Alabama Sample Order

About this form

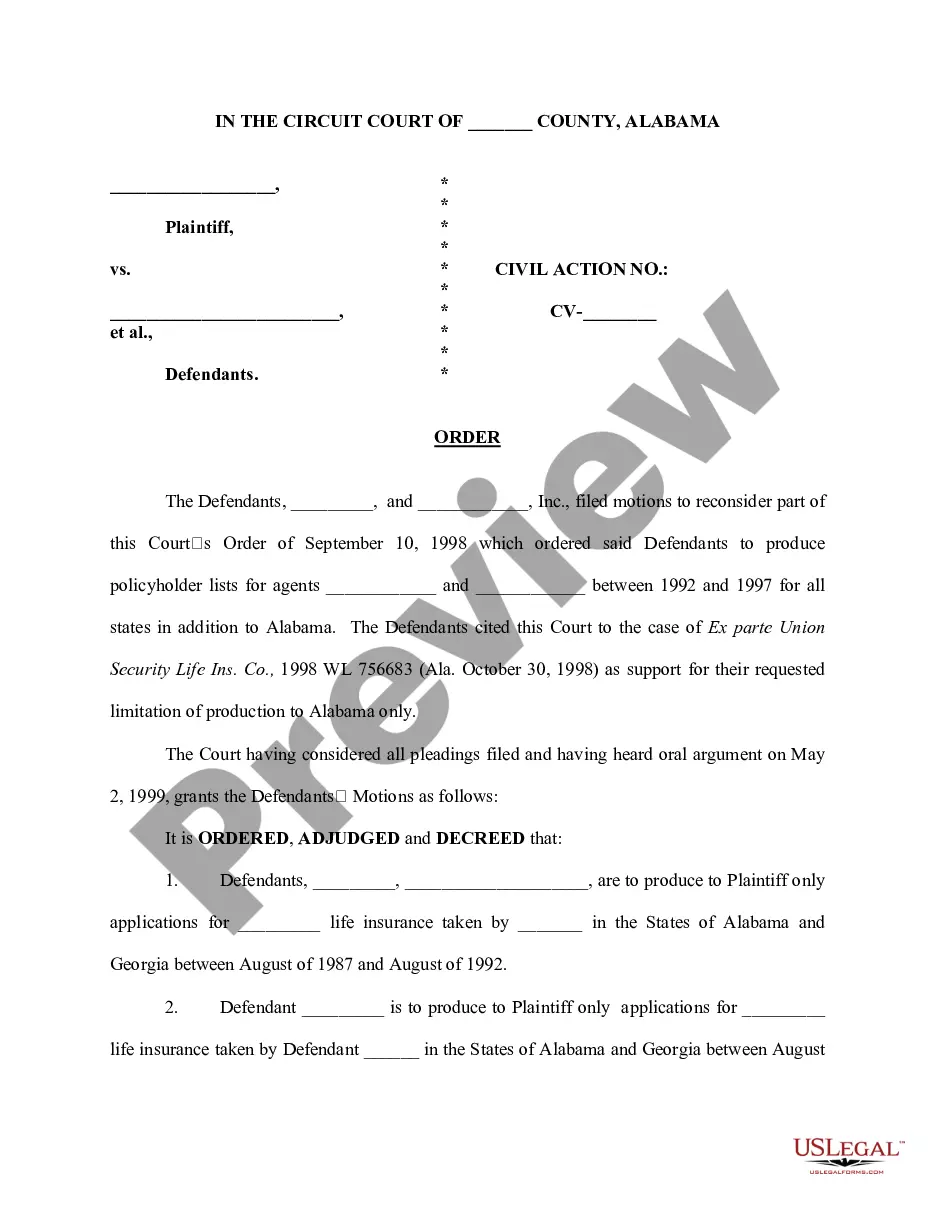

The Sample Order is a legal document issued by the Circuit Court that directs a defendant to produce specific documents relevant to an insurance fraud claim. This form is crucial in civil litigation, particularly in cases where document production is contested, setting it apart from other forms that may not address such procedural requests.

Main sections of this form

- Title and case number of the civil action.

- Order section detailing which documents the defendants must produce.

- Specific dates and scope of document production (years and states involved).

- Instructions for further applications if additional documents are identified.

- Deadline for compliance with the order.

When to use this document

This form is typically used in civil cases where a party is requesting further production of documents in response to a previous court order. It is most relevant in disputes over document access in insurance fraud allegations or other civil actions involving evidentiary requirements. If you believe that relevant documents have not been provided, this form may be necessary to clarify the court's directive to the opposing party.

Intended users of this form

- Plaintiffs seeking additional documentation in a civil action.

- Defendants who need to respond to a court's directive on document production.

- Legal practitioners working on cases involving insurance fraud allegations.

Steps to complete this form

- Identify and enter the names of the parties involved in the action.

- Fill in the civil action number to associate the order with the correct case.

- Specify the dates and types of documents the defendants must produce.

- Indicate the deadline for the document production.

- Include the signature and title of the judge issuing the order.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the correct civil action number.

- Omitting key details about the documents required.

- Not adhering to the prescribed deadline for compliance.

Benefits of using this form online

- Convenient access to a professionally drafted legal document.

- Editable format allows customization to fit your specific case.

- Reliable source with templates prepared by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Alabama state tax forms are available online through the Alabama Department of Revenue’s website. You can download and print the necessary forms directly from there. Alternatively, the USLegalForms platform offers a convenient way to access all required forms, including an Alabama Sample Order, making your filing process more efficient.

In Alabama, certain businesses must file annual reports to keep their status active, especially corporations and LLCs. These reports offer insights into the business’s activities and financial standing. If you're unsure about your obligations, an Alabama Sample Order can clarify these requirements for you.

Yes, many post offices carry basic tax forms during tax season, including some Alabama tax forms. However, the selection may be limited, so it’s wise to check availability ahead of time. For a broader selection, consider using the USLegalForms platform or ordering an Alabama Sample Order for the correct documents.

The A-4 form in Alabama is an Employee's Withholding Form that determines the amount of state tax withheld from your paycheck. Employers use this form to ensure they withhold the correct amount based on the employee’s circumstances. If you have further questions, the USLegalForms platform can assist you in obtaining this form along with other necessary documents.

Filing requirements in Alabama depend on factors such as residency status, income, and type of income. Generally, if you earn above a specific threshold, you must file a return. For complete details on these requirements, referring to the Alabama Department of Revenue is essential. An Alabama Sample Order can provide helpful insights.

To order tax forms for mailing, visit the Alabama Department of Revenue's website and check if they offer mail-order options. USLegalForms also provides an option to request forms through their platform, allowing you to receive them by mail directly. Consider using an Alabama Sample Order for a streamlined experience.

Form 40 should be mailed to the Alabama Department of Revenue at the address specified in the instructions on the form. It’s important to ensure that you send it to the correct address based on your filing status. Relying on resources like an Alabama Sample Order can help you understand all necessary steps for submission.

To obtain tax forms online, visit the Alabama Department of Revenue's website where you can download forms directly. Alternatively, the USLegalForms platform provides a wide range of tax forms, including Alabama forms, available for download. This makes accessing your needed documents straightforward and efficient.

You can order Alabama tax forms online through the Alabama Department of Revenue's website. Additionally, you can use the USLegalForms platform, which simplifies the process and offers various tax-related documents. For convenience, choosing an Alabama Sample Order saves time and ensures you get the correct forms needed for filing.

In Alabama, the income threshold for filing taxes can vary. For individuals, if you earn over a certain amount, which is adjusted annually, you must file a tax return. It is advisable to refer to the Alabama Department of Revenue's guidelines for the latest figures. Utilizing an Alabama Sample Order can guide you in determining if you need to file.