Alaska Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Are you in a situation where you require documents for business or personal uses almost constantly.

There is a plethora of legal document templates accessible online, but finding reliable versions isn't straightforward.

US Legal Forms provides an extensive range of form templates, such as the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

When you locate the correct form, simply click Buy now.

Choose the payment plan you wish, fill out the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you require and ensure it is for your correct region/area.

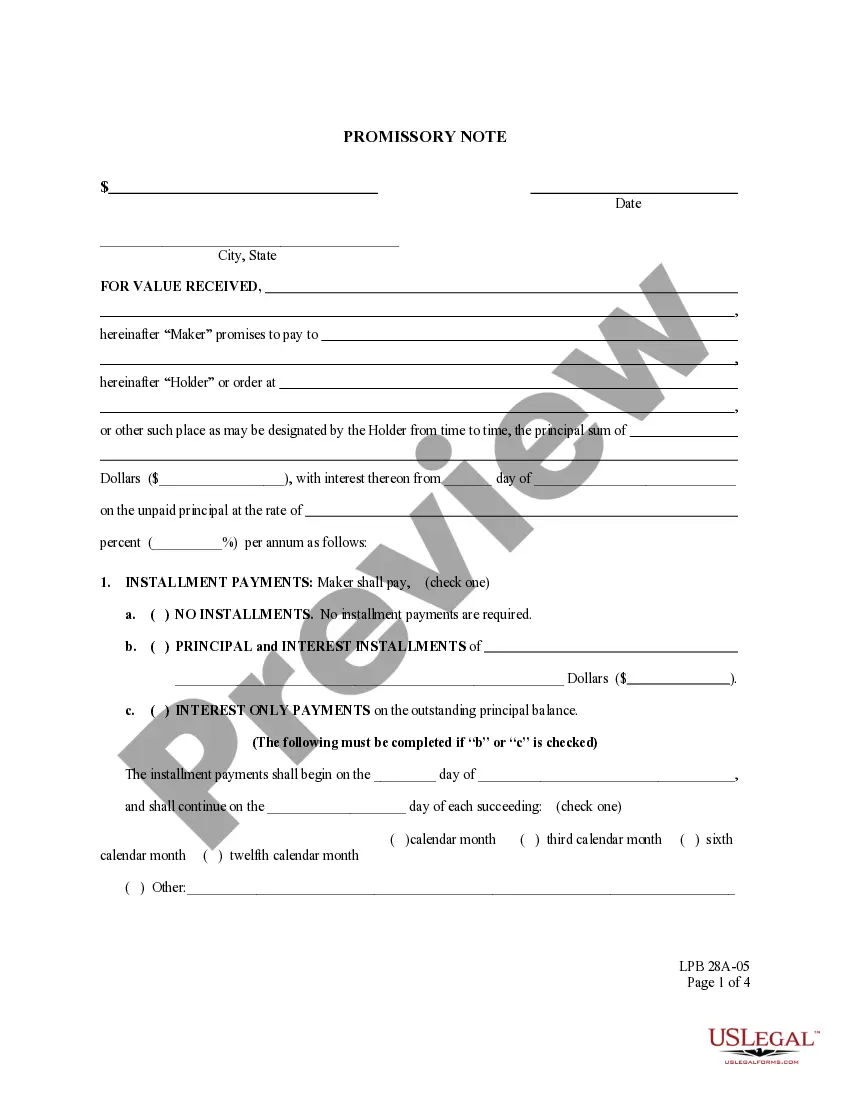

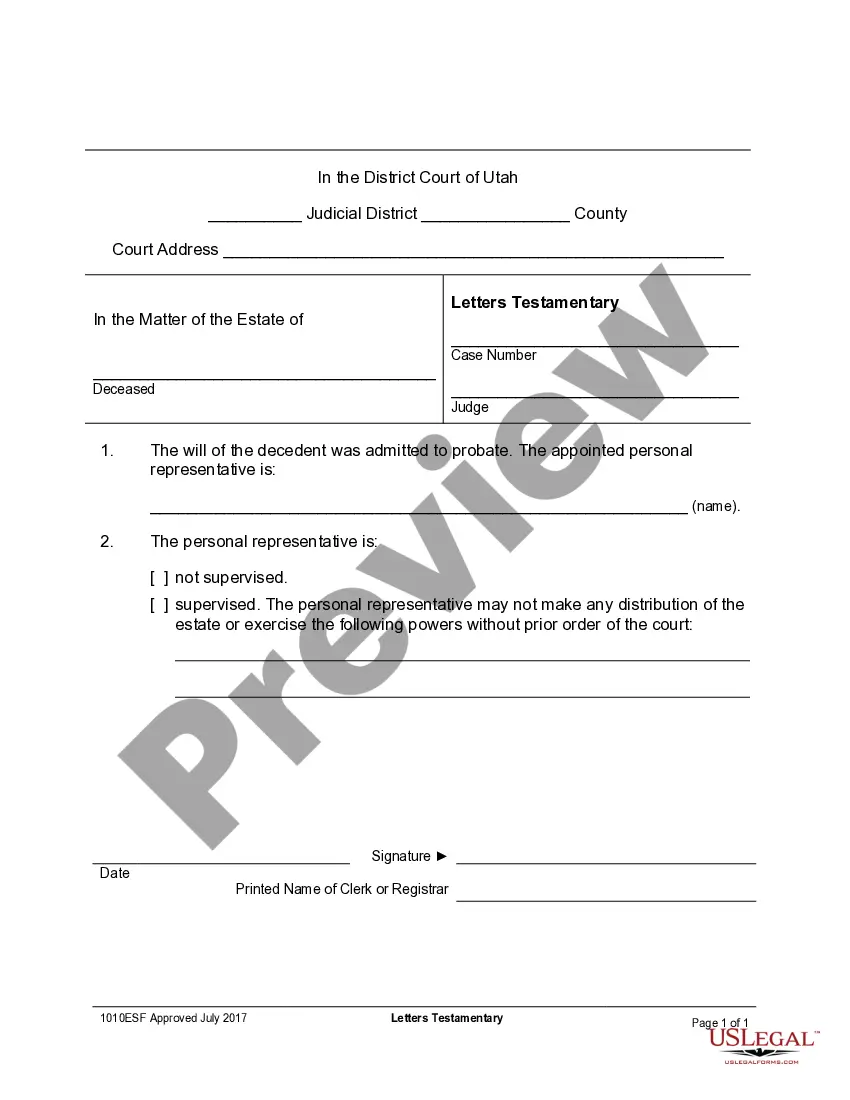

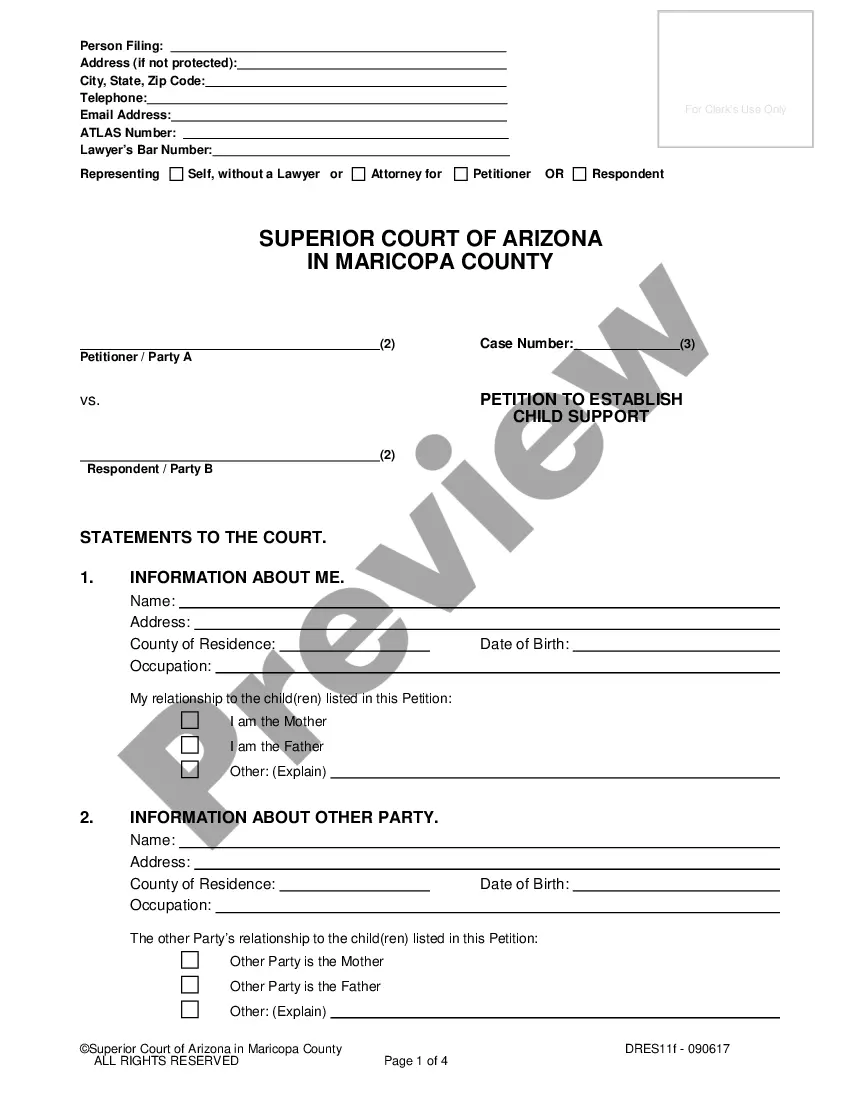

- Use the Review button to examine the document.

- Read the details to confirm you have selected the appropriate form.

- If the document isn't what you're looking for, utilize the Search section to find the template that fits your needs.

Form popularity

FAQ

The independent contractor agreement in Alaska is a legal document that outlines the terms between a company and an independent contractor. This agreement clarifies the duties, compensation, and duration of the work while ensuring both parties understand their rights. It is essential for compliance with state law and for protecting intellectual property and confidentiality. For your needs, consider the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor from USLegalForms to create a solid foundation.

Writing an independent contractor agreement involves outlining key elements such as the project description, payment terms, and obligations. Clearly define the relationship by stating that the contractor is not an employee and is responsible for their taxes. Use straightforward language to avoid confusion and protect both parties' interests. Utilize the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor template from USLegalForms for a comprehensive outline.

Filling out an independent contractor form requires you to provide essential information about both the contractor and the hiring party. Enter the contractor’s tax ID information and details about the services they will provide. Ensure you include payment details, including rates and schedules. For a structured approach, consider using the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor resources on USLegalForms.

To fill out an independent contractor agreement, start by clearly identifying the parties involved, including their legal names and addresses. Specify the scope of work, payment terms, and deadlines, which helps set clear expectations. Additionally, include confidentiality clauses and ownership of work to protect both parties. Consider using the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor template available on USLegalForms for guidance and compliance.

To provide proof of employment as an independent contractor, a well-structured contract serves as a critical document. Additionally, invoices and the 1099 tax form can back up your claims. With the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor, you can secure the evidence needed to validate your independent status.

The key difference lies in the level of control and independence. Independent contractors work independently and set their schedules, while employees have a set salary and are governed by employer policies. Clarifying this distinction through an Alaska Data Entry Employment Contract - Self-Employed Independent Contractor can protect your rights and outline expectations.

Indeed, an independent contractor is classified under self-employment. This classification not only impacts your tax obligations but also shapes your rights and responsibilities. Understanding this distinction is essential when entering into an Alaska Data Entry Employment Contract - Self-Employed Independent Contractor.

Yes, if you receive a 1099 form, it typically indicates that you are self-employed. This tax form is issued to independent contractors to report income earned. Hence, having an Alaska Data Entry Employment Contract - Self-Employed Independent Contractor effectively supports your self-employment status and tax documentation.

Absolutely, self-employed individuals can and should have contracts for their projects. A well-structured contract provides clear expectations and protection for both parties involved. Using the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor ensures that you have a solid framework to work within your independent endeavors.

The new federal rule aims to streamline the classification of independent contractors, providing more clarity on who qualifies for this status. This change impacts how businesses view their workforce and may influence future contracts. Understanding the Alaska Data Entry Employment Contract - Self-Employed Independent Contractor will help you navigate these regulations confidently.