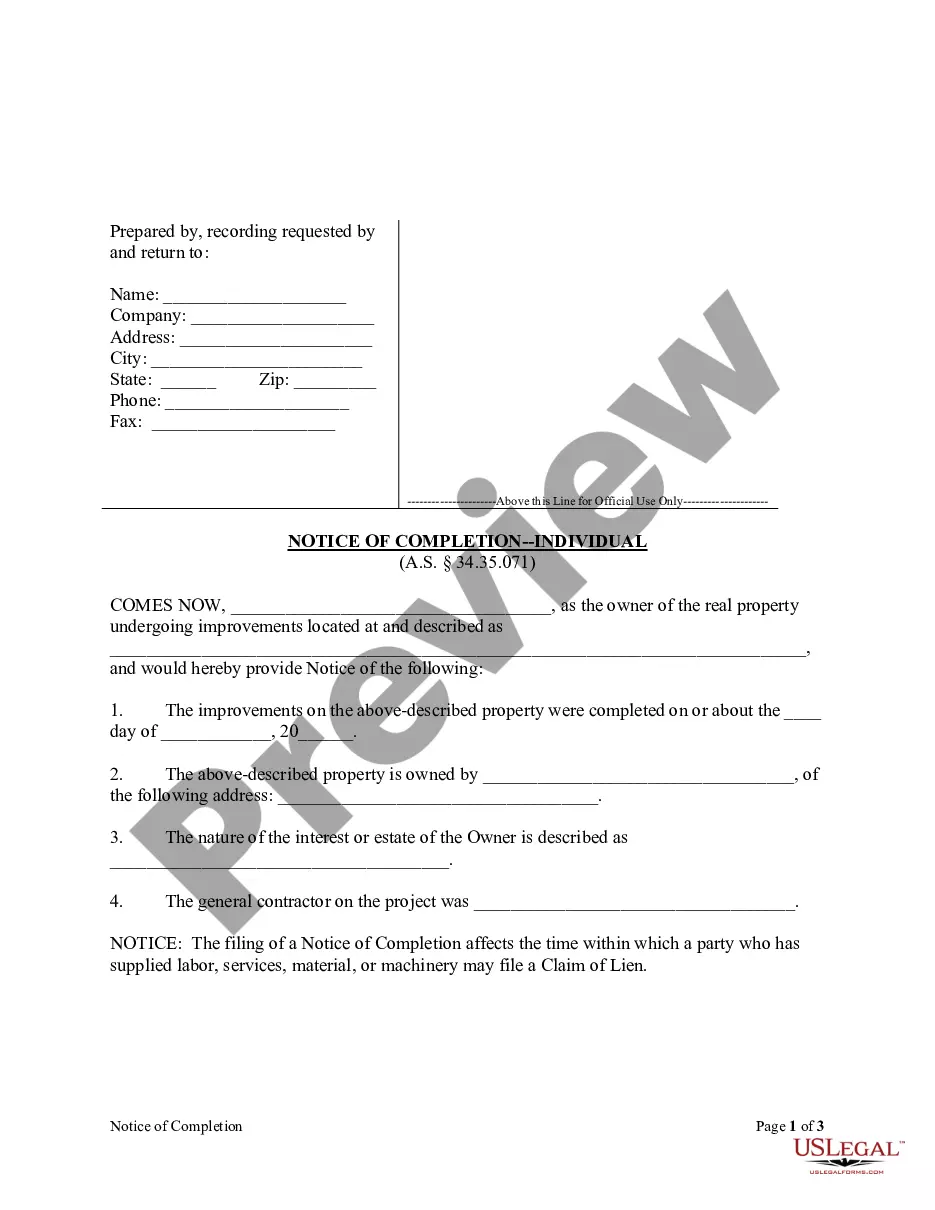

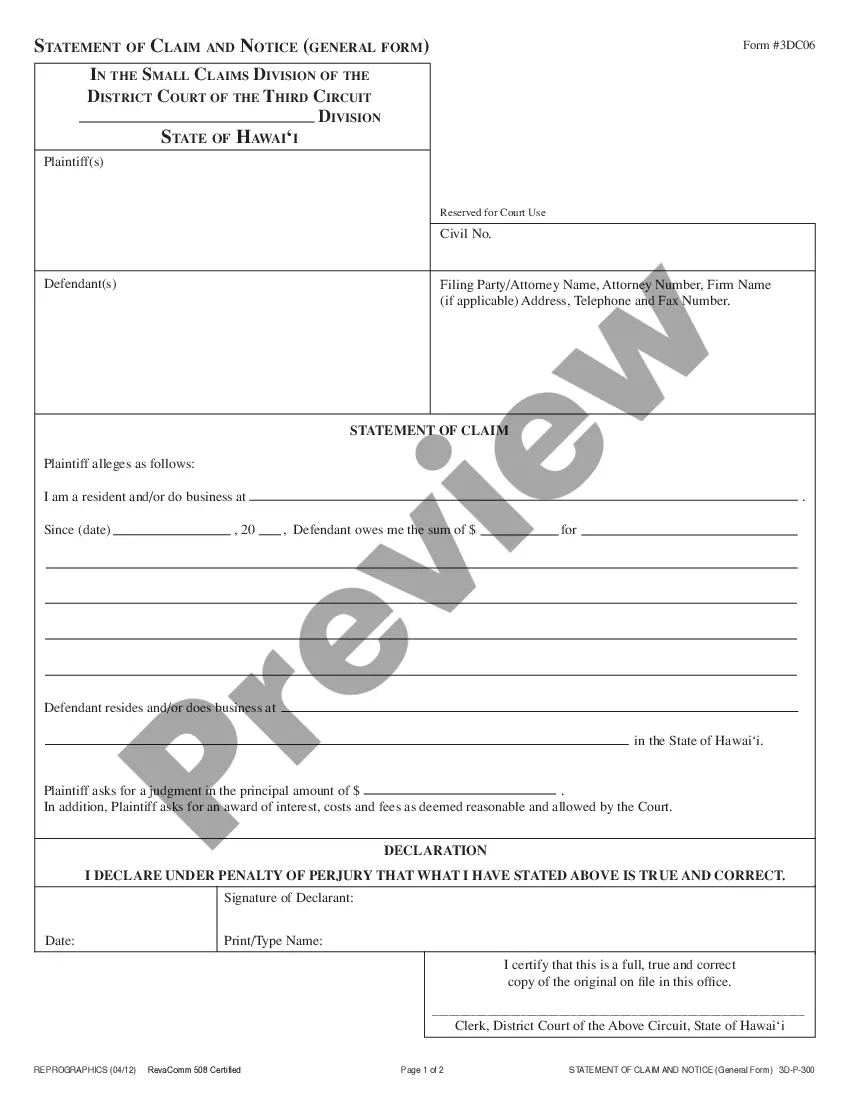

Alaska Agreement not to Compete during Continuation of Partnership and After Dissolution

Description

How to fill out Agreement Not To Compete During Continuation Of Partnership And After Dissolution?

US Legal Forms - one of the largest repositories of legal templates in the United States - provides a vast selection of legal document formats that you can obtain or print.

By utilizing the website, you can access numerous forms for business and personal use, categorized by type, state, or keywords. You will find the latest versions of forms such as the Alaska Agreement not to Compete during Continuation of Partnership and After Dissolution in just moments.

If you possess a monthly subscription, Log In to obtain the Alaska Agreement not to Compete during Continuation of Partnership and After Dissolution from the US Legal Forms collection. The Acquire button will appear on each document you view. You have access to all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and acquire the form onto your device. Make modifications. Fill out, modify, print, and sign the downloaded Alaska Agreement not to Compete during Continuation of Partnership and After Dissolution. Every template you have added to your account does not have an expiration date and is yours indefinitely. Thus, if you wish to acquire or print another copy, simply go to the My documents section and click on the form you need. Access the Alaska Agreement not to Compete during Continuation of Partnership and After Dissolution with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that satisfy your business or personal requirements and standards.

- Ensure you have selected the correct form for your location/region.

- Click on the Review button to assess the form's details.

- Examine the form summary to confirm you have selected the proper form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

1829 of the Civil Code states that on dissolution, the partnership is not termination but continues until the winding up of partnership affairs is completed.

Ending a partnership usually takes about ninety days from the time the paperwork is filed. That typically gives the partners enough time to wrap up remaining partnership dissolution matters, which may include the following: Canceling business permits, licenses, and registrations.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

A partnership has a limited life meaning that when the partners change for any reason, the existing partnership ends and new one must be formed. Partners can take money out of the business when they want. This is recorded in each partner's Withdrawal or Drawing account.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.