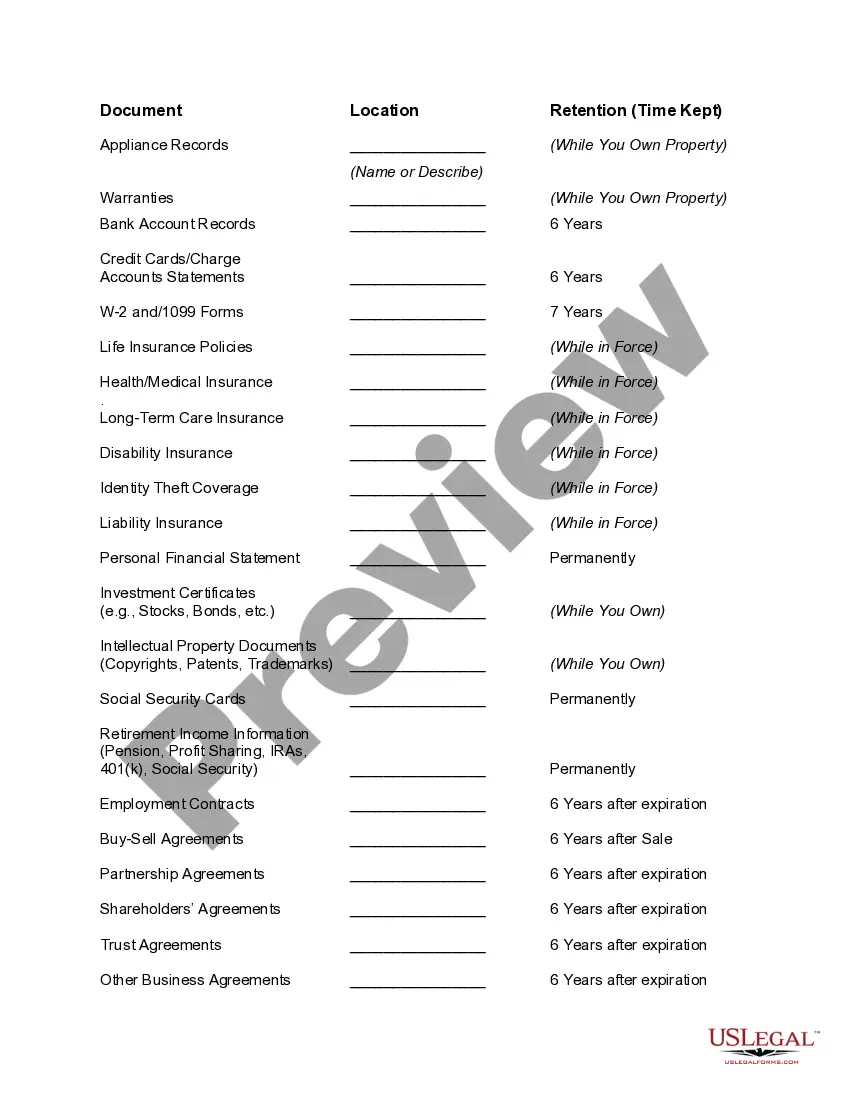

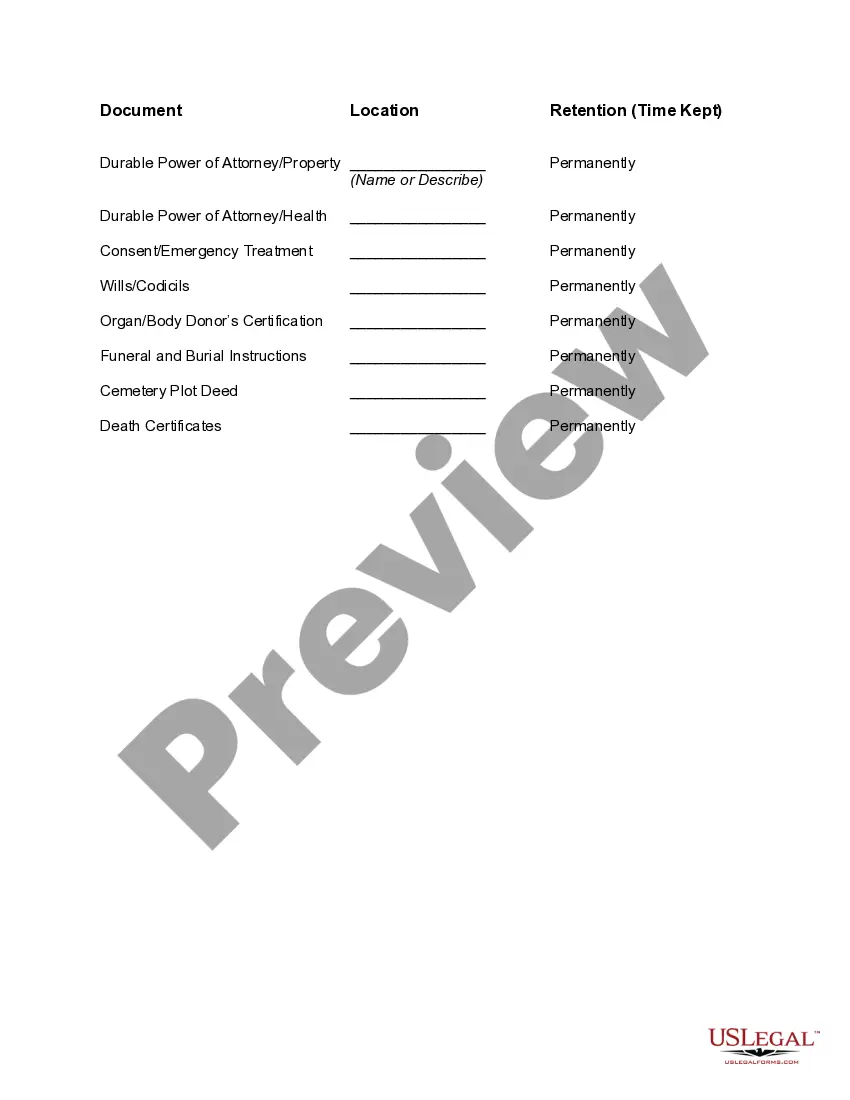

Alaska Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

Have you ever been in a scenario where you require documents for either business or personal reasons frequently? There are many lawful document templates accessible online, but finding reliable versions isn’t straightforward.

US Legal Forms provides thousands of form templates, including the Alaska Document Organizer and Retention, which are designed to comply with state and federal regulations.

If you’re already acquainted with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the Alaska Document Organizer and Retention template.

- Find the template you need and confirm it’s for your appropriate city/state.

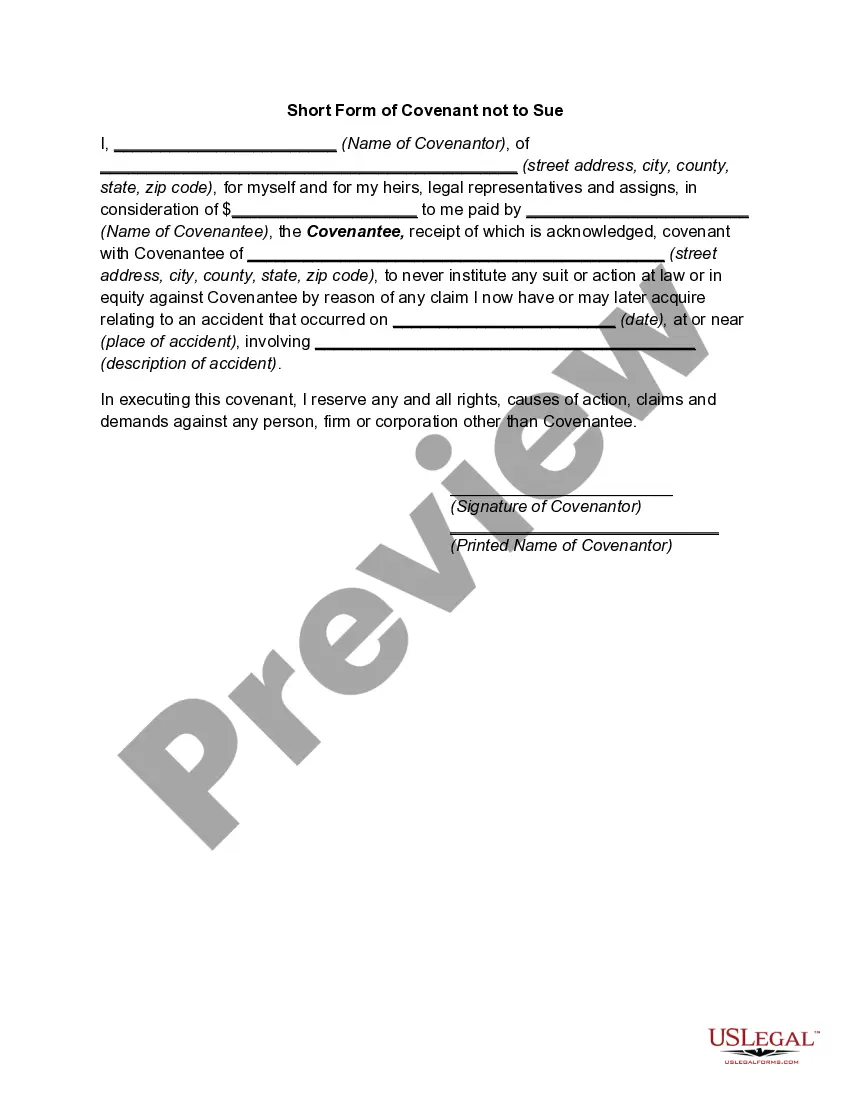

- Utilize the Preview button to examine the form.

- Review the description to ensure you have selected the correct template.

- If the form doesn’t meet your needs, use the Search field to find the form that fits your requirements.

- Once you locate the correct form, click on Get now.

- Select the pricing option you prefer, enter the required details to create your account, and complete your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Federal regulations require research records to be retained for at least 3 years after the completion of the research (45 CFR 46) and UVA regulations require that data are kept for at least 5 years. Additional standards from your discipline may also be applicable to your data storage plan.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

A document retention schedule is a policy that clearly defines what documents need to be maintained and for how long. A retention policy will include all types of documents and records that are created on behalf of the company as part of its business.

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

In general, company records must be retained for around six years from the end of the accounting period.