Alaska Uniform Residential Loan Application

Description

How to fill out Uniform Residential Loan Application?

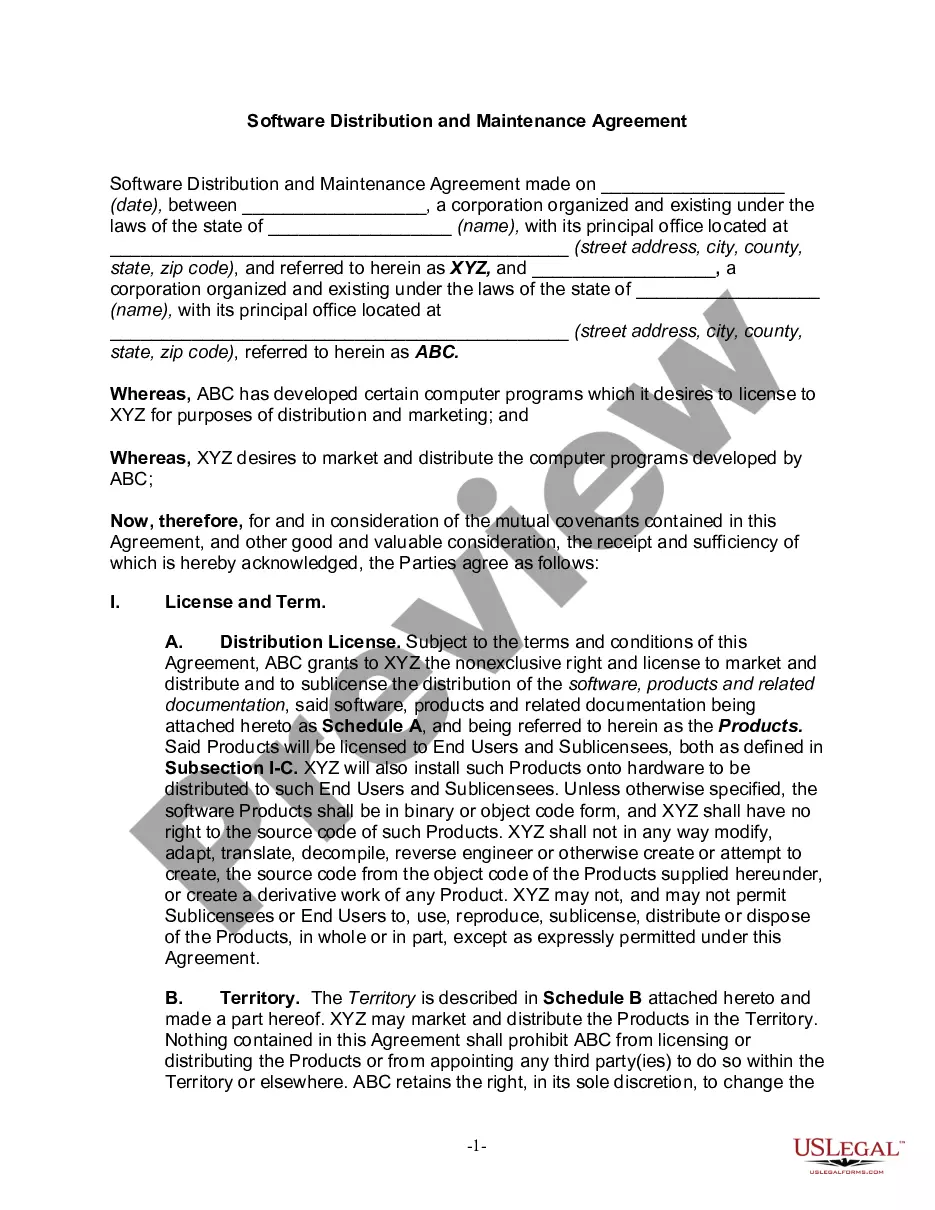

Are you presently inside a placement where you need files for both business or individual functions almost every day time? There are tons of lawful file layouts accessible on the Internet, but discovering kinds you can rely on isn`t simple. US Legal Forms gives thousands of type layouts, like the Alaska Uniform Residential Loan Application, which are written to fulfill state and federal demands.

In case you are previously knowledgeable about US Legal Forms website and also have an account, basically log in. Following that, you can obtain the Alaska Uniform Residential Loan Application design.

Should you not offer an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the type you want and ensure it is to the correct metropolis/county.

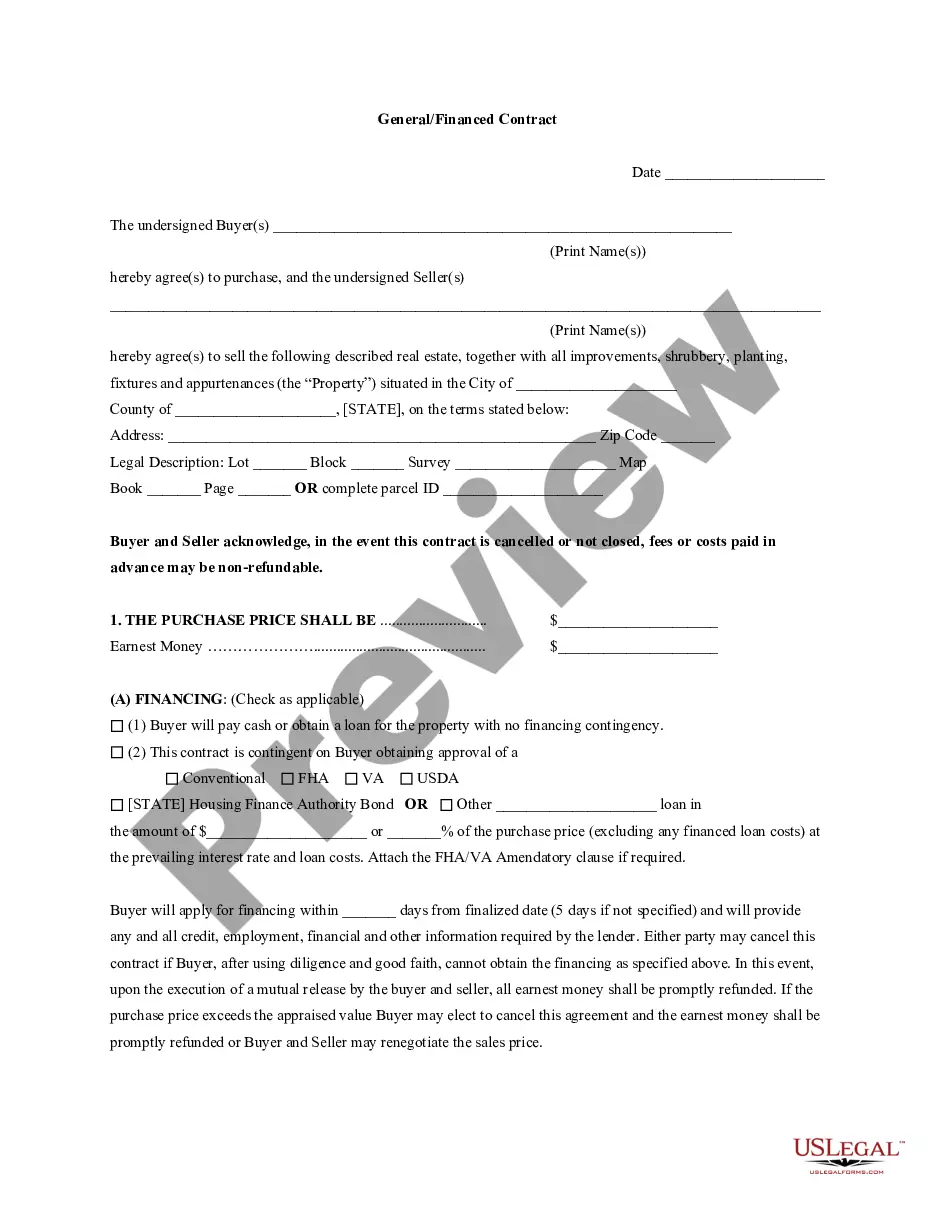

- Take advantage of the Review key to examine the form.

- Browse the information to actually have chosen the correct type.

- In case the type isn`t what you`re trying to find, make use of the Search field to obtain the type that meets your requirements and demands.

- Whenever you discover the correct type, just click Buy now.

- Choose the rates program you would like, fill out the required info to create your bank account, and pay for an order making use of your PayPal or credit card.

- Decide on a handy paper structure and obtain your duplicate.

Locate each of the file layouts you have purchased in the My Forms menu. You can obtain a more duplicate of Alaska Uniform Residential Loan Application anytime, if needed. Just click the needed type to obtain or print the file design.

Use US Legal Forms, probably the most substantial selection of lawful varieties, in order to save some time and steer clear of faults. The service gives skillfully created lawful file layouts that can be used for an array of functions. Make an account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older. This information only applies to Home Equity Conversion Mortgages (HECMs), which are the most common type of reverse mortgage loans.

The new mandate date for the use of the redesigned URLA and AUS specifications is March 1, 2021.

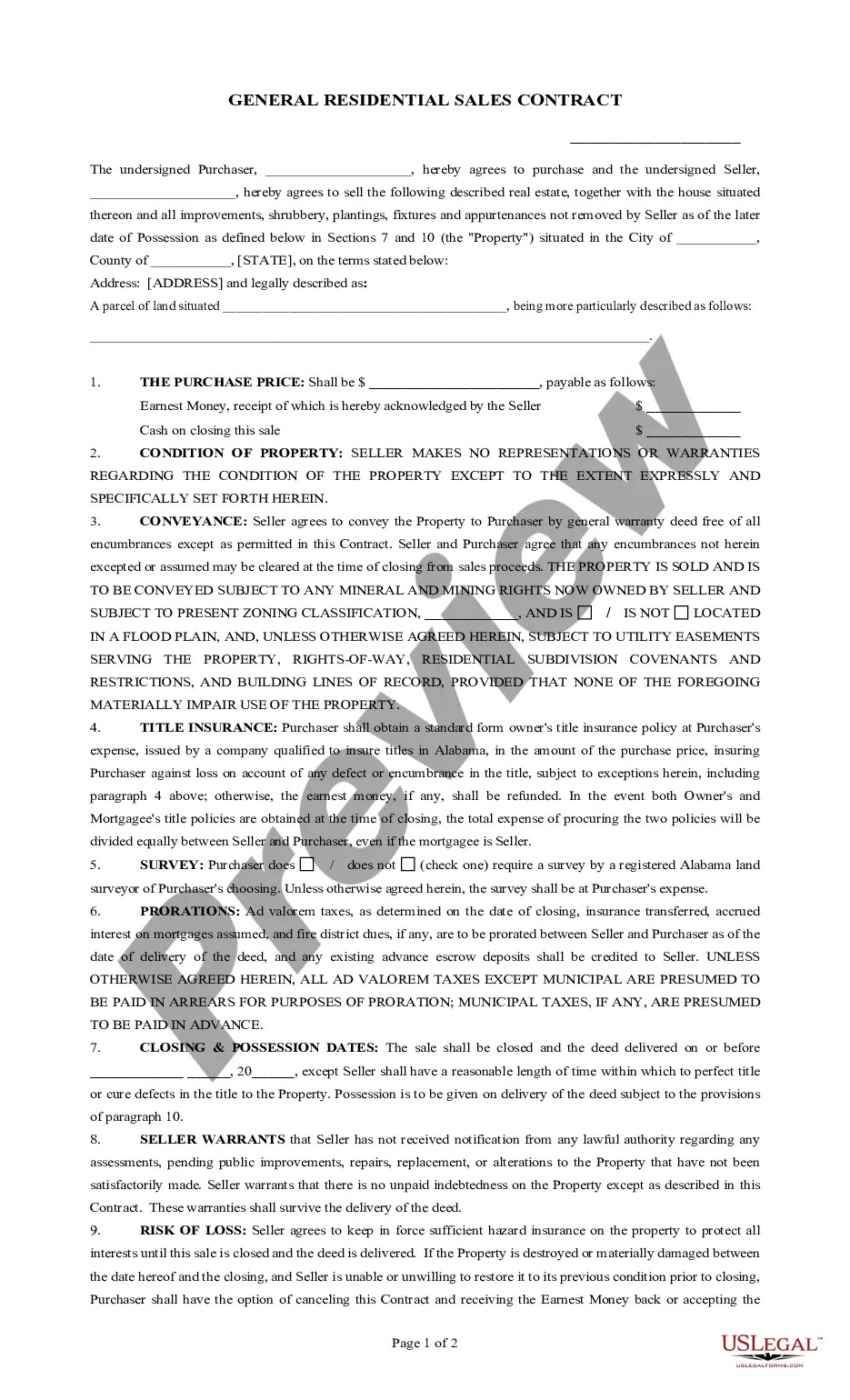

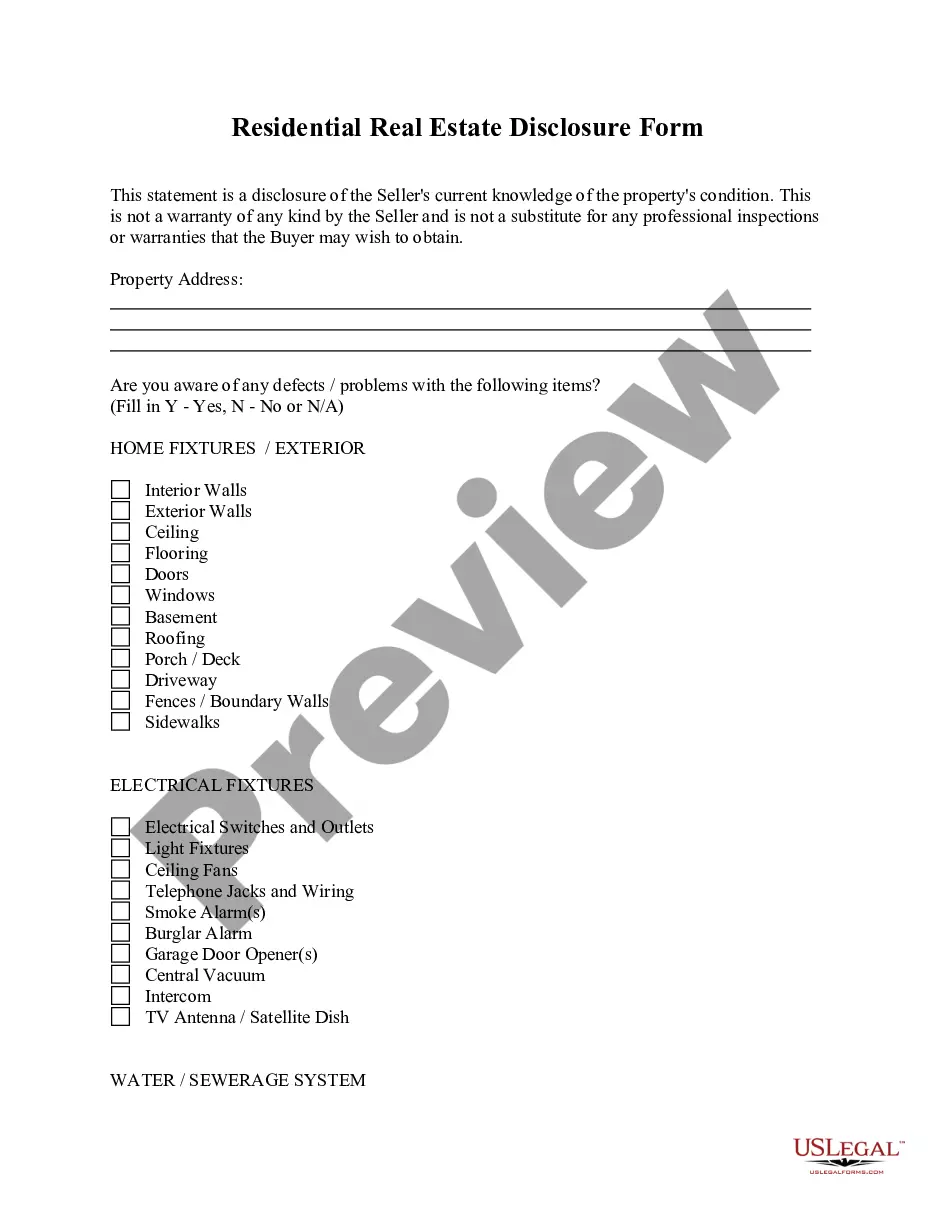

What Is a Mortgage Application? A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

After years of delays, including a year-long delay due to COVID-19, the release of the new Uniform Residential Loan Application (URLA) is about to happen. Starting March 1, 2021, all lenders who intend to sell closed residential mortgage loans to Fannie Mae or Freddie Mac will be required to use the new URLA.

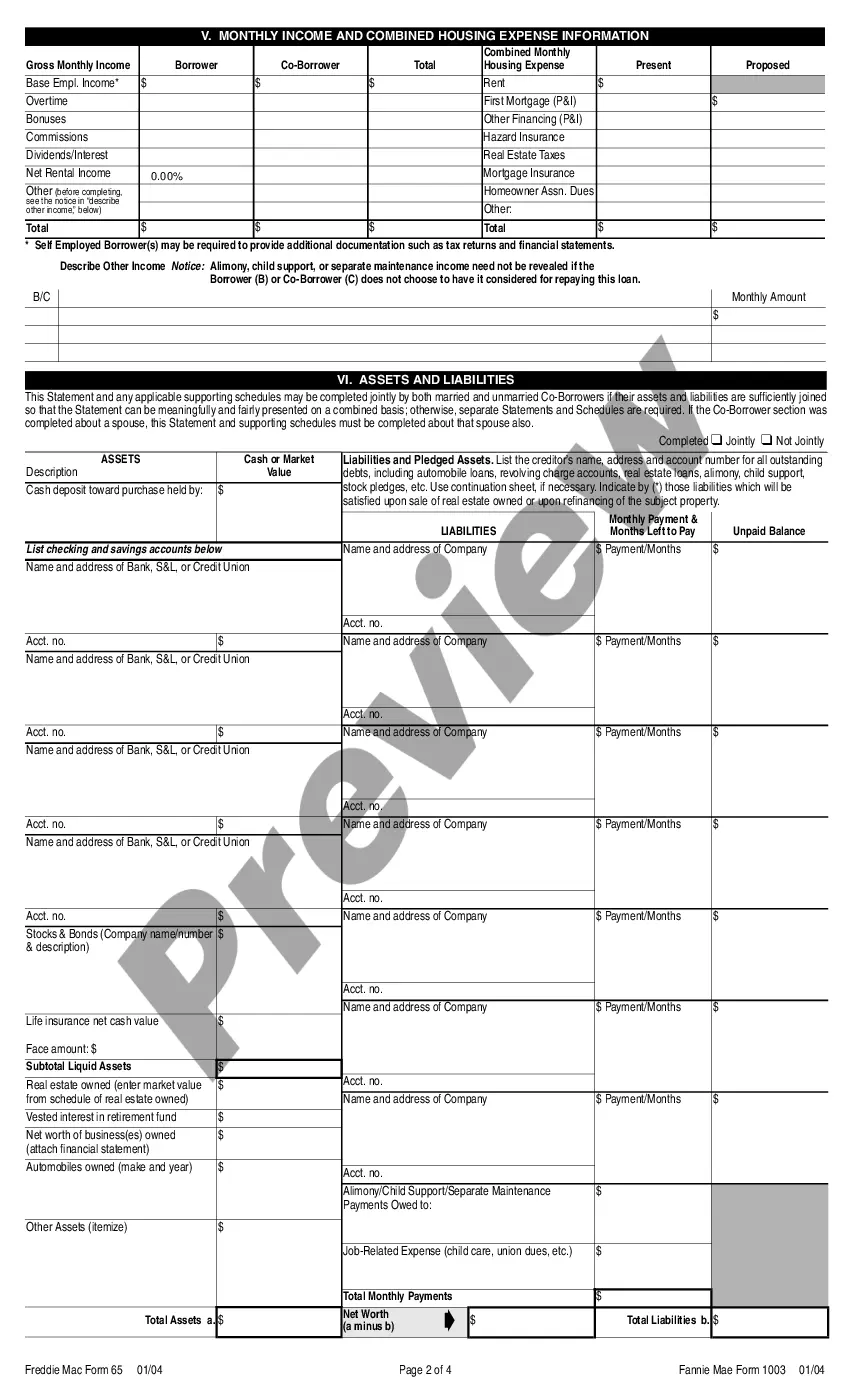

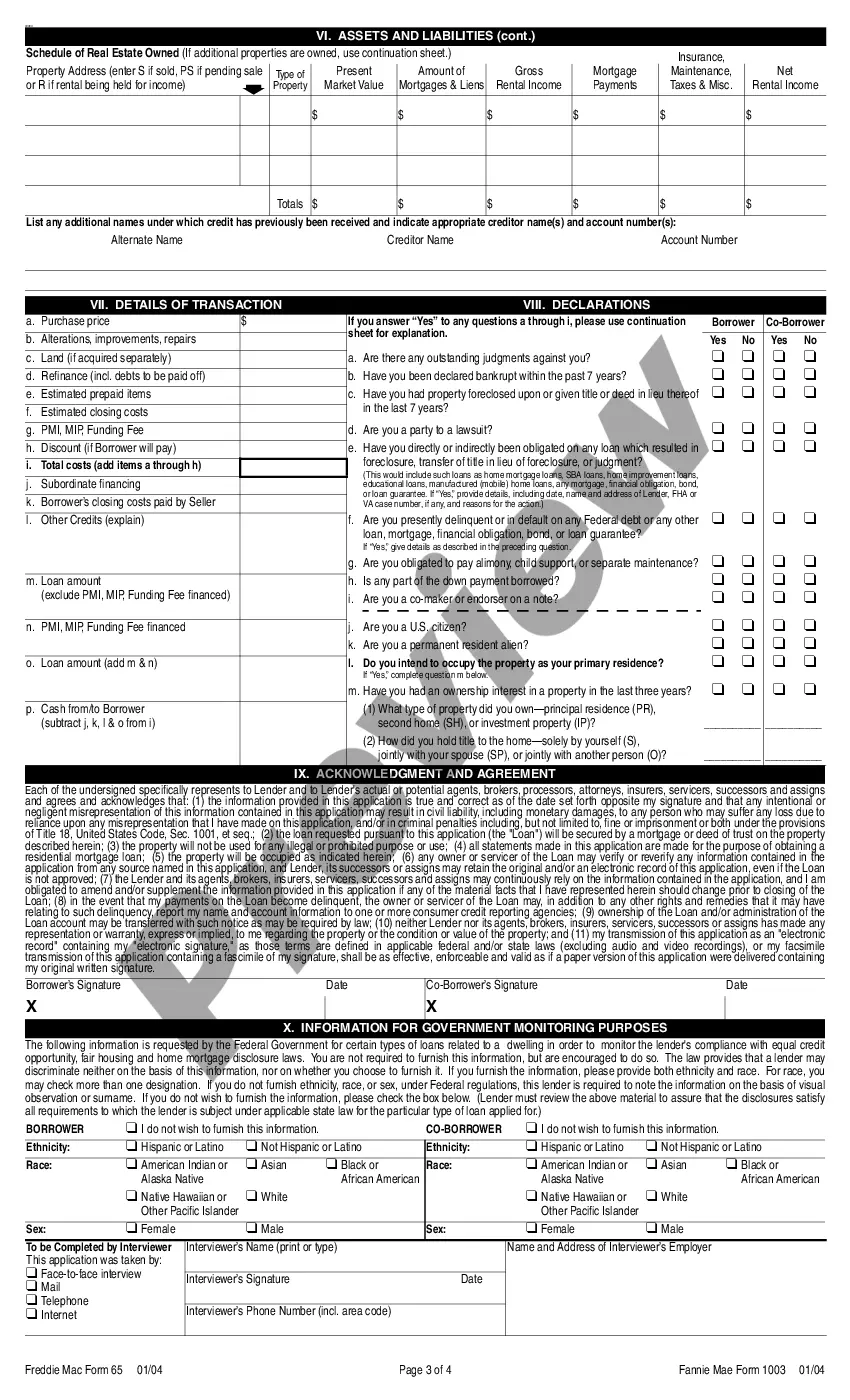

What is the Uniform Residential Loan Application? The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories.

Filling out a 1003 form is the first step you'll take to getting preapproved for a mortgage. Officially known as the uniform residential loan application ? URLA for short ? the 1003 application gives your lender the information required to determine whether you qualify for the loan you're applying for.

The redesigned URLA will replace Freddie Mac Form 65 and Fannie Mae Form 1003 and will require lenders to request more borrower information than ever. The new data fields include a wide range of information, such as: Borrower's mobile number(s) Borrower's email address(es)

No, the new URLA, like the existing 1003/65, does not include HELOC as a loan type.