Alabama Full Satisfaction of Recorded Lien

Overview of this form

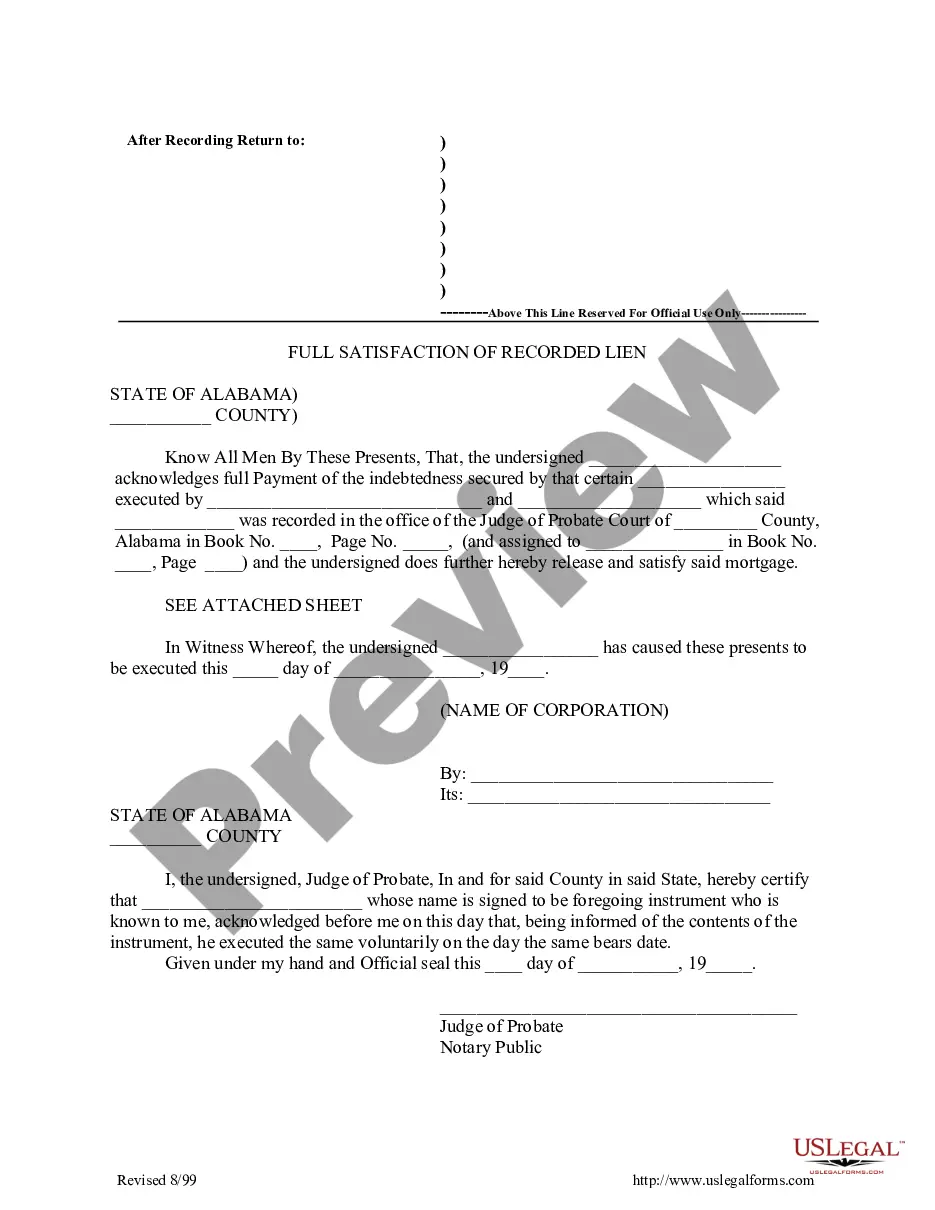

The Full Satisfaction of Recorded Lien form is a legal document that signifies the complete payment of a debt secured by a lien, officially recorded in land records. This form serves to notify all concerned parties that the lien has been satisfied, distinguishing it from other forms like a lien release or discharge, which may not clearly indicate full payment has been made. Proper execution of this form ensures that the lien is formally cleared from public records, benefiting both the lienholder and the property owner.

Main sections of this form

- Identification of the lienholder and the debtor.

- Details of the original lien, including book and page numbers where recorded.

- A clear statement acknowledging full payment of the debt.

- Signature lines for notarization and verification.

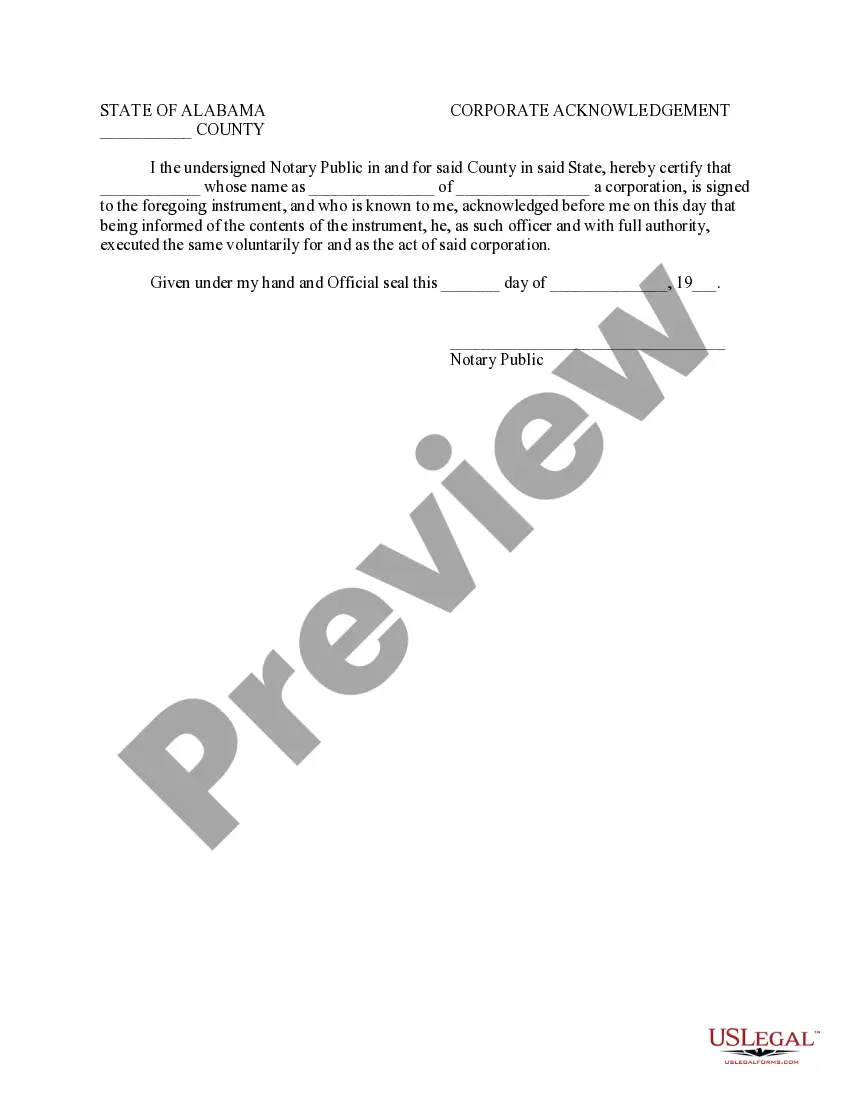

- State-specific certification sections acknowledging the authority of the signatories.

When to use this document

This form is commonly used when a property owner has fully paid off a mortgage or other lien on their property. It is essential to file this form after final payments have been made to ensure that the lien is officially removed from the property records, providing assurance to future buyers and lenders that the property is free of that lien.

Who needs this form

- Property owners who have settled a debt secured by a lien.

- Lenders who want to provide official confirmation that the lien has been satisfied.

- Real estate professionals involved in the sale or refinancing of properties.

- Attorneys helping clients with property transactions.

Instructions for completing this form

- Identify all parties involved: the lienholder and the debtor.

- Fill in the details of the original lien, such as the book and page number of the recording.

- State that the full payment has been made and acknowledge the release of the lien.

- Have the authorized representative sign the form in the designated sections.

- Ensure the document is notarized to validate the signatures.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to properly fill out the recording information for the lien.

- Not obtaining the necessary notarization before recording the form.

- Using incorrect names or details that do not match the original lien documents.

- Not providing sufficient information about the debt, leading to confusion about the satisfaction.

Why use this form online

- Convenience of accessing and downloading the form at any time.

- Editability that allows you to enter your specific details easily.

- Reliability of using templates prepared by licensed attorneys.

- Streamlined process reduces the need for additional legal consultation, saving time and money.

Looking for another form?

Form popularity

FAQ

Yes, a lien release serves as proof of ownership, indicating that any claims against the property have been resolved. Once you secure your Alabama Full Satisfaction of Recorded Lien, you gain clear title to your property, which is essential when transferring ownership or securing loans. This documentation is vital for your financial and legal standing.

Requesting a lien release letter involves reaching out to the lienholder, typically by phone or in writing. Provide all necessary details, including your account information and proof of payment. Ensure you articulate that you seek an Alabama Full Satisfaction of Recorded Lien to expedite the process.

In Alabama, you can obtain a lien release by first ensuring that you have fulfilled all financial obligations related to the lien. You'll need to request the release from the entity that filed it. Proper documentation confirming your Alabama Full Satisfaction of Recorded Lien is crucial, and tools like US Legal Forms can help simplify the process.

To obtain a lien release statement, contact the entity that filed the lien, typically a lender or governmental agency. After settling your obligations, you should receive a formal document confirming the lien's discharge. For a seamless experience, consider using US Legal Forms to efficiently manage the paperwork related to your Alabama Full Satisfaction of Recorded Lien.

In Alabama, the timeframe to file a lien typically depends on the underlying debt. Generally, you have one year from the date the debt becomes due to initiate the process. However, to avoid complications later on, it's advisable to file the lien promptly and, if needed, follow up on the Alabama Full Satisfaction of Recorded Lien once the debt is settled.

Buying a lien car can be risky, as outstanding liens usually carry financial obligations, making the transaction complicated. Before purchasing, confirm any existing liens and ensure they are either released or manageable to attain ownership. Understanding the implications of liens is vital, especially regarding the Alabama Full Satisfaction of Recorded Lien.

To release a lien in Alabama, you must file a release document with the appropriate county's probate court or land records office. This document should detail the debtor's information and affirm that the debt has been settled. For an efficient process, consider using the US Legal Forms platform to obtain the necessary templates for the Alabama Full Satisfaction of Recorded Lien.

Full satisfaction and discharge of a tax lien indicates that the tax obligation has been completely fulfilled, and the lien is no longer enforceable. This process confirms that the debt is resolved, legally freeing up the asset associated with the lien. It's essential to obtain documentation for the Alabama Full Satisfaction of Recorded Lien to ensure that your records accurately reflect this status.

Recording a satisfaction of a mortgage involves submitting the signed satisfaction form to your county's recorder’s office. Make sure to include necessary fees and verify that all information on the form is correct. Once recorded, this document serves as proof of the Alabama Full Satisfaction of Recorded Lien, ensuring that all parties are aware of the mortgage discharge.

To release a lien in Alabama, you must file a satisfaction of lien document with the appropriate county recorder's office. Ensure that the document is signed by the lienholder and all related information is accurate. This filing updates the public record, confirming the release of the lien. Using USLegalForms can simplify the preparation of your satisfaction documents for a smoother process.