Alaska Cease and Desist for Debt Collectors

Description

How to fill out Cease And Desist For Debt Collectors?

If you wish to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require. A range of templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to discover the Alaska Cease and Desist for Debt Collectors in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Compete and download, and print the Alaska Cease and Desist for Debt Collectors with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Alaska Cease and Desist for Debt Collectors.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

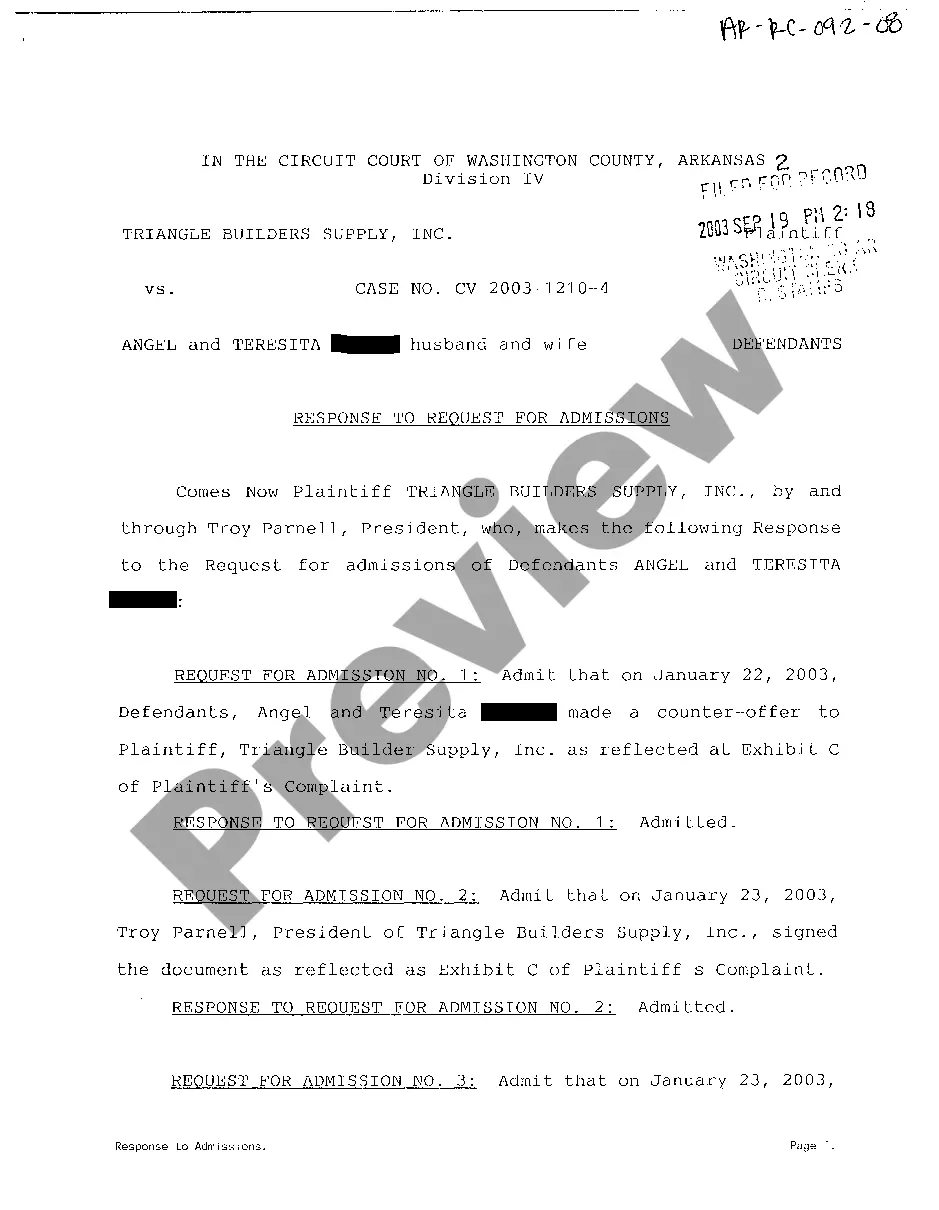

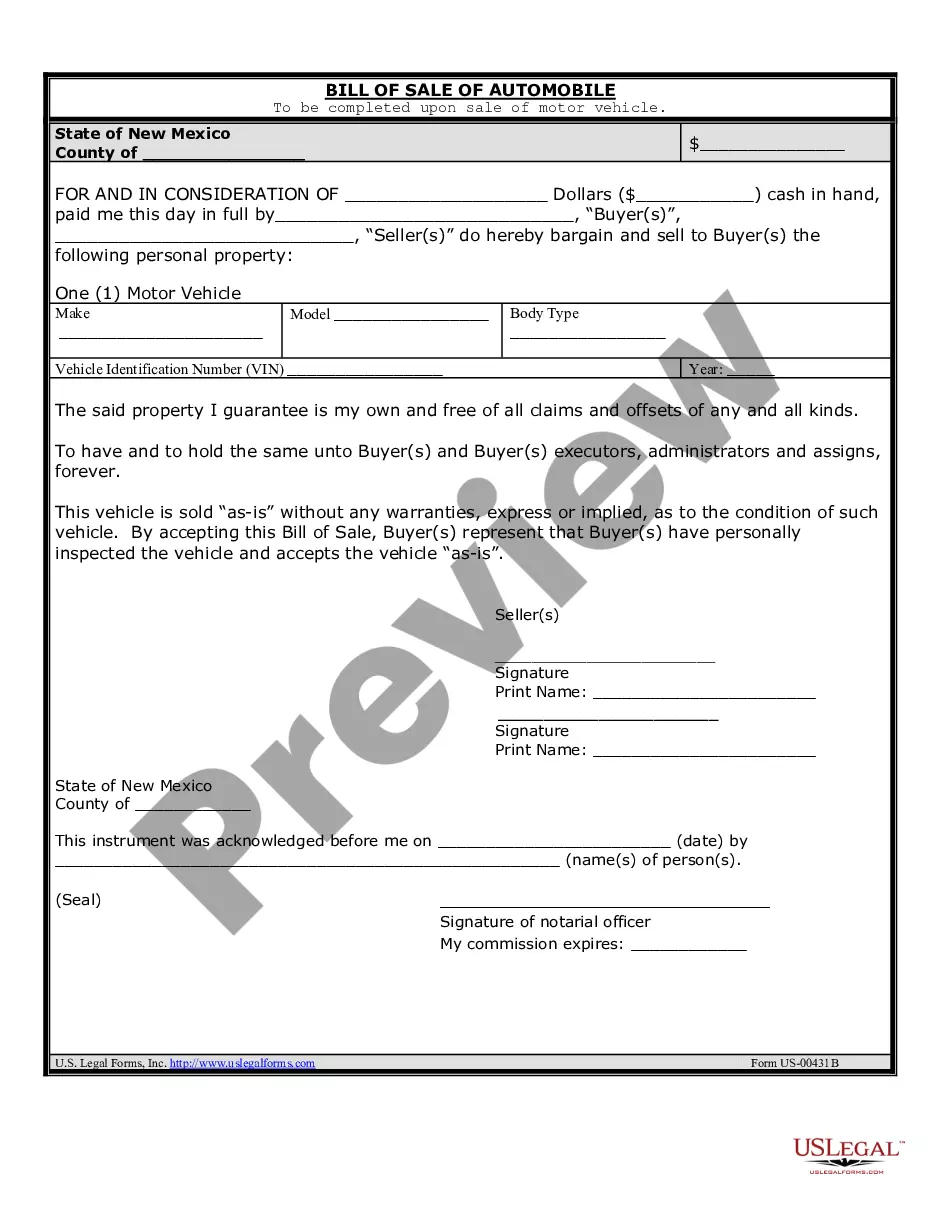

- Step 2. Use the Preview feature to review the form's details. Don't forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other variations of the legal form template.

- Step 4. After locating the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alaska Cease and Desist for Debt Collectors.

Form popularity

FAQ

The 777 rule is a guideline that suggests how debt collectors should operate within certain boundaries. This rule emphasizes that collectors should not engage in harassing behavior and must abide by legal standards. If you feel a collector has violated this rule, you can reference it when drafting your Alaska Cease and Desist for Debt Collectors. Understanding this rule can protect you from unfair practices.

Writing a cease and desist letter to a debt collector involves a few straightforward steps. Start by clearly stating your name, address, and the collector's information. Then, specify that you are issuing an Alaska Cease and Desist for Debt Collectors and include the reasons for your request. It’s crucial to keep the tone professional and assertive, ensuring you keep a copy for your records.

A 609 letter is a specific request that asks debt collectors to provide verification of the debt they claim you owe. This letter derives its name from Section 609 of the Fair Credit Reporting Act. By sending a 609 letter, you can challenge the debt's validity and request proof of the debt collector's right to collect. Using an Alaska Cease and Desist for Debt Collectors alongside a 609 letter can bolster your position.

To support your cease and desist request, you should provide documentation of any prior communication with the debt collector. This can include letters, emails, or notes from phone calls. If you have already made payments or have agreements in place, including those details can strengthen your case. An Alaska Cease and Desist for Debt Collectors should clearly state your request and the reasons behind it.

Yes, cease and desist letters can be effective tools for stopping debt collectors from contacting you. When you issue an Alaska Cease and Desist for Debt Collectors, it formally notifies them to cease communication. Many debt collectors respect these letters and may halt their attempts to collect. However, some may continue to pursue their claims, so it's essential to understand your rights.

In Alaska, the statute of limitations for debt collection is typically three years. This means that after three years, creditors may no longer sue you for unpaid debts. Understanding this timeframe can empower you when dealing with debt collectors. For specific guidance and to ensure proper handling of your debts, consider resources like USLegalForms for tailored legal assistance.

Yes, you can send a cease and desist letter to a debt collector at any time. This letter serves as your official notification that you want the collector to stop contacting you. To ensure your request is effective, consider using a template from USLegalForms, which specializes in legal documents. An Alaska Cease and Desist for Debt Collectors can help you take control of the situation.

Yes, you can tell a debt collector to cease and desist. By sending a formal request, you inform them that you do not wish to be contacted regarding the debt. This action is often referred to as an Alaska Cease and Desist for Debt Collectors. It is important to send this request in writing to maintain a record of your communication.

In Alaska, a debt typically becomes uncollectible after a period of three years, known as the statute of limitations. This period starts from the date of the last payment or acknowledgment of the debt. If you are dealing with persistent debt collectors, consider using an Alaska Cease and Desist for Debt Collectors to halt their efforts. This strategy not only protects your rights but also provides clarity on your obligations.

The 777 rule refers to a guideline that protects consumers from aggressive debt collection practices. Under this rule, debt collectors must provide clear and concise information about the debt, including the amount owed and the creditor's details. If you are facing harassment from debt collectors, you can use an Alaska Cease and Desist for Debt Collectors to stop unwanted communication. This document helps you assert your rights and regain control over your financial situation.