Alaska Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

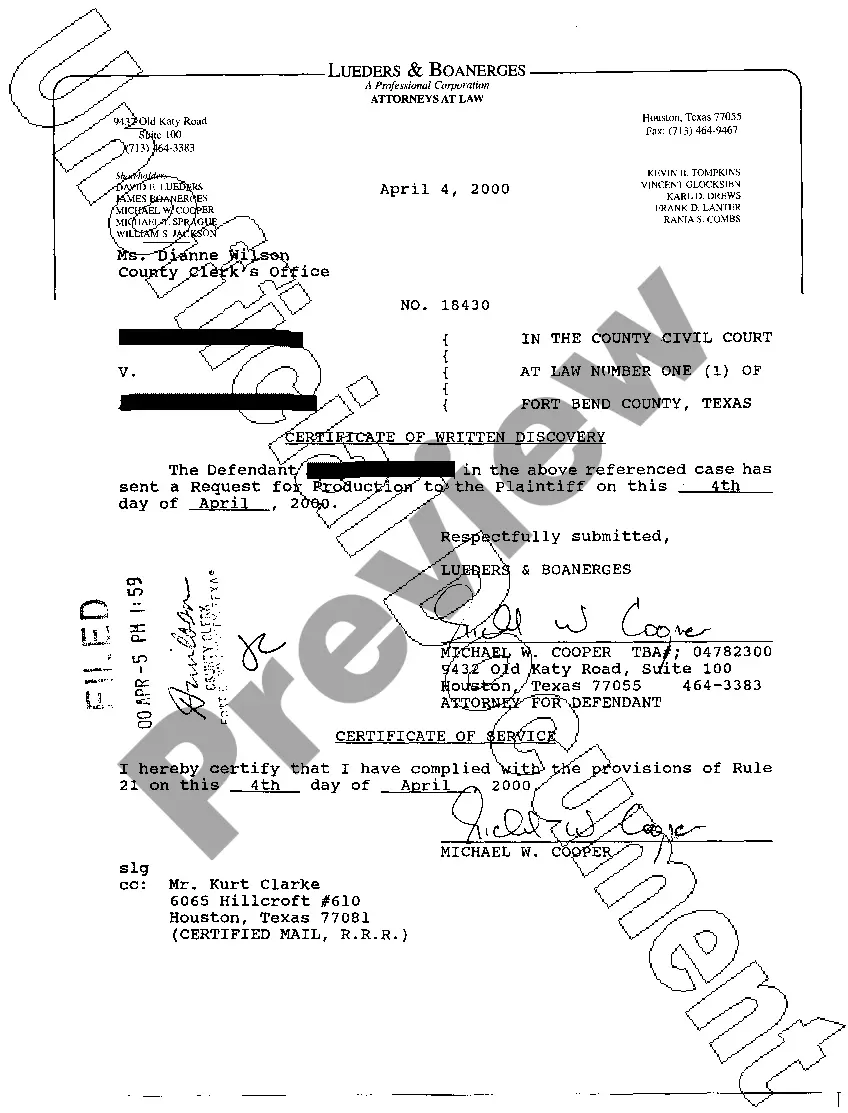

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

If you want to full, acquire, or produce legal record layouts, use US Legal Forms, the most important assortment of legal types, which can be found on-line. Use the site`s easy and hassle-free search to find the papers you will need. Numerous layouts for enterprise and individual reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Alaska Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation with a number of clicks.

When you are currently a US Legal Forms consumer, log in to your profile and click on the Down load option to have the Alaska Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Also you can entry types you formerly delivered electronically within the My Forms tab of the profile.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form for your right city/nation.

- Step 2. Utilize the Preview method to look through the form`s content material. Don`t neglect to see the description.

- Step 3. When you are unhappy with all the type, make use of the Search discipline near the top of the display to get other models of your legal type template.

- Step 4. Once you have discovered the form you will need, go through the Purchase now option. Opt for the prices plan you favor and add your accreditations to register on an profile.

- Step 5. Method the deal. You can utilize your charge card or PayPal profile to perform the deal.

- Step 6. Choose the structure of your legal type and acquire it on the product.

- Step 7. Comprehensive, edit and produce or sign the Alaska Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

Every single legal record template you buy is your own property permanently. You have acces to every single type you delivered electronically within your acccount. Click on the My Forms section and select a type to produce or acquire again.

Compete and acquire, and produce the Alaska Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation with US Legal Forms. There are millions of expert and condition-distinct types you may use to your enterprise or individual demands.

Form popularity

FAQ

There are a few outcomes for stock options when a company goes private. Stock options holders could receive a cash payment for cancelled shares or have their shares substituted to a successor entity. If you work for a company when this happens, the company may accelerate or terminate your vesting plan.

When an underlying security is converted into a right to receive a fixed amount of cash, options on that security will generally be adjusted to require the delivery upon exercise of a fixed amount of cash. Additionally, trading in the options will cease when the merger becomes effective.

A conventional stock split is a fairly clean increase of position size and a strike price adjustment and doesn't affect the value of an options position. It only means that the investor will be holding a greater number of contracts at a lower price.

When and how you should exercise your stock options will depend on a number of factors. First, you'll likely want to wait until the company goes public, assuming it will. If you don't wait, and your company doesn't go public, your shares may become worth less than you paid ? or even worthless.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

A listing exchange decides to halt trading of an underlying security. Trading of options on these securities subsequently is halted across all listing option exchanges. The trading halt may be brief or long-term in duration. The listing exchange may eventually make the decision to resume trading.

This is called vesting. You can exercise your NSOs as soon as they vest, but you can also choose not to exercise. If you choose to exercise, you can either pay the strike price in cash or, if your company allows it, sell a portion of your shares to cover the cost of exercise (referred to as a ?cashless? exercise).

Unvested Options ? Depending on the structure of the deal, there are three possibilities for unvested options. The holdings could be canceled, they might be converted to cash and paid out over time, or they could be converted to the acquiring company stock and subject to a new vesting schedule.