A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose

Description

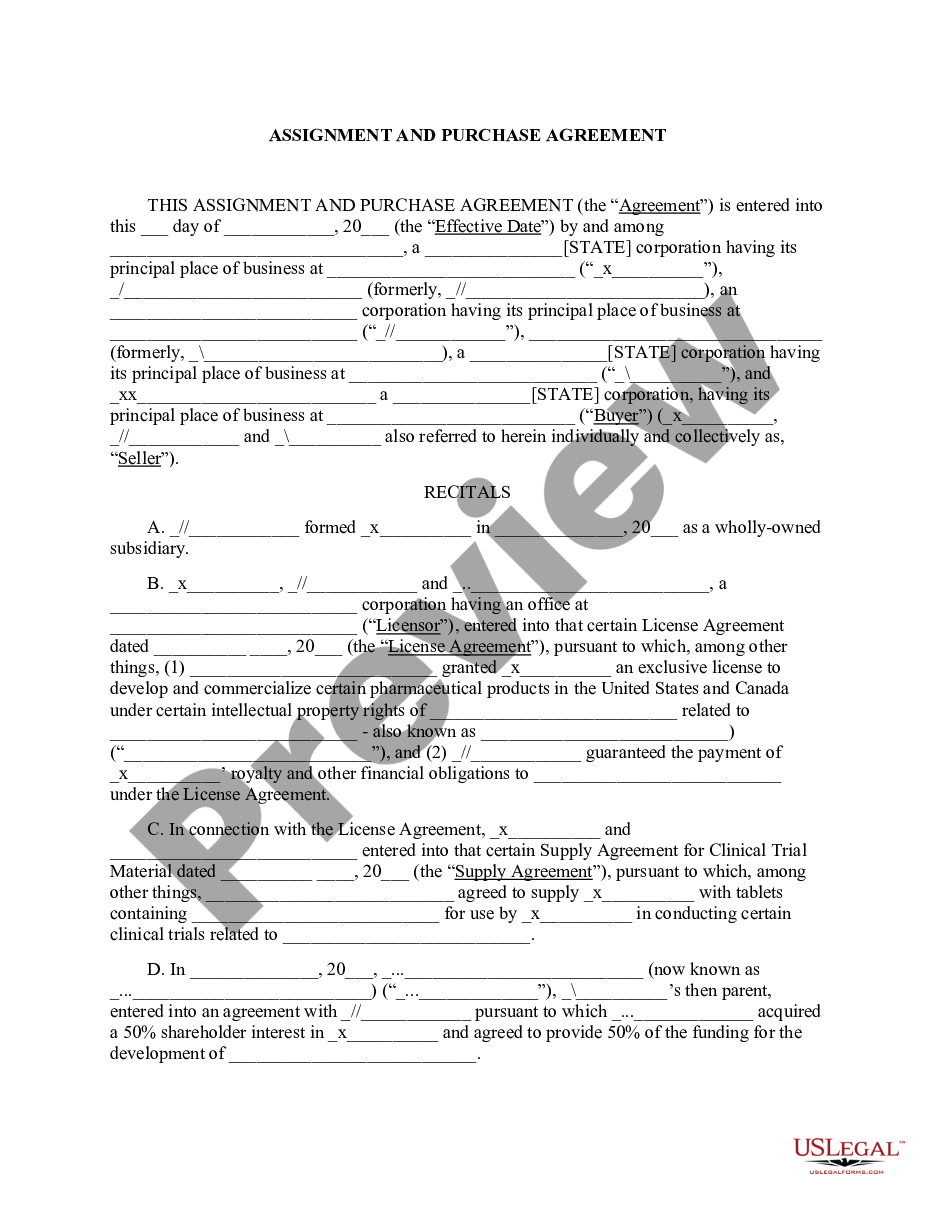

How to fill out Notice And Demand To Mortgagor Regarding Intent To Foreclose?

If you desire to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose in just a few clicks.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose. Every legal document template you obtain belongs to you indefinitely. You have access to every form you downloaded in your account. Visit the My documents section to choose a form to print or download again.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Responding to a foreclosure notice is critical to protect your rights. First, carefully review the Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose for accuracy and details. Next, understand your options, which may include negotiating with your lender or seeking legal counsel. Platforms like US Legal Forms can provide you with the necessary documents and guidance to help you navigate this process effectively.

A demand letter in foreclosure is a formal request from the lender for payment or action from the borrower before foreclosure proceedings begin. This letter specifies the outstanding amount and the steps the borrower must take to avoid further action. It highlights the urgency of the situation and serves as a final opportunity for the borrower to resolve issues. Understanding this letter is key to managing your mortgage situation effectively.

The notice of intention to foreclose is a formal communication from the lender to the borrower. This notice states the lender's intent to initiate foreclosure proceedings if the borrower does not rectify the default status. It serves as a way to inform the borrower of their situation while providing an opportunity to address the matter. Familiarity with this notice helps you understand your options and the urgency of your response.

A letter of intent to foreclosure formally expresses the lender's decision to move forward with the foreclosure process. This letter usually includes important details such as the amount owed, the property's address, and the timeline for the foreclosure. It is crucial for borrowers to take this letter seriously and understand the implications it carries. Responding promptly can sometimes reopen communication and lead to potential solutions.

A letter of intent is a document that outlines the preliminary terms of a real estate transaction. It serves as a non-binding agreement between parties, indicating their desire to negotiate and finalize terms before proceeding. In the context of foreclosure, it can clarify the intentions of both the lender and the borrower, but it is not a substitute for formal agreements. Understanding this document can help you navigate potential issues in your mortgage situation.

The foreclosure process in Alaska typically begins when a borrower fails to make mortgage payments. The lender will send a notice to the borrower indicating their intent to foreclose, known as the Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose. Following this notice, the lender must usually wait for a specified period before initiating foreclosure proceedings. This process can vary, so it's essential to understand your rights as a borrower.

Foreclosure primarily impacts homeowners, who face loss of property and potential credit damage. Additionally, families experience emotional stress and financial strain throughout the process. The community can also feel the effects, as foreclosures can lower property values in the area. Obtaining an Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose can help homeowners understand their situation and seek help early, potentially mitigating these negative impacts.

In Alaska, foreclosure typically starts when a borrower falls behind on mortgage payments, leading to an Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose. This notice gives borrowers a chance to address their default before the lender can proceed. If the situation remains unresolved, the lender can initiate a non-judicial or judicial foreclosure process. Homeowners should consider seeking assistance from platforms like US Legal Forms to understand their rights and options during this challenging time.

The 120-day rule for foreclosure requires lenders to wait 120 days after a homeowner defaults on payments before initiating foreclosure proceedings. During this time, lenders must send an Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose, notifying borrowers of their status and options. This grace period gives homeowners an opportunity to catch up on payments or negotiate with their lenders. Understanding this rule can help you navigate the foreclosure process more effectively.

The six phases of foreclosure include pre-foreclosure, notice of default, auction, redemption period, property sale, and post-sale. Within the pre-foreclosure phase, lenders often send an Alaska Notice and Demand to Mortgagor regarding Intent to Foreclose to inform homeowners of their default status. During the auction, the property is sold to the highest bidder. After the sale, homeowners may enter a redemption period, allowing them a final chance to regain ownership under certain conditions.