In a charitable lead trust, the lifetime payments go to the charity and the remainder returns to the donor or to the donor's estate or other beneficiaries. A donor transfers property to the lead trust, which pays a percentage of the value of the trust assets, usually for a term of years, to the charity. Unlike a charitable remainder trust, a charitable lead annuity trust creates no income tax deduction to the donor, but the income earned in the trust is not attributed to donor. The trust itself is taxed according to trust rates. The trust receives an income tax deduction for the income paid to charity.

Alaska Charitable Inter Vivos Lead Annuity Trust

Description

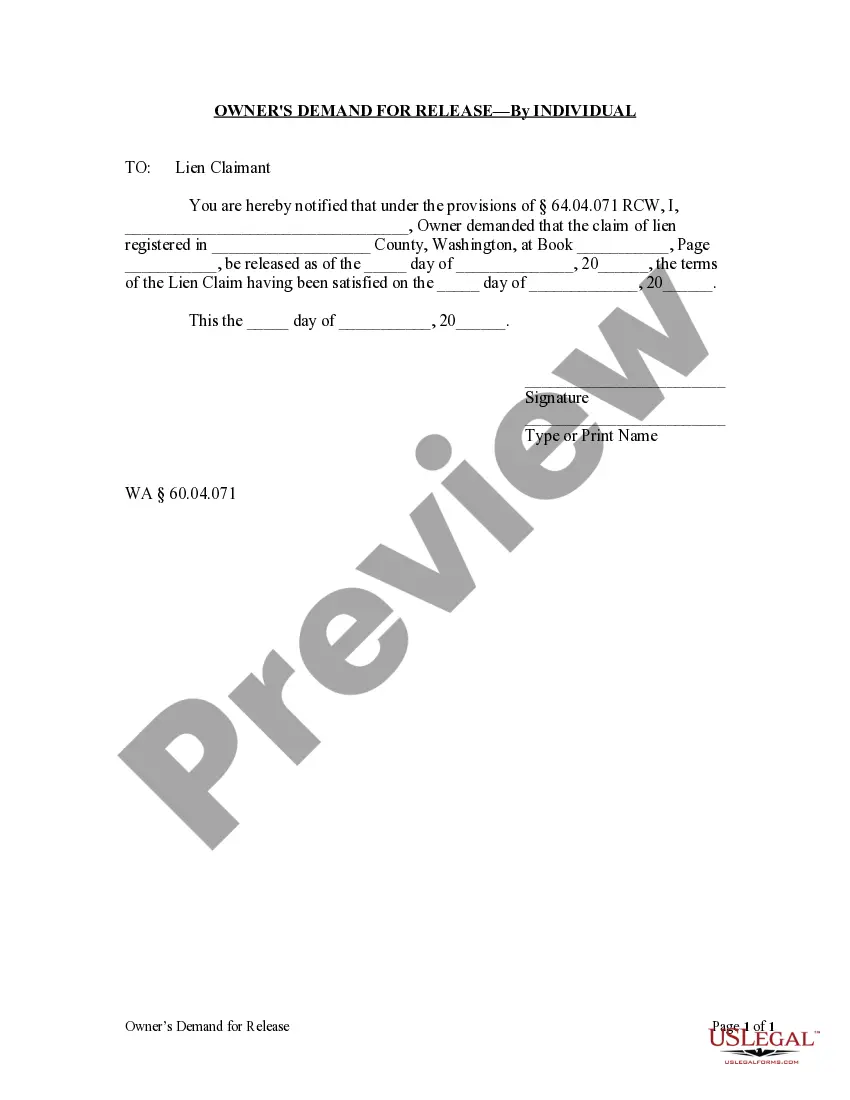

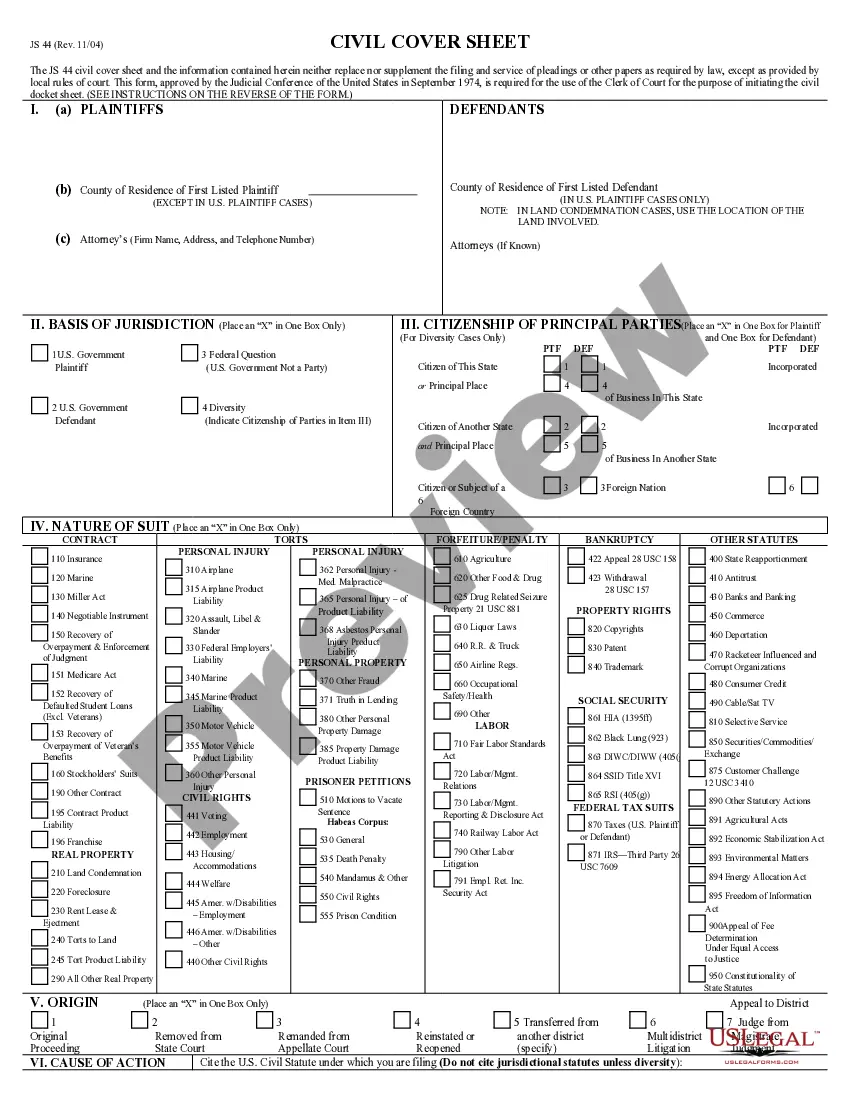

How to fill out Charitable Inter Vivos Lead Annuity Trust?

If you wish to obtain, download, or print sanctioned document templates, utilize US Legal Forms, the best range of legal forms available on the web.

Utilize the site’s user-friendly and efficient search to locate the documents you desire. Numerous templates for business and individual purposes are organized by categories and regions, or keywords.

Utilize US Legal Forms to quickly find the Alaska Charitable Inter Vivos Lead Annuity Trust in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Alaska Charitable Inter Vivos Lead Annuity Trust with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms member, sign in to your account and select the Download option to acquire the Alaska Charitable Inter Vivos Lead Annuity Trust.

- You can also access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines listed below.

- Step 1. Ensure you have selected the form for your appropriate area/state.

- Step 2. Use the Preview feature to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Buy now option. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alaska Charitable Inter Vivos Lead Annuity Trust.

Form popularity

FAQ

A charitable remainder trust pays income to the donor or specified beneficiaries first, before transferring the remaining assets to charity. In contrast, a charitable lead trust provides payments to charity initially, with remaining assets going to the beneficiaries later. The Alaska Charitable Inter Vivos Lead Annuity Trust exemplifies this model, allowing you to support your chosen charity while still preserving wealth for heirs. Each trust type has distinct benefits, so it's advisable to consider your personal goals when choosing between the two.

The main difference lies in the payment structure and beneficiary designations. A charitable gift annuity provides guaranteed payments to the donor for life, while a charitable remainder annuity trust distributes fixed income to beneficiaries for a specified term before the remaining assets go to charity. Both instruments serve unique purposes in estate planning, but an Alaska Charitable Inter Vivos Lead Annuity Trust focuses on providing income to charities first, which may lead to different tax advantages. Understanding these distinctions helps you choose the best option for your financial goals.

You cannot fund a charitable lead trust directly with an IRA, as IRAs have specific distribution rules. However, you can withdraw funds from your IRA to make a donation to an Alaska Charitable Inter Vivos Lead Annuity Trust. This withdrawal may incur tax implications, so it's essential to consult with a financial advisor. Utilizing such a trust can provide both charitable benefits and income for beneficiaries, enhancing your overall estate planning.

In the UK, trusts can typically last for up to 125 years, although specific rules may vary based on the type of trust established. For an Alaska Charitable Inter Vivos Lead Annuity Trust, understanding jurisdictional rules is essential, especially when considering cross-border implications. It's wise to consult with a legal expert to ensure compliance with relevant regulations.

At the end of a trust like an Alaska Charitable Inter Vivos Lead Annuity Trust, the trust assets are distributed according to the trust documents. This process ensures that beneficiaries receive their designated shares while charities benefit from the intended contributions. Proper administration during the trust's duration makes this distribution smooth and straightforward.

When a charitable remainder trust concludes, the remaining assets are distributed to the chosen charitable organizations. This often provides a significant benefit to the charities involved, while also reflecting the donor's philanthropic goals. Beneficiaries of the trust will no longer receive payments once the trust term ends.

At the end of an Alaska Charitable Inter Vivos Lead Annuity Trust, the remaining assets are transferred to the designated beneficiaries, which may include family members or other heirs. The charity also receives the annual distributions as specified in the trust agreement. This structure allows you to balance charitable intentions with the needs of your loved ones.

The maximum term of an Alaska Charitable Inter Vivos Lead Annuity Trust typically spans 20 years. However, some states may impose rules that limit this duration. It's crucial to consult a legal expert familiar with trust laws to understand any specific limitations applicable in your situation.

Filing a trust in Alaska requires organizing various documents, including the trust agreement and any necessary tax filings. You may not need to file the trust with any state entity, but ensuring compliance with federal regulations is essential. For those establishing an Alaska Charitable Inter Vivos Lead Annuity Trust, seeking assistance from UsLegalForms can simplify the process. Their platform offers resources to help ensure your filing is complete and accurate.

Generally, Alaska does not impose a state income tax on trust income, making it a tax-friendly choice for trust establishment. This lack of taxation applies even if the trust income is not distributed to beneficiaries immediately. When considering an Alaska Charitable Inter Vivos Lead Annuity Trust, it's crucial to understand how this advantage can enhance your charitable giving strategy. This can lead to greater financial freedom and impactful philanthropy.