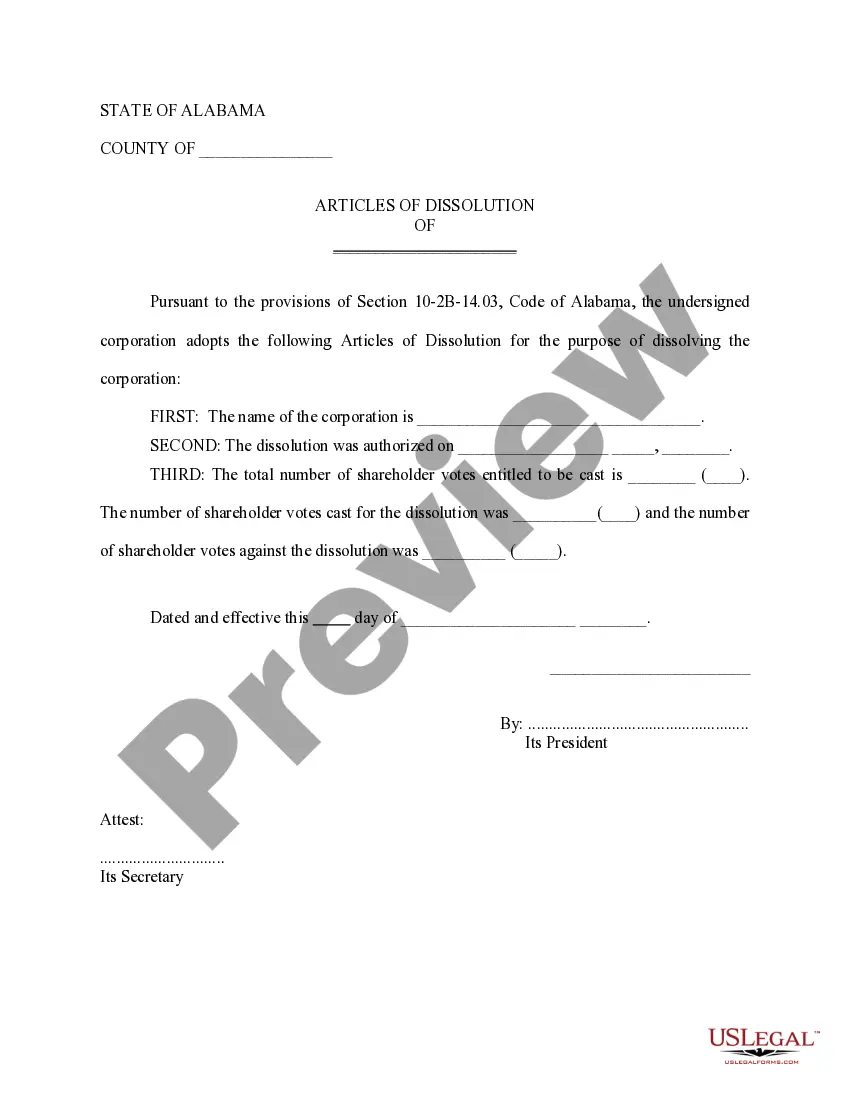

This form is used for the purpose of dissolving a corporation in the State of Alabama. The form is available in both word and word perfect formats.

Alabama Articles of Dissolution

Description

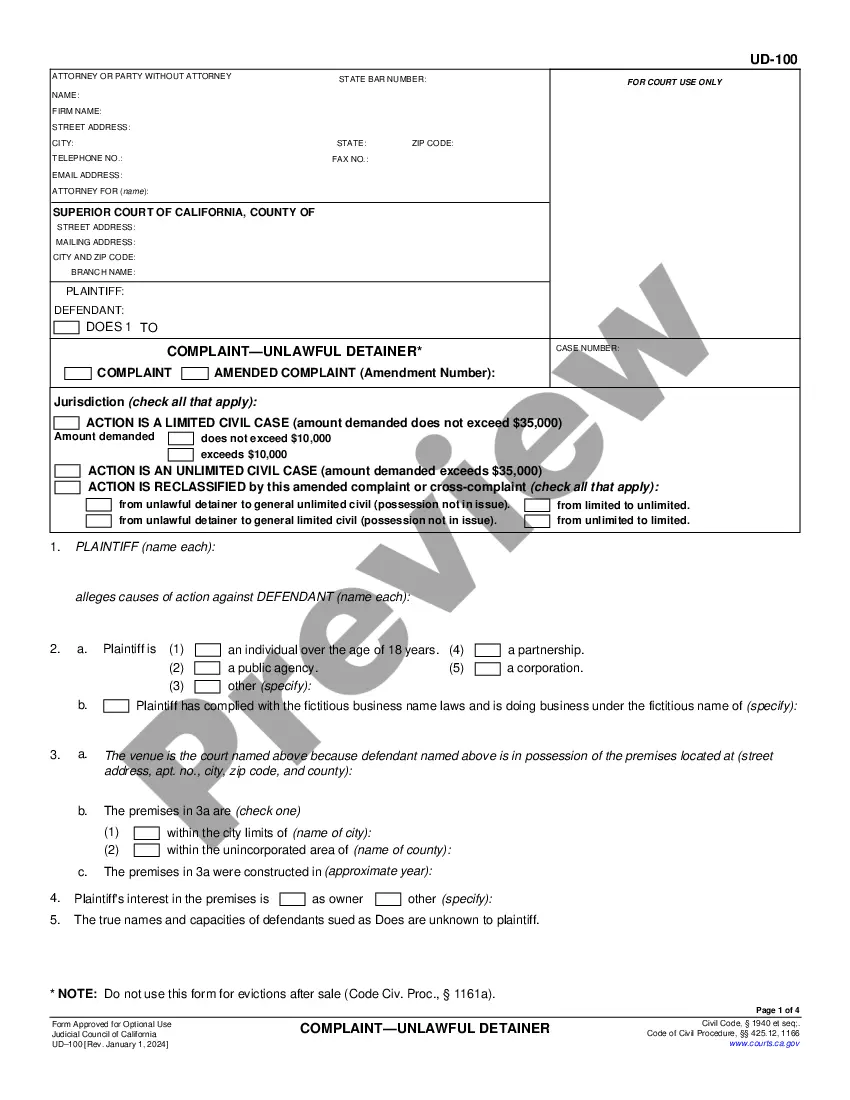

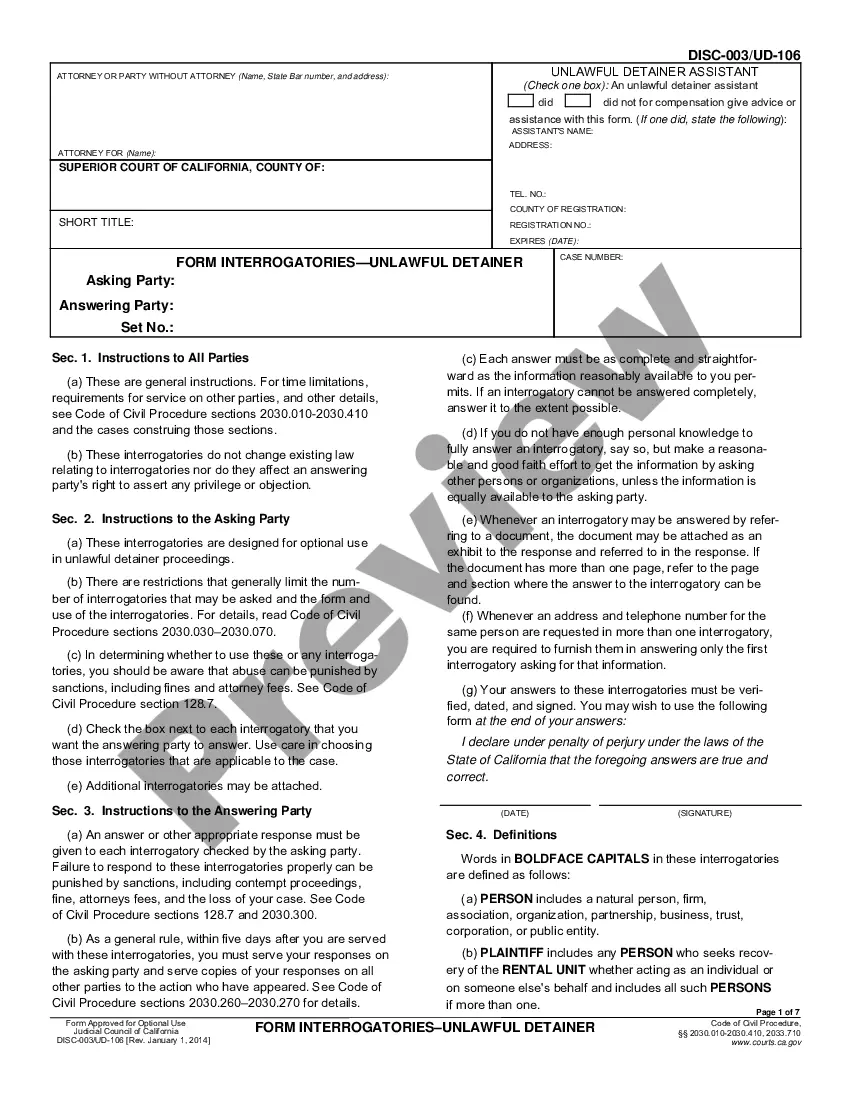

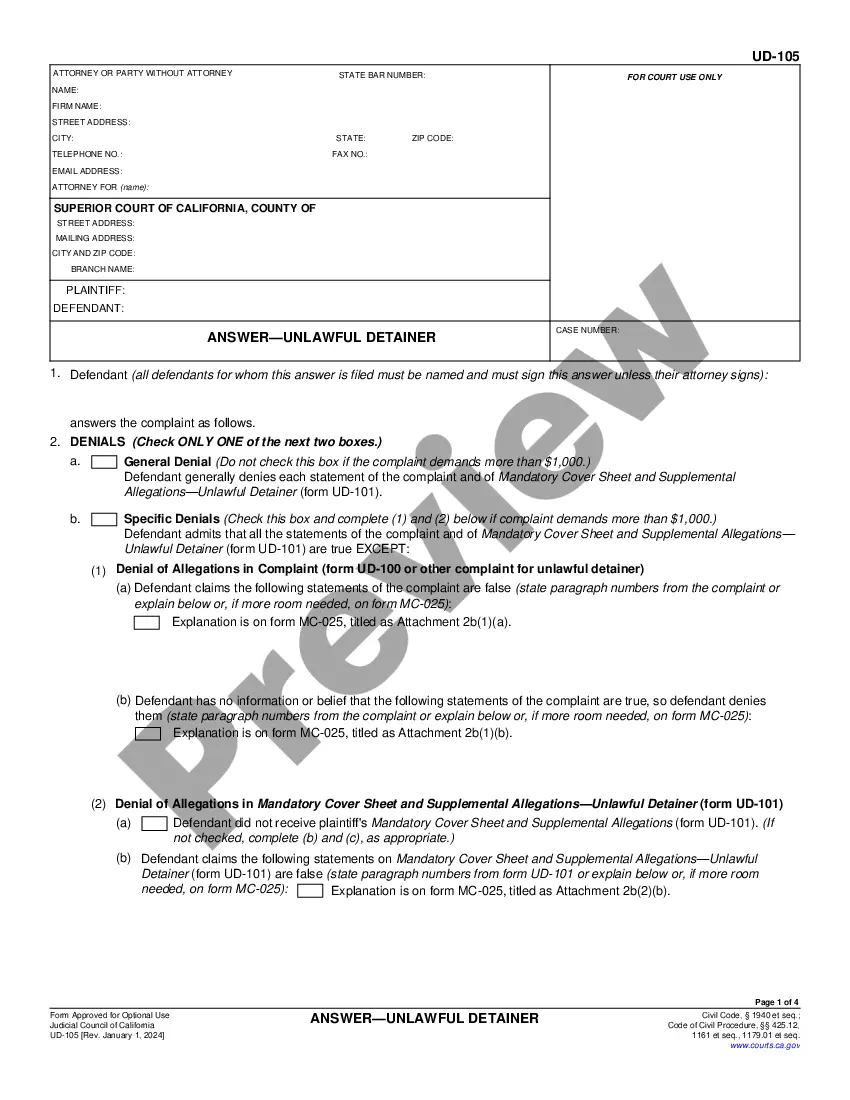

How to fill out Alabama Articles Of Dissolution?

Using Alabama Articles of Dissolution forms designed by professional lawyers helps you prevent frustrations when filling out paperwork.

Just download the form from our site, complete it, and have legal advice verify it.

This can save you considerably more time and effort than having an attorney create a document from scratch to meet your requirements.

Utilize the Preview option and read the overview (if available) to determine if this specific template is necessary for you; if it is, simply click Buy Now.

- If you currently hold a US Legal Forms subscription, simply Log Into your account and head back to the sample page.

- Locate the Download option next to the template you’re reviewing.

- Once you download a document, your saved samples will appear in the My documents section.

- If you lack a subscription, there’s no cause for concern.

- Just adhere to the steps outlined below to register for an account online, acquire, and fill out your Alabama Articles of Dissolution form.

- Ensure that you’re downloading the right state-specific form.

Form popularity

FAQ

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Hold a Board of Directors meeting and record a resolution to Dissolve the Alabama Corporation. Hold a Shareholder meeting to approve Dissolution of the Alabama Corporation. File all required Business Privilege Tax Return and Annual Reports with the Alabama Secretary of State. Clear up any business debts.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Articles of Dissolution are the forms that you file to voluntarily dissolve your LLC. Once this document has been filed and processed, your LLC will no longer legally exist. Alabama requires business owners to submit their Articles of Dissolution by mail.

What is the difference between dissolution and termination of an entity?Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.