Alaska Letter to Other Entities Notifying Them of Identity Theft

Description

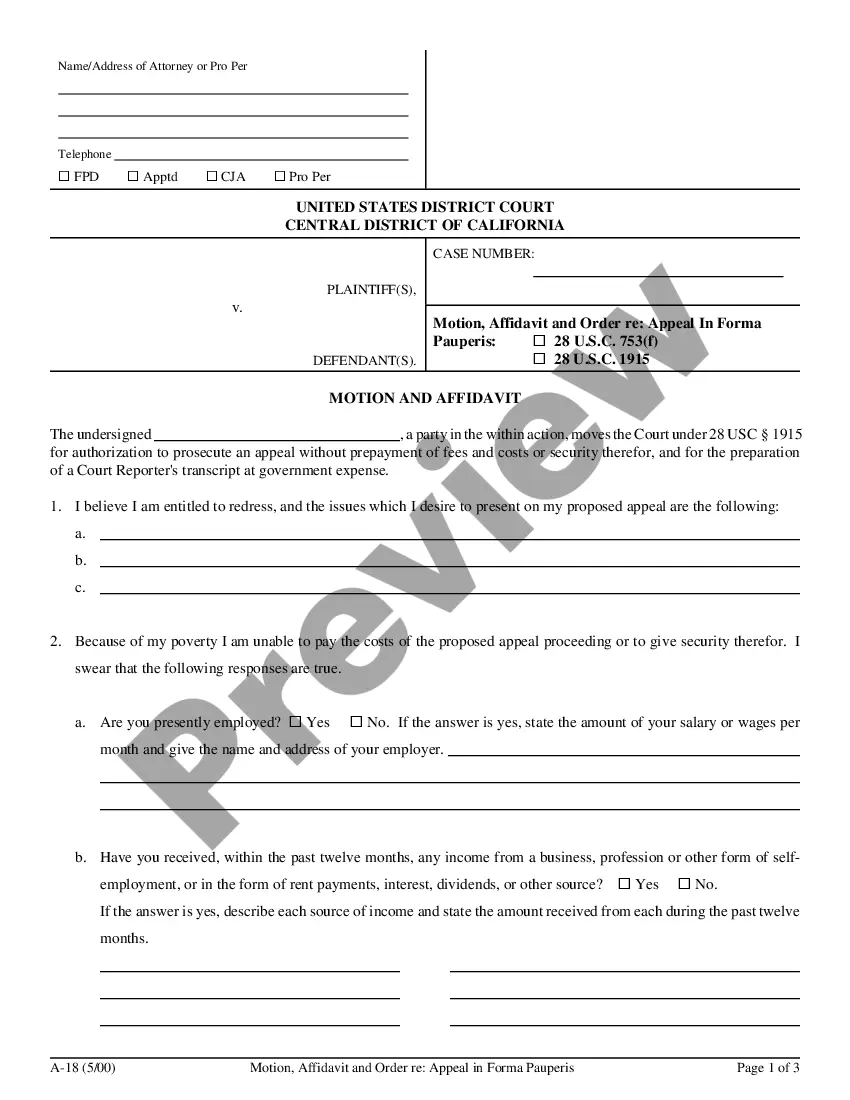

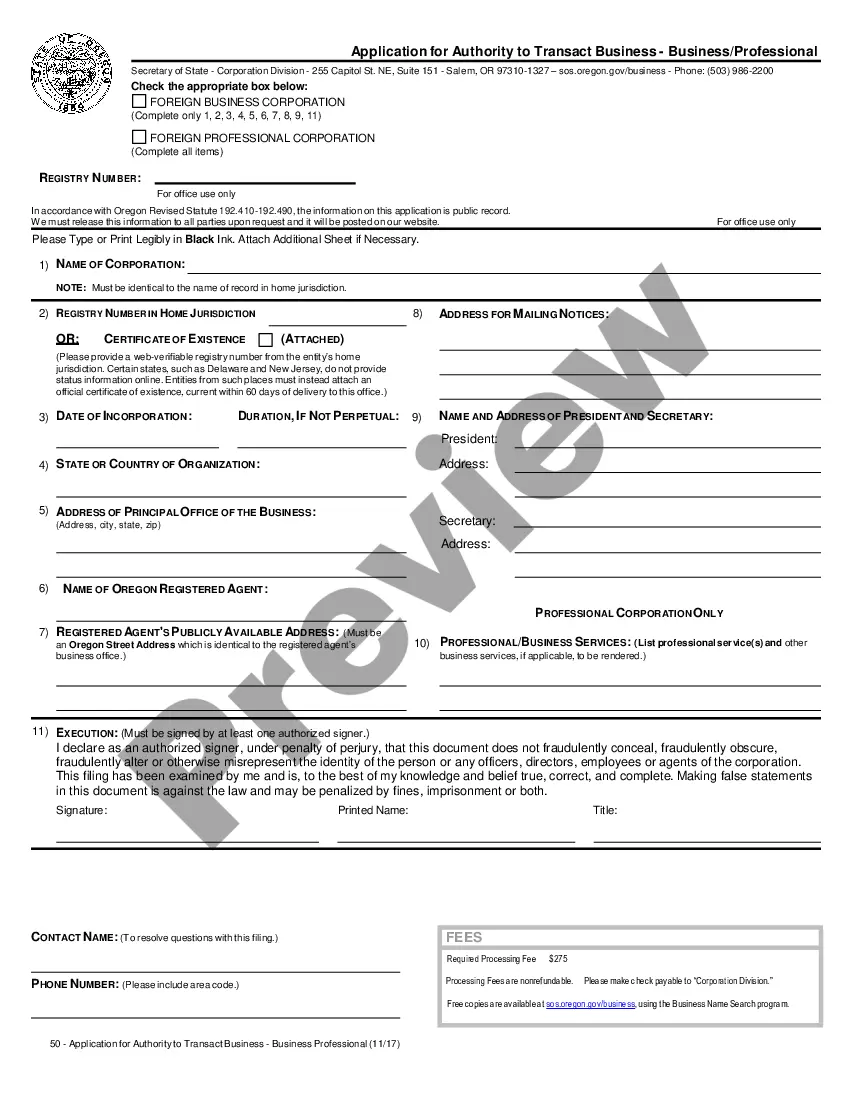

How to fill out Letter To Other Entities Notifying Them Of Identity Theft?

It is feasible to spend multiple hours online attempting to locate the legal document template that meets the federal and state standards you require.

US Legal Forms offers thousands of legal documents that can be evaluated by professionals.

You can indeed acquire or print the Alaska Letter to Other Entities Informing Them of Identity Theft through our services.

If available, use the Review option to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can complete, modify, print, or sign the Alaska Letter to Other Entities Informing Them of Identity Theft.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of a purchased form, navigate to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the state/city of your preference.

- Review the form description to make certain you have selected the appropriate form.

Form popularity

FAQ

How To Know if Someone Stole Your Identity Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Changes in your credit score can indicate identity theft. For example, if someone takes out utility bills in your name and doesn't pay them, your credit score may dip. Checking your credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion can help pinpoint the problem.

Check credit reports. Similarly, monitor your credit reports from all three credit-reporting bureaus for any unknown accounts or inaccurate information. Your credit score isn't enough information to check for identity theft; rather, you'll need the complete credit files.

Use this checklist to protect yourself from identity theft. Keep your mail safe. ... Read your account statements. ... Check your credit reports. ... Shred! ... Store personal documents at home. ... Be wary of unknown phone calls and emails. ... Create difficult logins and passwords. ... Use one credit card for online shopping.