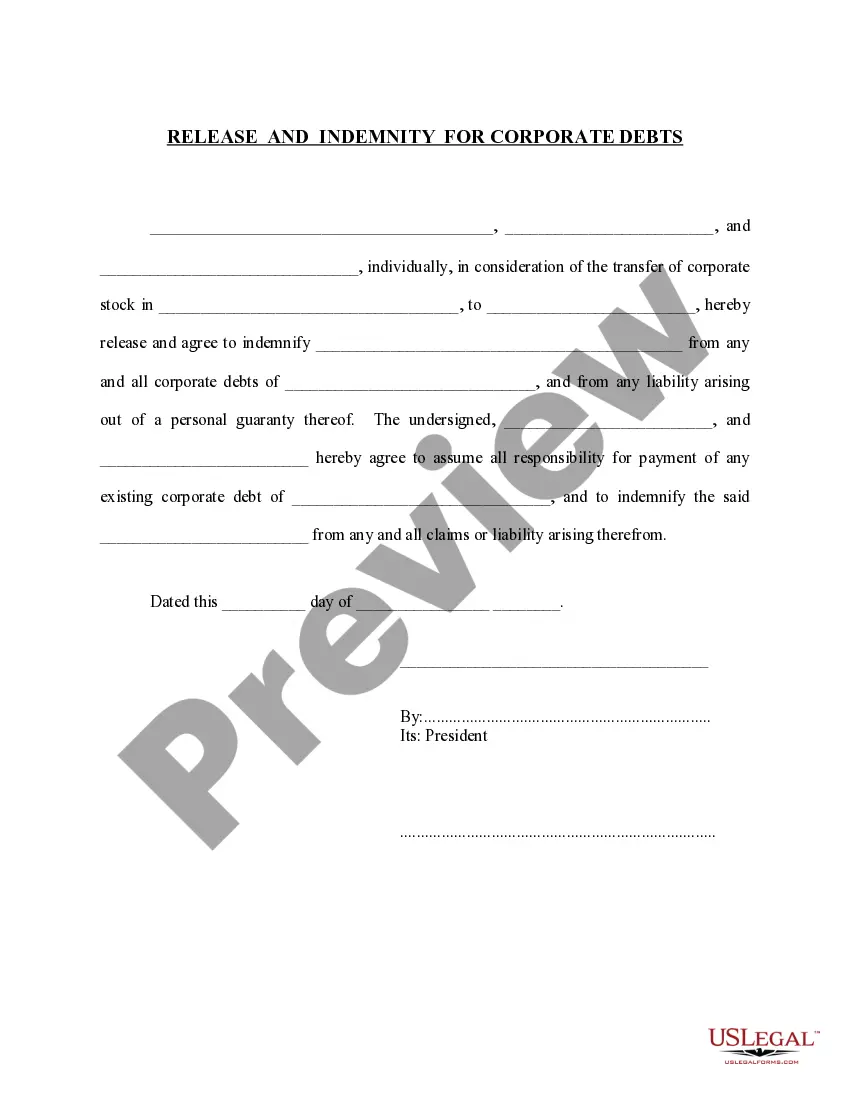

This form is a release and indemnity agreement for Corporate debts in exchange for a transfer of corporate stock. The form is available in both word and word perfect formats.

Alabama Release and Indemnity Agreement for Corporate Debts

Description

How to fill out Alabama Release And Indemnity Agreement For Corporate Debts?

Using examples of the Alabama Release and Indemnity Agreement for Corporate Debts crafted by skilled attorneys allows you to dodge troubles when filing documents.

Simply obtain the template from our site, complete it, and ask a legal expert to review it.

By doing so, you can conserve considerably more time and effort than searching for a lawyer to create a document entirely from the beginning for you.

Utilize the Preview feature and read the description (if it exists) to determine if you need this specific sample and if so, click Buy Now. Search for another sample using the Search field if necessary. Choose a subscription that suits your needs. Get started with your credit card or PayPal. Select a file format and download your document. After you've completed all the above steps, you'll be able to fill out, print, and sign the Alabama Release and Indemnity Agreement for Corporate Debts template. Be sure to verify all inserted information for accuracy before submitting it or sending it out. Minimize the time you spend on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, just sign in to your account and return to the form webpage.

- Locate the Download button near the template you are reviewing.

- After downloading a template, you will find your saved samples in the My documents tab.

- If you don't have a subscription, that's okay.

- Just follow the instructions below to register for your account online, obtain, and complete your Alabama Release and Indemnity Agreement for Corporate Debts template.

- Double-check and ensure that you’re downloading the correct state-specific form.

Form popularity

FAQ

It's still your business decision whether you sign them or not, but you should do so only where it is a critical contract that you have no way of modifying or negotiating changes. In contrast, the best kind of Indemnity Agreement is commonly called a Mutual Indemnity Agreement or a Mutual Hold Harmless Provision.

Unlike a release, which suppresses a cause of action, an indemnity creates a potential cause of action between the indemnitee and the indemnitor.A release extinguishes any actual or potential claims the releasor may have against the releasee without regard to third parties.

What is an indemnity?An indemnity form also limits the person's contractual and delictual liability. This means that a person indemnifies another person from liability by giving up his/her right to sue that person when s/he suffers damages, loses something or gets injured.

There are no formal requirements for creating a valid indemnity, so it could be oral, or in writing but not signed. However, an indemnity would still have to meet the requirements for a valid contract as it (in common with a guarantee) is only enforceable as a contractual obligation.

An Indemnity Bond may be drafted as below and executed on a stamp paper of the value which differs for every state. This deed of Indemnity executed on DATE at PLACE by ___________ having its registered office at ___________, through Mr.

First, include the date the document is being executed (signed). Title the letter as a "Letter of Indemnity" to make it clear what the document is about. Include a statement that the agreement will be governed by the laws of the specific state (where the agreement would be taken to court).

The date of the agreement. The name of the person held harmless or protected, with their address. The name of the other party to the agreement, with their address. Details about the activity or event the agreement is about, such as horseback riding or country club membership.

This form of a Release Agreement, Indemnity Agreement and Hold Harmless Agreement releases a party from certain specified liabilities. Releases are used to transfer risk from one party to another and protect against the released party or reimburse the released party for damage, injury, or loss.

Indemnity is compensation paid by one party to another to cover damages, injury or losses.An example of an indemnity would be an insurance contract, where the insurer agrees to compensate for any damages that the entity protected by the insurer experiences.