Alaska Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

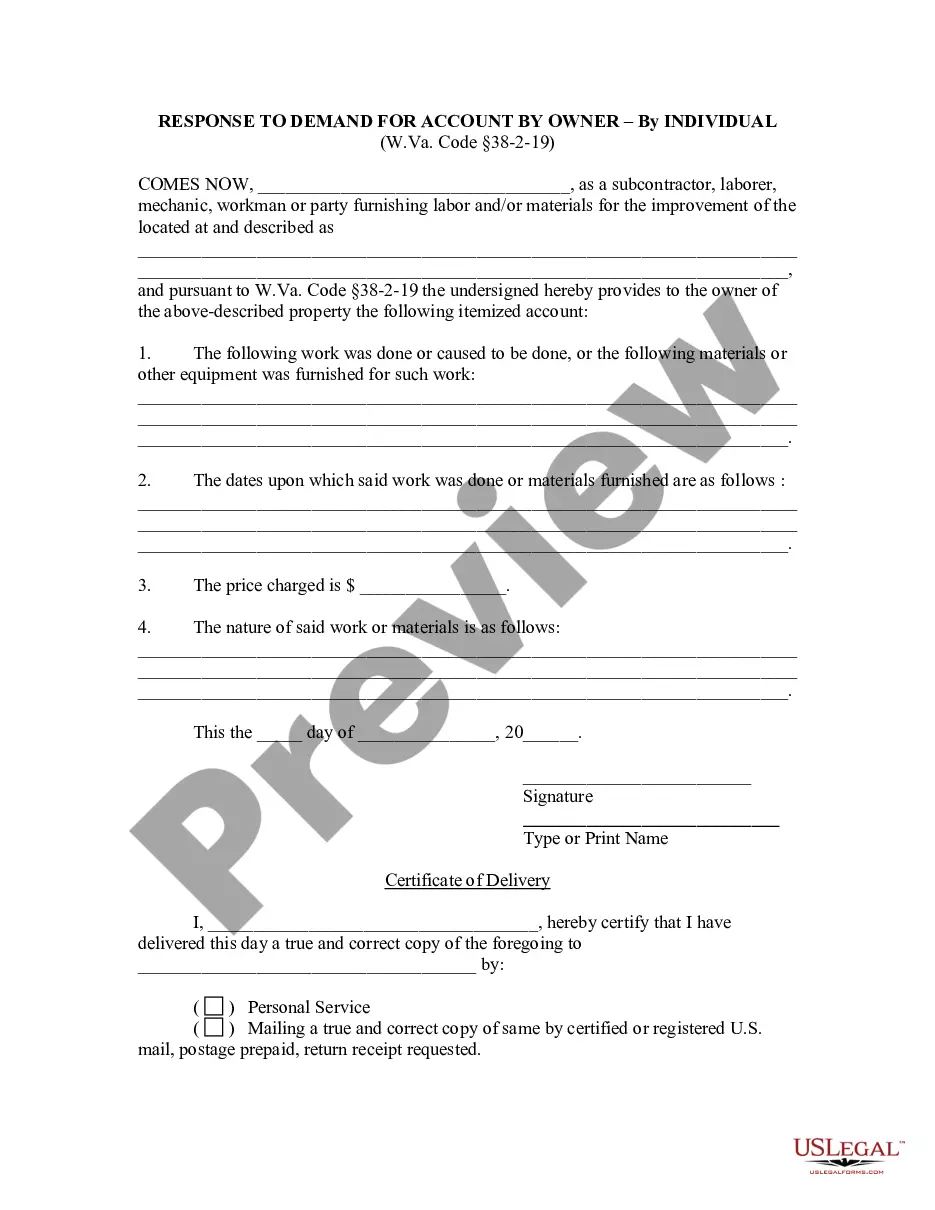

How to fill out Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

Have you been in a place in which you will need papers for either business or personal functions almost every day? There are a lot of legal record web templates accessible on the Internet, but locating versions you can rely is not simple. US Legal Forms offers thousands of form web templates, like the Alaska Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease, which can be published to satisfy federal and state specifications.

If you are currently familiar with US Legal Forms site and also have an account, simply log in. After that, it is possible to obtain the Alaska Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease web template.

Unless you come with an profile and want to start using US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for that correct town/state.

- Use the Preview option to analyze the form.

- See the description to actually have selected the appropriate form.

- When the form is not what you`re looking for, take advantage of the Lookup field to get the form that meets your requirements and specifications.

- When you get the correct form, just click Get now.

- Select the prices program you need, submit the desired info to create your account, and buy your order making use of your PayPal or credit card.

- Pick a handy data file structure and obtain your version.

Get all the record web templates you may have bought in the My Forms menu. You can aquire a extra version of Alaska Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease whenever, if required. Just click the necessary form to obtain or print out the record web template.

Use US Legal Forms, one of the most extensive selection of legal forms, in order to save time and steer clear of mistakes. The service offers skillfully manufactured legal record web templates that you can use for a range of functions. Generate an account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

One of the most productive areas in the world for oil remains rich in the resource, ing to the latest USGS assessment. The USGS estimates 3.6 billion barrels of oil and 8.9 trillion cubic feet of natural gas conventional resources in Alaska's Central North Slope.

While royalties on oil and gas produced from state territory generally hover between 12.5% and 16.67%, state law gives the commissioner of the Department of Natural Resources the authority to vary those terms if doing so is deemed in the state's best interest.

ConocoPhillips Alaska, Inc. is Alaska's largest oil producer and can trace its heritage back to the greatest oil discoveries in Alaska history.

ConocoPhillips has major ownership interests in two of North America's largest legacy conventional oil fields, both located on Alaska's North Slope: Kuparuk, which the company operates, and Prudhoe Bay.

Most of the oil produced in Alaska is sent to refineries in Washington and California. Tankers transport most of the oil produced in Alaska to refineries in Washington and California.

If you sign a mineral rights lease, then you are on your way to earning oil and gas royalties. As a mineral rights owner, you can receive royalty compensation. This is from the sale of crude oil, natural gas, and other valuable resources found on your property.

The National Petroleum Reserve in Alaska (NPRA) is an area of land on the Alaska North Slope owned by the United States federal government and managed by the Department of the Interior, Bureau of Land Management (BLM).

The state holds all other subsurface rights. The state constitution formalizes the right of Alaskans to have a share of the mineral wealth and the government does so in the form of the permanent fund dividend.