Alaska Agreement to Reimburse for Insurance Premium

Description

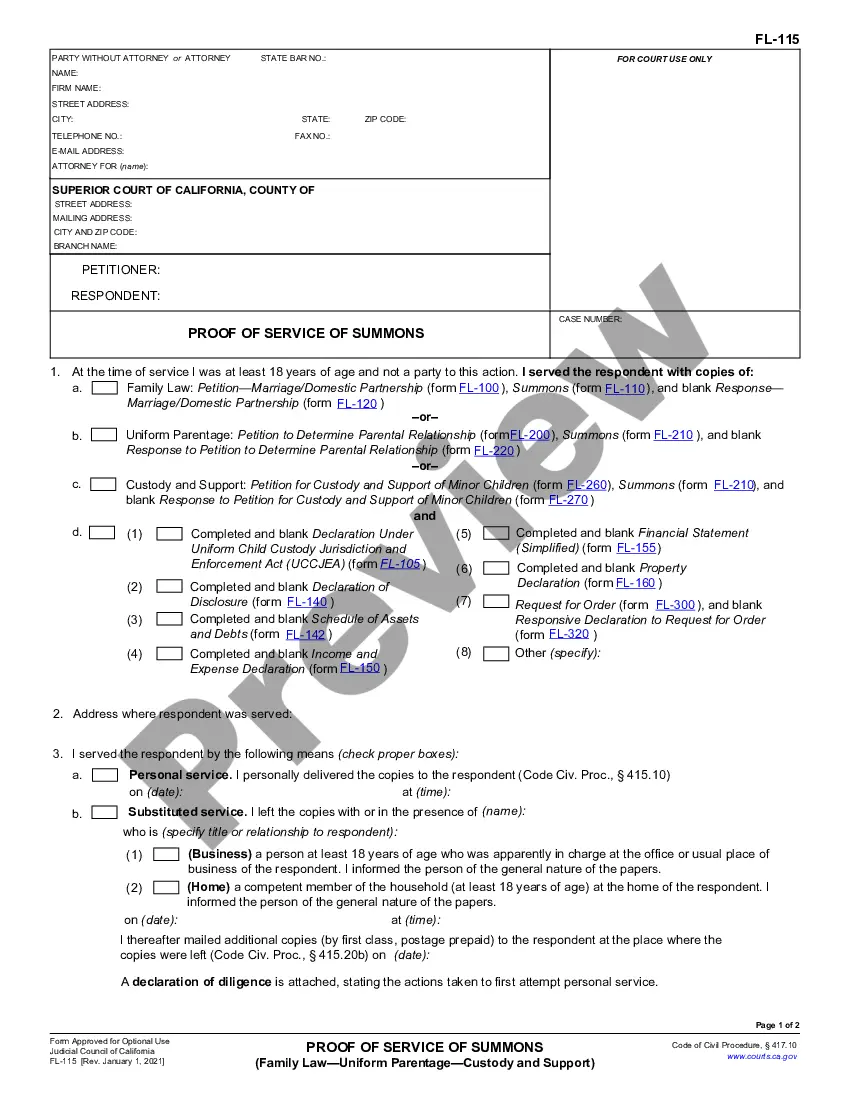

How to fill out Agreement To Reimburse For Insurance Premium?

You can spend hours online searching for the legal document template that satisfies the state and federal standards you require.

US Legal Forms provides thousands of legal templates that are vetted by specialists.

It is easy to obtain or print the Alaska Agreement to Reimburse for Insurance Premium from our service.

If you wish to find another version of the template, use the Search field to locate the template that fulfills your needs and criteria. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make alterations to your document if needed. You can complete, edit, and sign and print the Alaska Agreement to Reimburse for Insurance Premium. Download and print thousands of document templates using the US Legal Forms website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Alaska Agreement to Reimburse for Insurance Premium.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any bought document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Review the template description to ensure you have chosen the right one.

- If available, use the Preview button to examine the document template as well.

Form popularity

FAQ

Insurance is a legal agreement between two parties i.e. the insurance company (insurer) and the individual (insured). In this, the insurance company promises to make good the losses of the insured on happening of the insured contingency. The contingency is the event which causes a loss.

An insurer gets the money up front from customers, in the form of policy payments. They may or may not have to pay off a claim on that policy, and they can put the money to work for them right away earning investment income on Wall Street.

In exchange for healthcare coverage, the insurer charges you a monthly premium. According to eHealth's recent study of ACA plans, in 2020 the national average health insurance premium for an ACA plan is $456 for an individual and $1,152 for a family.

Under California law, if a provider does not contest a notice of overpayment, he or she is required to reimburse the insurance plan for the amount requested, within 30 working days of receipt of the notice.

The policy premium is a specific cost charged by the insurance company against a specified sum assured. Term life insurance premiums are decided through the policyholder's age, income, health, and life expectancy. The premium amount is fixed and paid throughout the policy term.

Unilateral Contract a contract in which only one party makes an enforceable promise. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. By contrast, the insured makes few, if any, enforceable promises to the insurer.

A promise to pay agreement is a promissory note. It details the amount of debt outstanding, the conditions under which the money will be repaid, the interest rate, and what will happen if the money is not repaid in a timely manner.

The basic concept of insurance being a promise is that you pay an insurance company, and they in turn promise to settle your claim should you have one. That is why it is essential to choose your agent and insurer with care. There Are Differences. A Captive Agent The individual insurance company pays these agents.

In most cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party, or their insurance company. The insured client receives payment promptly then the insurance company may pursue a subrogation claim against the party at fault for the loss.

The insuring clause contains the insurer's promise to pay benefits in the event of a covered loss. The consideration clause states that a policyowner must pay (5)2026