Alabama Official Form - Alabama Foreign Registered Limited Liability Partnership.

Alabama Foreign Registered Limited Liability Partnership

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Foreign Registered Limited Liability Partnership?

Utilizing Alabama Foreign Registered Limited Liability Partnership templates designed by expert lawyers allows you to sidestep issues while finalizing paperwork.

Simply download the template from our site, complete it, and have an attorney verify it.

This approach will save you significantly more time and effort than having a lawyer draft a document from the beginning tailored to your requirements.

Minimize your document preparation time with US Legal Forms!

- If you possess a US Legal Forms subscription, just sign in to your profile and revisit the sample page.

- Locate the Download button beside the templates you are examining.

- After downloading a file, you will find all your saved samples in the My documents section.

- If you lack a subscription, that’s not an issue.

- Simply adhere to the instructions below to register for your online account, obtain, and complete your Alabama Foreign Registered Limited Liability Partnership template.

- Double-check to ensure you are acquiring the correct state-specific document.

Form popularity

FAQ

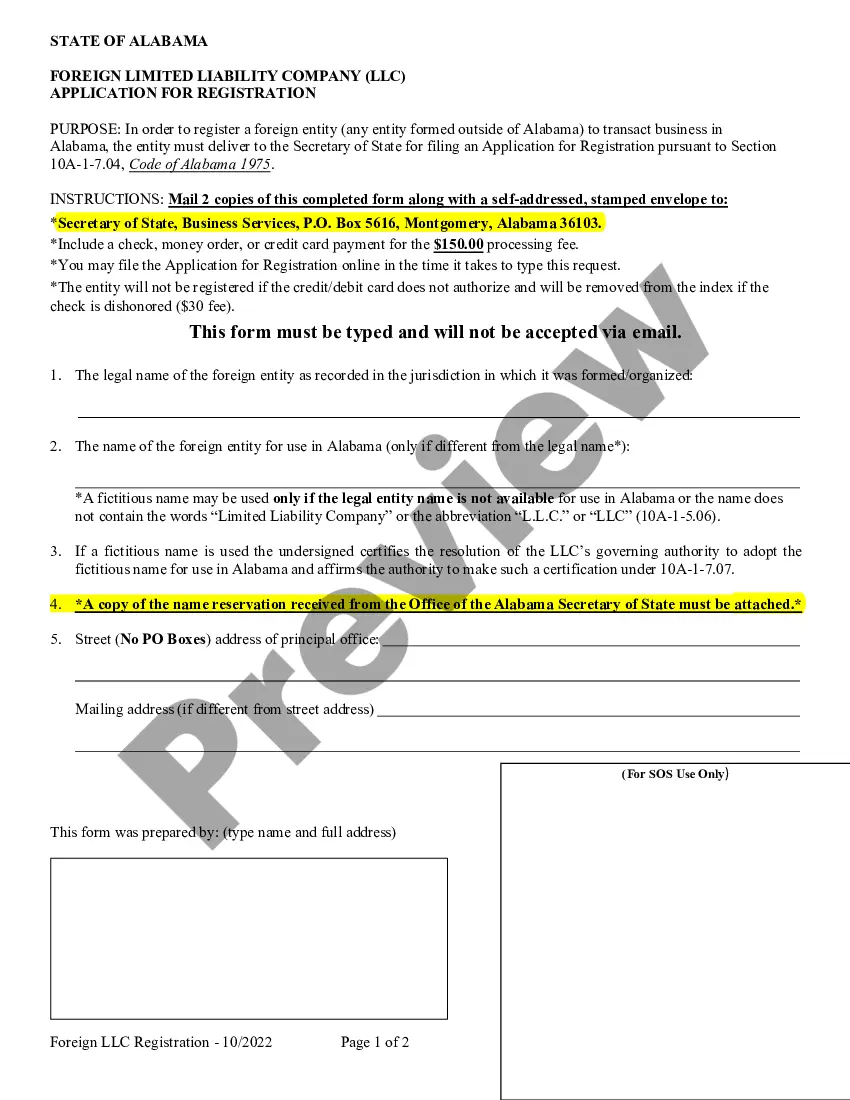

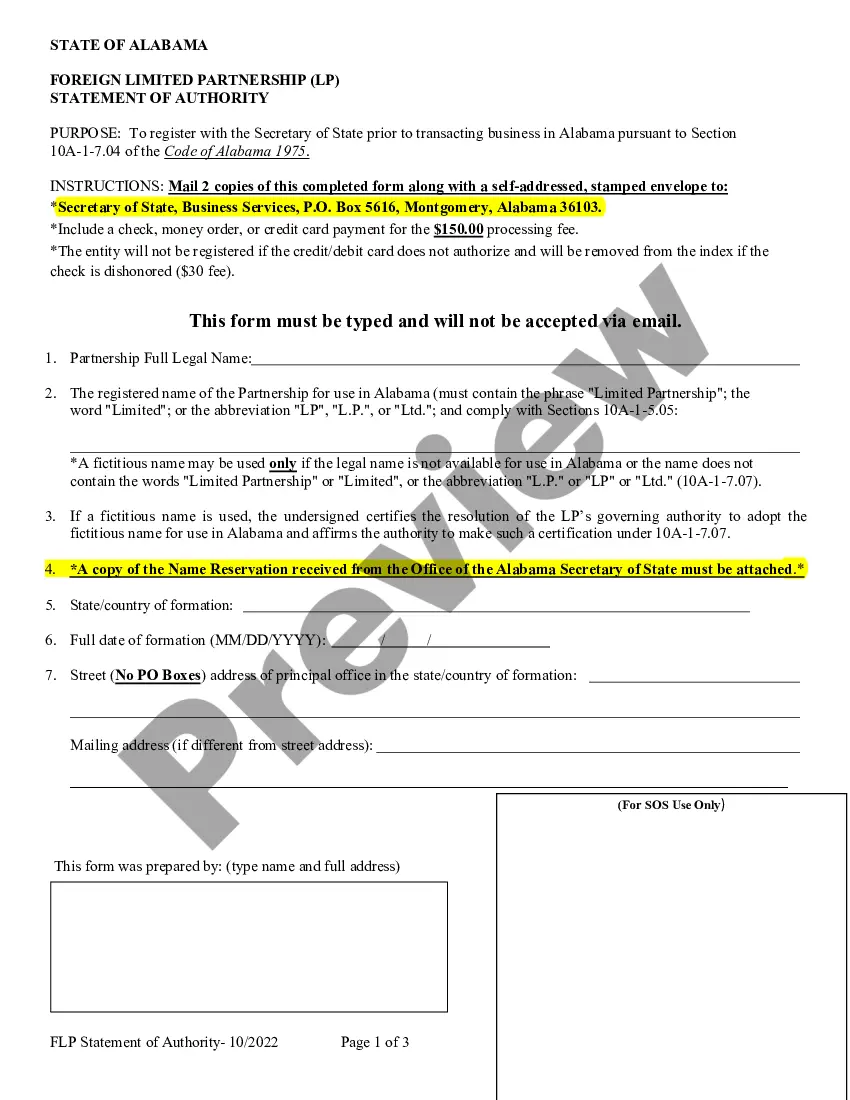

Limited liability partnerships (LLPs) are legal entities recognized in all states, including Alabama. Each state may have different regulations governing the formation and operation of LLPs. Therefore, if you plan to form an Alabama Foreign Registered Limited Liability Partnership, ensure you understand Alabama's specific requirements. Consulting resources like uslegalforms can guide you through this process.

Yes, if your LLC was formed in another state and you intend to do business in Alabama, you must register as a foreign LLC. This registration ensures that you comply with all local laws and regulations. It is essential to file the necessary paperwork with the state of Alabama to operate legally. Tools from uslegalforms can assist you in navigating the registration process effortlessly.

The decision between a domestic or foreign LLC depends on where you plan to operate your business. If you are primarily conducting business in Alabama, a domestic LLC may be more straightforward. Conversely, if your company operates in multiple states, you may need to consider registering as an Alabama Foreign Registered Limited Liability Partnership. Evaluating your business needs with experts can help you determine the best option.

Establishing a foreign LLC can provide various benefits, including liability protection and flexibility in business management. By registering your LLC as an Alabama Foreign Registered Limited Liability Partnership, you can enjoy the same protections and advantages that your home state offers. Additionally, foreign LLCs can access new markets, customers, and opportunities, enhancing your overall business growth. Utilizing services like uslegalforms can simplify this process for you.

A foreign limited liability company (LLC) is an LLC that is formed in one state but conducts business in another state, such as Alabama. When you form a limited liability company in a different state and then expand to Alabama, it must be registered as a foreign LLC. This registration allows you to legally operate in Alabama while maintaining your original business structure. Understanding the requirements for an Alabama Foreign Registered Limited Liability Partnership is crucial for compliance.

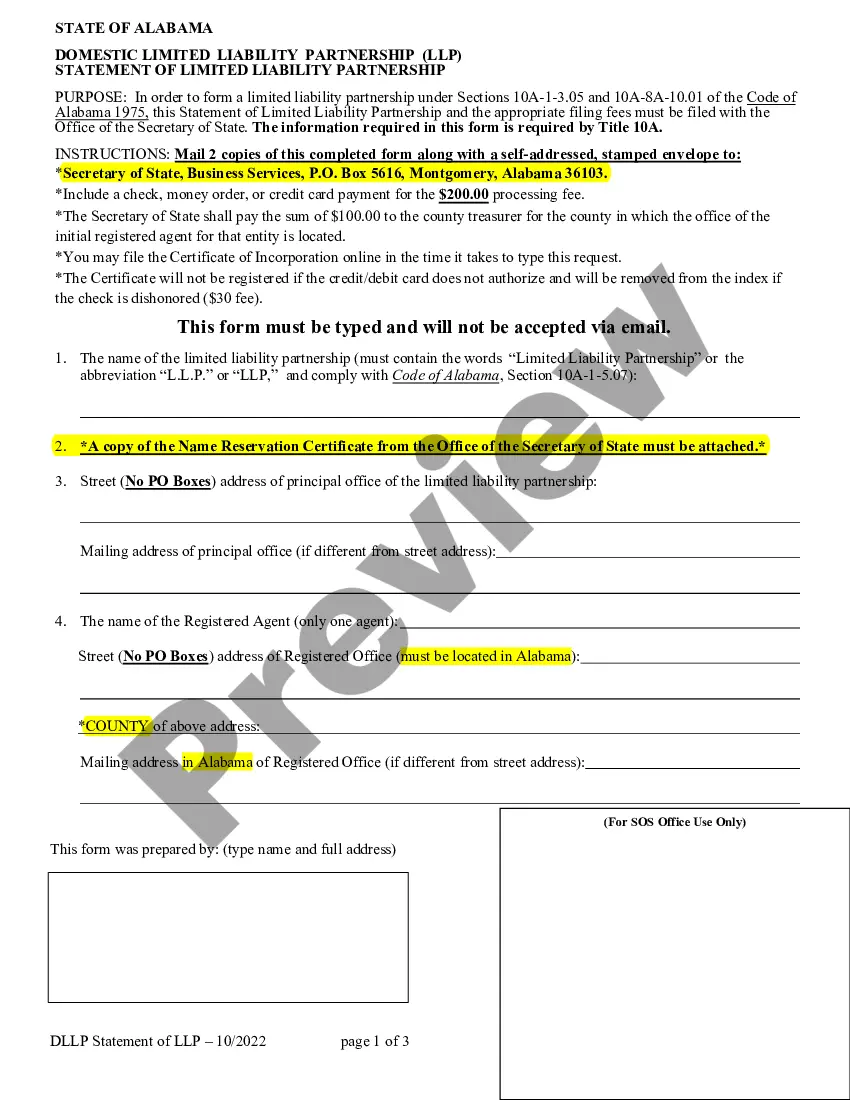

Whether an LLP is better than an LLC depends on your specific business needs. An Alabama Foreign Registered Limited Liability Partnership offers personal liability protection for partners while allowing flexibility in management structures. On the other hand, an LLC provides similar liability protection and may be more beneficial for smaller operations. Carefully consider your business model and consult with a legal expert to determine the best option.

An LLP is formed by filing a registration application with the relevant state authority. In Alabama, this means submitting the application to the Secretary of State along with the required fees. Additionally, it's important to establish a solid partnership agreement that defines the rights and obligations of each partner. This process ensures your Alabama Foreign Registered Limited Liability Partnership is legally recognized.

Forming a partnership LLC in Alabama involves selecting a suitable name and filing the necessary paperwork with the Secretary of State. You will also need to create an operating agreement that specifies the rules for running the business. Keep in mind that an Alabama Foreign Registered Limited Liability Partnership must adhere to all state requirements, including obtaining any necessary licenses and permits.

To form an Alabama Foreign Registered Limited Liability Partnership, you must first choose a name for your partnership that complies with state regulations. Next, you will need to file the application for registration with the Alabama Secretary of State. Additionally, it is crucial to draft a partnership agreement that outlines each partner's roles and responsibilities. After completing these steps, you can begin operating your LLP in Alabama.

The primary difference between an LLC and a partnership LLC lies in their legal structure and liability. An LLC provides limited liability protection to all its owners, while a partnership LLC distributes that liability amongst its partners. Additionally, management in an LLC is often more formal, while a partnership LLC allows more flexibility in operations and decision-making. When considering expansion, you may want to explore options for establishing an Alabama Foreign Registered Limited Liability Partnership to leverage the benefits of both structures.