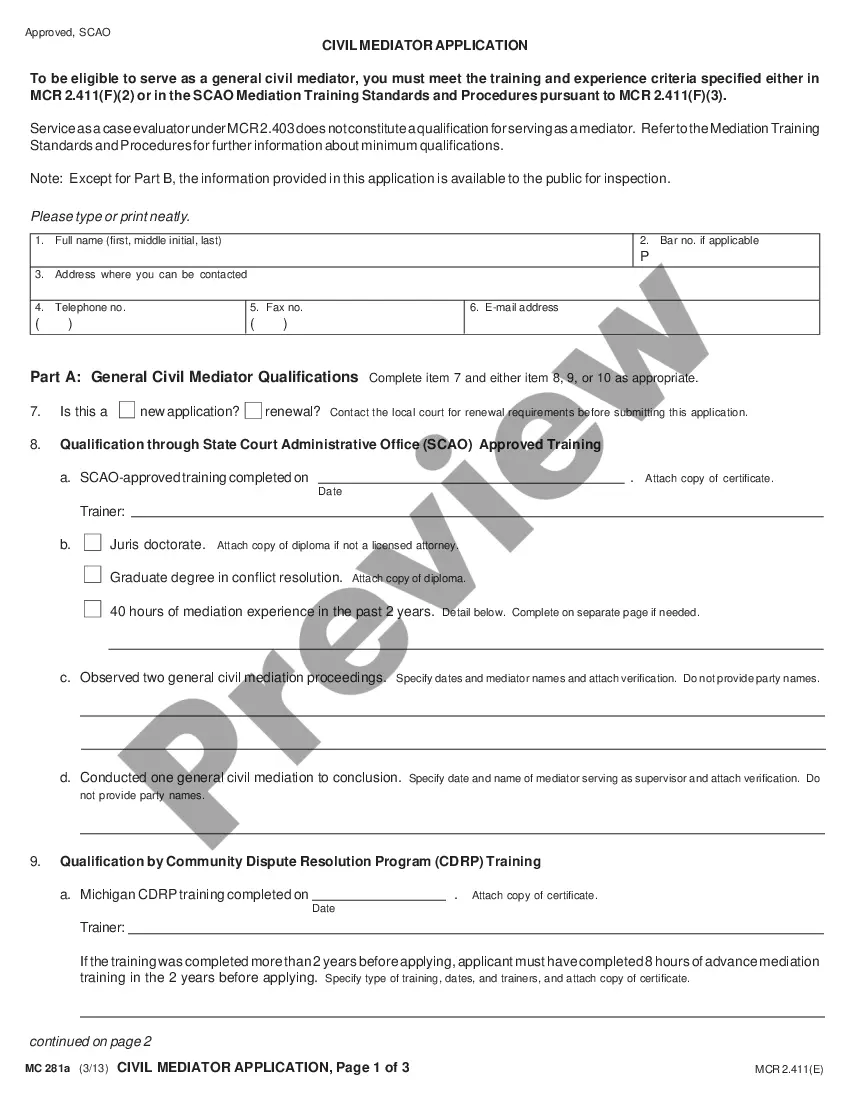

Alaska Electronic Services Form

Description

How to fill out Electronic Services Form?

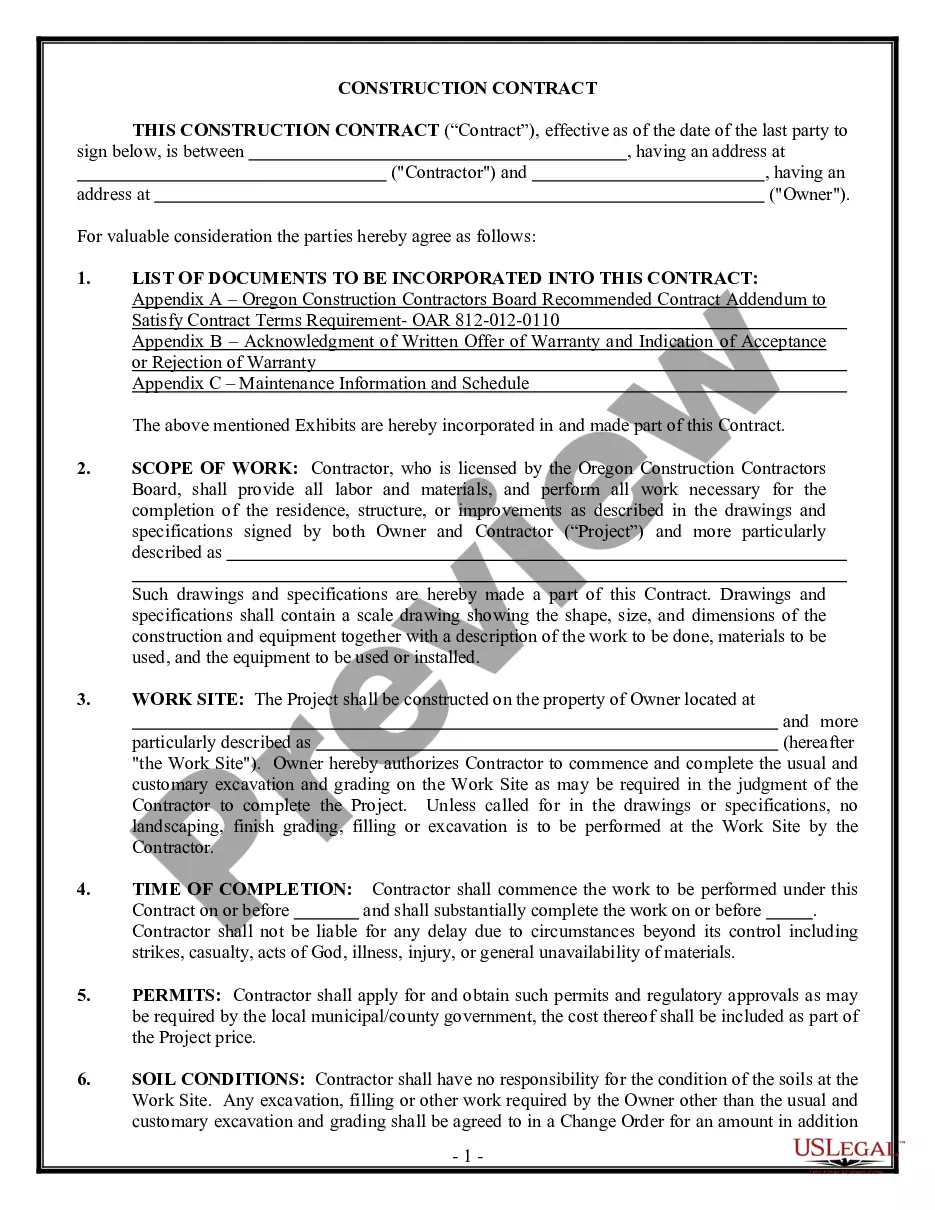

US Legal Forms - one of the greatest libraries of authorized varieties in America - offers a wide range of authorized record themes you are able to down load or print. Utilizing the internet site, you can get 1000s of varieties for business and individual functions, categorized by types, claims, or keywords.You can get the newest models of varieties such as the Alaska Electronic Services Form within minutes.

If you currently have a registration, log in and down load Alaska Electronic Services Form through the US Legal Forms collection. The Download button will appear on every single develop you look at. You gain access to all previously downloaded varieties within the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, listed below are straightforward recommendations to get you started out:

- Ensure you have picked out the proper develop to your city/state. Click on the Preview button to examine the form`s content material. Browse the develop explanation to ensure that you have chosen the right develop.

- In the event the develop does not match your demands, utilize the Research discipline near the top of the screen to discover the one that does.

- In case you are happy with the form, verify your selection by clicking the Get now button. Then, opt for the rates prepare you want and give your credentials to sign up for the accounts.

- Approach the transaction. Make use of credit card or PayPal accounts to finish the transaction.

- Find the file format and down load the form on your product.

- Make alterations. Complete, modify and print and indication the downloaded Alaska Electronic Services Form.

Each format you included in your money does not have an expiration day and is yours eternally. So, in order to down load or print yet another copy, just proceed to the My Forms portion and click on around the develop you require.

Obtain access to the Alaska Electronic Services Form with US Legal Forms, by far the most comprehensive collection of authorized record themes. Use 1000s of expert and status-distinct themes that fulfill your business or individual requires and demands.

Form popularity

FAQ

How much does it cost to form an LLC in Alaska? The Alaska Division of Corporations charges $250 to file the Articles of Organization. You can reserve your LLC name with the Alaska Division of Corporations for $25.

LLC members' income is taxed at the 15.3% federal self-employment tax rate (12.4% for social security and 2.9% for Medicare). Alaska is the only state with both no personal income tax and no sales tax, but your LLC may need to pay taxes to your local municipality or borough.

Alaska LLC Formation Filing Fee: $250 The main cost of starting an Alaska LLC is the $250 fee to file the Alaska Articles of Organization with the Division of Corporations. Filing this document officially forms your LLC, and you can file online, by mail, or in person.

Signed Request to Cancel License or LOA You may submit a signed request to cancel a license or line of authority. Please allow five working days for request to be processed. Send to insurance@alaska.gov, our mailing address at bottom of page, or fax to 907-465-2816.

How to Start a corporation in California Choose a name for your business. ... Designate a Registered Agent in California. ... File Your Articles of Incorporation in California. ... Create your Corporate Bylaws. ... Appoint your Corporate Directors. ... Hold the First Meeting of the Board of Directors. ... Authorize the issuance of shares of stock.

For fees and tax purposes, the LLC is probably your best choice. An Alaska LLC will only get taxed once, in the form of personal income taxes for each member. An Alaska Corporation will be subject to double taxation: first through a state corporate tax, and second on the individual tax returns of shareholders.

Alaska requires corporations to file a biennial report. The first report must be filed by January 2 of the year following incorporation and every two years thereafter. The report is considered delinquent if not filed before February 1 and fees and penalties may apply.

To start a corporation in Alaska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the State of Alaska Corporations Section. You can file the document online or by mail. The Articles of Incorporation cost $250 to file.

Beyond your federal EIN, you'll also need an Alaska business license, which costs $50 per year for each business name under which you operate. If you have one legal name plus a DBA, you'll need two business licenses for $100. You may also need to register for state business taxes specific to your industry.