Alaska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

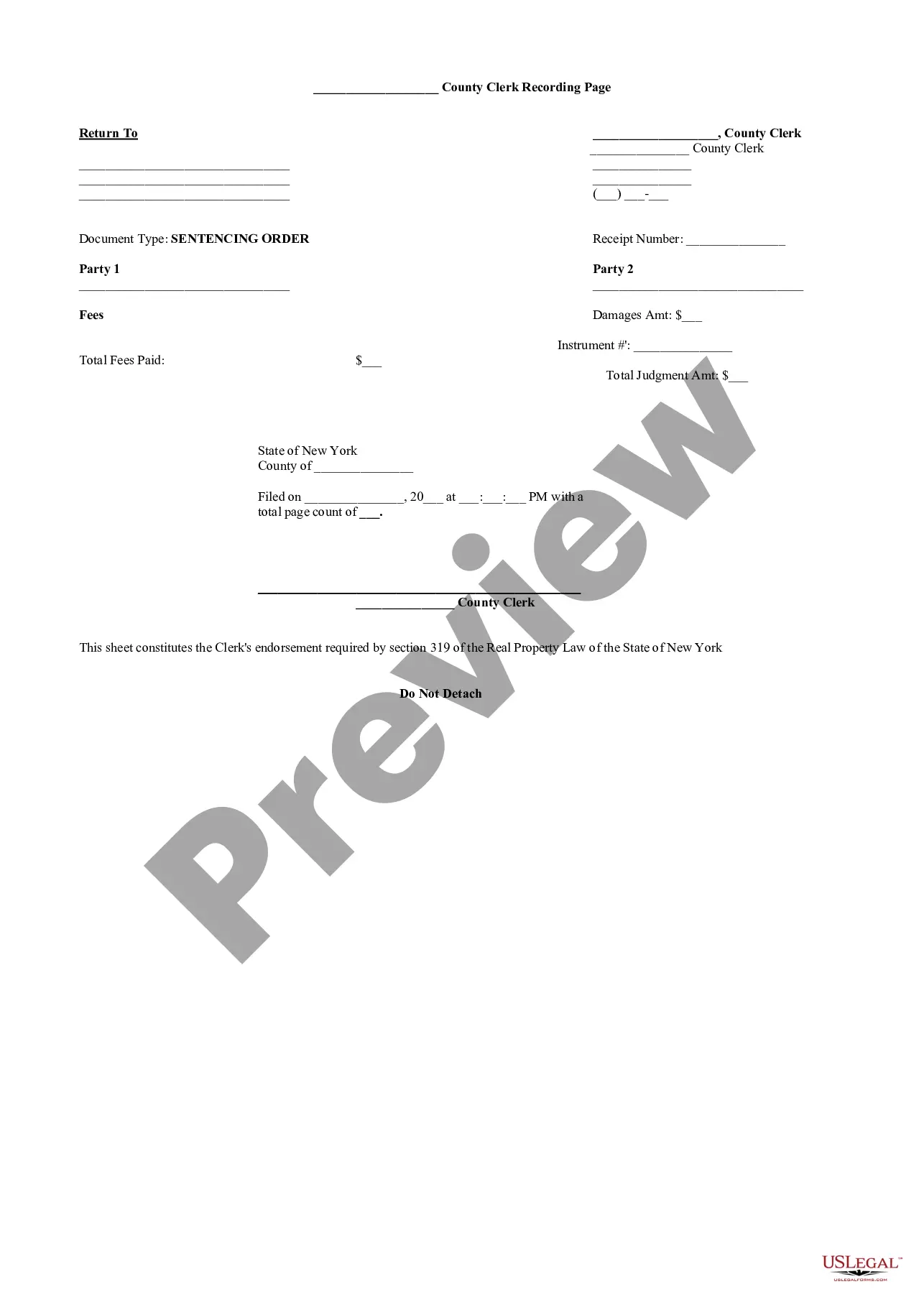

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

US Legal Forms - one of the largest libraries of legal kinds in the United States - delivers a wide array of legal file templates it is possible to obtain or print. While using website, you may get a huge number of kinds for enterprise and person reasons, categorized by classes, says, or key phrases.You will find the latest models of kinds just like the Alaska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan within minutes.

If you already have a subscription, log in and obtain Alaska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan from your US Legal Forms local library. The Download option can look on every single type you see. You have accessibility to all formerly downloaded kinds from the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, here are simple instructions to help you get started off:

- Ensure you have picked the correct type for your metropolis/area. Select the Review option to examine the form`s articles. Look at the type information to actually have selected the appropriate type.

- If the type doesn`t fit your requirements, take advantage of the Look for field near the top of the display screen to get the the one that does.

- In case you are content with the form, affirm your decision by simply clicking the Buy now option. Then, select the costs strategy you favor and supply your references to sign up on an account.

- Method the deal. Use your Visa or Mastercard or PayPal account to perform the deal.

- Select the file format and obtain the form on your own system.

- Make modifications. Fill up, revise and print and indication the downloaded Alaska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Every single template you put into your bank account lacks an expiration date which is your own property for a long time. So, if you wish to obtain or print one more duplicate, just go to the My Forms area and click on in the type you need.

Gain access to the Alaska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan with US Legal Forms, one of the most extensive local library of legal file templates. Use a huge number of specialist and status-certain templates that meet up with your business or person requires and requirements.

Form popularity

FAQ

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

A secured party can perfect a security interest by filing a financing statement with the appropriate state or local office. (3) a description of the collateral by item or type. All of the foregoing information must be accurate, otherwise the filing will not perfect the creditor's security interest.

Security agreement is the agreement between the secured party and the debtor that creates or provides for a security interest. Collateral refers to the items of property in which a security interest is granted by the debtor.

Security agreement is ?an agreement that creates or provides for a security interest.? It is the contract that sets up the debtor's duties and the creditor's rights in event the debtor defaults. Uniform Commercial Code, Section 9-102(a)(73).

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.