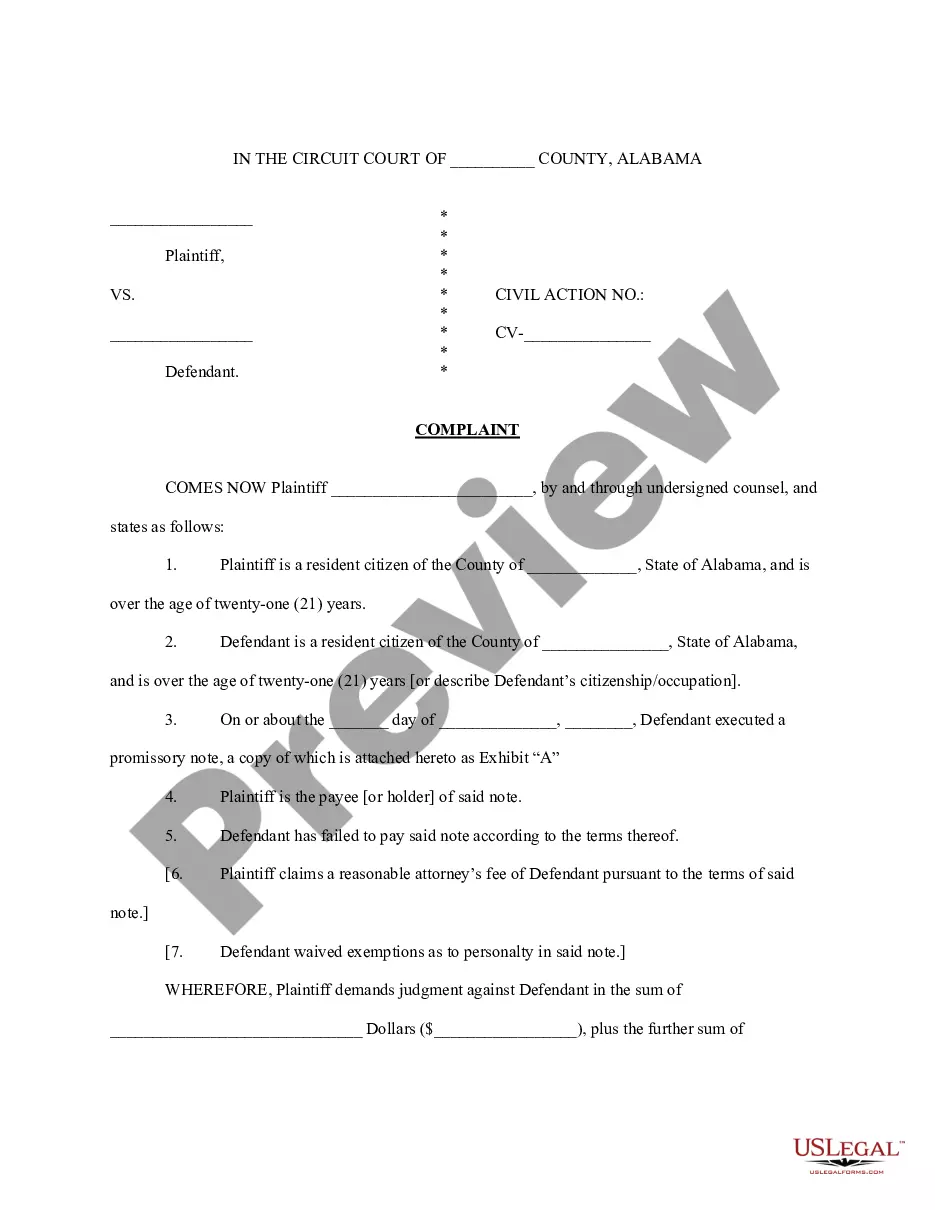

Alabama sample complaint filed in Circuit Court to Collect on a Promissory Notice.

Alabama Complaint to Collect on a Promissory Note

Description

How to fill out Alabama Complaint To Collect On A Promissory Note?

Utilizing Alabama Complaint to Collect on a Promissory Note templates crafted by skilled attorneys provides you the chance to avert frustrations when preparing paperwork.

Just download the document from our site, complete it, and ask a lawyer to review it.

By doing this, you can conserve significantly more time and expenses than attempting to find a legal expert to create a file from scratch for you.

Minimize the time spent on document creation with US Legal Forms!

- If you already possess a US Legal Forms subscription, just Log In to your account and return to the sample page.

- Locate the Download button adjacent to the templates you are examining.

- After downloading a template, you will find all your saved documents in the My documents tab.

- If you don’t have a subscription, it's not a major issue.

- Just follow the step-by-step instructions below to register for your account online, obtain, and fill out your Alabama Complaint to Collect on a Promissory Note template.

- Verify and ensure you’re acquiring the correct state-specific document.

Form popularity

FAQ

Yes, you can dispute a promissory note. Common reasons for a dispute may include claims of fraud, ambiguity in terms, or lack of consideration. If you find yourself in this situation, you might consider seeking legal advice to navigate your options. Resolving disputes often involves filing an Alabama Complaint to Collect on a Promissory Note, ensuring your concerns are addressed properly.

Breaching a promissory note can lead to serious consequences. If a borrower fails to meet the repayment terms, the lender can file an Alabama Complaint to Collect on a Promissory Note in court. This action may result in a judgment against the borrower, which could lead to wage garnishment or liens on property. Understanding your rights in this scenario is essential for both lenders and borrowers.

To legally enforce a promissory note, follow a few key steps. First, ensure you have a written, signed document outlining the terms of repayment. If a borrower defaults, you may file an Alabama Complaint to Collect on a Promissory Note, seeking recovery through the courts. Always consider consulting a legal professional to navigate this process effectively.

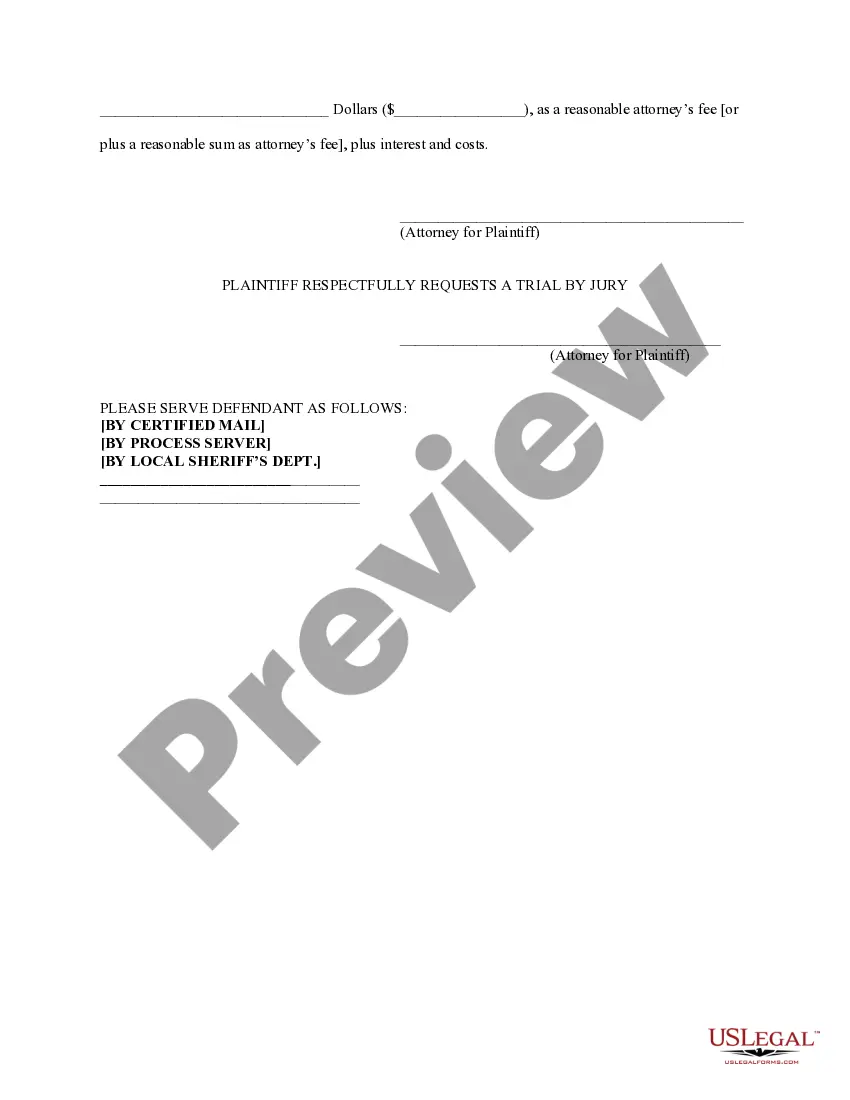

A draft for a complaint should include several essential components. Start with the title, heading, and parties involved. Detail the factual background and the basis of your claim regarding the Alabama Complaint to Collect on a Promissory Note. Don't forget to conclude with a prayer for relief, outlining what you are asking the court to grant.

To collect on a judgment in Alabama, you need to follow specific legal procedures. Begin by obtaining a judgment in your favor, then pursue collection methods such as wage garnishment, bank levies, or property liens. It's important to follow the rules of civil procedure to ensure compliance. Using resources from US Legal Forms can guide you through the process efficiently.

To draft a legal complaint, organize your thoughts clearly. Start with identifying the parties and establishing jurisdiction, then lay out the facts of your case concerning the Alabama Complaint to Collect on a Promissory Note. Articulate the legal basis for your claims and the specific relief you are requesting. Remember to proofread your document carefully before submission.

Formatting a complaint is crucial for clarity and professionalism. Begin with the title at the top, followed by the court name and case number. Use headings for each section, such as 'Parties,' 'Jurisdiction,' and 'Allegations.' Maintain consistent font and spacing throughout the document. You may find helpful templates on platforms like US Legal Forms.

Drafting a complaint for court involves carefully outlining your case. Start by identifying the parties involved and providing a statement of facts regarding your Alabama Complaint to Collect on a Promissory Note. Specify the legal grounds for your claim and what remedy you seek. Ensure that you sign and date the complaint before filing.

To write a letter of complaint to court regarding your Alabama Complaint to Collect on a Promissory Note, start with your contact information at the top. Follow with the court's address, a subject line, and a formal greeting. Clearly state the reason for your complaint, include relevant details, and provide any supporting documents. Close with your signature and a request for a response.

In Alabama, the statute of limitations for a promissory note is generally six years. This means you must file your Alabama Complaint to Collect on a Promissory Note within that timeframe from the date of default. It's essential to act promptly, as waiting too long may prevent you from recovering the debt. Consulting with legal resources, such as US Legal Forms, can help you navigate this timeline effectively.