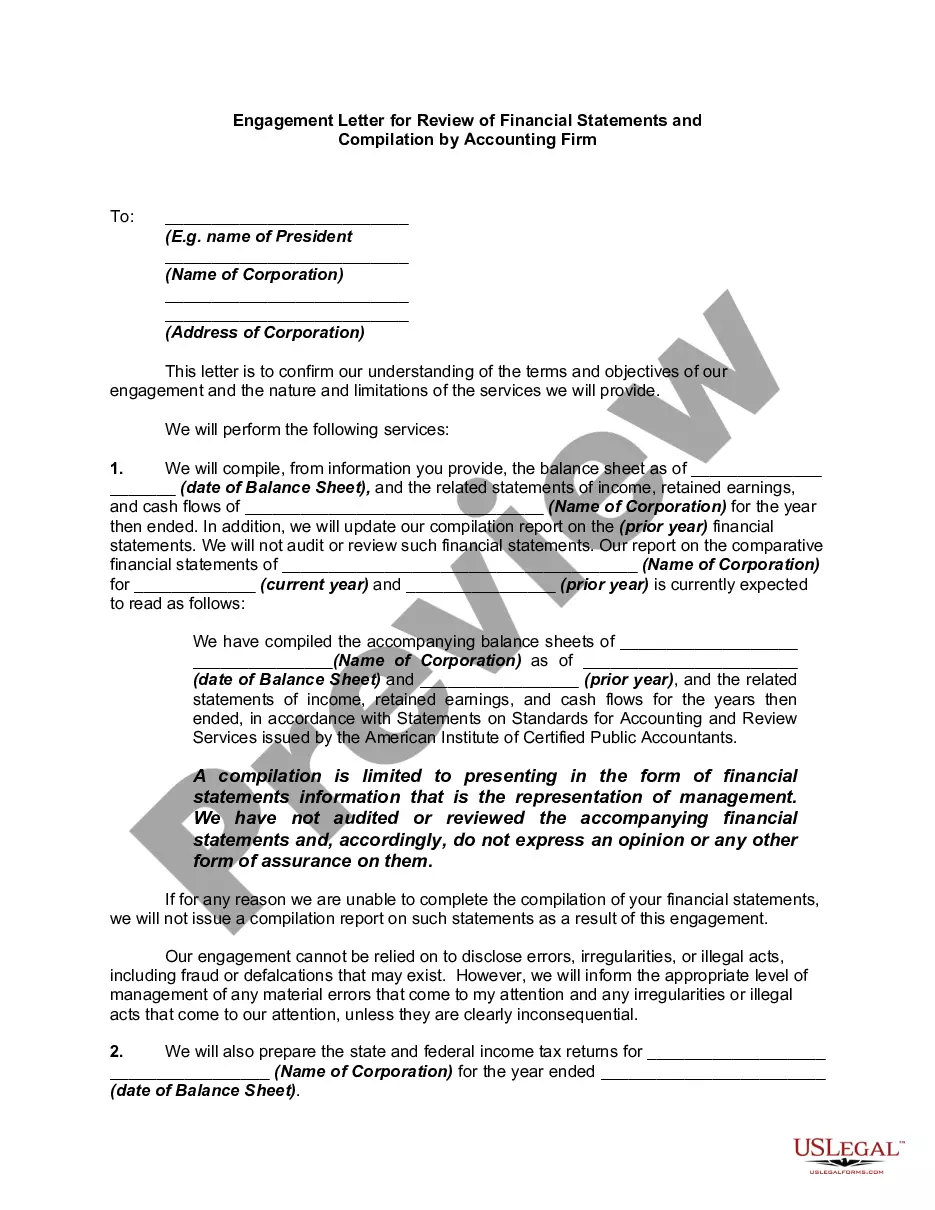

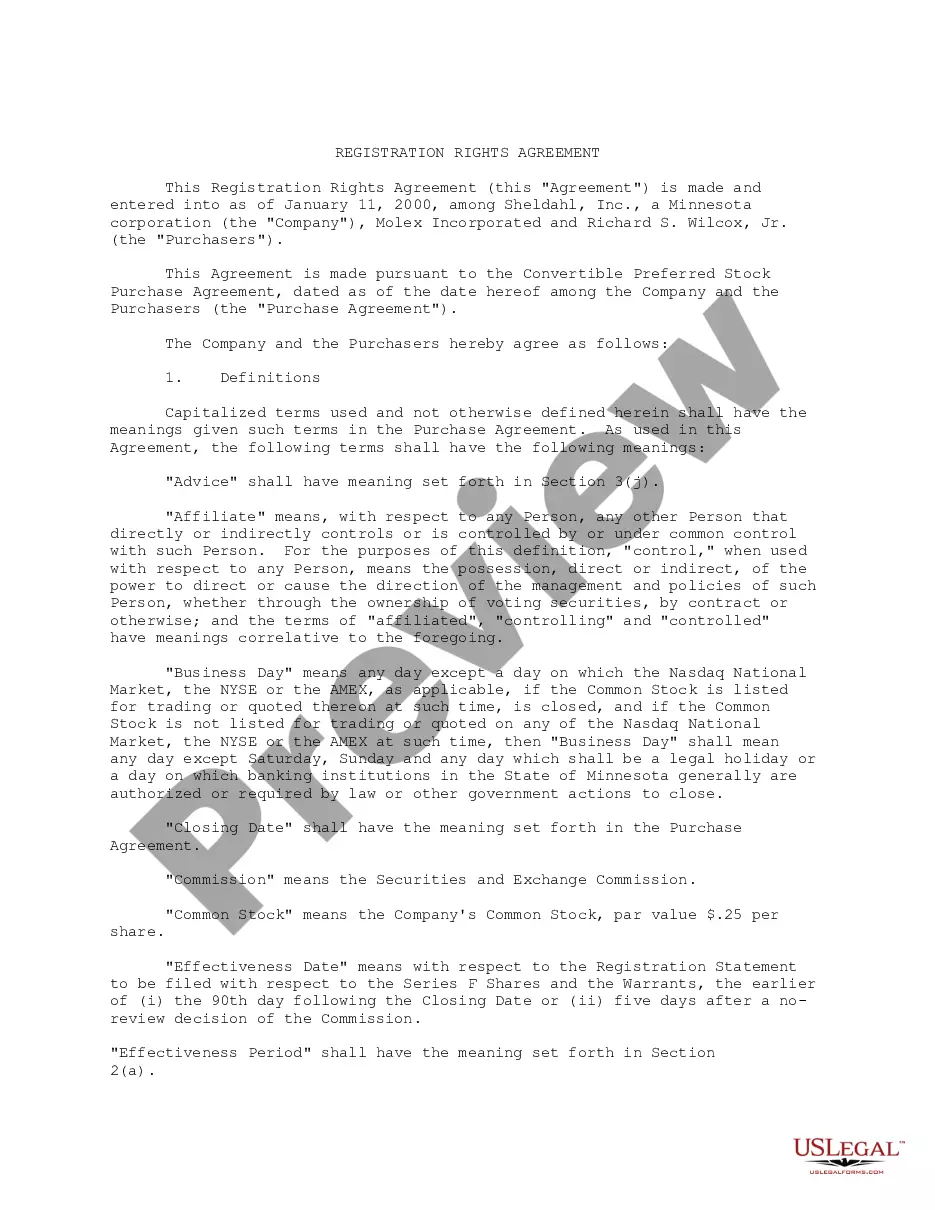

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Alaska Report from Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

Locating the appropriate certified document template may pose challenges.

Certainly, there are numerous formats available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Alaska Report from Review of Financial Statements and Compilation by Accounting Firm, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the form synopsis to confirm it suits your needs.

- All documents are verified by professionals and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to access the Alaska Report from Review of Financial Statements and Compilation by Accounting Firm.

- Use your account to review the legal documents you have previously obtained.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

A financial review report is a document prepared by a CPA that assesses the accuracy and reliability of an entity's financial statements, offering limited assurance to users. It summarizes the findings from the inquiries and analytical procedures performed, providing stakeholders with a clearer understanding of the financial position. When seeking an Alaska Report from Review of Financial Statements and Compilation by Accounting Firm, this review report is a pivotal tool for informed decision-making.

No, a compilation is not the same as a review. A compilation provides a report based on management’s assertions without verification, while a review includes additional procedures to assess the accuracy of financial statements. This distinction is essential when obtaining the Alaska Report from Review of Financial Statements and Compilation by Accounting Firm, as it affects the level of assurance you can expect.

Compiled financial statements are basic reports generated from management's financial information without verification, while reviewed financial statements include additional procedures to ensure accuracy and compliance. The review process involves analytical reviews and conversations with management, which lend credibility to the figures presented. For stakeholders or investors looking for an Alaska Report from Review of Financial Statements and Compilation by Accounting Firm, the reviewed option offers greater assurance.

The main difference between compilation and review is the level of assurance provided. A compilation presents financial statements based solely on information provided by management without any assurance of accuracy. In contrast, a reviewed financial statement includes analytical procedures and inquiries, providing a higher level of assurance. When you need a reliable Alaska Report from Review of Financial Statements and Compilation by Accounting Firm, understanding this difference is key.

A CPA performing a review of an entity's financial statements is tasked with analyzing financial data to provide limited assurance. This process involves evaluating the financial statements through inquiries and analytical procedures, rather than detailed testing. The Alaska Report from Review of Financial Statements and Compilation by Accounting Firm serves as a valuable resource for understanding the CPA's responsibilities in delivering a thorough and reliable review.

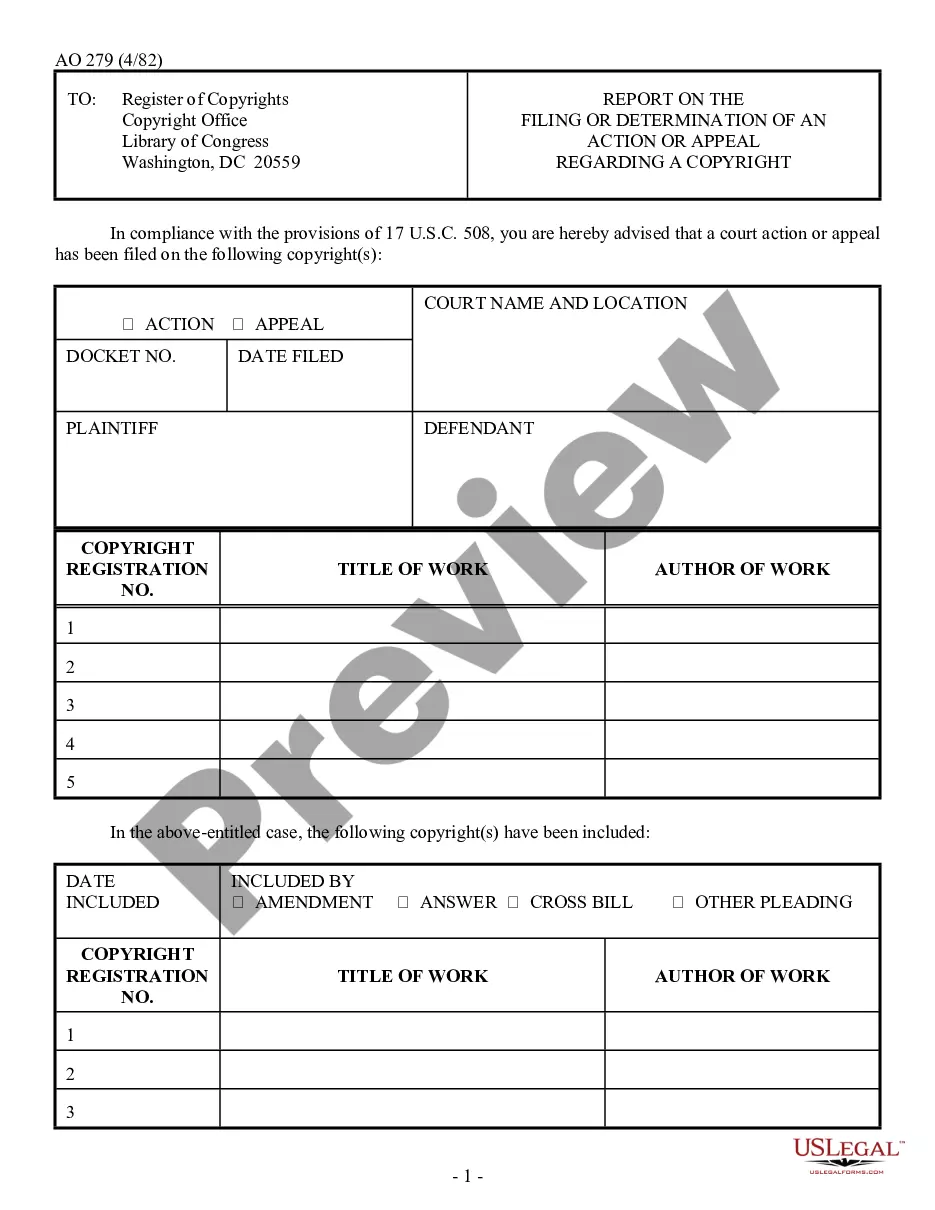

A CPA must understand the client's business environment, internal controls, and financial reporting framework when planning an audit. This comprehension allows the CPA to develop a tailored audit approach that addresses specific risks. The Alaska Report from Review of Financial Statements and Compilation by Accounting Firm emphasizes the importance of this understanding in achieving effective audit outcomes.

Yes, a CPA must maintain independence when performing a review of financial statements. Independence ensures the CPA's objectivity and impartiality, which is vital for the credibility of the review. The Alaska Report from Review of Financial Statements and Compilation by Accounting Firm highlights the significance of CPA independence in fostering trust with clients and stakeholders.

An audit provides a high level of assurance about the financial statements, involving extensive testing and verification of transactions. In contrast, a review offers limited assurance, focusing on analytical procedures and inquiries with management without extensive verification. Understanding the distinctions highlighted in the Alaska Report from Review of Financial Statements and Compilation by Accounting Firm can help businesses choose the appropriate review or audit service.

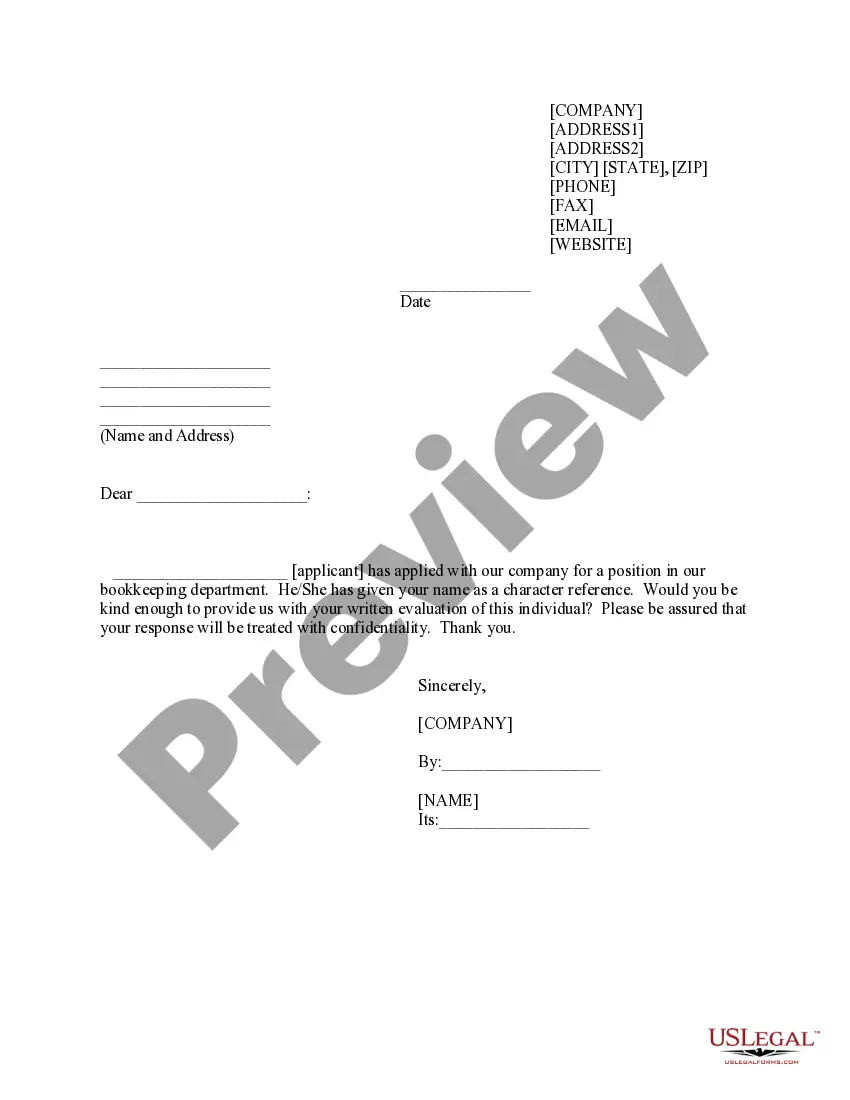

CPA cannot legally perform a financial review that complies with professional standards. Only licensed CPAs have the qualifications to conduct these reviews and provide the necessary reassurance to stakeholders. Using the Alaska Report from Review of Financial Statements and Compilation by Accounting Firm will help clarify the CPA's unique role in this process.

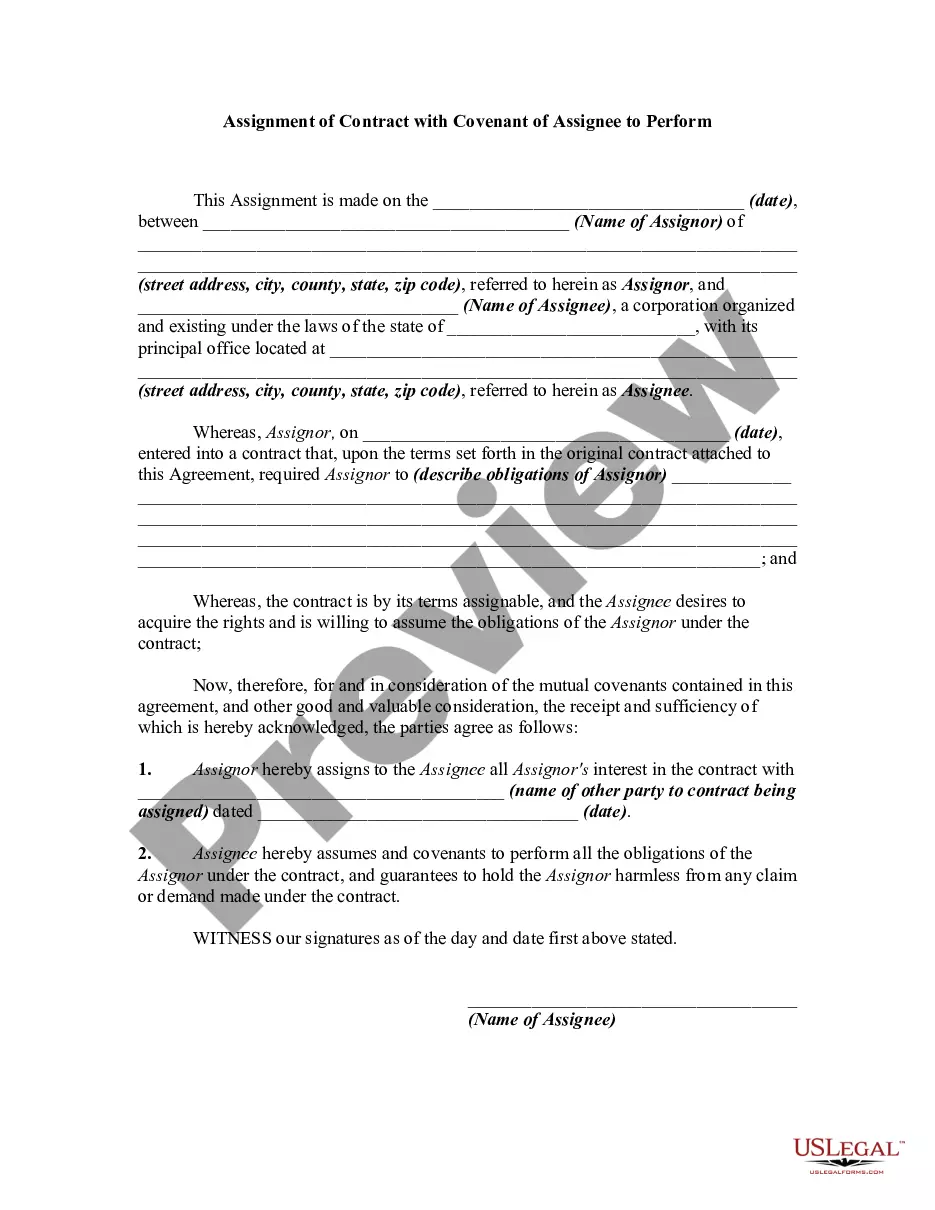

Financial statement preparation involves a more hands-on approach by a CPA to create financial reports based on information from clients. In contrast, compilation involves gathering existing financial data and presenting it without expressing assurance on its accuracy. The Alaska Report from Review of Financial Statements and Compilation by Accounting Firm ensures clarity in understanding these differences, emphasizing the role of CPAs in both processes.