Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed

Description

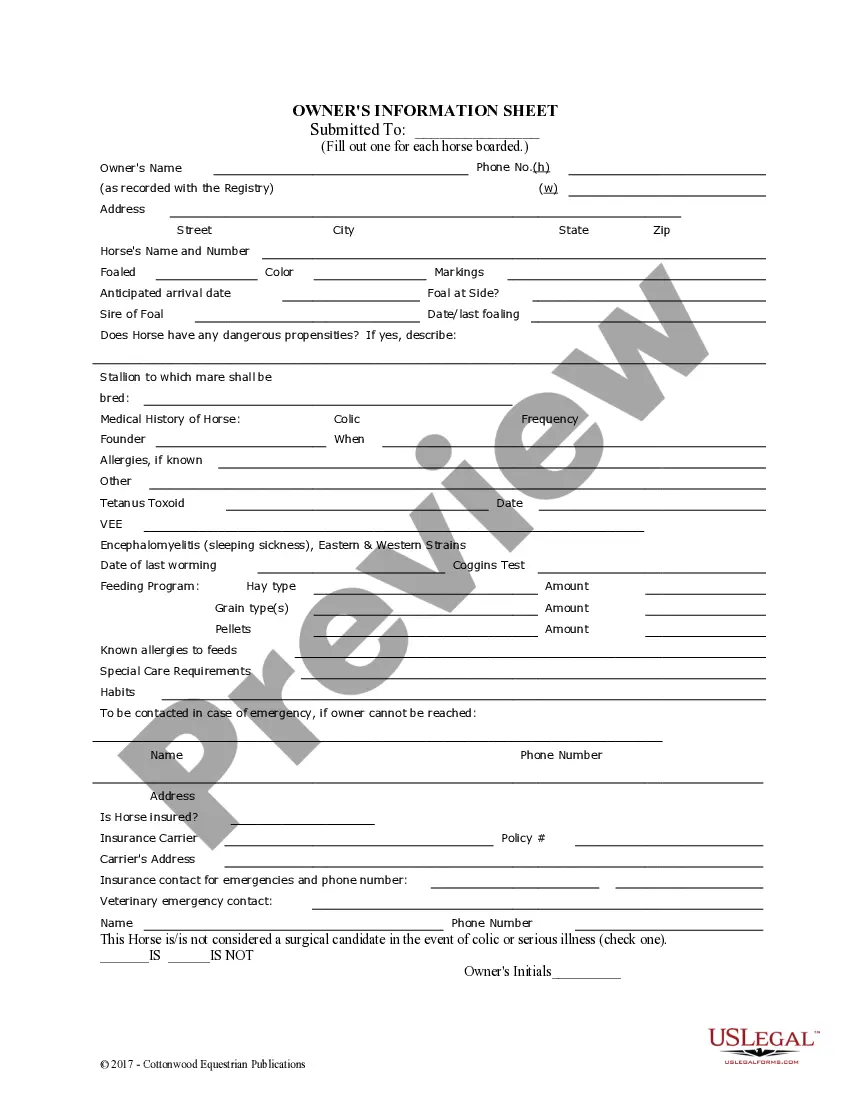

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company Purpose To Be Completed?

It is feasible to spend multiple hours online looking for the proper legal document template that meets both state and federal requirements you will need. US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the Alaska Notice of Meeting of Members of LLC Limited Liability Company form to be filled out from the service. If you already have a US Legal Forms account, you may Log In and click the Download button. Subsequently, you can fill out, edit, print, or sign the Alaska Notice of Meeting of Members of LLC Limited Liability Company form to be completed.

Each legal document template you purchase is yours permanently. To obtain another copy of a purchased form, navigate to the My documents tab and click the appropriate button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have chosen the correct document template for your county/city of preference. Review the form description to confirm you have selected the right one. If available, use the Preview button to view the document template as well.

Utilize expert and state-specific templates to meet your business or personal needs.

- To find another version of the form, use the Search field to locate the template that fits your needs.

- Once you have identified the template you want, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can fill out, edit, sign, and print the Alaska Notice of Meeting of Members of LLC Limited Liability Company form to be completed.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

To look up an LLC in Alaska, you can visit the Alaska Division of Corporations website where you can search for business entities by name or registration number. This resource provides information on the status and filings of the LLC, including the Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed. Utilizing uslegalforms can further assist you in obtaining detailed information about LLCs.

Deciding whether to dissolve your LLC or leave it inactive depends on your future business plans. If you do not intend to use the LLC, it may be more beneficial to dissolve it to avoid ongoing fees and obligations. Make sure to document all decisions through the Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed. For further guidance, uslegalforms can provide valuable resources.

To officially shut down an LLC, you need to follow the legal procedures set by the state of Alaska. This includes holding a member meeting to decide on dissolution, as well as filing the appropriate dissolution documents with the state authorities. The Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed will play a key role in this process. Consider using uslegalforms for guidance and to ensure compliance.

Dissolving an LLC in Alaska involves several steps. First, convene the members to approve the dissolution during a formal meeting. After this, you must file the necessary paperwork, including the Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed, with the state. Platforms like uslegalforms can assist you in ensuring that all requirements are completed accurately.

To dissolve an Alaska LLC, you must first hold a meeting of members to discuss and vote on the decision. Following this, you will need to file a Certificate of Dissolution with the Alaska Division of Corporations. This ensures that all obligations are met and the Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed is properly documented. Using services like uslegalforms can simplify this process.

In Alaska, most businesses, including LLCs, need a business license to operate legally. This requirement applies to various industries, whether you run a retail shop, a service-based company, or an online business. Additionally, as part of maintaining your LLC, you should file an Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed to ensure that your business governance is formalized. Always check with local authorities to confirm specific licensing requirements.

Yes, there is a significant difference between a business license and an LLC. A business license permits you to conduct business legally within a jurisdiction, while an LLC is a specific type of business structure that offers liability protection to its owners. When forming your LLC, ensure to also obtain your business license and file an Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed to keep your business compliant and organized. Understanding these distinctions is crucial for successful business operations.

To form an LLC in Alaska, start by choosing a unique name that complies with state regulations. Next, file your Articles of Organization with the Alaska Division of Corporations and obtain an Employer Identification Number (EIN). It is also essential to prepare an Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed to establish operating procedures and member roles. Utilizing uslegalforms can streamline this process with the right templates and guidance.

Yes, an LLC typically needs a business license to operate in Alaska. The business license ensures that your LLC complies with state regulations and local laws. Additionally, you will need to file an Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed, as this document helps in maintaining proper records and governance for your business. Always check local requirements, as they may vary.

To close an LLC in Alaska, you must first ensure all business debts are settled and notify all members of the decision to dissolve. Next, you should file the Articles of Dissolution with the Alaska Division of Corporations, along with any required fees. This process includes addressing the Alaska Notice of Meeting of Members of LLC Limited Liability Company purpose to be completed, as members need to approve the dissolution during a formal meeting. For convenience, uslegalforms offers templates and guidance to help you navigate this process smoothly.