Alaska Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

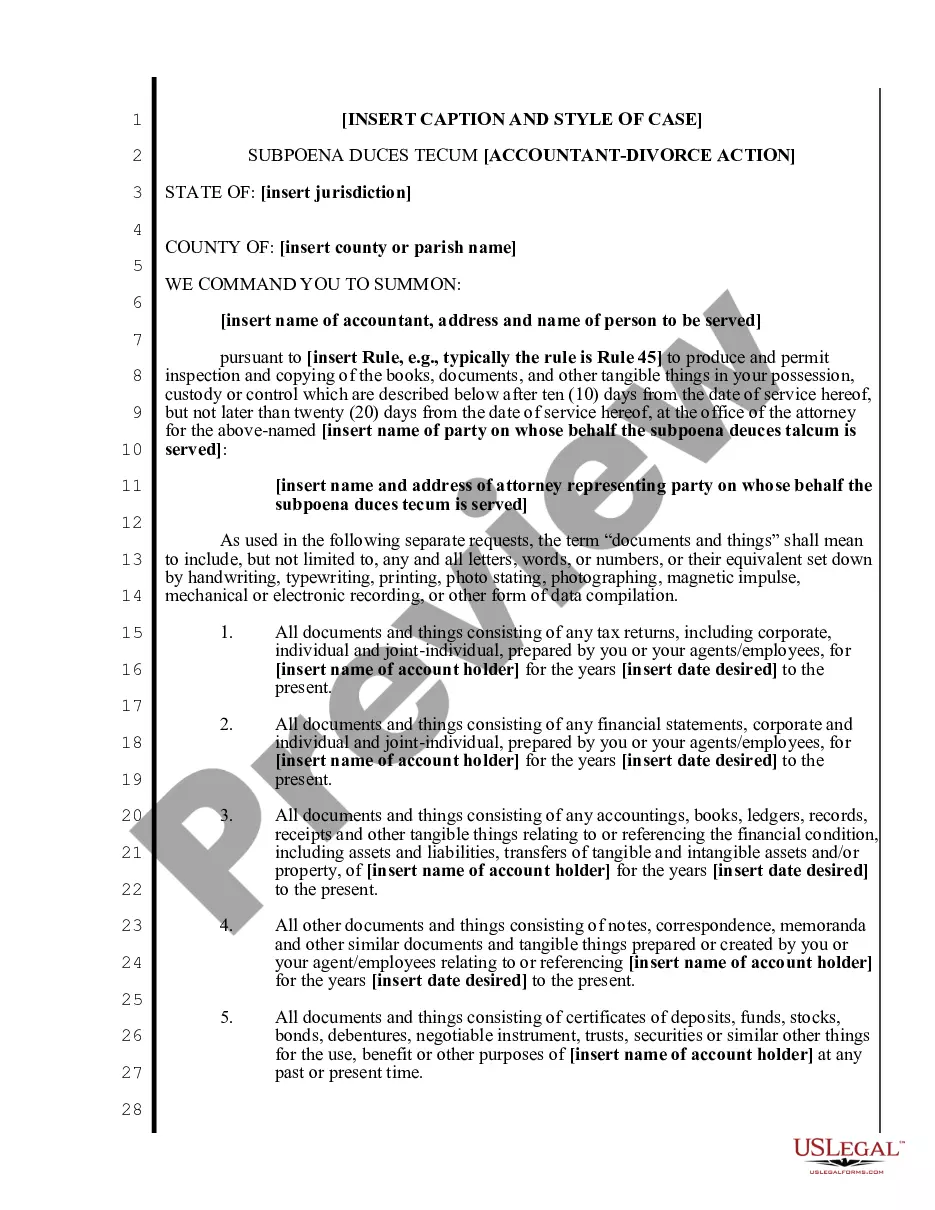

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Discovering the right authorized record format could be a battle. Naturally, there are a variety of themes available online, but how would you get the authorized form you will need? Use the US Legal Forms website. The services delivers 1000s of themes, for example the Alaska Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, which can be used for business and private requirements. Each of the forms are checked by specialists and satisfy federal and state requirements.

If you are currently signed up, log in for your bank account and click the Download option to find the Alaska Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease. Make use of your bank account to appear through the authorized forms you might have acquired in the past. Proceed to the My Forms tab of the bank account and acquire another backup of your record you will need.

If you are a whole new consumer of US Legal Forms, allow me to share easy directions so that you can follow:

- Initial, ensure you have chosen the proper form for your metropolis/county. It is possible to look through the shape making use of the Preview option and browse the shape description to make sure it will be the best for you.

- When the form is not going to satisfy your needs, use the Seach field to find the right form.

- When you are positive that the shape is acceptable, click on the Buy now option to find the form.

- Opt for the costs prepare you would like and enter in the necessary information. Build your bank account and pay money for the order using your PayPal bank account or Visa or Mastercard.

- Pick the data file structure and acquire the authorized record format for your product.

- Complete, change and produce and indicator the attained Alaska Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease.

US Legal Forms is definitely the greatest library of authorized forms in which you can see various record themes. Use the company to acquire professionally-made files that follow state requirements.

Form popularity

FAQ

While royalties on oil and gas produced from state territory generally hover between 12.5% and 16.67%, state law gives the commissioner of the Department of Natural Resources the authority to vary those terms if doing so is deemed in the state's best interest.

The General Mining Act of 1872 regulates gold, silver, cinnabar, copper, and ?other valuable deposits.? This legislation still governs extraction of many nonenergy minerals, like hardrock locatable minerals. The Minerals Leasing Act of 1920 limited the scope of the 1872 Act.

The Mineral Leasing Act for Acquired Lands of 1947 (30 U.S.C. §§ 351 et seq.) extended the mineral leasing laws (the Mineral Leasing Act, etc.) to all lands acquired by the United States. The Act allowed the United States to maintain title to the land and establish lease terms for all minerals found on acquired land.

The Mineral Leasing Act of 1920 30 U.S.C. § 181 et seq. is a United States federal law that authorizes and governs leasing of public lands for developing deposits of coal, petroleum, natural gas and other hydrocarbons, in addition to phosphates, sodium, sulfur, and potassium in the United States.

There are a few key differences between leasing your mineral rights and selling them to oil companies, which include: With leasing, if no minerals are found, you may not receive royalties. Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land.

The Mineral Leasing Act (MLA) is a United States federal law that authorizes the leasing of public domain lands for exploring and developing coal, oil, natural gas, and other minerals. Enacted in 1920, it has undergone numerous amendments.