Alaska Agreement Between Personal Trainer and Client

Description

How to fill out Agreement Between Personal Trainer And Client?

You can spend hours on the internet searching for the legal document format that meets the state and federal standards you require.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

It is possible to acquire or create the Alaska Agreement Between Personal Trainer and Client through the services.

If available, use the Preview option to browse through the format as well.

- If you have a US Legal Forms account, you can Log In and then select the Download option.

- Afterward, you can complete, modify, create, or sign the Alaska Agreement Between Personal Trainer and Client.

- Each legal document format you purchase is yours permanently.

- To obtain an additional copy of the purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct format for the state/city of your choice.

- Review the form description to confirm that you have chosen the right document.

Form popularity

FAQ

Realistically, personal trainers can make anywhere from $30,000 to over $100,000 annually, depending on various factors such as the training environment and clientele. By promoting their services effectively and building a solid client base, trainers can increase their income. Utilizing legal agreements like the Alaska Agreement Between Personal Trainer and Client can provide structure and security, aiding in financial growth.

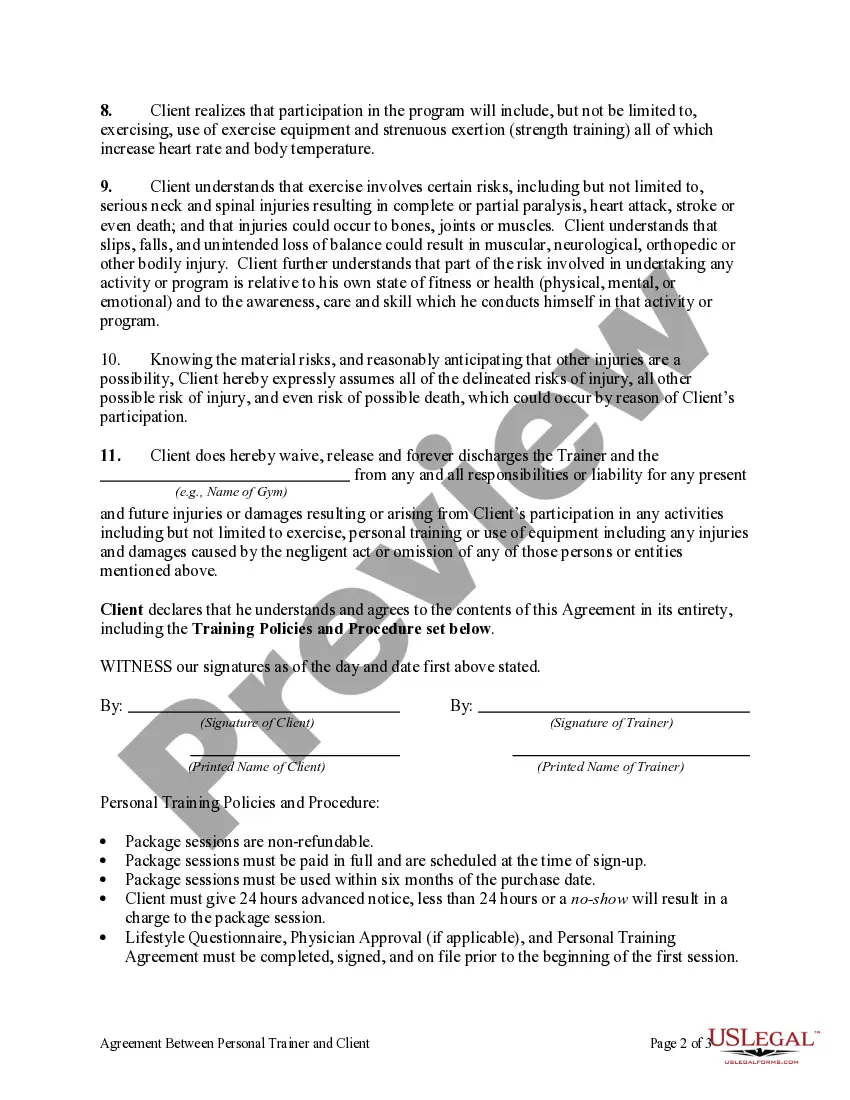

Many personal trainers use contracts to clarify the terms of their services. An Alaska Agreement Between Personal Trainer and Client serves as a formal document that outlines expectations, payment terms, and responsibilities for both parties. This helps protect both the trainer and the client, ensuring transparency and professionalism in their relationship.

Yes, it is possible for personal trainers to make $100,000 or more in a year. Success often depends on factors such as location, reputation, and the nature of their services. By effectively using an Alaska Agreement Between Personal Trainer and Client, trainers can create long-term relationships that enhance their earning potential.

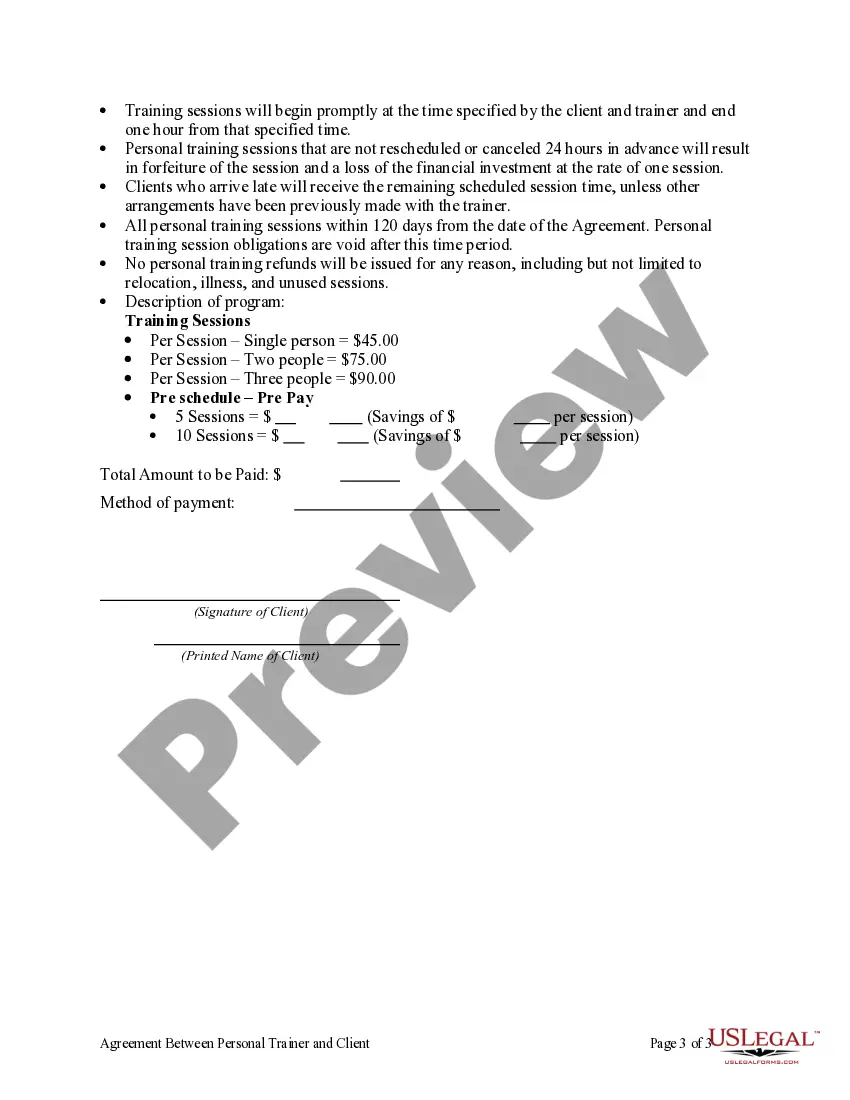

To set up a personal training business, you need a solid business plan, necessary certifications, and an Alaska Agreement Between Personal Trainer and Client. This agreement acts as a foundation for your business operations, covering essential aspects like client expectations and liability. Additionally, consider obtaining insurance and establishing a professional online presence to attract clients.

Having a separate business account as a personal trainer simplifies financial management. It helps you track your income and expenses more effectively, ensuring clarity when filing taxes. Additionally, an Alaska Agreement Between Personal Trainer and Client reinforces your professionalism, making it easier to handle client payments and transactions.

Establishing an LLC can be beneficial for personal trainers. It provides a layer of liability protection and can offer tax advantages. If you opt for an Alaska Agreement Between Personal Trainer and Client, having an LLC in place can enhance your professionalism, making clients feel more secure in your business structure.

Creating a personal training contract involves outlining the specifics of your services, payment terms, and client obligations. You can start by drafting an Alaska Agreement Between Personal Trainer and Client, which includes clauses on cancellation policies and liability waivers. This document serves to protect both you and your clients, ensuring clarity and understanding from the outset.

Yes, personal trainers should consider obtaining professional liability insurance. This insurance protects trainers from claims related to injuries or damages caused during training sessions. An effective Alaska Agreement Between Personal Trainer and Client can further safeguard both parties by clearly outlining responsibilities and expectations, promoting a professional environment.

To write a personal training contract, start by drafting a clear and concise document that includes all terms of the agreement. Clarify payment schedules, training locations, and cancellation policies under the Alaska Agreement Between Personal Trainer and Client. Ensure both parties review and understand the agreement to foster a positive working relationship.

Creating a personal training contract involves outlining key terms and conditions in an Alaska Agreement Between Personal Trainer and Client. Begin by detailing services, payment terms, and session frequency. You can use platforms like uslegalforms to find templates that simplify the process and ensure you cover all necessary aspects legally.