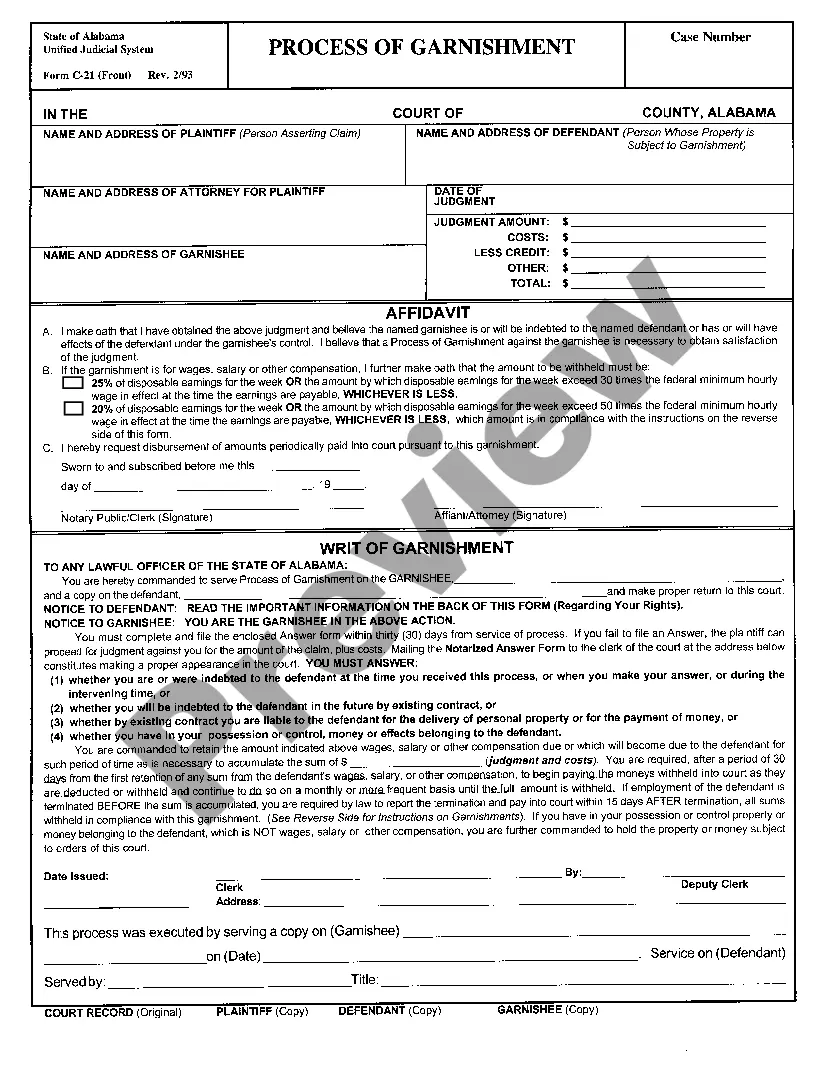

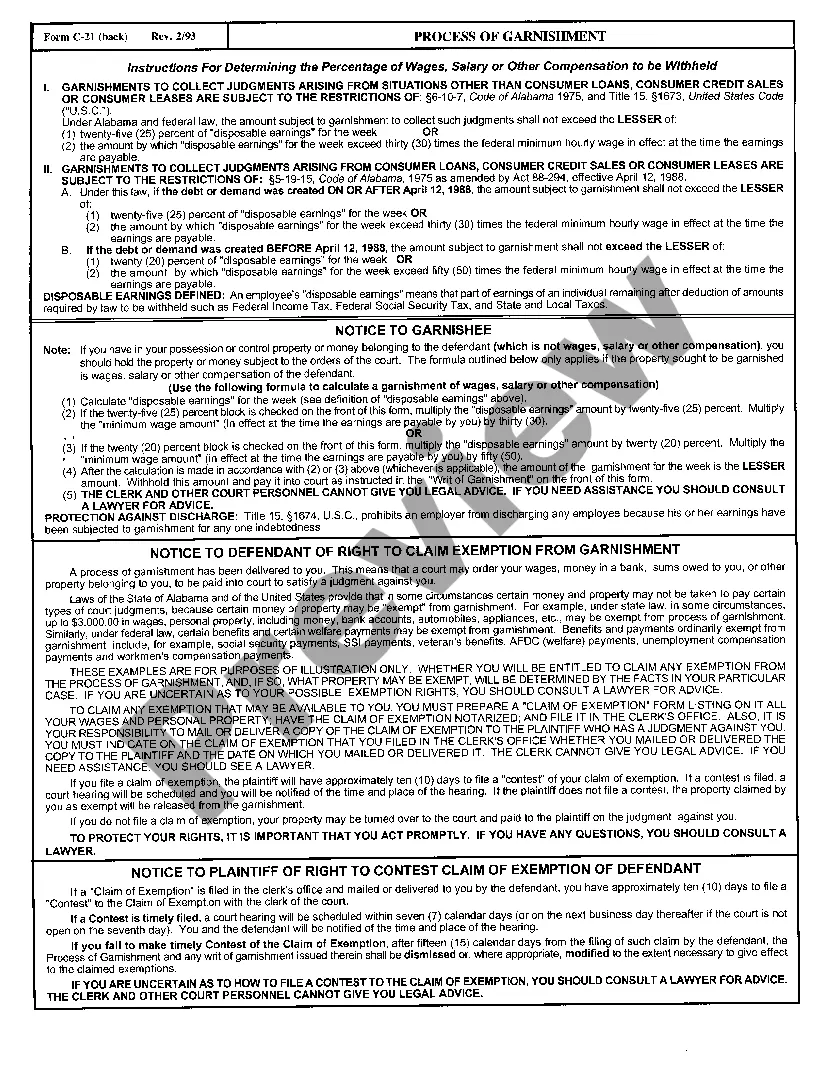

Alabama Official Form - Process of Garnishment to be served on garnishee.

Alabama Process of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Process Of Garnishment?

Utilizing Alabama Process of Garnishment templates crafted by skilled attorneys helps you avoid complications when filling out paperwork. Simply download the sample from our site, complete it, and have a legal expert review it. This approach will spare you significantly more time and expenses than having an attorney create a document from the ground up for you.

If you possess a US Legal Forms subscription, simply Log In to your account and return to the form section. Locate the Download button beside the templates you are examining. After you download a document, you will find your saved templates in the My documents tab.

If you lack a subscription, no worries. Just adhere to the step-by-step instructions below to register for your account online, acquire, and fill out your Alabama Process of Garnishment template.

After you’ve completed all of these steps, you will be able to fill out, print, and sign the Alabama Process of Garnishment template. Make sure to verify all entered information for accuracy before submitting it or sending it out. Minimize the time you spend on documentation with US Legal Forms!

- Double-check that you’re downloading the appropriate state-specific form.

- Utilize the Preview feature and read the description (if available) to determine if you need this particular sample and if you do, click Buy Now.

- Search for another template using the Search field if necessary.

- Choose a subscription that fits your needs.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

In the Alabama Process of Garnishment, the formula generally involves calculating the debtor’s disposable income and determining the allowable amount to be withheld. Disposable income refers to the earnings left after mandatory deductions, such as taxes and social security. According to federal guidelines, creditors can garnish only a specified percentage of a debtor's disposable income, ensuring that individuals retain enough funds for essential living expenses. By understanding this formula, you can navigate the garnishment process more effectively, and our platform at US Legal Forms provides resources that can assist you in managing the legal aspects involved.

Yes, you can stop a garnishment once it begins in Alabama by filing a request with the court. There are several legal grounds you can use to request the stop, such as claiming your income is exempt or identifying procedural errors. The Alabama process of garnishment allows for this recourse, so you should consider acting quickly and explore options available through platforms like US Legal Forms for guidance.

The rules for garnishments in Alabama require that creditors first obtain a court judgment. You must receive a notice of garnishment, which includes information about how much will be taken and your rights. It’s vital to understand these rules as the Alabama process of garnishment aims to ensure that both creditors and debtors follow the necessary protocols. Being well-informed can save you stress during this time.

In Alabama, once a default judgment has been entered against you, creditors can begin garnishing your wages almost immediately. Typically, they must follow the proper procedures and notify you of the garnishment. Therefore, it is essential to respond to legal notices timely during the Alabama process of garnishment to avoid complications. Staying proactive can ensure better control over your finances.

You can stop a garnishment in Alabama quickly by filing a motion in court, depending on the situation. If you have a valid reason, such as exempt income or an error in the garnishment process, the court can act promptly. Engaging with the Alabama process of garnishment swiftly can make a significant difference in your financial situation. For assistance, consider the resources provided by US Legal Forms to navigate this efficiently.

In Alabama, the maximum amount that can be garnished from your wages is 25% of your disposable earnings. Alternatively, if your disposable income is less than 30 times the federal minimum wage, no garnishment can take place. Knowing this limit is crucial when facing the Alabama process of garnishment and helps you budget your finances accordingly. Stay informed to protect your earnings.

In Alabama, the process of garnishment involves specific legal steps. Creditors must obtain a judgment against you before they can garnish your wages or bank account. It's important to notify the court if you believe the garnishment is incorrect, as Alabama law protects certain income types, such as Social Security benefits, from being garnished. Understanding the Alabama process of garnishment helps you know your rights and responsibilities.

Writing a hardship letter for wage garnishment involves clearly explaining your financial difficulties and reasons for requesting relief. Start with your personal information and state the garnishment details, followed by a description of your situation. Emphasizing how the garnishment negatively affects your finances can lead to a reconsideration, making this step in the Alabama Process of Garnishment crucial for your case.

To fill out a wage garnishment exemption form, begin by identifying your financial circumstances that may qualify you for an exemption. Include all necessary details such as income, household expenses, and any dependents. Showing a clear picture of your financial hardship is essential, and resources like UsLegalForms can guide you through this specific Alabama Process of Garnishment aspect.

Garnishing someone's wages in Alabama requires a court order, typically obtained through a civil suit or a collection process. First, file a lawsuit if you haven't done so and, upon winning, request a garnishment order. This legal mechanism allows you to collect debts effectively through the Alabama Process of Garnishment, ensuring you follow all local regulations.