This form is used when, as a result of continuous production from the Lease and Lands, payout, as defined in an Assignment, has occurred, and Declarant is entitled to elect to convert the Override to a Working Interest, as provided for in the Assignment.

Alaska Declaration of Election to Convert Overriding Royalty Interest to Working Interest

Description

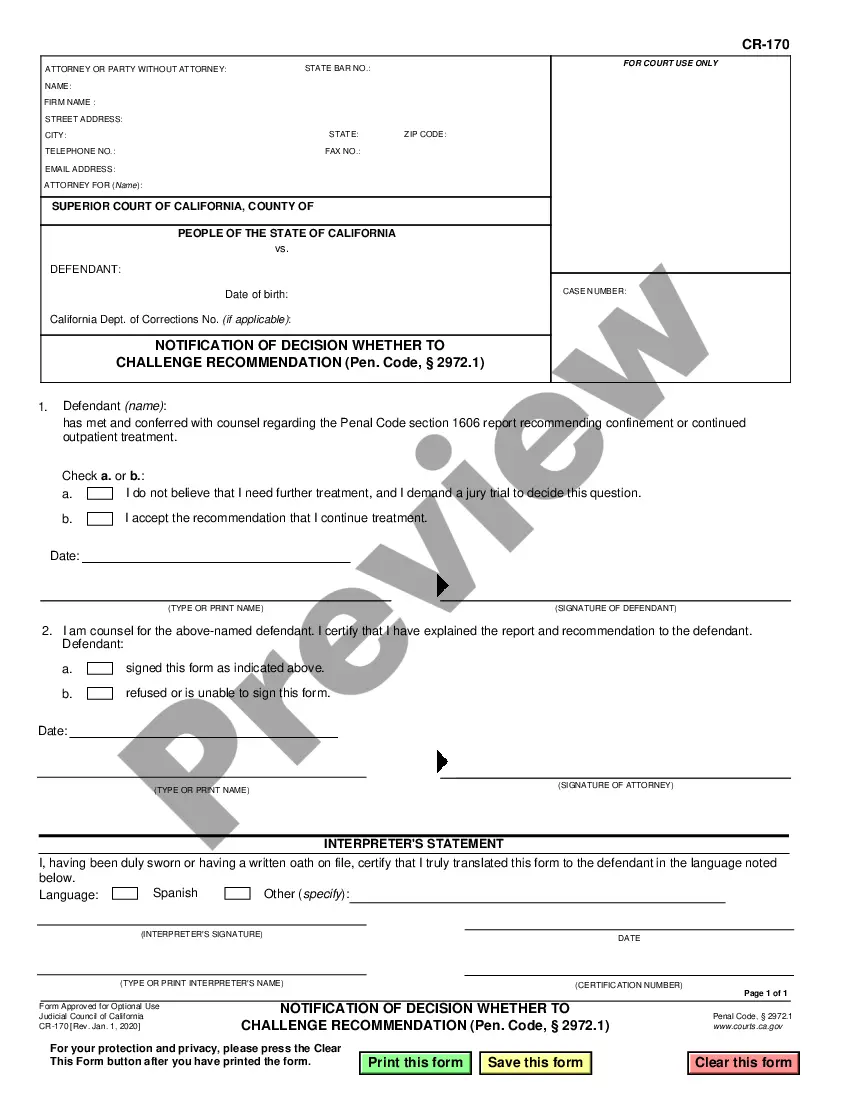

How to fill out Declaration Of Election To Convert Overriding Royalty Interest To Working Interest?

Have you been in a place where you will need files for both organization or personal functions just about every day time? There are a variety of authorized file layouts available on the Internet, but finding ones you can rely is not effortless. US Legal Forms offers thousands of type layouts, just like the Alaska Declaration of Election to Convert Overriding Royalty Interest to Working Interest, which are created in order to meet state and federal demands.

If you are already familiar with US Legal Forms web site and possess an account, basically log in. Next, you are able to obtain the Alaska Declaration of Election to Convert Overriding Royalty Interest to Working Interest format.

Should you not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for the correct area/state.

- Use the Preview option to examine the form.

- Look at the outline to ensure that you have selected the appropriate type.

- In case the type is not what you are searching for, take advantage of the Search field to find the type that fits your needs and demands.

- If you obtain the correct type, just click Buy now.

- Select the costs prepare you would like, submit the necessary information to make your money, and buy your order with your PayPal or credit card.

- Decide on a hassle-free document file format and obtain your backup.

Locate all of the file layouts you possess purchased in the My Forms menus. You can obtain a more backup of Alaska Declaration of Election to Convert Overriding Royalty Interest to Working Interest at any time, if needed. Just go through the necessary type to obtain or print the file format.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to conserve time and steer clear of errors. The assistance offers skillfully manufactured authorized file layouts which you can use for a range of functions. Produce an account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest. ABC can convey a share of that net revenue interest as a royalty.

Alaska's oil royalty rate varies ing to the terms of the lease agreement. It can range from 5% to 60% but is most often 12.5%. Some leases receive royalty rate reductions for new discoveries or economic considerations.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

While royalties on oil and gas produced from state territory generally hover between 12.5% and 16.67%, state law gives the commissioner of the Department of Natural Resources the authority to vary those terms if doing so is deemed in the state's best interest.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.