Alaska Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Have you found yourself in situations where you require documents for either business or personal reasons almost daily.

There are numerous authentic document templates accessible online, but obtaining ones you can trust is not straightforward.

US Legal Forms offers thousands of document templates, including the Alaska Private Annuity Agreement, which can be created to comply with federal and state regulations.

Once you find the right document, just click Purchase now.

Choose the payment option you prefer, fill in the required information to create your account, and place an order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alaska Private Annuity Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and confirm it is for the correct city/state.

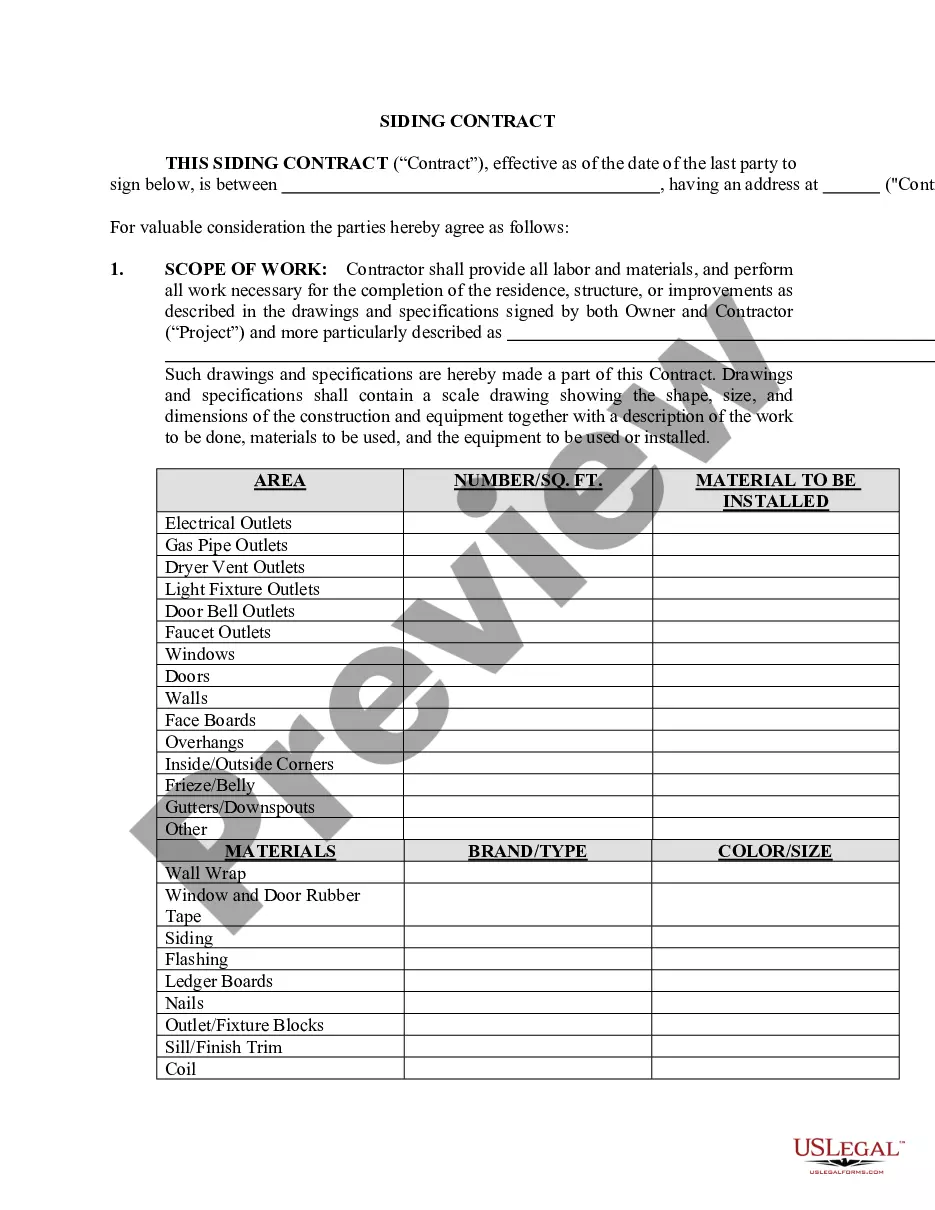

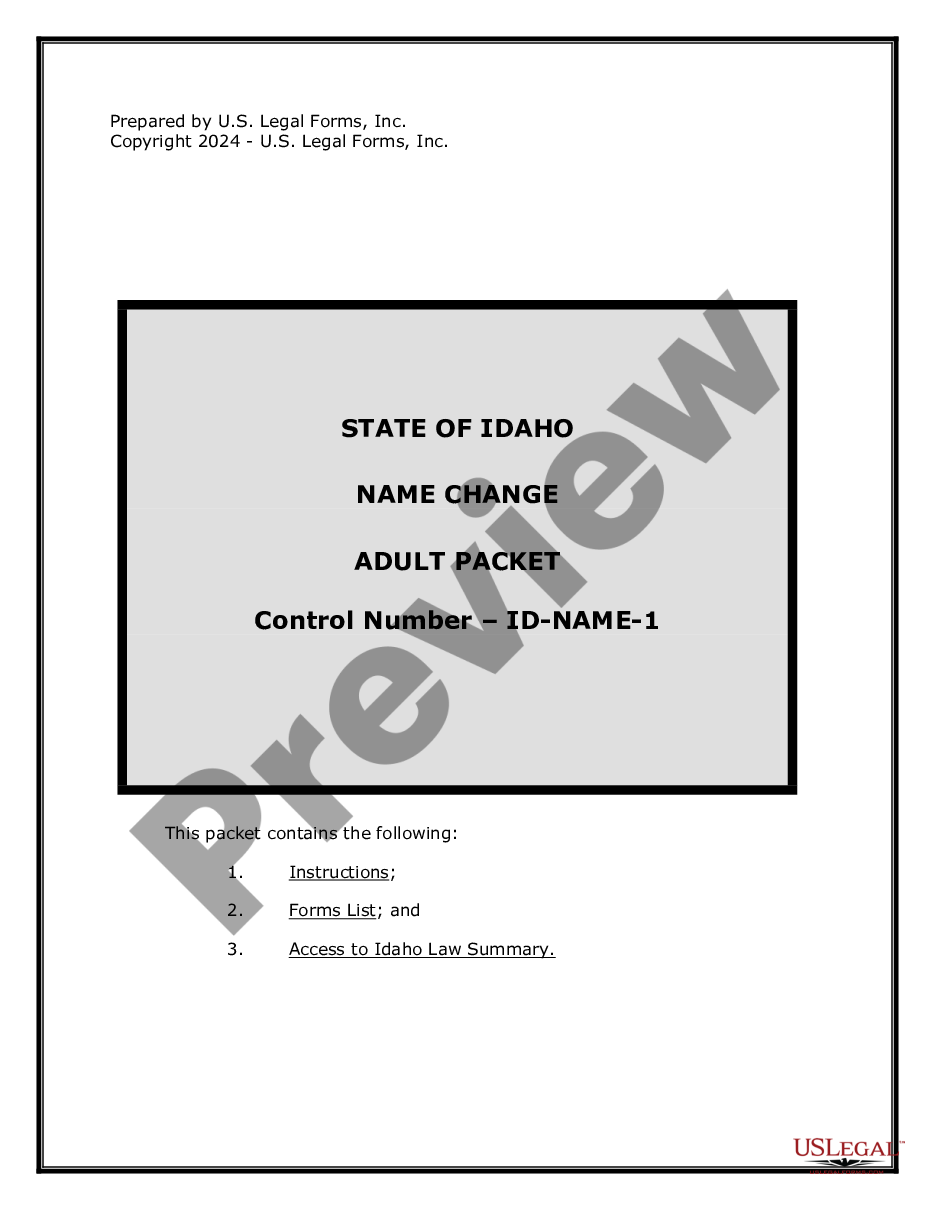

- Utilize the Preview button to examine the document.

- Review the details to ensure you have selected the correct document.

- If the document does not meet your needs, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

What is the Alaska Supplemental Annuity Plan? The Alaska Supplemental Annuity Plan (SBS-AP) is a defined contribution plan governed by Section 401(a) of the Internal Revenue Code. A portion of your wages and a matching employer contribution are made pre-tax to this Plan instead of contributions to Social Security.

Pension and annuity distributions are usually made to retired employees, disabled employees and in some cases to the beneficiary of a deceased employee. If no after-tax contributions were made to the pension plan before distribution, the entire amount is generally included in taxable income.

Page 1. FORM 1099-R Explanation of Boxes. Box 1: Gross Distribution includes all payments for monthly Benefits, DROP, Leave, and Initial Benefit Option funds disbursed directly to you, contributions refunded upon leaving state service, and funds transferred to another non-qualified plan.

Fact Sheet #35. OVERVIEW. The Supplemental Annuity Collective Trust of New Jersey (SACT) is a voluntary investment program that provides retirement income separate from, and in addition to, your basic pension plan. With SACT, your contributions are invested conservatively in the stock market.

The PERS Plan For employees who first entered prior to July 1, 2006, the Public Employees' Retirement System (PERS) is a defined benefit plan which is designed to offer a lifetime monthly benefit once retirement eligibility is reached.

The Supplemental Annuity Benefit is payable to those who are able to retire on an immediate (i.e., full benefit) Federal Employees Retirement System (FERS) basic benefit that is not reduced for age.

Supplemental Annuity Reduced for Employer Pension It is established and maintained by the railroad employer for a defined group of employees. It provides for the payment of definitely determinable benefits to employees over a period of years, usually for life, after retirement or disability.

Fact Sheet #35. OVERVIEW. The Supplemental Annuity Collective Trust of New Jersey (SACT) is a voluntary investment program that provides retirement income separate from, and in addition to, your basic pension plan. With SACT, your contributions are invested conservatively in the stock market.

Line 5a on IRS Form 1040 is where you enter the total amount of pension and annuity payments you received during the tax year. You should leave line 5a blank if your pension and annuity payments were fully taxable.