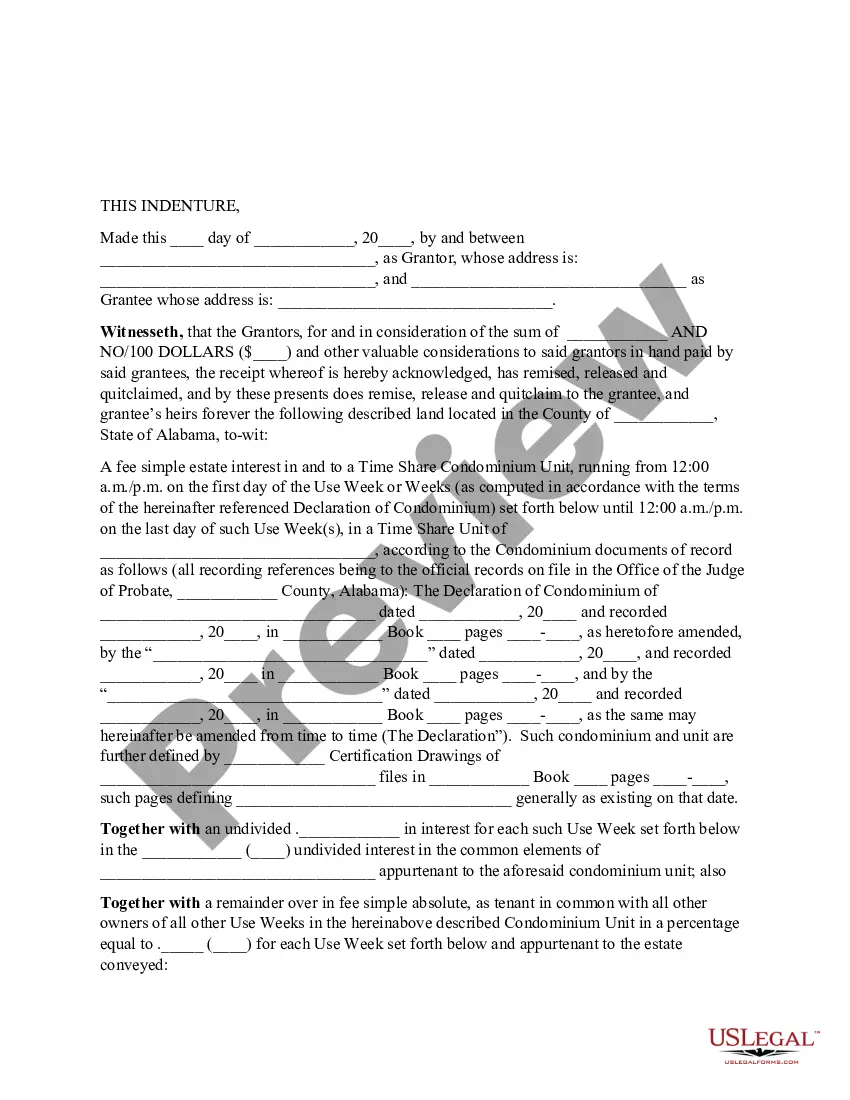

Alabama Indenture

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Indenture?

Employing Alabama Indenture templates crafted by skilled lawyers helps you to evade troubles when completing paperwork.

Simply download the template from our site, fill it out, and seek legal advice to review it.

This can save you significantly more time and energy than having an attorney create a document entirely from scratch for you.

Utilize the Preview feature to view the description (if available) to determine if you need this specific example, and if you do, simply click Buy Now.

- If you already possess a US Legal Forms subscription, just Log In to your account and return to the form webpage.

- Locate the Download button close to the templates you are examining.

- Once you download a template, all of your saved samples will be visible in the My documents section.

- If you don't have a subscription, that's not an issue.

- Just adhere to the steps outlined below to register for an account online, obtain, and fill out your Alabama Indenture template.

- Verify that you’re downloading the correct state-specific form.

Form popularity

FAQ

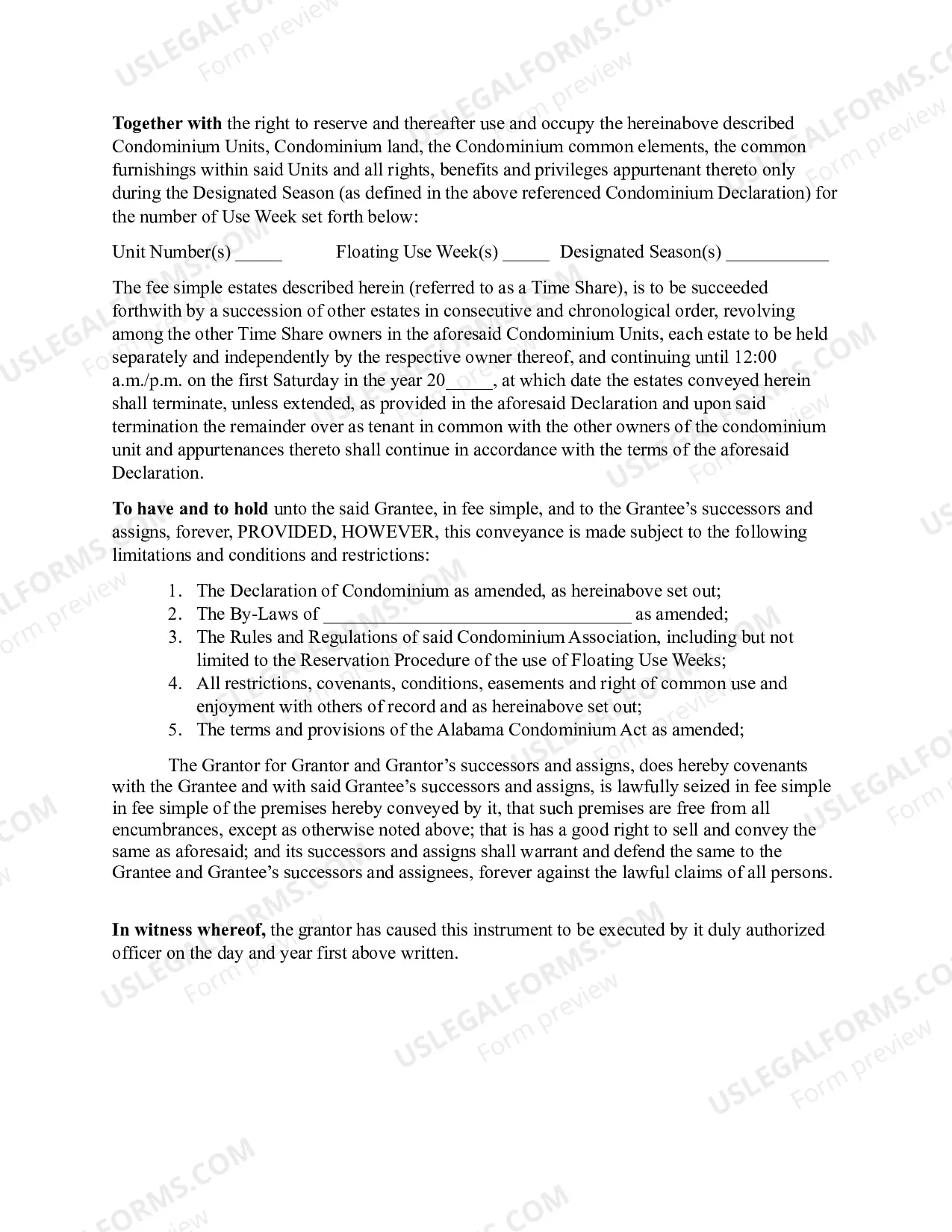

Typically, a trust indenture is prepared by an attorney experienced in estate planning or an estate professional. They ensure that the document is compliant with state laws, including those specific to Alabama. If you prefer a straightforward solution, US Legal Forms provides various templates and resources to help you draft a suitable Alabama Indenture without needing extensive legal expertise.

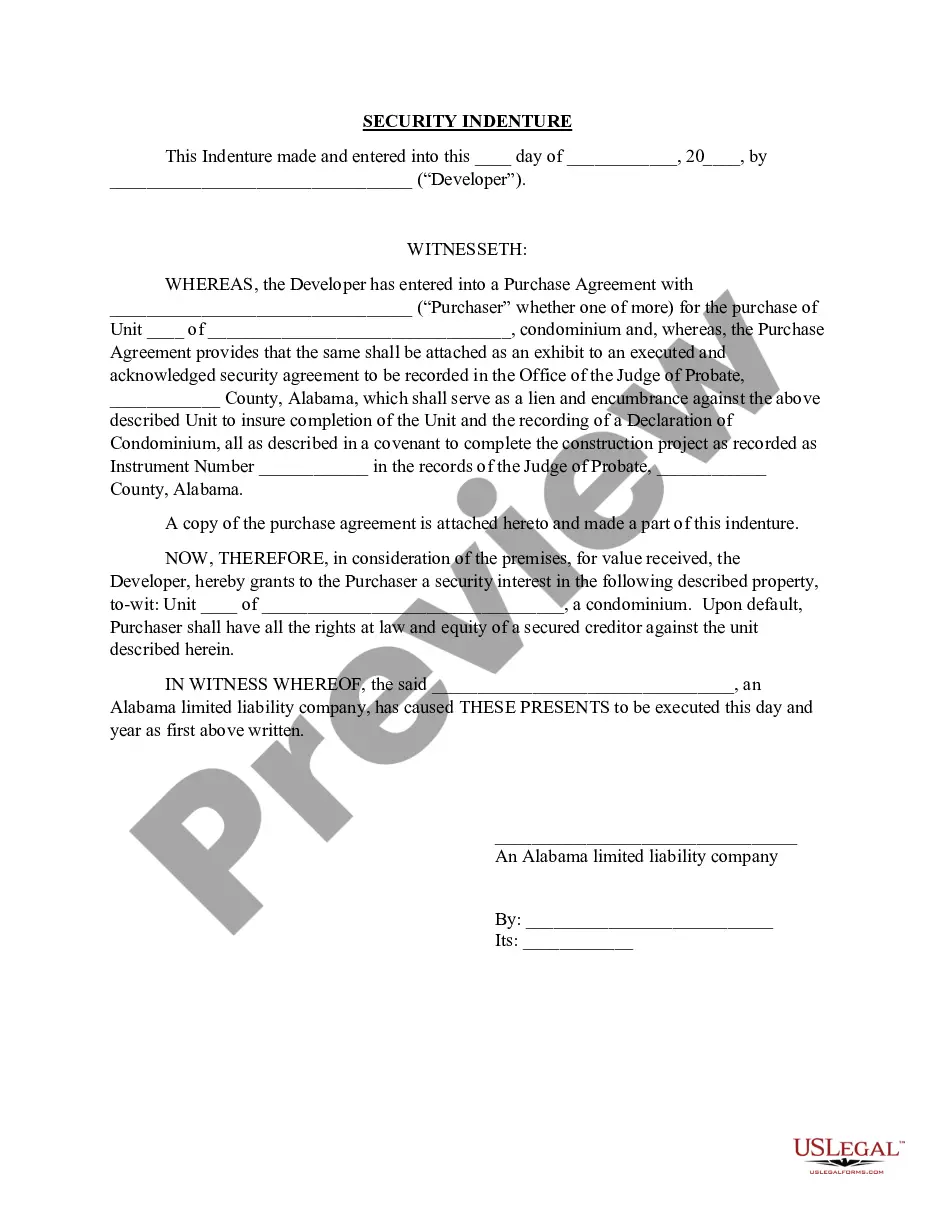

An example of an indenture might be a bond indenture that details the arrangement between a bond issuer and bondholders. This document specifies interest payments, maturity dates, and assurances about repaying the principal. Such indentures are crucial to guarantee that investors know their rights and can anticipate their returns. Using US Legal Forms can help you craft an Alabama Indenture suited to your needs.

An indenture agreement typically includes the obligations of the borrower, the rights of the lenders, and specifications on fiscal management. Important components include details about payment schedules, interest rates, and default provisions. Additionally, it may outline covenants that the borrower must adhere to during the life of the agreement. Utilizing templates from US Legal Forms can simplify creating an effective Alabama Indenture.

Creating a valid trust indenture requires essential elements such as the identification of parties, description of trust property, and the duties of the trustee. You need to ensure that the document is signed by the relevant parties and may need a witness or notarization to enforce it legally. Compliance with state laws in Alabama is crucial, so refer to US Legal Forms to ensure your Alabama Indenture meets all legal requirements.

Writing a trust indenture involves a clear outline of the terms and conditions agreed upon by the parties involved. You'll need to define the role of the trustee and the rights of the beneficiaries. Start by including key components like the purpose of the trust, assets involved, and distribution methods. For a reliable template, consider using services like US Legal Forms for guidance on Alabama Indenture.

To establish Alabama residency, you must physically reside in the state and demonstrate intentions to make it your permanent home. This usually involves obtaining a driver's license, registering to vote, and possibly filing state income taxes. If you are considering financial planning involving the Alabama Indenture, establishing residency can also aid in implementing effective estate strategies tailored to Alabama law.

A trustee and an indenture trustee fulfill different roles in managing trust assets. A trustee is an individual or entity that holds and manages trust assets on behalf of the beneficiaries. An indenture trustee, particularly in the context of Alabama Indentures, often oversees bonds and other debt securities, ensuring compliance with the indenture's terms while protecting the interests of bondholders.

No, a trust indenture and a trust agreement are not synonymous. While both documents serve to outline the management of assets, a trust indenture typically involves formal agreements among multiple parties, often used in corporate settings. In contrast, a trust agreement pertains more to personal estate planning, focusing on how assets are handled in relation to the Alabama Indenture.

The trust agreement is typically prepared by a qualified attorney or a legal expert specializing in estate planning. In Alabama, it is essential to ensure that the document aligns with state laws surrounding Alabama Indentures. By using reputable online platforms like US Legal Forms, individuals can access templates and guidance to help create a robust trust agreement that meets their specific needs.

An Alabama Business Privilege Tax (al-ppt) must be filed by entities that derive income from doing business in Alabama. This includes corporations and limited liability companies, regardless of their taxable income levels. If your operations relate to an Alabama indenture, ensure you meet this filing requirement to avoid penalties.