Alaska Employees' Stock Deferral Plan for Norwest Corp.

Description

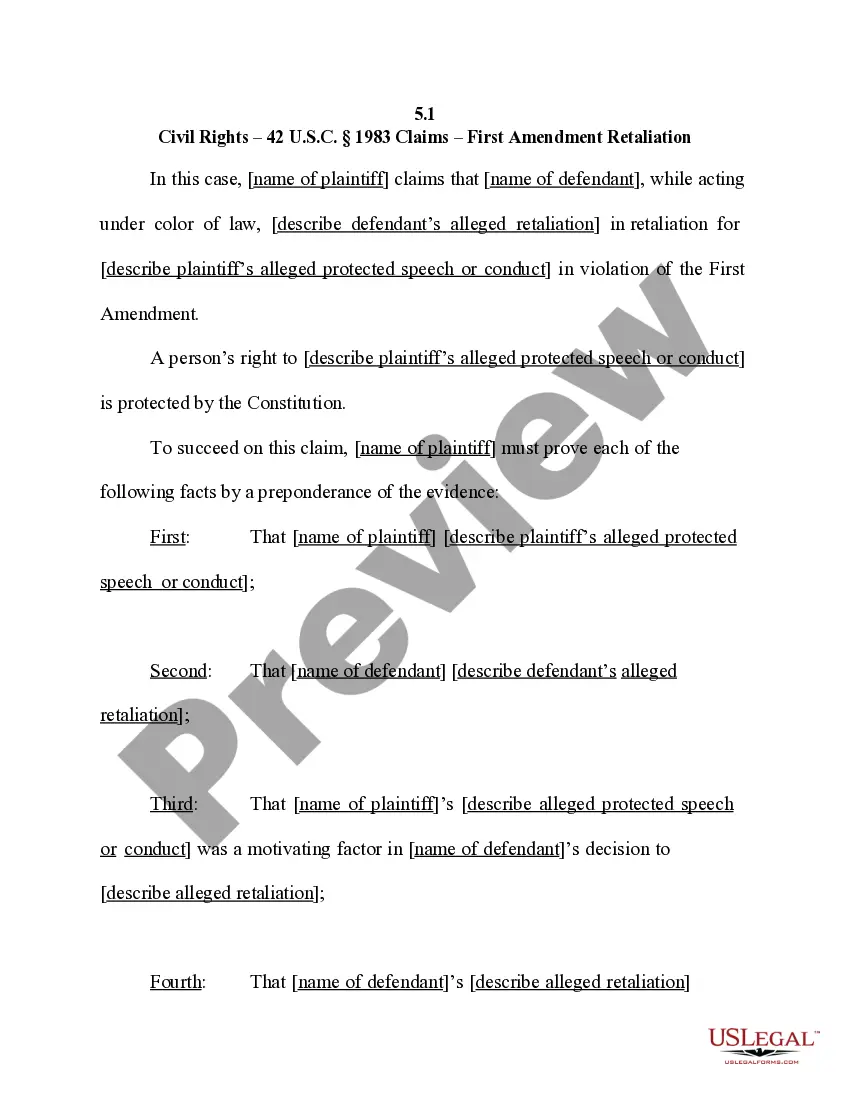

How to fill out Employees' Stock Deferral Plan For Norwest Corp.?

US Legal Forms - one of several greatest libraries of authorized kinds in the USA - offers a variety of authorized record layouts you may obtain or produce. Using the website, you can get 1000s of kinds for enterprise and specific purposes, sorted by categories, claims, or keywords and phrases.You will discover the most up-to-date variations of kinds such as the Alaska Employees' Stock Deferral Plan for Norwest Corp. within minutes.

If you already have a monthly subscription, log in and obtain Alaska Employees' Stock Deferral Plan for Norwest Corp. through the US Legal Forms catalogue. The Obtain option will appear on each and every develop you view. You have accessibility to all formerly saved kinds from the My Forms tab of your respective profile.

If you would like use US Legal Forms the first time, listed here are easy recommendations to get you started out:

- Be sure to have picked the proper develop for your personal city/region. Click on the Preview option to analyze the form`s information. Browse the develop explanation to actually have chosen the right develop.

- In case the develop does not satisfy your demands, take advantage of the Research discipline at the top of the display screen to find the one who does.

- Should you be satisfied with the form, affirm your decision by clicking the Get now option. Then, choose the prices plan you prefer and give your credentials to register for an profile.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal profile to finish the financial transaction.

- Select the format and obtain the form in your gadget.

- Make modifications. Fill out, edit and produce and indication the saved Alaska Employees' Stock Deferral Plan for Norwest Corp..

Every single design you added to your bank account does not have an expiry date and is also the one you have eternally. So, if you would like obtain or produce an additional duplicate, just check out the My Forms area and click on the develop you require.

Gain access to the Alaska Employees' Stock Deferral Plan for Norwest Corp. with US Legal Forms, by far the most substantial catalogue of authorized record layouts. Use 1000s of expert and state-particular layouts that satisfy your organization or specific requires and demands.

Form popularity

FAQ

These retirement plans allow workers to save and invest for retirement by setting aside some of their salaries for that purpose. By participating in a plan, you can receive tax benefits while giving your money the opportunity to grow. Most salary deferral plans also give you a degree of control over your money.

Depending on your plan provisions, the payment of the deferred compensation can also be structured to reduce your tax liability based on a series of installment payments or lump sum payments based on a specified time. By spreading out the payments, you potentially could reduce your income for each applicable year.

If the company goes bankrupt or cannot pay its bills, you may lose the compensation you deferred.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

An executive deferred compensation plan allows employers to defer a part of their executives' income so that they will pay taxes on it later when they start withdrawing from it.

The employer must adopt an irrevocable resolution to terminate the plan during a period that begins 30 days prior to closing and ends 12 months after closing, and the plan must be liquidated within 12 months after the resolution is adopted.

The Deferred Compensation Plan allows you to voluntarily set aside a portion of your income either before it is taxed or after it has been taxed. The amount set aside, plus any change in value (interest, gains and losses), is payable to you or your beneficiary at a future date.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.