Alaska Wire Transfer Instruction to Receiving Bank

Description

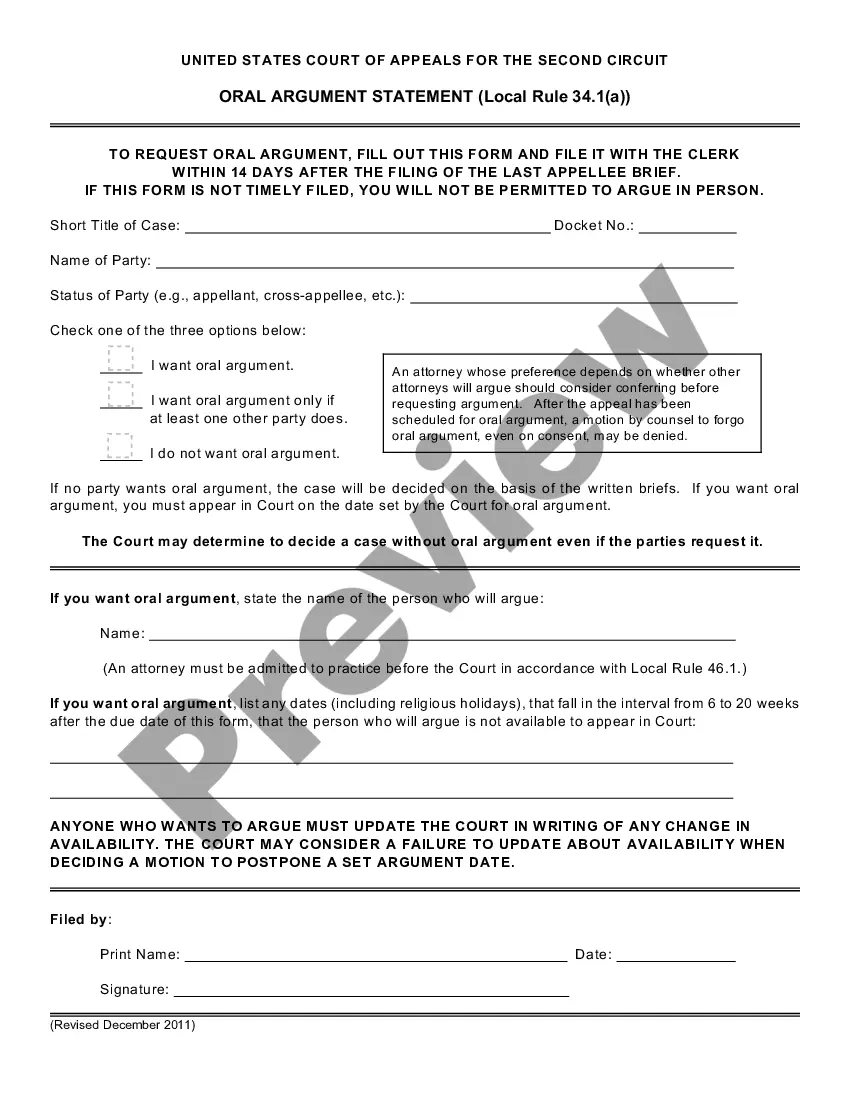

How to fill out Wire Transfer Instruction To Receiving Bank?

US Legal Forms - among the greatest libraries of legal types in America - delivers an array of legal file web templates you can down load or print. Making use of the website, you may get a huge number of types for organization and individual reasons, categorized by classes, says, or key phrases.You can get the most recent versions of types such as the Alaska Wire Transfer Instruction to Receiving Bank within minutes.

If you already have a monthly subscription, log in and down load Alaska Wire Transfer Instruction to Receiving Bank in the US Legal Forms collection. The Download option can look on every type you perspective. You get access to all in the past saved types inside the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed below are simple guidelines to obtain started:

- Ensure you have selected the right type for the area/county. Go through the Review option to review the form`s content. Browse the type description to ensure that you have chosen the proper type.

- In case the type doesn`t satisfy your demands, make use of the Research industry towards the top of the display to discover the one who does.

- When you are content with the form, verify your option by clicking on the Purchase now option. Then, choose the prices program you want and offer your accreditations to sign up for an accounts.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Pick the file format and down load the form on your device.

- Make changes. Fill up, modify and print and signal the saved Alaska Wire Transfer Instruction to Receiving Bank.

Every web template you put into your account lacks an expiry day and it is the one you have eternally. So, in order to down load or print an additional version, just check out the My Forms section and then click in the type you require.

Get access to the Alaska Wire Transfer Instruction to Receiving Bank with US Legal Forms, the most substantial collection of legal file web templates. Use a huge number of skilled and express-distinct web templates that fulfill your organization or individual requirements and demands.

Form popularity

FAQ

Wells Fargo California routing numbers The ACH routing number for Wells Fargo is also 121042882. The domestic and international wire transfer routing number for Wells Fargo is 121000248.

Specific details may vary depending on the recipient's country and bank, but the following is typically required. The receiver's full name. The recipient's physical address. Bank name and address. The bank account number and type (e.g., checking, savings, etc.) ... The bank routing number.

Your full name, as it appears on the account. Your full account number. For domestic wires, your routing number. For international wires, they need to use a Swift Code instead of the routing number.

From experience, as long as the bank's routing number / sort code and recipient's account number are correct, the wire should go through. If by "address" you mean the bank's street address, that shouldn't be an issue. If you mean recipient's address, that also should be no problem.

What information is needed for a wire transfer? The sender's valid government-issued photo ID or driver's license. The sender's full name and contact information. The sender's bank account and transit number. The recipient's full name and contact information. The recipient's bank account information and transit number.

For the Bank Address, this is the address of the Banking institution, not your own address. You need to use the address of the local bank branch, the address of the bank branch that you use, or the corporate address of the bank. As long as it is one of the Bank's addresses, it will be acceptable.

Bank of America has 2 primary SWIFT Codes: BOFAUS3N (US dollars or unknown currency) Bank of America, NA 222 Broadway New York, New York 10038.

Bank Address You will need the full address of the branch of the foreign bank that the beneficiaries account is held at.