Alaska Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

How to fill out Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Are you presently within a situation that you will need paperwork for possibly company or individual purposes nearly every day time? There are a variety of legitimate record templates available on the Internet, but discovering versions you can depend on is not simple. US Legal Forms provides a large number of kind templates, just like the Alaska Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, that happen to be created to fulfill state and federal demands.

When you are previously acquainted with US Legal Forms web site and also have an account, merely log in. Following that, you are able to obtain the Alaska Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit web template.

Should you not have an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for your appropriate metropolis/county.

- Use the Review key to check the shape.

- Read the outline to ensure that you have selected the right kind.

- When the kind is not what you are seeking, make use of the Search area to find the kind that fits your needs and demands.

- Whenever you obtain the appropriate kind, click Purchase now.

- Select the pricing prepare you would like, submit the required details to produce your money, and pay money for your order using your PayPal or credit card.

- Choose a convenient paper formatting and obtain your duplicate.

Find every one of the record templates you possess purchased in the My Forms food selection. You can aquire a additional duplicate of Alaska Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit any time, if needed. Just click on the essential kind to obtain or produce the record web template.

Use US Legal Forms, by far the most extensive selection of legitimate forms, to save lots of some time and prevent blunders. The services provides appropriately made legitimate record templates that can be used for a range of purposes. Generate an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

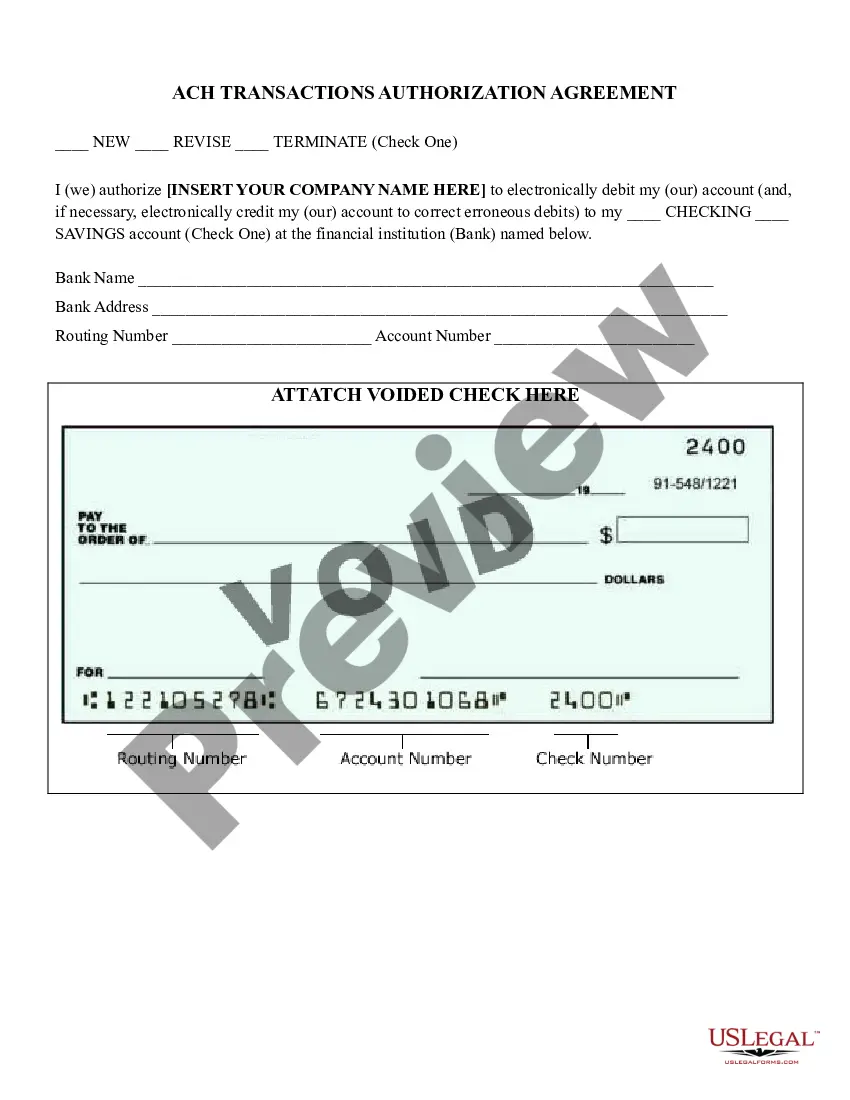

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

If a creditor has security interest in your property, it will likely be outlined in a security agreement. This important contract should not be entered into without careful consideration, as a default could lead to harsh consequences.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

If the debtor defaults, the lender can gain all rights to the property, as laid under the security agreement. Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property.

A security interest exists when a borrower enters into a contract that allows the lender or secured party to take collateral that the borrower owns in the event that the borrower cannot pay back the loan. The term security interest is often used interchangeably with the term lien in the United States.

Key Takeaways A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A bank or lender can request collateral for large loans for which the money is being used to purchase a specific asset or in cases where your credit scores aren't sufficient to qualify for an unsecured loan.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.