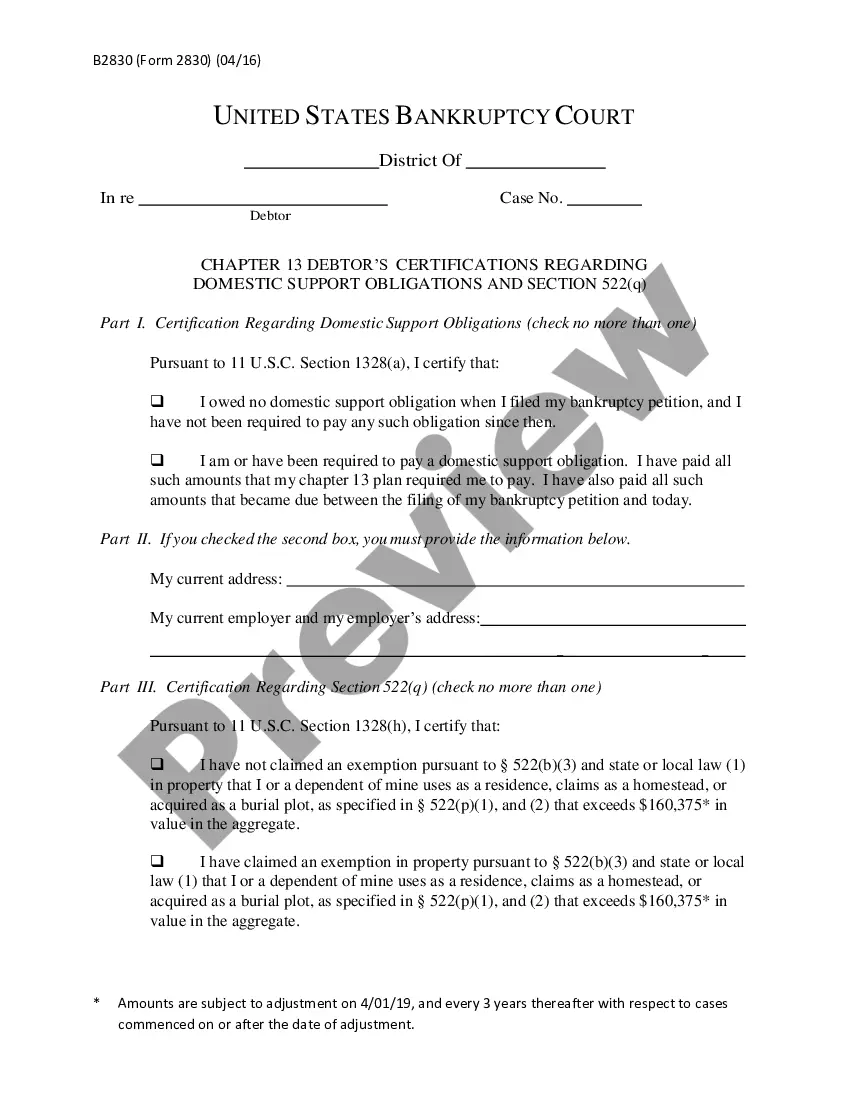

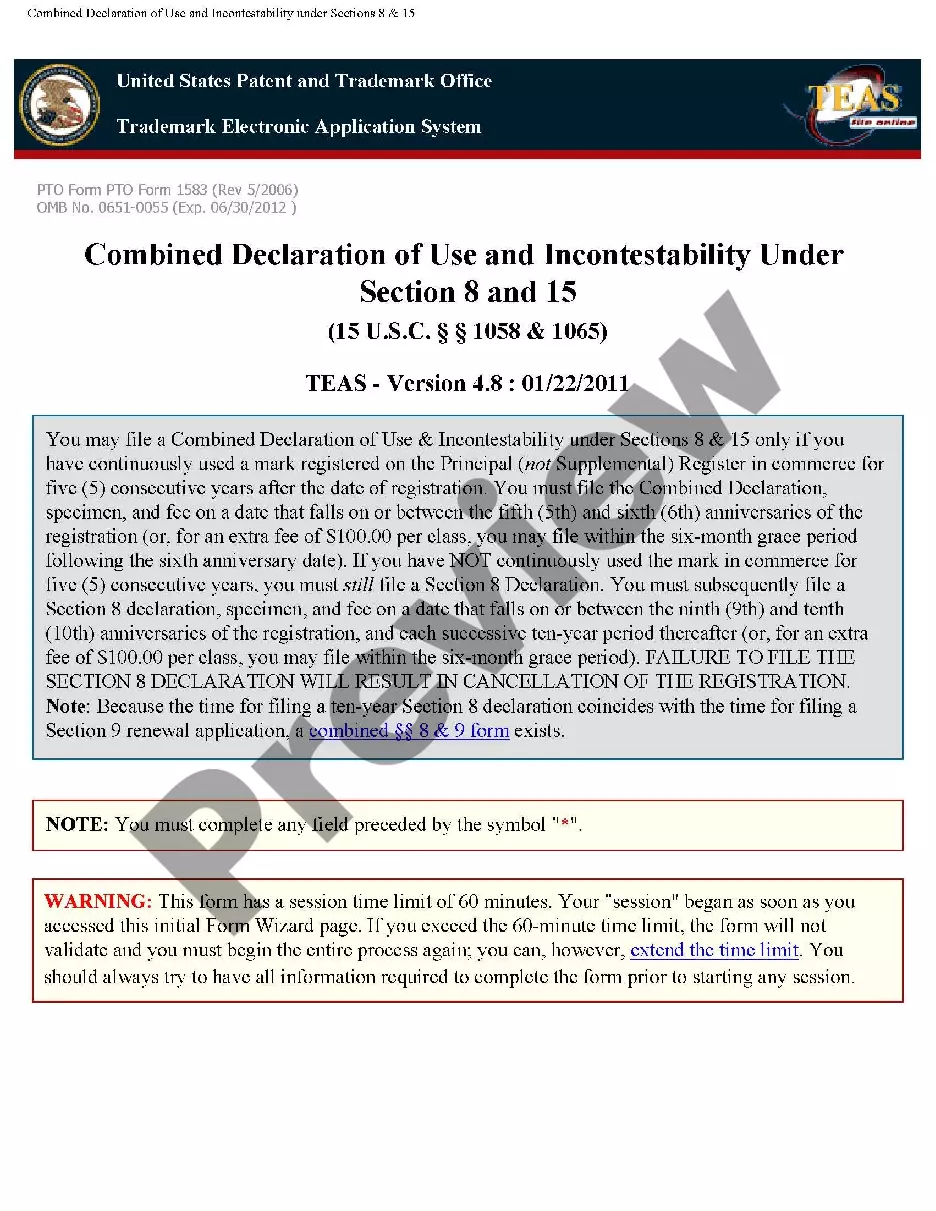

- Step 2. Utilize the Review feature to inspect the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, take advantage of the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Demand Bond.

Form popularity

FAQ

The difficulty of obtaining an Alabama Demand Bond largely depends on your individual circumstances and the specific bond type. While some applicants may face challenges due to credit issues or insufficient financial documentation, many find the process manageable. Utilizing resources like US Legal Forms can provide you with the necessary information and tools to enhance your chances of obtaining the bond you need.

To secure an Alabama Demand Bond, most surety companies typically look for a credit score of at least 650. However, some companies may offer bonds to individuals with lower scores, albeit at a higher premium. It’s essential to understand that your financial profile will influence the terms of your bond, so reviewing your credit history can be beneficial before applying.

Getting an Alabama Demand Bond can vary in difficulty depending on several factors, such as your financial history and the type of bond required. Generally, the process is straightforward, especially if you qualify for a standard bond. By using the US Legal Forms platform, you can easily find the necessary forms and guidance to streamline your application process, making it more manageable.

Residential Roofer Bond Bond NameCoverage AmountCost (Annual Premium)Bail Agent Bond$10,000 / $25,000$250*Contractor License BondVariesVaries*Motor Vehicle Dealer Bond$25,000$250Residential Roofer Bond$10,000$1001 more row

The bond is a prerequisite for obtaining a bonded title that will enable you to register, sell, donate, or otherwise transfer ownership of the vehicle to another party.

Provide a Bill of Sale Alabama doesn't require a bill of sale when you sell a vehicle privately. However, some counties do require this document. If the vehicle is without a proper title, you will need a bill of sale to transfer it to the new owner. Some counties will provide a form on their government website.

Title Bonds are a type of surety bond required in the state of Alabama for vehicle owners with lost, damaged, or stolen titles. The bond is issued for a 3 year term and allows the applicant to claim ownership and register the vehicle.

How much does an Alabama contractor license bond cost? Alabama contractor license bond costs start at $75 annually. Your exact cost will vary depending on the license type you need and its required bond amount. Most city and county contractor license bonds cost $100 annually.

Without a valid title, a vehicle cannot be registered, insured, or sold. A bonded title allows a vehicle owner to do all of those things. The bond securing a bonded title indemnifies DHSMV if it turns out that no bonded title should have been issued and provides a way to compensate the rightful owner or a lienholder.

You must purchase this type of bond in order to obtain a bonded title from the Motor Vehicle Division of the Alabama Department of Revenue. A bonded title will allow you to register, insure, or sell the vehicle.