Alabama Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal document templates available for download or printing.

By using the site, you can find thousands of forms for both business and personal use, organized by categories, states, or keywords. You can access the most recent versions of documents such as the Alabama Affidavit of Lost Promissory Note within moments.

If you already possess a membership, Log In to download the Alabama Affidavit of Lost Promissory Note from the US Legal Forms collection. The Download button will appear on every form you view.

When you are content with your selection, confirm your choice by pressing the Purchase now button.

Then, choose the pricing plan you prefer and provide your information to register for an account.

- You can access all previously acquired documents in the My documents section of your account.

- If this is your first time using US Legal Forms, here are straightforward instructions to get you started.

- Make sure you have selected the right form for your region/state.

- Click on the Review button to examine the form’s contents.

- Check the description of the form to confirm that you've selected the correct one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

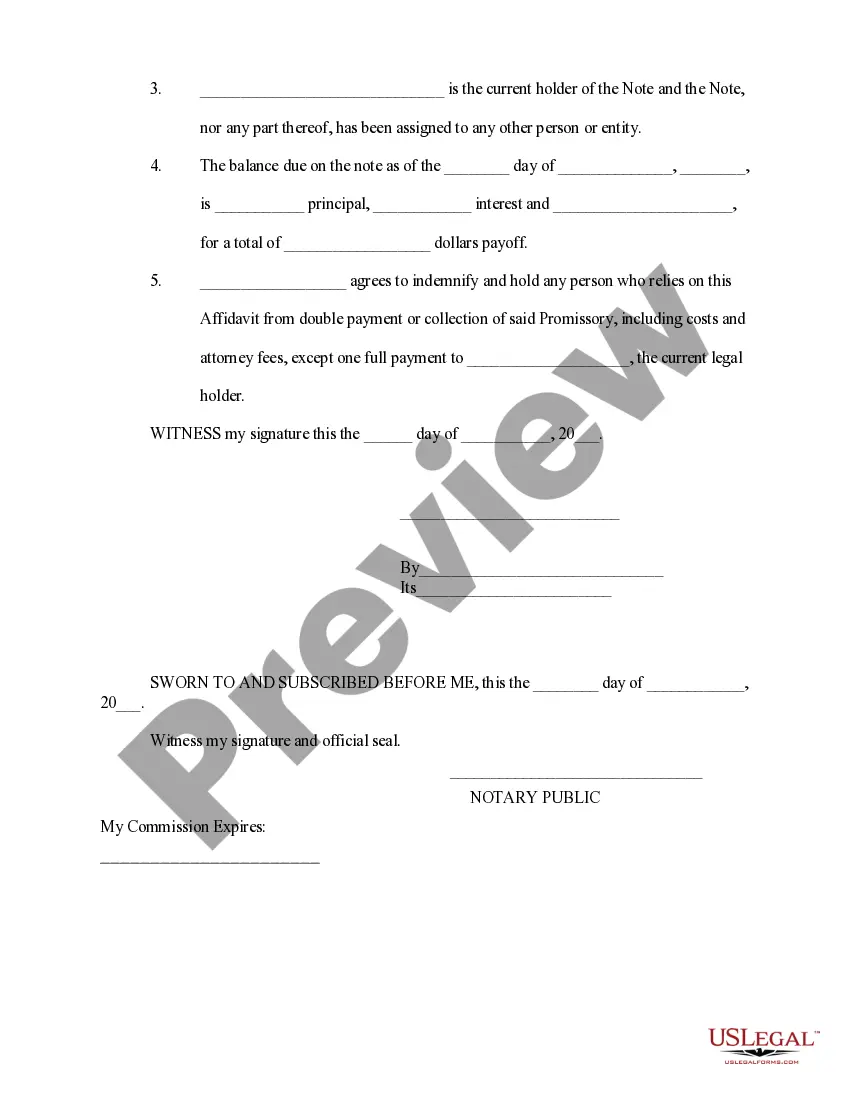

A lost note affidavit is a sworn statement made by the lender that it has lost the original note. The affidavit also contains factual representations from the lender about the status of the note and the loan.

When a borrower pays off a mortgage, the note holder gives the note to the borrower. This means that the home is theirs, free and clear. If a borrower refinances a mortgage, the new mortgage pays off the original lender and a new note is created, to be held by that lender until the new mortgage is paid in full.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Unlike a deed of trust or mortgage, the promissory note is typically not recorded in the county land records (except in a few states like Florida). Instead, the lender holds on to this document until the amount borrowed is repaid.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.