Alaska Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

US Legal Forms - one of the largest collections of authentic forms in the United States - provides a range of valid document templates that you can download or print.

By utilizing the website, you gain access to thousands of forms for business and personal use, organized by categories, states, or keywords.

You can acquire the latest forms such as the Alaska Revocable Trust Agreement - Grantor as Beneficiary in just a few minutes.

Check the form description to confirm that you have chosen the correct one.

If the form does not meet your requirements, utilize the Lookup field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and download the Alaska Revocable Trust Agreement - Grantor as Beneficiary from the US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the appropriate form for your city/state.

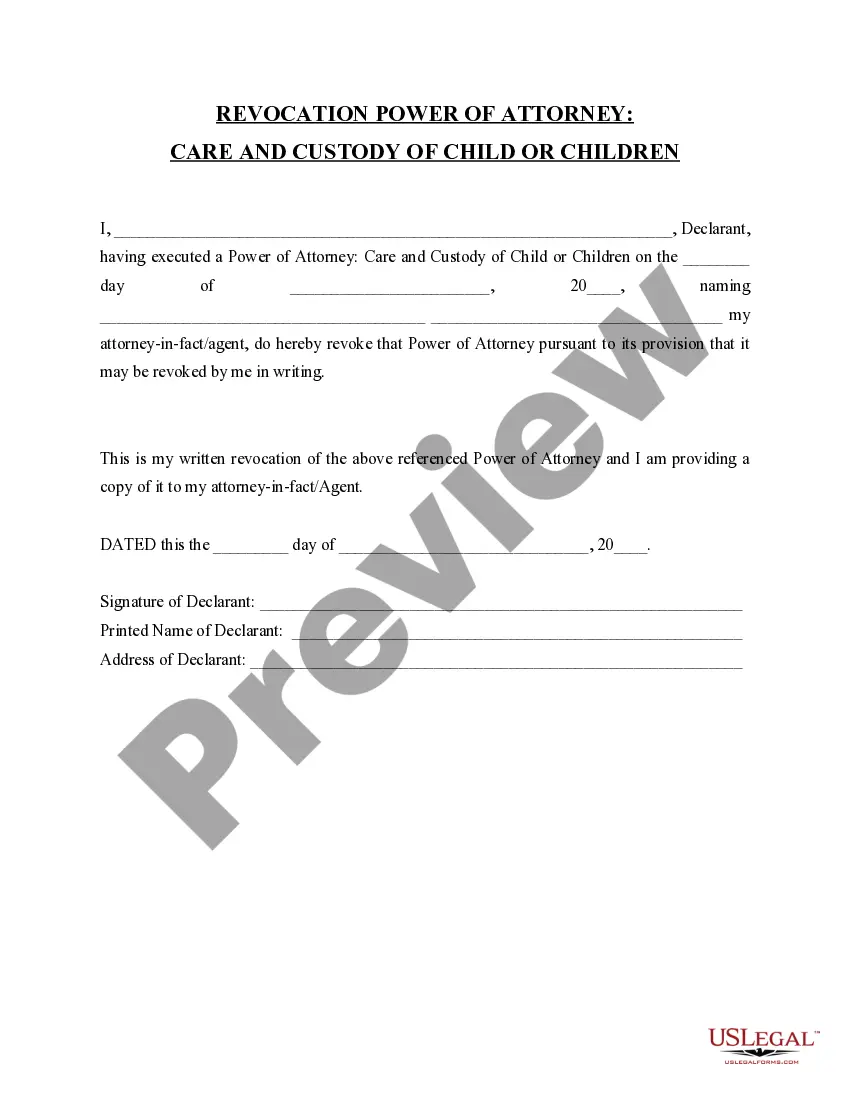

- Click the Preview option to review the form's content.

Form popularity

FAQ

Trust funds can present various dangers, primarily concerning mismanagement and misunderstandings about their structure. An Alaska Revocable Trust Agreement - Grantor as Beneficiary requires attention to detail to ensure all assets are handled responsibly. Additionally, if the terms of the trust are not clearly communicated, conflicts among beneficiaries can arise. Regular reviews and open communication can help mitigate these risks.

While the focus here is on Alaska Revocable Trust Agreements, it's worth noting common mistakes parents make in setting up trusts, even in the UK. One major error is underestimating the importance of tax implications related to beneficiaries and assets. Parents sometimes overlook potential tax liabilities that can arise during distributions from the trust. Understanding these factors upfront can prevent future complications.

To add a beneficiary to a trust, you typically need to amend the trust document officially. For an Alaska Revocable Trust Agreement - Grantor as Beneficiary, this process may involve drafting an amendment that clearly states the new beneficiary's name and their relationship to the trust. It's advisable to consult with a legal professional to ensure that the amendment adheres to state laws and maintains the trust's integrity.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust properly. Without proper funding, even an Alaska Revocable Trust Agreement - Grantor as Beneficiary cannot serve its purpose. Parents often forget to transfer assets into the trust or mistakenly assume certain assets are automatically included. It is vital to regularly review and ensure proper funding for the trust to function effectively.

The negative aspect of a trust, especially an Alaska Revocable Trust Agreement - Grantor as Beneficiary, is the ongoing administrative duties it requires. Trusts can be costly to set up and may involve complex tax filings. Furthermore, if not funded correctly, a trust may not provide the intended benefits, leaving assets subject to probate. Careful planning and management can mitigate these downsides.

A family trust can pose challenges, particularly regarding the control and distribution of assets. An Alaska Revocable Trust Agreement - Grantor as Beneficiary can help maintain some control, but disagreements among family members can lead to conflicts. Additionally, establishing and maintaining a family trust involves costs and time commitments that some may not anticipate. Understanding these factors is essential before setting one up.

One disadvantage of naming a trust as a beneficiary is the potential for added complexity during the estate settlement process. With an Alaska Revocable Trust Agreement - Grantor as Beneficiary, it's crucial to manage it correctly to avoid legal challenges or misunderstandings among heirs. Additionally, tax implications may arise that require careful planning. Consulting legal expertise can help navigate these complexities.

Yes, a beneficiary can also be a grantor in an Alaska Revocable Trust Agreement - Grantor as Beneficiary. This arrangement allows the grantor to maintain control over the assets during their lifetime while also naming themselves as a beneficiary. It provides flexibility in managing the trust and can ease the transfer of assets upon death. However, it's essential to ensure this alignment meets specific legal requirements.

One disadvantage of naming a trust as a beneficiary of an IRA is the complexity it introduces in tax treatment. Trusts can face different tax implications than individual beneficiaries, potentially resulting in a higher tax burden. Additionally, if the trust does not comply with specific regulations outlined in the Alaska Revocable Trust Agreement - Grantor as Beneficiary, it may lead to unintended consequences for your heirs.

Naming a trust as the beneficiary of an IRA can provide structured estate planning advantages. The trust, according to the Alaska Revocable Trust Agreement - Grantor as Beneficiary, can manage distributions to your heirs based on their circumstances. However, it is vital to understand how this can impact required minimum distributions and tax implications for the trust.