Alaska Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

How to fill out Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

Are you currently in the position the place you need papers for both business or personal functions virtually every working day? There are tons of lawful document layouts available on the Internet, but discovering ones you can depend on is not effortless. US Legal Forms delivers thousands of form layouts, much like the Alaska Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, that are created in order to meet federal and state demands.

If you are previously knowledgeable about US Legal Forms web site and get your account, merely log in. Next, you are able to acquire the Alaska Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service web template.

If you do not offer an accounts and wish to start using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for the proper town/state.

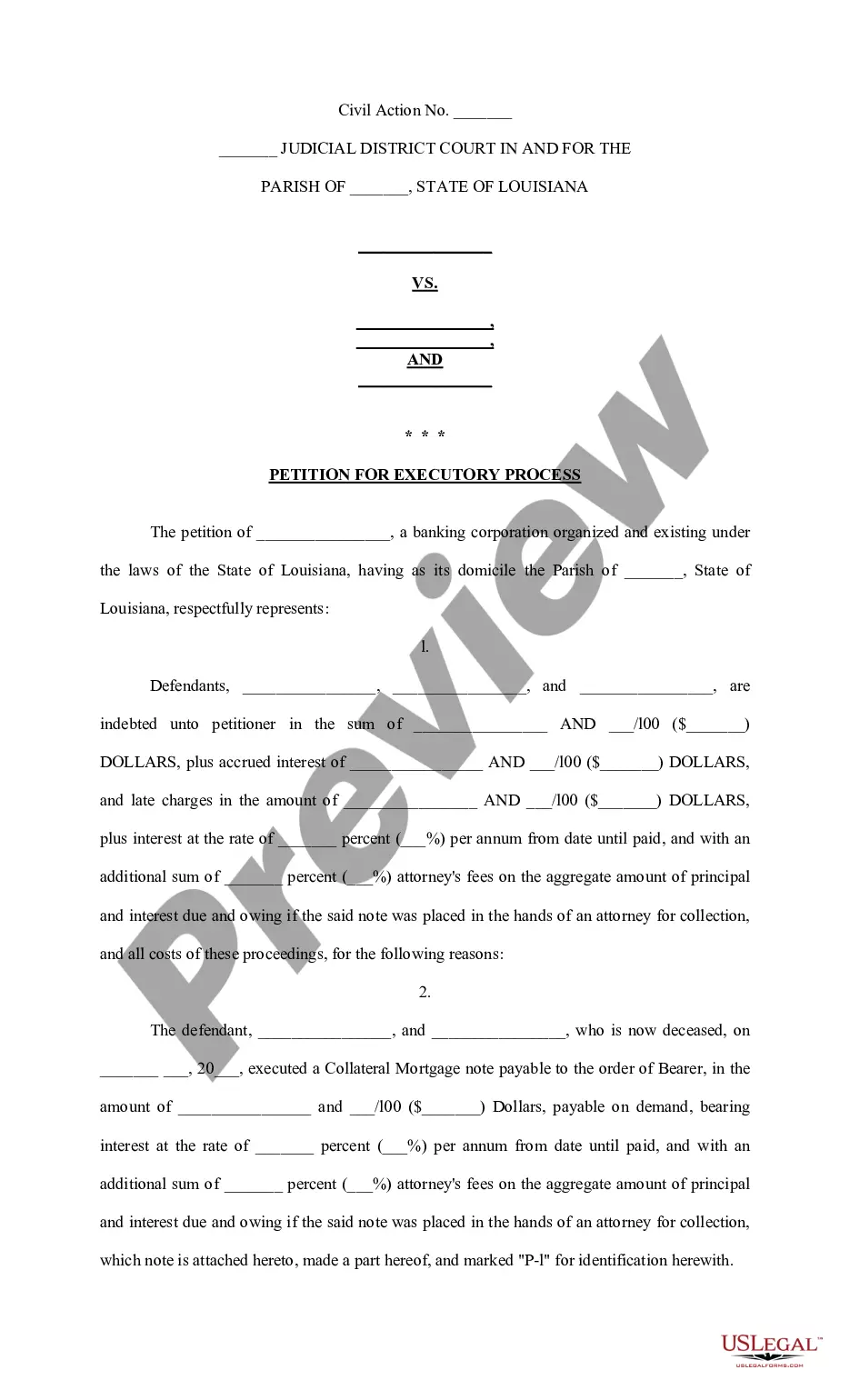

- Utilize the Review button to examine the shape.

- Look at the outline to ensure that you have selected the proper form.

- In case the form is not what you`re looking for, make use of the Search area to discover the form that meets your requirements and demands.

- When you obtain the proper form, just click Acquire now.

- Select the rates plan you desire, fill out the desired info to generate your account, and buy your order using your PayPal or charge card.

- Select a handy paper file format and acquire your backup.

Get all of the document layouts you have bought in the My Forms menu. You may get a extra backup of Alaska Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service at any time, if required. Just select the required form to acquire or print the document web template.

Use US Legal Forms, one of the most substantial selection of lawful kinds, to save time as well as steer clear of blunders. The support delivers appropriately produced lawful document layouts which you can use for a selection of functions. Produce your account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

The State of Alaska 457 Deferred Compensation Plan (DCP) allows you to set aside and invest a portion of your income for your retirement on a voluntary basis. It is designed to complement the Alaska SBS Supplemental Annuity Plan and the Alaska PERS/TRS Retirement Plan. 457 Deferred Compensation Plan - Division of Retirement and Benefits alaska.gov ? EToolkit-PlanHighlights-457 alaska.gov ? EToolkit-PlanHighlights-457

Eligible recipients, who have not received pension benefits during the entire preceding calendar year, will receive a prorated PRPA. If you meet these requirements or are age 60 to 64 on July 1, 2023, you will receive 50% (3.948%) of the Consumer Price Index (CPI) change during 2022. Ak DRB > PERS Newsbreak: Summer 2023, Issue 128 alaska.gov ? news ? 07128-PERS alaska.gov ? news ? 07128-PERS

This is the result of legislation approved in 2023. Under the law, eligible PERS 1 and TRS 1 retirees will receive a one-time, permanent 3% increase in their monthly benefit, to a maximum of $110.00 per month. PERS 1, TRS 1 one-time benefit increase in July wa.gov ? pers-1-trs-1-increase-july-news... wa.gov ? pers-1-trs-1-increase-july-news...

While you are employed, the available withdrawal options are limited and vary by plan. Some options may include the ability to withdraw voluntary, after-tax contributions at any time or to withdraw money after you reach a certain age (e.g., 59½, 70½, or the plan's normal retirement age). 401(a) Defined Contribution Plan - MissionSquare Retirement missionsq.org ? products-and-services ? 401... missionsq.org ? products-and-services ? 401...

2023: A one-time $7,500 stipend to eligible annuitants who are 75 years of age and older. A one-time $2,400 stipend to eligible annuitants age 70 to 74. Annuitants must be eligible to receive a TRS annuity in August 2023 and meet the qualifying age on or before Aug. TRS News August 2023 - Retirees - Texas.gov texas.gov ? TRSNews-Aug2023-retirees texas.gov ? TRSNews-Aug2023-retirees

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans. A Simplified Employee Pension Plan (SEP) is a relatively uncomplicated retirement savings vehicle. Types of Retirement Plans - U.S. Department of Labor dol.gov ? general ? topic ? typesofplans dol.gov ? general ? topic ? typesofplans

Age 60 for normal retirement or age 55 for early retirement if you first entered the PERS on or after July 1, 1986 (Tier II or Tier III). Ak DRB > PERS & TRS Defined Benefit Retirement Plan alaska.gov ? employee ? dbrplan alaska.gov ? employee ? dbrplan