Alaska Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a range of legal template categories you can download or print.

While navigating the website, you can find a multitude of forms for professional and personal purposes, organized by categories, states, or keywords. You can access the most current versions of forms like the Alaska Qualified Written RESPA Request to Dispute or Validate Debt in just moments.

If you possess a membership, Log In and download the Alaska Qualified Written RESPA Request to Dispute or Validate Debt from the US Legal Forms library. The Download button will be available on every form you view. You can also find all previously saved forms under the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Complete, modify, and print the downloaded Alaska Qualified Written RESPA Request to Dispute or Validate Debt. Each template you add to your account does not expire and remains yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you need. Access the Alaska Qualified Written RESPA Request to Dispute or Validate Debt with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the appropriate form for your city/state.

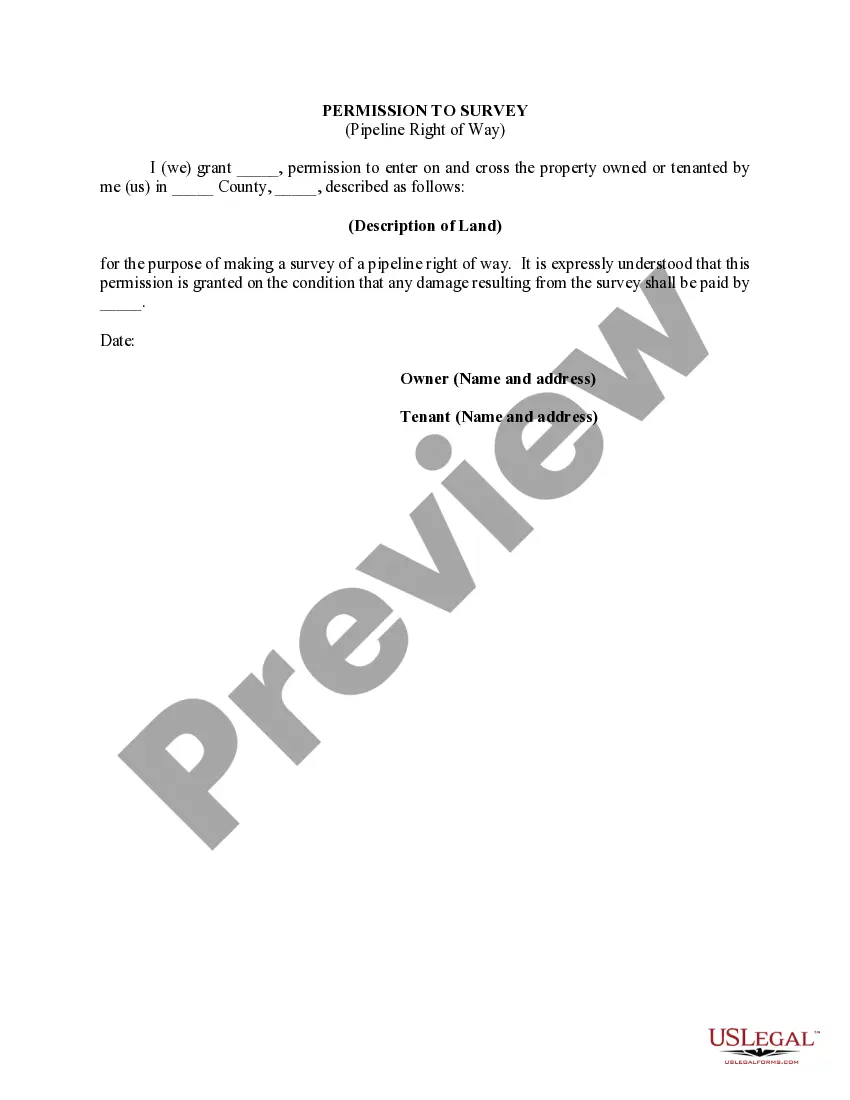

- Click the Preview button to review the form's details.

- Read the form description to confirm that you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Filling out a debt validation letter involves including your personal information, the details of the debt, and a clear request for validation. Make sure to ask for specific documentation, such as the account statement and original contract. Leveraging an Alaska Qualified Written RESPA Request to Dispute or Validate Debt can simplify this process, ensuring that your letter is comprehensive and effective.

Yes, a debt validation letter is a smart approach for managing your debts effectively. It forces creditors to provide proof of the debt, ensuring that you are not responsible for erroneous charges. By using an Alaska Qualified Written RESPA Request to Dispute or Validate Debt, you gain leverage in your interactions with creditors, promoting fair communication and resolution.

An example of a debt validation letter includes a request for confirmation of the debt amount, details of the original creditor, and evidence that the debt is valid. This letter acts as a formal way of seeking clarity about any outstanding debt. Utilizing an Alaska Qualified Written RESPA Request to Dispute or Validate Debt can help you formulate an effective debt validation letter tailored to your situation.

A certified letter to validate debt is a formal communication you send to a creditor, requesting proof that the debt is yours and valid. By using an Alaska Qualified Written RESPA Request to Dispute or Validate Debt, you can ensure your rights are protected. This letter provides a paper trail that proves you've made the request, which is beneficial if further action becomes necessary. If you want guidance in preparing this letter, UsLegalForms can provide templates to simplify the process.

To obtain a debt validation letter, start by sending an Alaska Qualified Written RESPA Request to Dispute or Validate Debt to your creditor. This request formally asks them to verify that the debt is valid and includes details regarding its origin. Under the Fair Debt Collection Practices Act, they are required to respond to your request in a timely manner. If you need assistance in drafting your request, consider using the resources available on the UsLegalForms platform.

Debt validation dispute refers to the process where you challenge a debt by requesting proof of its validity from the collector. By issuing an Alaska Qualified Written RESPA Request to Dispute or Validate Debt, you ensure that you are not liable for unsubstantiated claims. This process helps clarify your financial history and can protect you against unfair practices. Empowering yourself in this way leads to better financial decision-making.

When you dispute a debt collection, the debt collector must stop all collection activities until they validate the debt. They must respond to your Alaska Qualified Written RESPA Request to Dispute or Validate Debt with sufficient proof. Failure to do so means they cannot pursue the debt further, providing you with a significant advantage in your financial dealings. It is a step towards securing your rights.

A debt validation dispute arises when you formally challenge a debt's validity, demanding proof from the collector. Using an Alaska Qualified Written RESPA Request to Dispute or Validate Debt signals your intent to verify the legitimacy of the claim. This process not only protects you but also allows you to hold debt collectors accountable for their actions. It is an important tool in debt management.

If a debt collector fails to validate the debt after receiving your Alaska Qualified Written RESPA Request to Dispute or Validate Debt, they must cease collection efforts. This lack of validation indicates that they may not have a legitimate claim against you. You can use this opportunity to claim your rights under the Fair Debt Collection Practices Act to ensure that your financial health stays intact.

A debt verification letter confirms that a debt exists, while a validation letter goes further by including details about the debt. When you use an Alaska Qualified Written RESPA Request to Dispute or Validate Debt, you request the debt collector to provide detailed information and evidence regarding the account. Understanding this distinction helps you in disputing potentially invalid debts more effectively.