Alaska Bank Account Monthly Withdrawal Authorization

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

You may spend hours on the Internet searching for the legal document template that meets the federal and state needs you want. US Legal Forms offers a large number of legal forms that are analyzed by pros. It is possible to acquire or produce the Alaska Bank Account Monthly Withdrawal Authorization from our service.

If you already have a US Legal Forms account, you may log in and then click the Obtain key. Afterward, you may total, revise, produce, or indication the Alaska Bank Account Monthly Withdrawal Authorization. Every legal document template you purchase is your own permanently. To have another backup of any acquired develop, check out the My Forms tab and then click the related key.

If you work with the US Legal Forms website for the first time, keep to the straightforward instructions beneath:

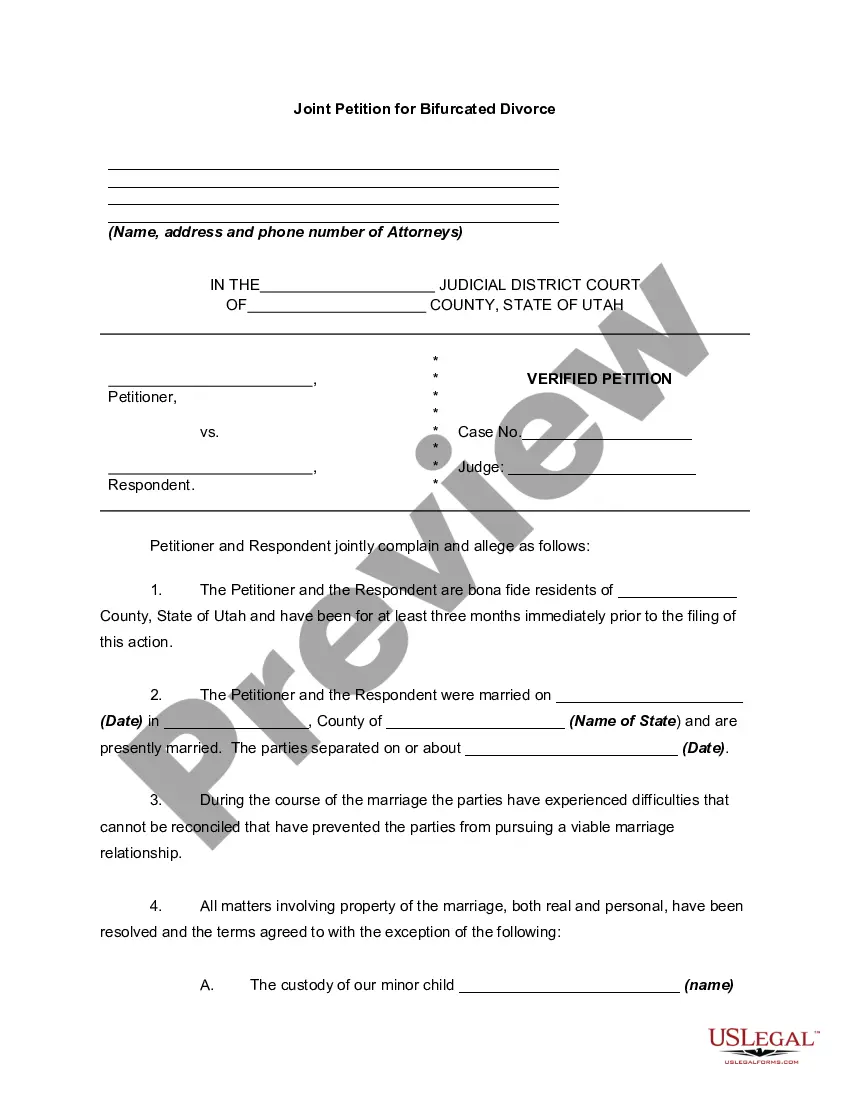

- Initial, make sure that you have selected the proper document template for that state/metropolis of your choosing. Read the develop explanation to ensure you have selected the correct develop. If available, make use of the Review key to appear through the document template too.

- In order to discover another model of the develop, make use of the Look for area to discover the template that meets your requirements and needs.

- Upon having identified the template you desire, just click Get now to move forward.

- Find the pricing plan you desire, type your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal develop.

- Find the format of the document and acquire it in your gadget.

- Make adjustments in your document if necessary. You may total, revise and indication and produce Alaska Bank Account Monthly Withdrawal Authorization.

Obtain and produce a large number of document themes while using US Legal Forms web site, which provides the greatest selection of legal forms. Use skilled and condition-particular themes to handle your business or individual demands.